Futures Flat Ahead Of Payrolls

Futures Flat Ahead Of Payrolls

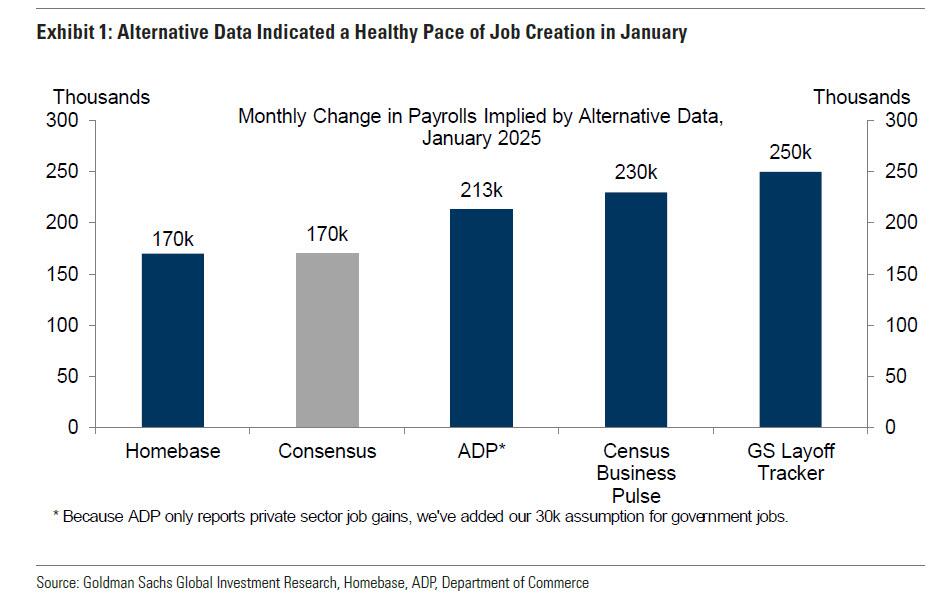

US equity futures are unchanged, with tech lagging and small caps leading as traders hunker down ahead of a payrolls report that is expected to show 175,000 new workers but will https://www.zerohedge.com/economics/tomorrows-jobs-report-will-finally-capture-surge-illegal-aliens-lead-another-negative

