Respect & Clarity: China Opens Door For Reengaging Trump In Trade Talks

Respect & Clarity: China Opens Door For Reengaging Trump In Trade Talks

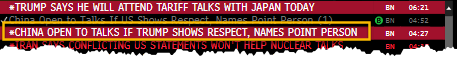

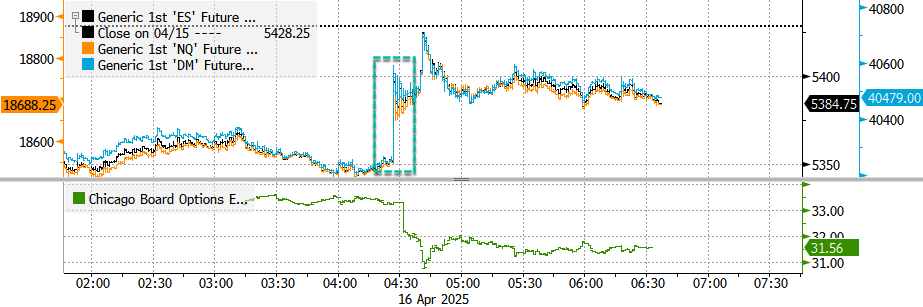

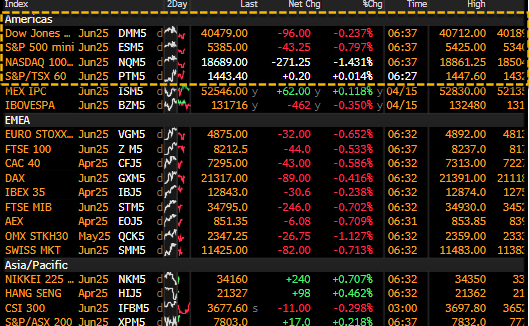

Nasdaq 100 and S&P 500 e-mini futures trimmed overnight losses after China reportedly laid out a set of preconditions for resuming trade talks with President Trump and his administration, https://www.bloomberg.com/news/articles/2025-04-16/china-open-to-talks-if-trump-shows-respect-names-point-person

reported, citing a source familiar with Beijing's internal deliberations.

According to the source:

Demand for Respect: China wants a more respectful tone from the U.S., particularly reducing disparaging remarks from U.S. cabinet members. Beijing was especially angered by Vice President JD Vance's recent "Chinese peasants" comment. Chinese Foreign Ministry spokesman called Vance's remarks "ignorant and disrespectful."

Unified U.S. Messaging: Chinese officials are confused by conflicting signals from Washington. While Trump's tone on Chinese President Xi Jinping has been moderate, hawkish comments from other high-ranking White House officials have conflicted. Without a clear and consistent U.S. position, China sees little value in engagement.

Point Person: Beijing wants the Trump administration to designate a point person to oversee trade talks.

News of the preconditions crossed the Bloomberg wires at 0427 ET.

?itok=8LfzG-gh

?itok=8LfzG-gh

This sent the U.S. main equity index futures surging, trimming earlier losses from European and Asian sessions.

?itok=JFzRBcYd

?itok=JFzRBcYd

As of 0630 ET, Nasdaq futures are still down 1.5%, while S&P 500 futures are down around 1%.

?itok=838QMEsv

?itok=838QMEsv

Commenting on the Bloomberg report, Gary Ng, senior economist at Natixis, said these developments of potential trade talks between the U.S. and China might fuel more risk-on sentiment:

"The impact on the dollar will still be mixed for now, but there will be more inflows into equities, both in China and the US."

Ng emphasized that this is not a U-turn in strategy, noting China had already signaled its openness to talks in a white paper published on April 9. However, he cautioned that a deal remains uncertain given the wide range of unresolved issues and the deepening economic and geopolitical rivalry between the two economic superpowers.

Goldman analyst Rich Privorotsky commented on the latest trade developments and markets:

China IP and retail sales strong overnight…largely ignored as markets lower on the back of U.S. restrictions on NVDA chip exports to China. This follow's yday's announcement of China halting the import of Boeing plans. Seems like the conflict between the two countries continues to escalate without a clear off ramp. "US President Donald Trump is willing to strike a trading deal with China, but the latter should reach out first" (RTRS) The upshot "China has appointed a new top trade negotiator amid the tariff war with the U.S." Bar feels low for some face saving exercise to bring both sides to the table (tricky part is who makes the first move). In a sense that could be a short term positive catalyst from here but even if tariffs are reduced they are likely to persist on China at some elevated level. The implications on U.S. consumers, global trade and growth remain impaired.

So technicals we're largely supportive yday and we for the most part ignored those trade headlines including news that European/U.S. trade negotiations had made little progress and EU trade delegation came back expecting no change to U.S. tariff policy. Hard to read too deep with another ~85 days left in trade negotiations... did we really think we'd have a breakthrough on day 5?