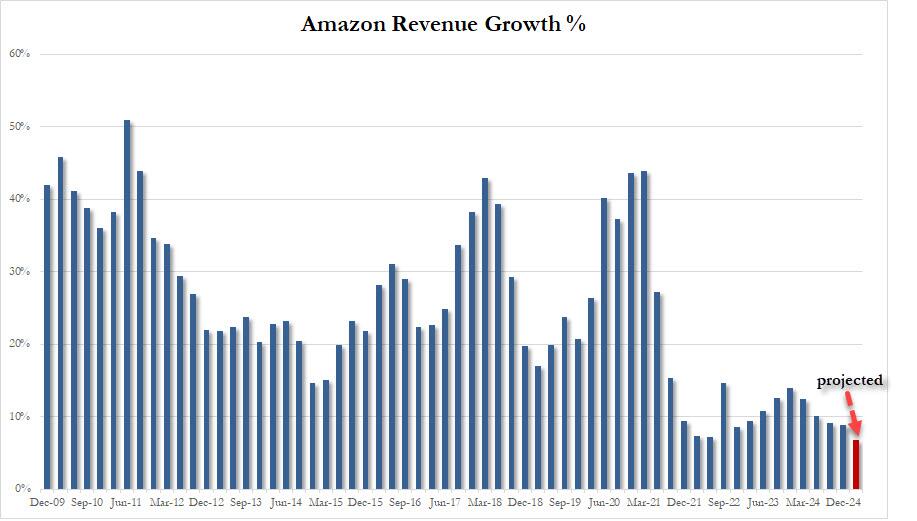

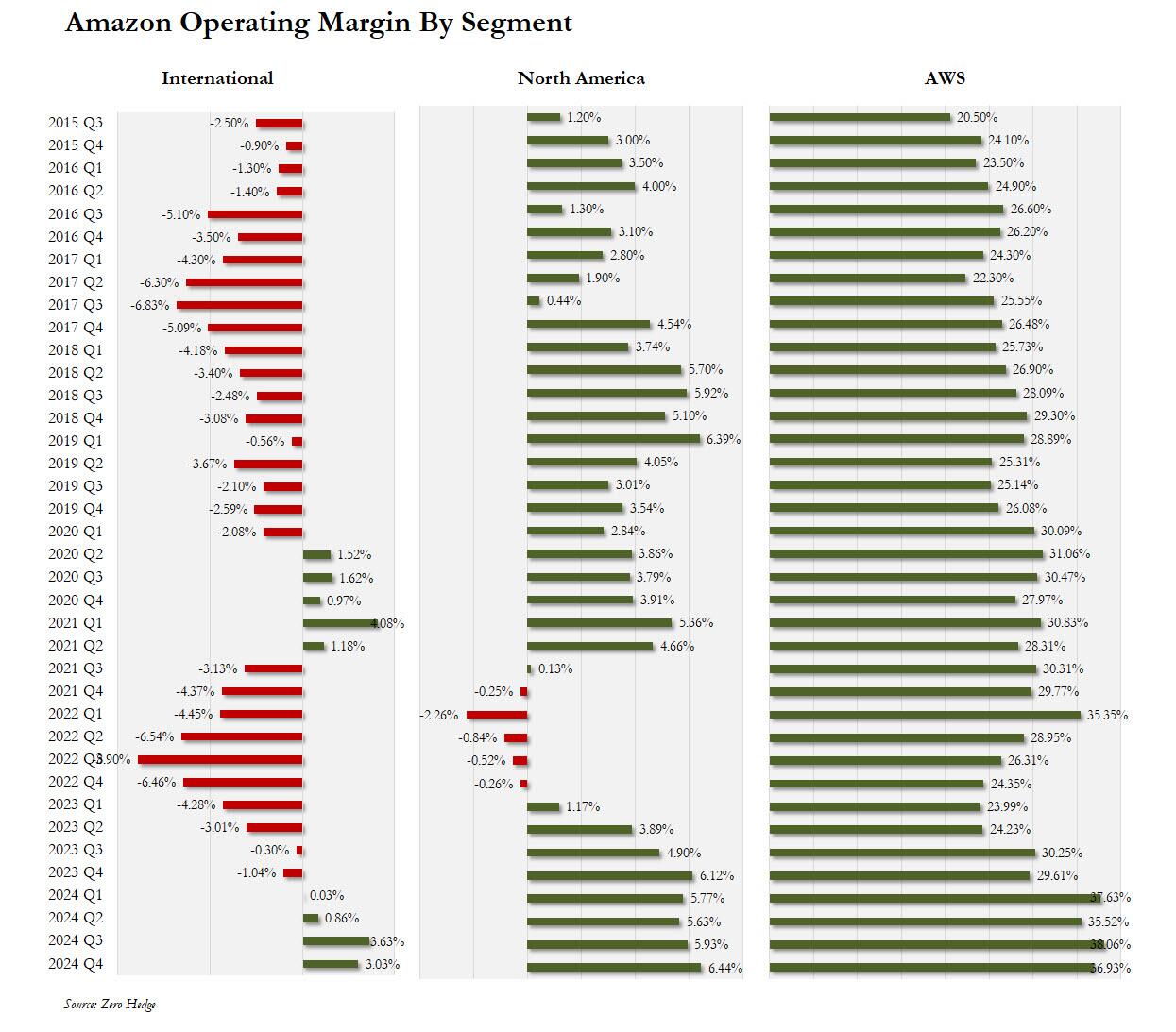

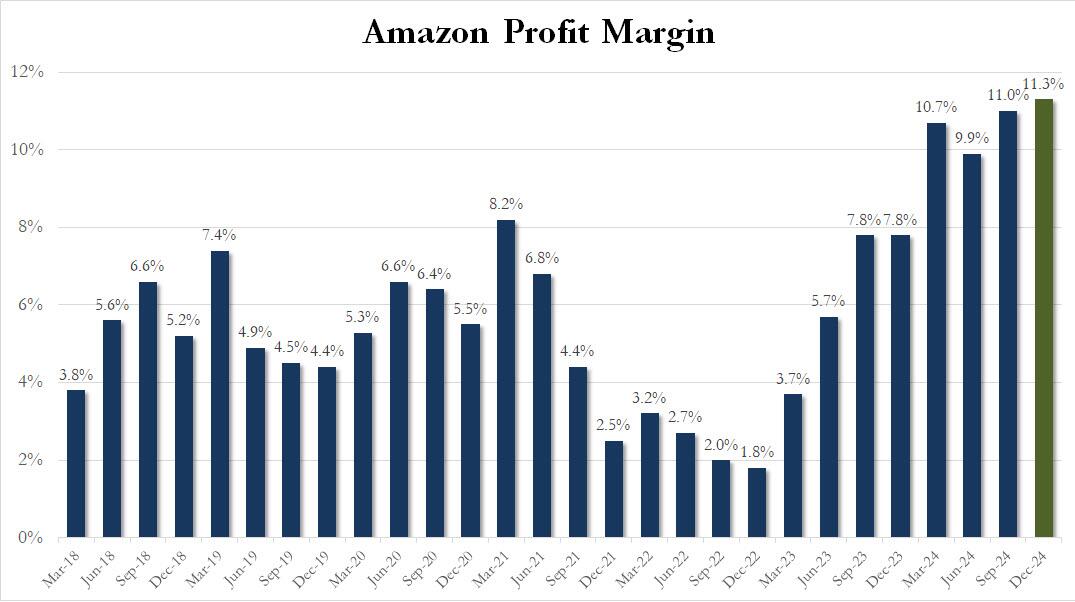

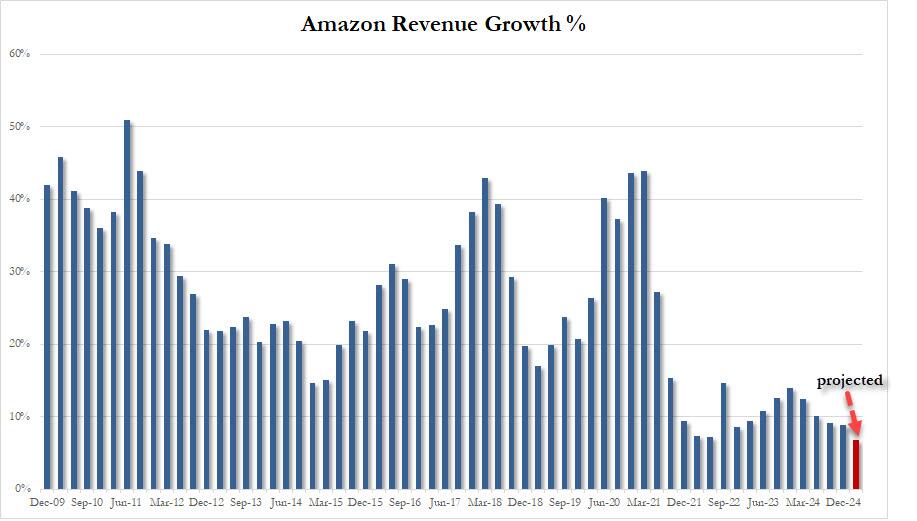

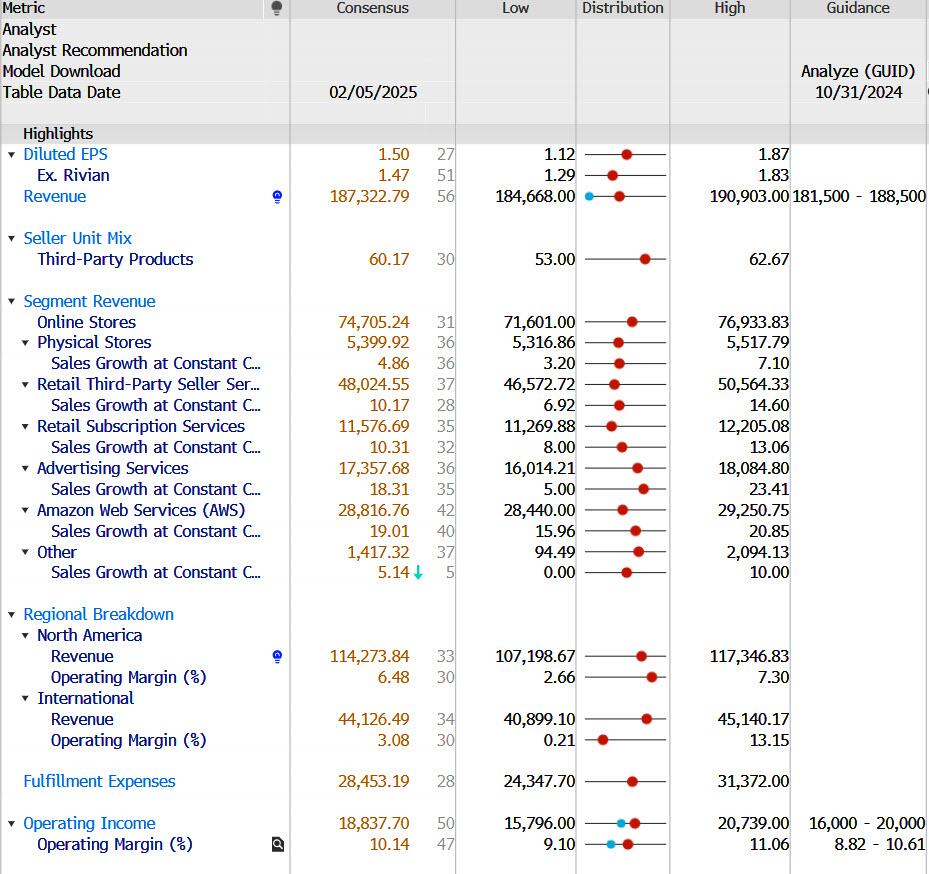

. As of 8:00am ET, S&P futures are flat with the index on track for a 0.7% weekly advance; Nasdaq futures are down 0.1%, with Mag 7 mostly lower after AMZN’s earnings disappointment last night (AMZN -2.6%; TSLA -1.5%; NVDA -0.9%); the e-commerce and cloud-computing company gave an outlook that was weaker than expected. Meanwhile, there seems to be no stopping Meta as the social networking giant is on track to extend gains for a record 15th consecutive session. Bond yields are largely flat; USD unchanged. Commodities are mostly higher led by oil (+0.8%). Today, the key macro focus will be NFP (a full scenario analysis from JPM and Goldman can be found here): the Street’s estimate is 175k; a step down from last month’s 256k print. For the unemployment rate the Street expects 4.1%.

?itok=Fm5EuLQm

?itok=Fm5EuLQm

In premarket trading, Amazon was down 3% and is leading losses for the Mag7 after warning investors that it could face capacity constraints in its cloud computing division despite plans to invest some $100 billion this year, with most of the money going toward data centers, homegrown chips and other equipment to provide artificial intelligence services. Affirm Holdings rose 15% after the financial technology company reported quarterly results that beat expectations and gave an outlook that is seen as strong. Expedia shares jumped almost 10% in premarket trading after the online travel agency reported fourth-quarter results that beat expectations. Here are some other notable premarket movers:

Bill Holdings Inc. (BILL) sinks 29% after the company forecast total revenue for the third quarter below the average analyst estimate

Canopy Growth (CGC) falls 17% after posting a wider-than-expected quarterly loss.

Cloudflare (NET) climbs 10% after the software company reported fourth-quarter results that beat expectations

Denny’s (DENN) rises 4% after Wedbush raised the restaurant operator to outperform from neutral, calling its Keke’s breakfast chain “meaningfully undervalued and underappreciated”

Doximity (DOCS) rises 24% after the healthcare-software company raised its full-year forecast

Elf Beauty (ELF) plunges 27% after the cosmetics company lowered fiscal-year projections for sales and profits, citing softer-than-anticipated January trends

Fortinet (FTNT) rises 5% after the network security software provider’s forecast for 2025 revenue topped the average analyst estimate

Microchip Technology (MCHP) declines 6% after the semiconductor device company gave an outlook that was weaker than expected

Monolithic Power Systems (MPWR) rises 6% after the semiconductor device company gave an outlook for revenue that is much stronger than expected

Nikola Corp. (NKLA) falls 35% after the Wall Street Journal reported that the company is exploring filing for bankruptcy

Open Text ADRs (OTEX) are up 4% after the software company reported second-quarter results that beat expectations. However, analysts noted concerns about its outlook

Pinterest (PINS) jumps 20% after the company posted strong holiday-quarter revenue and gave an upbeat forecast for sales in the current period

Skechers (SKX) falls 12% after the footwear company issued annual forecasts for sales and profit that trailed Wall Street expectations

Take-Two (TTWO) jumps 10% after the video-game company reiterated its plan to launch the highly-anticipated Grand Theft Auto VI in fall 2025

Webtoon (WBTN) plummets 20% after the online comics company posted quarterly preliminary revenue that fell short of the average analyst estimate

All eyes now turn to the US jobs report which is expected to show 175,000 new roles added last month after advances in excess of 200,000 in the prior two months, which partly reflected recovery from two severe hurricanes. Wall Street will be closely watching a revision to job growth for the 12 months through the previous March. Economists expect the markdown to show a labor market that’s gradually cooling (our full https://www.zerohedge.com/markets/january-payrolls-preview-small-drop-big-revisions

).

?itok=cv1DkVBA

?itok=cv1DkVBA

"The stock market, needing a boost after a decent but lukewarm earnings season, could potentially rise if the job market shows signs of cooling,” said Florian Ielpo, head of macro research at Lombard Odier Investment Managers. An uptick in hiring might reignite concerns about inflation, he added.

In other markets news, US Treasury Secretary Scott Bessent said that he favors a strong dollar and has no plans to alter the government’s debt-issuance plans. During the election campaign, President Donald Trump expressed concern about the strength of the dollar, given that it makes US products more expensive overseas.

“The strong-dollar policy is completely intact with President Trump,” Bessent said in an interview with Bloomberg. “We want the dollar to be strong. What we don’t want is other countries to weaken their currencies, to manipulate their trade.”

European equities traded lower on Friday after some key earnings reports disappointed and before investor focus switches to US employment data. Construction and material shares outperform in Europe after a flurry of well-received earnings updates. Consumer and health care stocks provide a drag however with the Stoxx 600 down 0.1%. Here are the biggest movers Friday:

Vinci gains as much as 4.4%, the most since July, after the French construction group’s full-year report shows another quarter of strong cash flows, analysts note

Danske Bank shares advanced as much as 7.5% to the highest level since March 2018 after it launched a new buyback program and pledged higher-than-expected dividends. Denmark’s largest lender also gave a profit outlook for this year

Thule shares rise as much as 5.6% and hit their highest level since April 2022 after fourth-quarter results from the Swedish maker of car roof racks and bike trailers beat estimates

Legal & General shares jump as much as 11%, the most since 2020, after the firm said it plans to sell its US protection business and return around £1 billion of the proceeds to its shareholders after striking a deal with its longstanding partner Meiji Yasuda

Iveco soar as much as 18%, the most on record, as the Italian truckmaker says it’s considering separating its defense business in 2025 through a spinoff

Telecom Italia shares rise as much as 5% to the highest in over a year, after newspaper Corriere della Sera reported that Iliad representatives met with Italy Finance Ministry officials in the past few days to pitch the benefits of combinations in the Italian telecom sector

L’Oreal shares in Paris drop as much as 4.5%, following the drop suffered by its ADRs in the US overnight, after the beauty company’s like-for-like sales for the fourth quarter missed consensus estimates

Porsche shares fall as much as 8% to an intraday record low valuation after the German carmaker slashed its 2025 guidance in a move Bernstein called a “major concern” after the company had described 2024 as its transition year. Citi sees shares testing new low

Saab shares fall as much as 6.5%, the most since October, as Citi spots the Swedish defense firm reduced its cumulative cash conversion guidance, and says investors may not like this. Shares rose 54% in 2024

Kongsberg shares fall as much as 3.4% after the Norwegian defense firm reported full-year results that failed to enthuse investors, as analysts note some margin weakness. The pullback follows a 175% surge in the shares last year

Asian stocks advanced, with gains in Chinese shares offsetting losses in Japan, as traders awaited US jobs data that will help provide clues for the Federal Reserve’s rate path. The MSCI Asia Pacific Index rose 0.1%, erasing an earlier 0.2% loss. Technology shares including TSMC and Tencent were among the biggest boosts. Toyota Motor dragged on the gauge as Japanese stocks fell on a stronger yen. Despite recent volatility in the market amid a brewing US-China trade war, some calm has returned as traders focus on earnings reports and economic data. The Asian stock benchmark is headed for a fourth-straight week of gains, the longest such win streak in 11 months.

In FX, the Bloomberg Dollar Spot Index is also little changed. The yen is the weakest of the G-10 currencies, falling 0.4% against the greenback and pushing USD/JPY above 152.

In rates, treasuries are steady with US 10-year yields trading around 4.435%, little changed on the day, with bunds and gilts outperforming by 1.5bp and 2.5bp in the sector; front-end Treasuries lagging has 2s10s spread flatter by 1.2bp, extending a three-day move that has seen the curve drop from around 30bp Wednesday to current 21bp. Bunds and gilts outperform over early London session, but price action broadly quiet ahead of the January nonfarm payrolls print expected at 8:30am New York time; German and UK 10-year yields down 1 bp each.

In commodities, oil prices advance, with WTI rising 0.8% to $71.20 a barrel. Spot gold climbs $8 to around $2,864/oz. Bitcoin rises 0.5% and above $97,000.

Looking to the day ahead, US economic data calendar includes January jobs report (8:30am), February University of Michigan sentiment, December wholesale inventories (10am) and December consumer credit (3pm). Fed speaker slate includes Bowman (9:25am) and Kugler (12pm).

Market Snapshot

S&P 500 futures little changed at 6,102.25

STOXX Europe 600 down 0.1% to 544.29

MXAP up 0.2% to 185.64

MXAPJ up 0.6% to 583.58

Nikkei down 0.7% to 38,787.02

Topix down 0.5% to 2,737.23

Hang Seng Index up 1.2% to 21,133.54

Shanghai Composite up 1.0% to 3,303.67

Sensex down 0.4% to 77,741.03

Australia S&P/ASX 200 down 0.1% to 8,511.43

Kospi down 0.6% to 2,521.92

German 10Y yield little changed at 2.36%

Euro little changed at $1.0393

Brent Futures up 0.6% to $74.70/bbl

Gold spot up 0.4% to $2,868.64

US Dollar Index little changed at 107.64

Top Overnight News

US President Trump signed an executive memo ordering a review of funding to all NGOs that rely on federal dollars, while it was also reported that the Trump administration is to keep just 294 USAID staff out of over 10,000 globally, according to sources cited by Reuters. In relevant news, the Trump administration is being sued by government workers over slashing of international aid agency USAID.

US House Speaker Johnson said they were working to finish the final details of the reconciliation bill and could wrap up the deal by Thursday night.

In just two weeks as Treasury chief, Scott Bessent has seen plenty of turbulence. The department became a target of Elon Musk’s crackdown on federal spending — triggering protests outside Bessent’s office — and investors are on edge over President Donald Trump’s unpredictable trade policies: BBG

House republicans are torn over the level of spending cuts, House GOP initially proposed USD 500bln to USD 1tln, conservative hardliners are pushing for at least USD 2.5tln: Punchbowl

US President Trump has reportedly placed VP Vance and NSA Waltz in charge of overseeing a potential sale of TikTok: Punchbowl

Fed's Logan (2026 voter) said choices in 2025 boil down to resuming rate cuts soon or holding rates steady for quite some time, while she added that near-2% inflation with the labour market holding steady would not necessarily allow the Fed to cut rates soon. Logan also stated that a rise in inflation would signal monetary policy has more to do and cooling labour market or demand could be evidence it's time to cut rates. Furthermore, she said estimates of the real neutral rate in the US vary widely, but most have moved up substantially since the pandemic and it will always be important to take broad financial conditions into account when setting monetary policy.

Porsche AG is falling further off track from lofty targets set during its splashy stock listing, with costs mounting from executives having misjudged how eager sports-car buyers were to go electric: BBG

Private equity’s favorite tax break is back in President Donald Trump’s crosshairs. Trump on Thursday told Republican lawmakers he wants to end the carried interest exemption used by legions of private equity fund managers and venture capitalists around the country, arguing it could be used to offset the multitrillion-dollar tax cut Republicans plan to pass before the end of the year: BBG

New York-based hedge fund Fir Tree Partners — known for instigating activist campaigns against distressed companies — is returning outside capital to investors: BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the similar performance stateside where price action was choppy amid soft data and as participants looked ahead to the latest key US jobs report. ASX 200 struggled for direction as strength in tech and consumer staples offset the losses in energy and healthcare. Nikkei 225 was pressured by recent currency strength and mild upside in yields but with losses cushioned by stronger-than-expected Household Spending data which showed a surprise M/M growth and the fastest Y/Y pace of increase since August 2022. Hang Seng and Shanghai Comp were on the front foot despite the absence of any major fresh catalysts with participants potentially taking solace from the lack of trade war escalation, while the gains in Hong Kong were led by advances in tech and auto names.

Top Asian News

Chinese Foreign Minister, in response to a media inquiry regarding reports that China is exploring a potential antitrust probe into Apple (AAPL) policies related to its app store policies and fees, says "he was not aware of the situation", via Global Times

UMC (2303 TT) revenue +4.2% Y/Y to TWD 19.8bln.

RBI cut the Repurchase Rate by 25bps to 6.25%, as expected, via a unanimous vote and unanimously decided to maintain a neutral policy stance, while the Standing Deposit Facility rate was adjusted to 6.0% and the Marginal Standing Facility Rate was set at 6.5%. RBI Governor Malhotra stated that CPI has mostly stayed aligned with the target, barring a few occasions, as well as noted that growth is expected to recover and growth-inflation dynamics will open up space to support growth. He also commented that food inflation pressures should see significant softening, barring supply shocks, and core inflation is expected to rise but remain moderate. The central bank lowered its FY25 real GDP growth forecast to 6.4% from 6.6% and sees FY26 real GDP growth at 6.7%, while it maintained FY25 CPI inflation view at 4.8% and sees FY26 CPI inflation at 4.2%. Furthermore, Malhotra said exchange rate policy has remained consistent, with intervention focused on smoothing excess volatility and the RBI does not target any exchange rate level or band.

China mutual funds have reportedly been buying convertible bonds amid less supply with end-Q4 2024 fund holdings of convertible bonds reaching CNY 287.7bln, according to China Securities Journal.

European bourses (Stoxx 600 +0.1%) are mixed, with trade tentative ahead of the all-important US NFP report. European traders will also be cognizant of the ECB Staff Revision of the Natural Interest Rate. European sectors are mixed, and aside from the top/bottom performers, the breadth of the market is fairly narrow. Construction and Materials tops the pile, lifted by post-earning strength in Vinci; Consumer Products is weighed on by losses in L’Oreal (-4%) after posting weak LFL Sales in Q4 and highlighting poor Chinese demand.

Top European News

ECB's Lane says services inflation in January was softer-than-expected; 2% inflation target should be achieved "fairly soon".

ECB's de Guindos says inflation is beginning to converge to 2% in spring, services inflation remains top price concern, need prudent approach to monetary policy.

FX

DXY is a touch softer with the USD mixed vs peers (firmer vs. havens, weaker vs. cyclicals). Today is of course NFP day with headline payrolls expected to slow to 170k from 256k and the unemployment rate hold steady at 4.1%. Note, today will also see the BLS publish its annual benchmark revisions.

EUR/USD is steady vs. the USD in the run-up to today's publication of the ECB's neutral rate. Ahead of which, ECB Chief Economist Lane has suggested that it is best not to focus too much on the neutral rate. EUR/USD is currently capped by the 1.04 mark and within yesterday's 1.0352-1.0405 range.

JPY is a touch softer vs. the USD as havens lag cyclicals. Overnight, USD/JPY saw two-way price action in which it initially extended on recent declines after stronger-than-expected Household Spending data from Japan but then rebounded off support around the 151.00 level. Since then, the pair has made its way up to a 151.89 peak.

GBP is attempting to recoup some of Thursday's BoE-induced losses, which were triggered by a "dovish cut" from the MPC as uber-hawk surprised markets with a vote for a 50bps cut. Cable is currently tucked within yesterday's 1.2359-1.2509 range.

Antipodeans are both incrementally firmer vs. the USD in what has been a strong showing this week for both currencies after a shaky performance on Monday.

PBoC set USD/CNY mid-point at 7.1699 vs exp. 7.2780 (prev. 7.1691).

BoC Governor Macklem said they are facing new uncertainty with a shift in policy direction in the US and President Trump's threats of new tariffs are already affecting business and household confidence, particularly in Canada and Mexico. Furthermore, Macklem said the world looks increasingly shock-prone and the longer the uncertainty persists, the more it will weigh on economic activity in their countries.

Fixed Income

USTs are flat and are awaiting today's US NFP report, as well as the benchmark payroll revisions. Firstly, the pace of payroll additions is expected to ease towards recent averages with consensus looking for 170k; though, hurricane, wildfire, cold weather and industrial factors could all impact and weigh on the headline. Into the release, USTs hold in a particularly narrow 109-13+ to 109-20 band with yields mixed and the curve itself a touch flatter.

Bunds are contained; German export data was better than expected but sparked little move at the time. Bunds find themselves at the top-end of 133.29-49 band which is entirely within Thursday’s 133.13-61 parameters. No reaction to commentary from ECB’s Lane or de Guindos this morning, who both spoke on inflation. Traders are awaiting the ECB Natural Interest Rate release, due at 12:00GMT / 07:00 ET. Ahead of the release it is worth revisiting remarks from recent officials on where they think the Neutral Rate is, to surmise: Lagarde 1.75-2.25%; Schnabel 2.0-3.0%; Rehn 2.2-2.8%, Villeroy & Stournaras around 2.0% and Centeno >2.0%.

Gilts are contained with specifics light post-BoE and as the fixed complex is focussed on upcoming events from the ECB and US BLS. As such, Gilts are pivoting the unchanged mark in a 93.06-93.49 band.

Commodities

Crude futures overnight attempted to pick themselves up from the prior day's trough. Newsflow was light this morning but Iran delivered some punchy rhetoric in which Leader Khamenei said talks with the US are neither smart, wise, nor honourable, according to IRNA. Brent Apr resides in a USD 74.26-75.12/bbl parameter.

Spot gold remains afloat but within Thursday's ranges as the yellow metal bides times ahead of the US Jobs reports. China's Financial Regulator will allow insurance funds to purchase gold as part of a pilot project - modest upticks in prices were seen around this time. Spot gold resides in a current USD 2,855.98-2,870.73/oz parameter.

Copper futures overnight edged mild gains amid the positive risk sentiment seen in its largest buyer, with traders now looking ahead to the US jobs report. 3M LME copper resides in a USD 9,295.97-9,433.00/t range.

China gold reserves end-Jan USD 206.53bln (vs end-Dec USD 191.34bln); Gold reserves 73.65mln toz (prev. 73.29mln toz).

China's Financial Regulator will allow insurance funds to purchase gold as part of pilot project

Geopolitics

Russian Kremlin's Peskov says Russia is open to negotiations on Ukraine.

IAEA Head Grossi says the number of attacks on Zaporizhia nuclear power plant in Ukraine has increased; adds the situation is tough, via Tass

"Al-Arabiya sources: Hamas informed mediators that Israel did not abide by the agreed humanitarian protocol" and as such Hamas is "Delaying the names of hostages scheduled to be released tomorrow".

Russia's Kremlin says Russia and the US have not yet begun to discuss a possible Trump-Putin meeting and there have been no initial contacts about whether such a meeting is needed or where and how it might take place if it is, according to IFAX.

Israel's army conducted a strike in Lebanese territory on two military sites that contained Hezbollah weapons.

Taiwan announced that it detected six Chinese balloons near the island, while it also detected nine Chinese military aircraft, six warships and two official ships in the prior 24 hours.

US Event Calendar

08:30: Jan. Change in Nonfarm Payrolls, est. 175,000, prior 256,000

Jan. Change in Private Payrolls, est. 158,000, prior 223,000

Jan. Unemployment Rate, est. 4.1%, prior 4.1%

Jan. Underemployment Rate, prior 7.5%

Jan. Labor Force Participation Rate, est. 62.5%, prior 62.5%

Jan. Average Weekly Hours All Emplo, est. 34.3, prior 34.3

Jan. Average Hourly Earnings YoY, est. 3.8%, prior 3.9%

Jan. Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

10:00: Dec. Wholesale Trade Sales MoM, est. 0.5%, prior 0.6%

Dec. Wholesale Inventories MoM, est. -0.5%, prior -0.5%

10:00: Feb. U. of Mich. Sentiment, est. 71.8, prior 71.1

Feb. U. of Mich. Current Conditions, est. 73.7, prior 74.0

Feb. U. of Mich. Expectations, est. 70.1, prior 69.3

Feb. U. of Mich. 1 Yr Inflation, est. 3.3%, prior 3.3%

Feb. U. of Mich. 5-10 Yr Inflation, est. 3.2%, prior 3.2%

15:00: Dec. Consumer Credit, est. $14.6b, prior -$7.49b

DB's Jim Reid concludes the overnight wrap

As we reach the end of another exhausting week where the themes at the end of it are a long way from where they were on the Monday, I have a film recommendation for you for the weekend if you’re looking to switch off, especially if you like music! It’s over 10 years old but I finally watched a film called “Searching for Sugarman” last weekend. It was a remarkable documentary that if paraded as fiction you would say was too unrealistic. It is about a musician who was relatively unknown in the US (circa 1970) and soon went back to labouring after releasing two unsuccessful albums.

Unbeknown to him he became bigger than Elvis in South Africa (selling half a million copies) but in an age of apartheid and without the internet, they knew nothing about him and the stories were that he was dead. It took 25 years for him to realise his fame abroad and for them to realise he wasn’t dead. You can then see the movie for what happened next. It inspired me to believe that my former band Vapour Trail might be bigger than the Beatles in say North Korea. I live in hope.

After Monday’s trade-related slump, film scriptwriters would have been thrown out for a plot that had markets hitting or approaching their highs by the end of the week. But that’s what’s happened, and last night the S&P 500 (+0.36%) closed less than 1% away from its all-time high, whilst Europe’s STOXX 600 (+1.17%) hit a new record. In fact, the German DAX (+1.47%) even took its YTD gains above the 10% mark, making it the only major global index to do so this year, which is pretty striking when you consider the sensitivity of German automakers to the tariff threats. Nevertheless, markets have continued to take the trade news in their stride, and investors remain sceptical that President Trump will follow through on his more aggressive threats, which has helped to support a broader recovery in risk assets since the weekend.

Having said that, the positive mood has lost a bit of ground on Amazon’s results after the close. The company delivered a solid earnings beat but this was overshadowed by slower cloud growth and weaker guidance for Q1, with projected operating income in the $14bn to $18bn range (vs $18.2bn average estimate). Amazon’s CEO noted capacity constraints in cloud computing, with plans to invest $100bn in 2025, and its shares fell by about -4% in after-market trading. If confirmed in today’s regular session, it would make it 4 out of 6 of the Magnificent 7 reporting so far that’s seen a negative market reaction. See my CoTD yesterday here that speculates whether the hyperscalers within the Mag-7 are in a "winner's curse" at the moment, where to stay in the game they have to spend mind boggling sums on Capex. Like the telcos in 1999/00 with 3G licences but obviously without the debt. This capex spend encourages share price appreciation when no-one has any doubts about eventual AI monetisation, but begins to become an issue when doubts emerge. You have certainly seen that a bit more this results season.

Of the Mag-7 there is now just Nvidia left to report on February 26th so the group have some space now. And prior to Amazon’s results, tech stocks had a pretty solid day, with the Mag-7 (+0.68%) and NASDAQ (+0.51%) slightly outperforming the S&P 500 (+0.36%). That said, the equity gains were far from uniform with equal-weighted S&P 500 (-0.12%) and the small cap Russell 2000 (-0.39%) both retreating.

Overnight in Asia, we’ve seen a mixed performance for equity markets. In Hong Kong, the Hang Seng (+1.28%) is on track for its highest closing level since October, and both the CSI 300 (+1.59%) and the Shanghai Comp (+1.32%) have also seen solid gains. But elsewhere the performance has been more negative, with the Nikkei (-0.55%) and the KOSPI (-0.41%) both losing ground, whilst US equity futures are also pointing a bit lower, with those on the S&P 500 down -0.09%.

Meanwhile in Japan, there was further strong economic data overnight, with real household spending up +2.7% year-on-year in December (vs. +0.5% expected). That’s the fastest pace since August 2022, which is helping to cement expectations that the BoJ will keep hiking over the months ahead. Indeed, the 2yr Japanese government bond yield (+3.3bps) is up to 0.79%, which is the highest it’s been since 2007. And the 10yr yield is up +2.7bps to 1.29%, the highest since 2011.

Looking forward now, today’s main highlight will be the US jobs report for January, which is coming out at 13:30 London time. In terms of what to expect, our US economists are looking for nonfarm payrolls at +175k, dipping down from the 9-month high of +256k in December. Part of that downtick is because of the Los Angeles wildfires, which occurred during the survey week, but they think the unemployment rate should remain at 4.1%. The other important feature of today’s report is the annual benchmark revisions, meaning that the previous 5 years of payrolls are subject to revisions this month. For more details, see our economists’ preview here and how to sign up for their subsequent webinar.

Ahead of the jobs report, the weekly initial jobless claims were a bit worse than expected, rising to 219k in the week ending February 1 (vs. 213k expected). That also pushed the 4-week moving average up to 216.75k, its highest so far this year. But even so, US Treasury yields ticked up across the curve, with the 2yr yield up +2.6bps to 4.215%, whilst the 10yr yield was up +1.8bps to 4.44%. That came as investors dialled back the likelihood of rate cuts this year, with the amount priced in by December down -2.7bps on the day to 44bps. That’s continued to dial back overnight, following comments from Dallas Fed President Logan that even if inflation moved close to 2% in the months ahead, “it wouldn’t necessarily allow the FOMC to cut rates soon, in my view”.

Other notable comments came in an interview by Treasury Secretary Bessent, who reiterated a preference for lower 10yr yields, which he said would naturally come down under Trump’s policies. He also said he did not “foresee any changes in the issuance (of Treasuries) for the foreseeable future” and noted that the US would continue to have a “strong dollar” policy.

Over in Europe, the main story came from the UK, as the Bank of England delivered another 25bp rate cut, taking their policy rate down to 4.5%. Significantly, the vote was a 7-2 split, with the two dissenters wanting a larger 50bp rate cut, and their latest forecasts halved the growth projection for 2025 to 0.75%, down from 1.5% three months ago. On top of that, they’re now forecasting CPI inflation rising to 3.7% in Q3, so in general the forecasts moved in a stagflationary direction.

With investors anticipating more rate cuts this year in response, sterling was the worst-performing G10 currency on the day, weakening -0.56% against the US Dollar. However, even though front-end gilt yields fell initially, they ended the day higher after Governor Bailey said he wouldn’t “put too much weight on the voting”. So by the close, the 2yr gilt yield was up +2.2bps, and the 10yr gilt yield was up +4.9bps. In addition, the rhetoric from the BoE themselves was still fairly cautious, with the summary saying that “a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate.”

Elsewhere in Europe, the risk-on tone was clear from several angles, as the STOXX 600 (+1.17%) pushed up to a new record. Those moves were also evident in the bond market, where yields on 10yr bunds (+1.2bps) moved a bit higher, and there was a fresh tightening in sovereign bond spreads as well. In fact, the Franco-German 10yr spread tightened to just 71.3bps yesterday, which is the tightest it’s been since mid-September.

Finally on central banks, today is also set to bring the ECB’s review on where they see r*, or what’s called the neutral/natural/equilibrium interest rate. In simple language, it’s the rate at which monetary policy is neither stimulating nor restricting the economy, hence “neutral”. But it’s a theoretical concept that can’t be directly observed, so economists have a range of estimates for where that is for different countries. For markets, the significance is it’ll offer an indication of how far the ECB think their current deposit rate of 2.75% is above neutral, and hence how much further they might cut rates.

To the day ahead, and the main highlight will be the US jobs report for January. Other data releases include the University of Michigan’s preliminary consumer sentiment index for February (watch inflation expectations), along with German industrial production for December. From central banks, we’ll hear from ECB Vice President de Guindos, the Fed’s Bowman and Kugler, along with the BoE’s Pill.

https://cms.zerohedge.com/users/tyler-durden

Fri, 02/07/2025 - 08:24

https://www.zerohedge.com/markets/futures-flat-ahead-payrolls

Goldman "Cautiously Optimistic" On China Tech As DeepSeek Fuels Bullish Bets

Goldman "Cautiously Optimistic" On China Tech As DeepSeek Fuels Bullish Bets

Goldman's Hailey He remains "cautiously optimistic" about Chinese stocks, noting that "AI enthusiasm sparked by Deepseek" has driven tech shares into a bull market.

On Friday, China had a solid session with SHCOMP +1%, CSI 300 +1.3%, and HSI +1.2% as technology companies outperformed on AI tailwinds.

HK shares gained 4.5% for the week, marking the best weekly performance since the first week of October. Key drivers of this bullish price action included EV, AI, and robotics stocks—all amid a week in which the https://www.zerohedge.com/markets/china-finds-leverage-ahead-trade-talks-beijing-mulls-probe-apples-app-store-practices

between the US and China escalated.

During the session, HSI saw auto stocks surge, with Geely up 8%, Li up 6.5%, and BYD gaining 5%. HSTECH rose nearly 2%, rebounding into technical bull market territory, now up 22% from its January lows. Alibaba shares climbed 1.5%, while Tencent gained around 2%.

?itok=9UfS8_e8

?itok=9UfS8_e8

Goldman's He provided more color around "cautiously optimistic":

As China returns from one week CNY holiday, market sentiment on China asset improves as seen from the bullish price action in both equities and fixed income. Tariff reprieve, AI enthusiasm sparked by Deepseek and easy liquidity all contributed to the move.

China equities staged a meaningful rebound this week on AI optimism. HSI tech, the parameter of foreigner confidence, surged 23% from January lows. GS Asia internet research is bullish on further AI advancement and cost efficiencies. To highlight, the cost of Doubao, the most popular AI Chatbot in China, is 85% cheaper than industry average. In terms of stocks, we continue to see Tencent as best positioned in introducing To-C AI agent applications given the Weixin super-app with both social and transaction capabilities. We continue to be bullish on Alibaba (China's largest public cloud hyperscaler) and data centers (GDS, VNET) that will benefit from ongoing public cloud and AI computing demand growth from multi-year higher AI adoption. The latest piece from equity research on China AI can be accessed here.

In a separate note, Sat Duhra, portfolio manager at Janus Henderson Investors in Singapore, told clients, "This is a sector that has been ignored but like other purely domestic sectors, there are some bright spots," adding, "The recent DeepSeek announcement is a timely reminder that behind the scenes, industrial policy — for example Made in China 2025 — has pushed many sectors toward world-class status."

Deutsche Bank analyst Peter Milliken told clients, "We think 2025 is the year the investing world realizes China is out-competing the rest of the world."

"Investors, we believe, will have to pivot sharply to China in the medium term and will struggle to get access to its stocks without bidding them up," Milliken wrote.

The increasing bullishness in Chinese tech sharply contrasts with several years of bearish sentiment that weighed on shares as the world's second-largest economy grappled with a property downturn, deflation, and a demographic winter.

Any escalation in the tit-for-tat trade war between the US and China can quickly end the bull party, hence why Goldman's He is "cautiously optimistic."

https://cms.zerohedge.com/users/tyler-durden

Fri, 02/07/2025 - 07:20

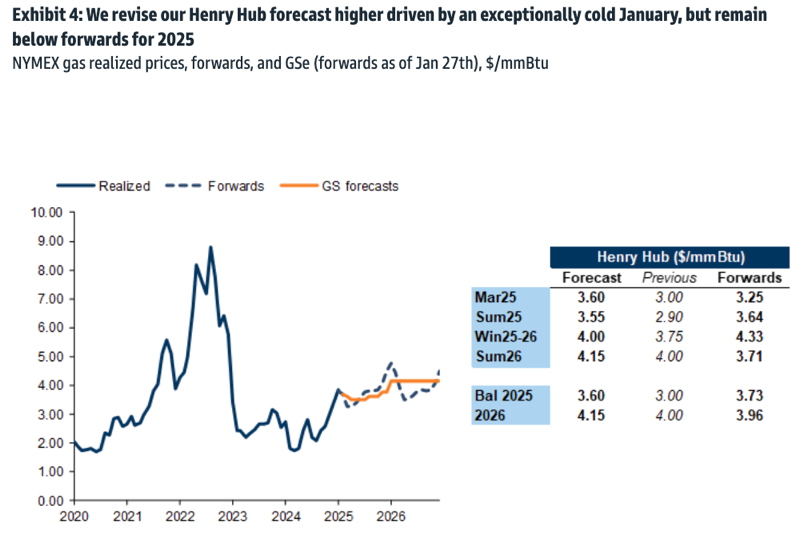

NatGas Volatility Blows Out To Record For March Futures

NatGas Volatility Blows Out To Record For March Futures

The March natural gas contract has been on a rollercoaster ride over the past month, driven by several factors, including polar vortex blasts across the Lower 48, trade tensions, rising artificial intelligence-related energy demand under the https://www.zerohedge.com/commodities/aggressive-power-surge-goldmans-powering-america-theme-may-supercharge-trumps-stargate

, and surging liquefied natural gas (LNG) exports. This heightened volatility reflects how traders are uncertain about price direction ahead of the spring months.

Bloomberg calculations based on 60-day volatility show that the March contract for NatGas has blown out to the widest level ever over what Bloomberg's Elizabeth Elkin pointed out are traders "trying to figure out the direction for gas as LNG exports, increasing demand for gas-fired electricity to run data centers and the threat of tariffs are emerging as potential fundamental movers in a market typically dominated by weather fluctuations."

?itok=dGks_a2i

?itok=dGks_a2i

Elkin added, "To cap it off, forecasts have swung widely over the last few weeks, making it difficult to predict how high demand will be to heat homes and businesses."

?itok=7j3p_frh

?itok=7j3p_frh

For color on possible direction, Goldman's Samantha Dart told clients early last week that she shifted her US NatGas price forecast from $3/mmBtu to $3.6 "to reflect tighter balances."

?itok=gVLV3Qk6

?itok=gVLV3Qk6

Dart also noted: "We see further upside to 2026 US gas prices."

https://cms.zerohedge.com/users/tyler-durden

Fri, 02/07/2025 - 06:55

https://www.zerohedge.com/commodities/natgas-volatility-blows-out-record-march-futures

TikTok's Actual Offense? Innovating While Not Being American

TikTok's Actual Offense? Innovating While Not Being American

,

Ten days ago the shares of Nvidia corrected 17 percent. How could this have happened to such an “owned” and analyzed company? The answer, at least as of now, is that surprise over inexpensively trained and very capable DeepSeek forced investors to at least rethink Nvidia’s long-term dominance.

?itok=CdCXPgRa

?itok=CdCXPgRa

The news on January 26th gave investors reason to at least question whether the current face of AI would perhaps be disrupted by dynamism within the sector that its chips had helped create. It's worth thinking about Nvidia and the market meaning of DeepSeek’s surprising rollout with TikTok top of mind.

China-fearful politicians have voted to ban TikTok in the United States unless it can find an American owner. Forget for a moment that TikTok is already American owned, and simply ask the question about whether or not the same politicians would have pursued “sell or ban” legislation if TikTok were an unknown. Hopefully the question answers itself.

TikTok’s problem is that it discovered the future of social media much more effectively than its American competition. At which point it can be said that the attacks on TikTok aren’t much different from antitrust attacks over the years on American companies like Amazon, Apple, Google, Live Nation, and many others.

What’s important about those suits is that none of them took place when Amazon had the nickname “Amazon.org,” or when Apple was near bankruptcy, when Google was an unknown David to Yahoo’s Goliath, or when Live Nation was one of many cheaply priced entertainment companies trying to divine how the internet and streaming would upend the music industry. It’s just a comment that antitrust ankle biters never discover dominance in its ascendance

Antitrust is by definition a look backwards, and an attempt to penalize the businesses that had the temerity to discover a previously unknown commercial future. TikTok’s travails are a manifestation of the previous truth. Having led the needs of social media users much better than the American competition, TikTok faces a forced separation from the investors and innovators that made it great in the first place. In short, the political class is taking a page from the antitrust playbook in its attempt to wrest TikTok away from its owners on the cheap. Which requires more thought beyond the odious antitrust flavor of TikTok’s theft.

Its ascendance from unknown to the world’s most popular social media company plainly discredits the excuses bruited by politicians as they attempt to take it. Former Rep. Mike Gallagher has excused his own long fingers with op-eds at the Wall Street Journal asserting that TikTok is “controlled by the Chinese Communist Party.” No, government-controlled businesses are never this popular. Other conservatives (including Gallagher) claim the problem with TikTok is that it will gather data on American users for the Chinese Communist Party. That’s similarly an empty excuse when it’s remembered that all user supported sites attain their value from the data gleaned from those users; data that is subsequently sold.

Which brings us back to the “sell or ban” legislation from a U.S. political class that should hang its collective head in shame. As is the case with all antirust attacks, the attempt to break up and take TikTok personifies obnoxious conceit about the future of a commercial sector defined by relentless change, including change at the top.

Assuming the political class can pull off its attempted heist, rest assured that the thieving of successful businesses for innovating while not being American won’t end with TikTok. And that’s because antitrust is by its very name is once again a look backwards. See the DeepSeek surprise if you’re confused.

John Tamny is editor of RealClearMarkets, President of the https://parkviewinstitute.org/

. His next book is The Deficit Delusion: Why Everything Left, Right and Supply Side Tell You About the National Debt Is Wrong.

https://cms.zerohedge.com/users/tyler-durden

Fri, 02/07/2025 - 06:30

https://www.zerohedge.com/political/tiktoks-actual-offense-innovating-while-not-being-american

Microplastics Found In Brain Weighs As Much As A Plastic Spoon: Study

Microplastics Found In Brain Weighs As Much As A Plastic Spoon: Study

(emphasis ours),

Microplastics are making their way into human brains at higher levels than in other vital organs, according to new findings.

?itok=sa1mGLdi

?itok=sa1mGLdi

https://www.nature.com/articles/s41591-024-03453-1

published in Nature Medicine on Feb. 3, confirms that tiny plastic fragments are passing through the brain’s protective blood-brain barrier, potentially impacting health and cognitive function.

Researchers from the University of New Mexico (UNM) tested autopsy samples from 2016 and 2024. They found that over just 8 years, the amount of microplastic fragments in the brain has increased by about 50 percent. Brain samples from 2024 contained microplastics equal in weight to a plastic spoon.

Brains affected by dementia showed significantly higher concentrations of these plastic particles.

Finding such high concentrations in the brain was unexpected and alarming, https://hsc.unm.edu/directory/campen-matthew-j.html

, lead researcher and toxicologist, told The Epoch Times during a press conference.

“People are simply being exposed to ever-increasing levels of micro- and nanoplastics,” said Campen. The particles are so small, they’re roughly the width of two COVID viruses standing side by side, he noted.

The rate of accumulation “is simply mirroring the environmental buildup and exposure.” As plastic breaks down over time, it degrades and becomes small enough to enter the human body and brain.

Plastic Pollution in Organs

Brain tissue contained 7 to 30 times more microplastics than other vital organs like the livers or kidneys, making it one of the most plastic-polluted tissues yet examined.

Researchers tested 52 human brain samples from both 2016 and 2024, all taken from the frontal cortex—the part of the brain responsible for judgment, decision-making, and muscle movement.

In the brain, the microplastic concentration reached around 5,000 micrograms per gram—far higher than the liver and kidneys, which carried around 400 micrograms of plastics per gram.

The study also compared earlier brain samples from the eastern U.S. (1997–2013), which had lower microplastic levels, around 1,250 micrograms per gram. Their findings support a trend of gradual increases in plastic accumulation in the organs over time, with 2024 showing the highest levels.

To visualize the amount of microplastics in the brain, Campen held up a plastic spoon. Since the brain weighs around 1,400 grams (or three pounds), having 5,000 micrograms of plastic per gram would amount to over 5 grams of plastic in total—roughly the weight of a plastic spoon.

In deceased people with dementia, levels reached much higher levels of over 26,000 micrograms per gram. In the dementia samples, some particles were clumped together in areas with inflammation, raising concerns about a possible link between microplastics and brain tissue damage, according to the researchers.

However, while the study correlates microplastics to dementia, the study does not prove that higher plastic levels in the brain directly cause dementia symptoms.

It is also possible that the disease process itself may hinder the brain’s ability to clear out the accumulated plastics, Campen added.

Common Plastic Found in the Brain

Researchers found 12 types of plastic in the brain, with polyethylene (PE), commonly used in bottles, bags, and containers, making up 75 percent of the total. Other plastics included types commonly found in packaging, car parts, pipes, flooring, bottles, containers, fabrics, and other industrial products.

“It was notable that these are largely mirroring proportions of polymers that we do see in our environment,” https://hsc.unm.edu/medicine/departments/pathology/asert-iracda/fellows/current-fellows/marcus-garcia-bio.html

, study co-author and postdoctoral researcher at UNM, explained to The Epoch Times during the press briefing.

The particles in the brain were mostly sharp nanoscale shards and flakes. These tiny particles are small enough to cross the blood-brain barrier, although Campen says it’s still unclear how exactly the particles enter the brain.

Researchers believe that micro- and nanoplastics may enter the body through eating, drinking, and breathing. These particles have been found in various parts of the body, including arteries, hearts, lungs, blood, and placentas. A https://onlinelibrary.wiley.com/doi/10.1002/pmf2.12004

published on Jan. 30 found plastic pollution to be significantly higher in placentas from premature births.

One possible reason for the buildup, according to Garcia, is that organs like the liver and kidneys are designed to filter toxins, while the brain has more limited clearance systems.

Another theory is that brain tissue, which is about 60 percent fat, may better “trap” plastic particles.

“If you’ve ever cleaned a Tupperware bowl that had bacon grease or butter in it, you know, it takes a lot of soap and hot water. It’s really hard to get the plastics and fats apart,” Campen said. He suggests that microplastics might be “hijacking” their way into the brain along with dietary fats being metabolized.

The finding also lends concerns to plastics being used in some medical applications, like heart stents or artificial joints.

According to Campen, the physical properties of the plastic particles could be the main issue, rather than any chemical toxicity.

These plastics might obstruct blood flow in capillaries, he speculated. There is also the potential that they could interfere with the connections between brain cells. But “we just don’t know for sure.”

Bigger Picture

Despite the concerning rise in microplastics, Campen believes the data provide some optimism: The observation that plastic levels are similar in both older and younger people suggests that there may be natural processes at play to help manage or rid the body of them over time.

The researchers believe that many of these particles come from older “decades old, degraded plastics” that have been discarded and left to break down in the environment over the years, Campen said. This insight can help guide environmental policies that include older sources, rather than focusing solely on newer products.

Effective environmental policies aimed at reducing plastic pollution could help limit future exposure, Campen said. Microplastic pollution is increasing rapidly, with levels in the environment doubling https://news.un.org/en/story/2021/10/1103692

, he said, and adding that addressing the source of this pollution could help slow down this build up in our bodies.

Currently, no treatment exists to remove microplastics from the body. To help reduce exposure, Campen and his colleagues are investigating the sources of microplastics in the environment, including in soil, plants, and even meat.

“I don’t feel comfortable with this much plastic in my brain,” Campen said. “I don’t want to wait 30 more years to see what happens if the concentrations keep rising.”

https://cms.zerohedge.com/users/tyler-durden

Fri, 02/07/2025 - 05:00

https://www.zerohedge.com/medical/microplastic-found-brain-weighs-much-plastic-spoon-study

Here's What To Know About US Withdrawal From The WHO

Here's What To Know About US Withdrawal From The WHO

(emphasis ours),

On the first day in office of his second term, President Donald Trump signed an https://www.whitehouse.gov/presidential-actions/2025/01/withdrawing-the-united-states-from-the-worldhealth-organization/

to withdraw the United States from the World Health Organization (WHO), making good on a project from his first administration.

?itok=E5ApGGgZ

?itok=E5ApGGgZ

Trump’s Jan. 20 order halted U.S. funding to the United Nations body, citing the WHO’s “mishandling of the COVID-19 pandemic that arose out of Wuhan, China,” as well as other global health concerns.

Negotiations with the group about a pandemic agreement and the International Health Regulations will be suspended while the withdrawal is taking place.

Because of the 1948 https://avalon.law.yale.edu/20th_century/decad052.asp

by Congress, the United States has the right to withdraw from the WHO, but it must give a one-year notice. The resolution also requires the United States to fulfill “financial obligations” to the WHO for the current fiscal year.

The Largest WHO Funder

The United States is currently the largest WHO funder, contributing about $1.28 billion during 2022–2023, the last reported year on the organization’s https://www.who.int/about/funding/contributors/usa

. That equates to almost half of the WHO’s joint external evaluation missions for the last fiscal year.

The 2024–2025 fiscal year is shaping up similarly, with the United States serving as the largest donor by far, https://apnews.com/article/who-trump-tedros-global-health-a2eafc341cd2200e8800a2421d30bdfc

an estimated $988 million, or roughly 14 percent of the WHO’s $6.9 billion budget.

Documents obtained by The Associated Press show that the United States covers about 95 percent of the WHO’s work on tuberculosis in Europe and about 60 percent in Africa and the Western Pacific, and that the WHO’s Europe office is more than 8 percent reliant on U.S. contributions.

Additionally, U.S. funding provides “the backbone of many of WHO’s large-scale emergency operations,” covering up to 40 percent of that funding.

WHO Response

WHO Director General Tedros Adhanom Ghebreyesus https://www.theepochtimes.com/us/trump-withdraws-us-from-who-on-first-day-in-office-5795858?utm_source=twitter&utm_medium=Social&utm_campaign=ettwitter

relations with the United States as “a good model partnership” during a press briefing in Geneva in December 2024.

“[We] have been partnering for many years, and we believe that will be the case. And I believe the U.S. leaders understand that the United States cannot be safe unless the rest of the world is safe,” he told reporters.

Following the announcement of Trump’s decision to remove the United States from the organization, Ghebreyesus spoke out, asking world leaders to push the White House to reverse the decision.

The WHO chief said during a closed-door meeting with diplomats that the United States would miss out on critical information about disease outbreaks, The Associated Press reported.

George Kyriacou, the agency’s finance director, said if the WHO’s spending continues at its current level without funding from the United States, the organization would be “very much in a hand-to-mouth type situation” regarding cash flow for at least portions of 2026.

CDC Response

Officials at the U.S. Centers for Disease Control and Prevention (CDC) have ordered agency employees to stop working with the WHO, effective immediately.

John Nkengasong, the CDC’s deputy director for global health, sent a memo to agency leadership on Jan. 26 calling on staff to cease collaborating with the WHO immediately and wait for further guidance. CDC staff also are not allowed to engage with the WHO, virtually or in person, and staff members are not allowed to visit the WHO offices.

Some public health experts, including Dr. Jeffrey Klausner, a professor of medicine and global health at UCLA who works with the WHO on sexually transmitted infections, have voiced concern about halting the collaboration.

“Stopping communications and meetings with WHO is a big problem,” Klausner said. “People thought there would be a slow withdrawal. This has really caught everyone with their pants down.”

Behind the Withdrawal

The Trump administration said the WHO was not able to demonstrate independence from the “inappropriate political influence” of member states and had failed to “adopt urgently needed reforms.”

The president’s executive order also cites “unfairly onerous payments” by the United States that Trump said are “far out of proportion with other countries’ assessed payments.”

“China, with a population of 1.4 billion, has 300 percent of the population of the United States, yet contributes nearly 90 percent less to the WHO,” the order stated.

This is Trump’s second attempt to withdraw from the WHO. The president began the process in 2020 because of frustration over the WHO’s reaction to China’s coverup of details surrounding the transmission of SARS-CoV-2 at the start of the COVID-19 pandemic.

The House Oversight and Select Subcommittee on the Coronavirus Pandemic released https://www.theepochtimes.com/us/house-oversight-report-supports-chinese-lab-leak-theory-for-covid-19-origin-5769770

in December 2024 on the WHO’s response to the COVID-19 pandemic, calling it “an abject failure.”

According to the report, the WHO is accused of bending to pressure from the Chinese Communist Party and placing “China’s political interests ahead of its international duties.”

As part of the alleged failure, the WHO reportedly ignored warnings by Taiwan on Dec. 31, 2019, about “atypical pneumonia cases” in Wuhan, which it asked the WHO to investigate.

“The initial mismanagement of the COVID-19 pandemic not only potentially caused the further spread of the virus, but it created a situation where people lost trust in the global public health organization,” the https://www.congress.gov/118/meeting/house/117748/documents/HRPT-118-SSCPReport.pdf

stated.

The Associated Press and Aldgra Fredly contributed to this report.

https://cms.zerohedge.com/users/tyler-durden

Fri, 02/07/2025 - 03:30

https://www.zerohedge.com/political/heres-what-know-about-us-withdrawal-fromthe-who

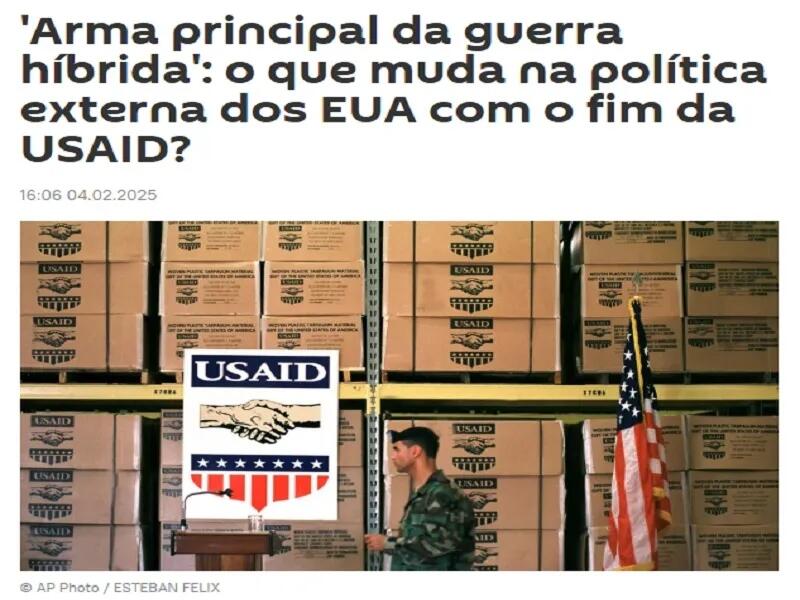

USAID Is A Premier Weapon Of US Hybrid Warfare In The Southern Hemisphere

USAID Is A Premier Weapon Of US Hybrid Warfare In The Southern Hemisphere

https://korybko.substack.com/p/korybko-to-sputnik-brasil-usaid-is

Here’s the full interview that I gave to Sputnik Brasil about USAID, excerpts of which were published in their report titled “'Arma principal da guerra híbrida': o que muda na política externa dos EUA com o fim da USAID?”

?itok=DW8yLSWO

?itok=DW8yLSWO

1. How has USAID been used by the government of United States through the years to meddle in other countries, mainly Brazil and other countries from Latin America?

USAID is infamous for funding political programs under the cover of human rights and democracy to meddle in the recipient country’s domestic affairs. This popularly takes the form of funding movements, including media projects, for exposing alleged corruption in Latin American states. The purpose is to artificially generate a groundswell of grassroots opposition to incumbent governments that manifests itself through street protests and/or surprise election showings in order to bring about political change.

Some of the locals who collaborate with these foreign-funded political projects sometimes go on to become advisors or even figures in the more pro-American governments that replace the targeted ones. Therefore, USAID doesn’t just work to remove Latin American governments, it also sometimes provides trained advisors and personnel for the next governments. This makes it a premier weapon of US Hybrid Warfare in the hemisphere.

2. Does the end of USAID mean the end of US interference in other countries’ domestic affairs? Will they just change their method instead?

New Secretary of State Marco Rubio declared that he’s the acting administrator of USAID as it goes through radical reforms.

Per Trump’s Executive Order suspending foreign aid for 90 days, with the exception of emergency humanitarian aid, an assessment is taking place to determine their efficiency and consistency with policy. Accordingly, many programs dealing with socio-cultural issues like LGBT will likely be cut, while foreign media funding and the training of foreign political cadres will likely continue.

3. How do you evaluate Trump’s decision to end USAID?

USAID made sense from the perspective of older American interests back when it was first founded, but it was hijacked by liberal-globalist ideologues to proselytize radical socio-cultural policies that don’t objectively align with the US’ national interests. Examples of the most ridiculous programs are being shared all across X right now. Many Americans are enraged to discover what they were funding and surprised that a lot of the money also went to domestic “NGOs” for implementing these projects.

Ending USAID was necessary since that’s the only way to implement the radical reforms that the Trump Administration envisages, which are most immediately reducing government expenditures via the Elon Musk-led “Department Of Government Efficiency” (DOGE) and then realigning those that remain with policy. Many employees are also diehard ideological opponents of Trump and all that he represents so keeping them around runs the risk that they’d try to sabotage his second term like they did his first one.

What’s essentially happening is that Trump 2.0 entered power with a detailed plan for purging hostile elements of the US’ “deep state”, which refers in this context to its permanent military, intelligence, and diplomatic bureaucracies, with some also including its administrative and other ones too. USAID was a major component of the US’ power structure for decades prior to Trump’s second term so dismantling it is considered crucial for the success of his team’s foreign policy.

4. Some US politicians have criticized the Trump Administration’s reforms of federal agencies, fearing that confidential information might leak out and even describing the overall gist of what’s going on as a “serious threat to national security”. What do they fear? Is this a sign of USAID’s connection with the CIA like Musk recently talked about?

Not every USAID employee and project is connected to the CIA, but the CIA does indeed sometimes employ the aforesaid in advance of its goals due to the relative ease with which their democracy and human rights covers enable US spies to infiltrate and/or destabilize foreign countries. Those who are criticizing Trump’s reforms are elements of the US’ power structure who stand to lose from his and Musk’s campaign to expose irresponsible government spending and political meddling abroad.

Some of them do have a point, namely that innocent USAID employees might be suspected of being spies and this could lead to credible threats against them, but the Trump Administration is willing to risk those consequences in pursuit of its ambitious reform campaign. Purging USAID, the State Department, and the “deep state” more broadly is the only way to prevent them from sabotaging Trump’s foreign policy the second time around, which he envisages revolutionizing the US’ relations with the world.

Excerpts from this interview were published in Sputnik Brasil’s report titled “https://noticiabrasil.net.br/20250204/arma-principal-da-guerra-hibrida-o-que-muda-na-politica-externa-dos-eua-com-o-fim-da-usaid-38379746.html

”

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 23:25

https://www.zerohedge.com/geopolitical/usaid-premier-weapon-us-hybrid-warfare-southern-hemisphere

US "De Minimis" Exemption (Was) One Of The Highest In The World

US "De Minimis" Exemption (Was) One Of The Highest In The World

As a part of the tariffs imposed by the Trump administration Saturday on Canada, Mexico and China, so-called "de minimis" rules on small imports from the countries were suspended.

"De minimis" rules say that incoming goods under a certain value are not subject to import duties (and sometimes tax). As a result, the U.S. temporarily stopped accepting parcel from China and Hong Kong as many popular retailers send scores of "de minimis" shipments from these locations, including the likes of Temu or Shein. https://www.nytimes.com/2025/02/04/business/usps-china-de-minimis.html

. USPS said it was working on a solution of implementation of the new rules that would cause the least disruptions to parcel delivery.

While the rule change was explained in the case of China, but also Canada, with stopping the unregistered import of fentanyl or its ingredients to the U.S., https://www.statista.com/chart/20154/countries-applying-a-%2522de-minimis%2522-exception-of-taxes-and-or-duties/

out that most of the parcels affected will come from e-commerce platforms, with Chinese imports taking up the bulk of "de minimis" shipments. Checking the parcels to impose Trump's new additional 10 percent tariff on Chinese goods as well as any other tariffs that might apply per product category would cause a lot of extra work. However, the ability of Chinese e-commerce sellers to create large business footprints overseas while skirting many of the dues of a traditional export business has also caused discontent in the U.S. and elsewhere.

how many of the products shipped from the likes of Shein et al. are not up to quality standards, which caused complaints from consumer protection bodies.

shows that more than 100 countries around the world employ "de minimis" in order to speed up international shipping. However, the maximum value such parcels can have varies widely.

You will find more infographics at https://www.statista.com/chartoftheday/

The U.S.' $800 threshold is one of the highest in the world while EU countries impose charges on imports of much lower value (above €150 - approximately $156).

China's "de minimis" rules are also more strict, with any tax or duty under 50 Yuan Renminbi (approximately $7) considered void - this would for most products be in line with a value of $99 or less.

The country also already has a more refined approach to "de minimis" with a pre-registration and approval system for e-commerce traders in place that allows for higher exemptions at the discretion of the government.

Other countries have also posed additional hurdles to "de minimis", for example exempting B2B shipments or specific goods. Others allow neighbors or certain major trade partner to take advantage of a bigger "de minimis" allowance.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 23:00

https://www.zerohedge.com/geopolitical/us-de-minimis-exemption-was-one-highest-world

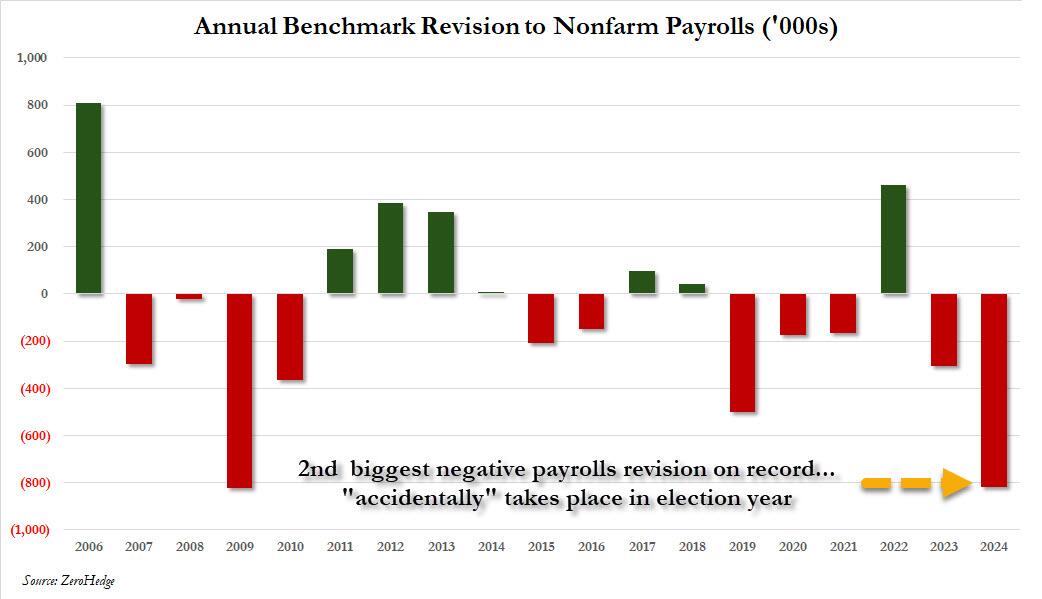

Tomorrow's Jobs Report Will Finally Capture The Surge In Illegal Aliens, Lead To Another Big Negative Payrolls Revision

Tomorrow's Jobs Report Will Finally Capture The Surge In Illegal Aliens, Lead To Another Big Negative Payrolls Revision

Remember last August when the Biden admin finally admitted it had been rigging the jobs number, when as part of its preliminary revision it https://www.zerohedge.com/markets/us-jobs-revised-down-818000-election-year-shocker-second-worst-revision-us-history

in the past year that were never actually added, a historical negative revision (the second biggest on record) which the Fed used as justification for its panicked jumbo 50bps rate cut just a few weeks later?

?itok=ZBeeov3I

?itok=ZBeeov3I

Well, tomorrow that revision - along with a dramatic increase in the US population estimate by 3.5 million primarily to reflect the surge in illegal immigration - will finally flow through fully into the jobs report, as part of a bigger overhaul of the labor market by the now-Trumpian Bureau of Labor Statistics, and the results could be dramatic.

First, some background.

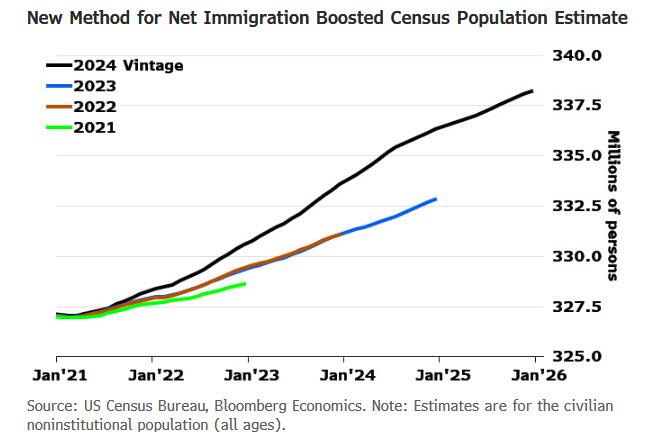

Each year the US Census Bureau adjusts the weights in the Current Population Survey – the source data for labor-force statistics like the unemployment rate – incorporating updated estimates of the population’s size and composition. In the latest vintage, the Census modified its approach to estimating net international migration - for obvious reasons, the main of which being that for the past 4 years the US effectively had no southern border - which had the effect of substantially boosting its estimate of the US population since 2020.

Bureau of Labor Statistics employment data for January (due for release Feb. 7) will reflect these adjustments, capturing the cumulative undercounting of the population relative to the last vintage of Census estimates.

That, according to Bloomberg, could lead to a large population adjustment this year which could raise the aggregate unemployment rate by raising the weight of recent immigrants, who tend to have higher unemployment rates than the general population. Overall, Bloomberg expects population adjustments to lift January’s unemployment rate by 5 basis points (which as everyone https://www.cnbc.com/2023/01/13/matt-yglesias-got-confused-about-basis-points-heres-what-to-know.html

, is not percent but rather one hundredth of a percent).

Here are the details according to Bloomberg:

The latest vintage of the Census Bureau’s population estimates raised the level of the civilian noninstitutional population for December 2024 by around 3.6 million relative to the prior vintage a year earlier.

The main reason was changes to the methodology for estimating net immigration. Historically, Census has relied on American Community Survey (ACS) data for its estimates of net international migration. But this approach posed two challenges:

First, the ACS data is lagged. For each vintage of population estimates, Census had ACS immigration information only for the previous year, so the data failed to capture very recent trends.

Second, ACS misses some migrants. This is supported by the divergence in recent years between the ACS immigration estimates and immigration totals from administrative data from other parts of the government.

To address this, Census adjusted its methodology to incorporate 75% of the difference between the sum of immigration totals from the administrative data and the ACS data. That resulted in a higher estimate for net immigration, lifting the estimate of the total population from 2020-2024.

?itok=M00LbS0e

?itok=M00LbS0e

Of that 3.6 million, roughly 3 million are 16 and older – the relevant population for the BLS unemployment statistics.

Historically, adjustments to the population — even relatively large ones — haven’t had much impact on the unemployment rate.In some cases the adjustments have resulted in significant changes to labor-force participation or employment rates, but usually there have been offsetting effects that dampen any change.

But for tomorrow's report there is a risk that the updated immigration estimates could lift the unemployment rate more visibly because the adjustment could increase the survey weight of workers with a higher unemployment rate.

Bottom line: Adjustments to the population controls in January’s household survey to boost the unemployment rate by ~5 bps. Together with Bloomberg's forecast of a decline in government jobs, the unemployment rate is expected to edge up to 4.16% in January from 4.09% a month earlier.

There's more: since the increase in the population will also raise the level of the labor force and employment, the updated employment level will imply average monthly job growth of around 150k-170k last year — narrowing the gap between the employment figures from the household survey and the estimates from the BLS’ establishment survey.

And indeed, Bloomberg cautions that the separate, benchmarking process in the establishment survey is likely to result in significant downward revisions to nonfarm-payrolls data, bringing average monthly job growth last year down to about 150k, from around 180k before revisions.

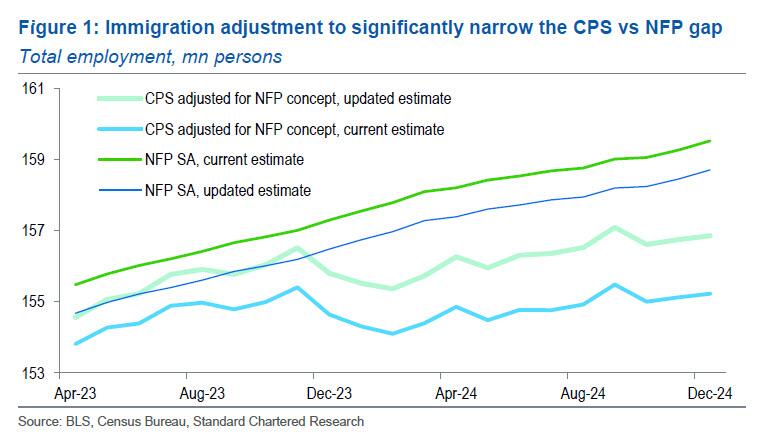

As Standard Chartered's Steve Englander writes (full note available to pro subs), according to the abovementioned BLS estimates as of August 2024, March 2024 NFP is likely to be revised down by 818k after benchmarking to the Quarterly Census of Employment and Wages (QCEW). However, further QCEW revisions since August make a 670k downward NFP revision more likely, so the overall gap between NFP and CPS (as of end-2024) will be reduced to about 2mn from 4.3mn.

?itok=OJ9dlEl0

?itok=OJ9dlEl0

The adjustment supports Englander's - and our - view that the surge in illegal aliens is more likely to be captured in NFP than CPS, as many of these workers were able to obtain employment authorization and work "legally" in the country. The household survey has likely understated annual employment growth by c.0.5mn during the past three years.

One problem the BLS will face is that participation rates and employment-to-population ratios for undocumented immigrants are highly uncertain. The BLS uses administrative data from other sources to bulk up population underestimates from standard Census and American Community Survey sources. However, no survey is likely to capture labor-force participation and employment among undocumented immigrants, so the BLS will probably have to make some assumptions based on legal immigrants and native-born labor-market participants. In addition, according to BLS methodology undocumented immigrants who have not been in contact with US Customs and Border Protection agents are unlikely to show up in either census population counts or BLS household employment. While these fully under-the-radar immigrants are a minority, CBO estimated them at c.800k for 2024.

An additional quirk is that the BLS puts most of its population revisions into each year’s January release (data to be released on 7 February). Its practice has been to introduce an abrupt upward or downward jump in January levels to capture the new population controls. This is arbitrary and does not align with monthly census population estimates. In practice, this means that m/m changes in population, employment, unemployment and labor-force numbers are largely meaningless, as they miss the big January shift. The 12M, 24M and 36M changes embed the population changes so they are relevant to the analysis. Ratios such as the unemployment rate, participation rate and employment to population remain meaningful on a m/m basis.

More to the point, as we https://www.zerohedge.com/markets/philadelphia-fed-admits-us-payrolls-overstated-least-800000

as the BLS subsequently admitted in August 2024, the March 2024 NFP would be revised down by 818k after benchmarking to the QCEW. However, subsequent QCEW revisions suggest a benchmark NFP reduction of around 670k. The overall gap between NFP and CPS will be reduced to 2.0mn from 4.3mn.

Of course, that's not the full story. As we also reported in December, the subsequent QCEW release pointed to en even much weaker Q2-2024 employment growth than signalled by NFP. (see "https://www.zerohedge.com/economics/biden-lied-about-everything-philly-fed-finds-all-jobs-created-q2-were-fake

"). However, the benchmark revision will not correct for the overstatement of payrolls in Q2-2024 until the second quarter of 2026, or more than a year into the future, leaving us with another year of NFP distortions!

Yes, dear readers, the full extent of the labor market devastation under Biden - and just how fabricated the jobs report truly has been - will continue to be unveiled for years to come, long after Biden himself is gone.

to pro subscribers.

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 22:10

Former UPenn Athletes Sue To Expunge Trans Swimmer Lia Thomas' Records

Former UPenn Athletes Sue To Expunge Trans Swimmer Lia Thomas' Records

Three former swimmers for the University of Pennsylvania have sued the Ivy League college to expunge the records of transgender athlete Lia Thomas.

?itok=ah4duT1Z

?itok=ah4duT1Z

Alums Grace Estabrook, Margot Kaczorowski and Ellen Holmquist filed the suit on Tuesday, alleging they suffered emotional trauma after Thomas competed as a woman, destroying everything they'd worked their entire lives to achieve. The lawsuit was filed one day before President Donald Trump signed an executive order banning biological men from competing in women's sports, the https://www.foxnews.com/sports/former-lia-thomas-teammates-sue-ivy-league-ncaa-alleging-aggressive-push-pro-trans-ideology

reports.

The three actual women claim that their former school, along with Harvard University, the NCAA, and the Ivy League Council of Presidents subjected them to harassment and abuse in violation of federal laws by allowing Thomas to compete on their team.

"The UPenn administrators told the women that if anyone was struggling with accepting Thomas’ participation on the UPenn Women’s team, they should seek counseling and support from CAPS and the LBGTQ center," reads the lawsuit.

2004 grads Kaczorowski and Holmquist, and Estabrook, a 2022 graduate, say they were "repeatedly emotionally traumatized" after Thomas was allowed to compete with them in violation of Title IX, and say that school officials pushed pro-trans ideology on them the entire time Thomas was on the team.

They also allege that school administrators invited them to a talk titled "Trans 101," where they were the problem if they had issues with a "trans-identifying male" on their team.

School officials also allegedly warned them against speaking out about Thomas or they'd be labeled transphobes and risk not finding jobs upon graduation.

?itok=DGyNH8BW

?itok=DGyNH8BW

The defendants are accused of creating a culture of intimidation that forced young women to deny biology. The plaintiffs claim that adding Thomas to their team jeopardized their opportunities, privacy, and safety.

Thomas, who competed for the UPenn Men's Swimming and Diving team between 2017 and 2020 then transitioned to the women's team, coming in first in the 500, 200, and 100-yard freestyle races - setting women's records. Thomas also broke several women's records at the 2022 Ivy League Championship, hosted at Harvard University.

The lawsuit asks a judge to declare that Thomas was ineligible to compete in women's races, and expunge his records, according to https://thenationaldesk.com/news/americas-news-now/former-upenn-swimmers-sue-to-vacate-lia-thomass-collegiate-records-lia-thomas-ncaa-womens-swimming-title-ix-transgender-harvard-ivy-league-sports-university-of-pennsylvania

.

"The Ivy League’s plan was to crown a man as a women’s champion in one of the most iconic swimming venues in America as scores of national and international journalists described the scene as a landmark civil rights accomplishment to be venerated," reads the lawsuit. "To bring its vision to fruition, the Ivy League engaged in a season-long pressure campaign to keep Thomas eligible to compete and prevent women from speaking up for their equal rights."

The swimmers' attorney, Bioll Bock, told The National News Desk that the alleged "pressure campaign" defied common sense and harmed his clients.

"The Ivy League believed that if America’s oldest and most storied educational institutions led the way, Americans would suppress common sense and submit to radical policies that steal young women’s cherished sports opportunities and obliterate biological reality," he wrote, adding "This lawsuit exposes the behind the scenes scheming that led to the attempt by Harvard University, UPenn, the Ivy League and the NCAA, to impose radical gender ideology on the American college sports landscape."

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 21:20

DOJ Sues Chicago, The Entire State Of Illinois, And Local Officials Over 'Sanctuary City' Laws

DOJ Sues Chicago, The Entire State Of Illinois, And Local Officials Over 'Sanctuary City' Laws

It's no secret that Chicago has forsaken its own low-income residents to virtue signal as a so-called 'sanctuary city' for illegal immigrants - to the point where local residents have been https://www.zerohedge.com/political/chicago-residents-throw-fit-over-new-migrants-dem-cities-clash-biden-admin-over-finances

."

?itok=ZR8egixa

?itok=ZR8egixa

Now, the Trump DOJ is suing Chicago, the state of Illinois, local officials over laws creating said 'sanctuary,' and have accused the defendants of impeding federal immigration enforcement efforts. In their complaint, the DOJ has asked a judge to declare the state and local measures unconstitutional due to the federal government's supremacy.

One of the laws challenged by the Wednesday lawsuit prohibits officials from complying with federal immigration detainers and providing certain information about noncitizens.

"The challenged provisions of Illinois, Chicago, and Cook County law reflect their intentional effort to obstruct the Federal Government’s enforcement of federal immigration law and to impede consultation and communication between federal, state, and local law enforcement officials that is necessary for federal officials to carry out federal immigration law and keep Americans safe," reads the https://storage.courtlistener.com/recap/gov.uscourts.ilnd.473062/gov.uscourts.ilnd.473062.1.0.pdf

.

Named in the case are Illinois Gov. JB Pritzker (D), Chicago Mayor Brandon Johnson (D), as well as the city's police superintendent and other city officials.

The case, filed in federal court in Chicago, marks one of the first major cases brought by the Trump administration in such a case, and comes after the Wednesday confirmation of Attorney General Pam Bondi, who issued a same-day memo restricting sanctuary cities from accessing DOJ funds.