Despite supportive technicals those pesky fundamentals continue to point a pretty downbeat picture. Second European bellwether to miss this morning ASML: orders seemingly well below consensus and Q2 guidance seems light (downside compounded by NVDA news). UAL (forgive the dad joke) gave guidance wide enough for jumbo jet to fly between "United Airlines shared two financial outlooks for its full-year earnings because it believes it is "impossible to predict" how the economy will shape up during the rest of the year. The first outlook, which is the same range it previously shared in January, is based on a stable economic scenario where books remain weaker but stable. If the U.S. enters a recession, United is modeling an incremental five-point reduction to total operating revenue, further capacity reductions and a lower adjusted earnings range. "A single consensus no longer exists, and therefore the Company's expectation has become bimodal," United said. If corporate are experiencing this level of uncertainty its hard to see how orders/activity/capex/any form of forward planning in the economy isn't materially slowing (see side-note).

Macro dinner last night think we all acknowledge that the market could continue to squeeze up in the short-term. Vol compression, holiday, lack of incremental trade bad news (Can we really go higher than this: "China now faces up to a 245% tariff on imports to the United States as a result of its retaliatory actions."

The fate of the global economy and financial markets hinges on a trade deal. The latest effective rate of 145% on Chinese goods entering the U.S. and 125% on U.S. goods entering China have already created ructions in global trade routes (read https://www.zerohedge.com/markets/liberation-day-fallout-chinas-port-volumes-sink-after-trumps-tariff-blitz

) that only suggest macroeconomic headwinds are incoming in both China and the U.S.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/16/2025 - 07:20

Turkish Admiral: NATO Has Become A Reckless "Zombie Alliance"

Turkish Admiral: NATO Has Become A Reckless "Zombie Alliance"

A prominent Turkish defense official has given a rare interview to a regional Middle East outlet wherein he describes NATO as a "zombie alliance" which has outlived its functionality and legitimacy as a real military alliance, something which is becoming increasingly evident at Trump threatens to walk the United States away from being its main funder and leader.

Retired Rear Admiral Cem Gurdeniz is architect of the "https://thecradle.co/articles-id/28676

" maritime doctrine and remains a prominent geopolitical commentator in Turkish society and the region. Blue Homeland signifies Ankara's expanded maritime claims in the eastern Mediterranean of the last several years.

The controversially includes waters surrounding the entirety of the EU country of Cyprus (based on the decades-long Turkish occupation of northern Cyprus), which gives Turkey access to large deposits of natural gas. These claims have renewed the long-running geopolitical standoff between Turkey and Greece and Cyprus, with the EU backing their argument that Turkeys is violating their sovereignty.

?itok=PA5ObDZE

?itok=PA5ObDZE

Thus the Blue Homeland doctrine has pitted NATO powers against each other, with Turkey possessing the second largest army within the NATO alliance. But the country remains somewhat of a wayward thorn in the side of the alliance, given it being at odds with the US on many fronts, most especially policy in northern Syria and the Kurdish question.

Adm. Gurdeniz was recently interviewed by prominent Turkish journalist https://x.com/ceydak

for the Lebanon-based The Cradle, and among the most notable remarks of the former top official is seen in the following:

NATO is now a zombie alliance. It exists more as a myth than a functional military bloc. Its expansion has been reckless. Its operations – from the Balkans to Libya to Ukraine – have destabilized entire regions, and its credibility is collapsing.

The EU, meanwhile, is pushing a €800 billion (approximately $864 billion) military revamp under the name “https://ec.europa.eu/commission/presscorner/detail/en/ip_25_793

.” But this requires massive austerity at home. European governments are preparing their populations for war, not peace. They need enemies to justify the spending.

He then admits, "But without US leadership, NATO cannot survive as a coherent structure. Trump’s America will not fight for Estonia or send troops to Moldova. Europe will have to defend itself – and it is not ready."

One might not expect this kind of blistering commentary from an admiral from a NATO country, but this is somewhat less surprising coming from someone whose career was in the Turkish military.

Below is the partial interview with link below to the https://thecradle.co/articles/blue-homeland-architect-warns-nato-has-failed-and-the-eu-wants-turkiye-on-its-knees

...

* * *

The Cradle: With US President Donald Trump back in office and the Ukraine war exposing NATO’s weaknesses, how should we understand the rupture in the western-led world order?

Gurdeniz: We are witnessing the second great breakdown of a global security order since World War II. The first came after 1990, when the Soviet Union voluntarily dissolved, and Washington rapidly expanded its influence across Eastern Europe. But today, 80 years after the end of that war, the US is beginning its own retreat – shifting its strategic center of gravity from Europe to the Asia-Pacific.

The Trump administration recognises this. Its strategy is no longer about global control but about retrenchment and preparing for great power rivalry in the Pacific, particularly with China. This isn’t a tactical adjustment – it’s a systemic collapse. NATO’s defeat in Ukraine was not just a battlefield loss – it was the end of an illusion.

The Cradle: What broke the neocon-led post-Cold War consensus?

Gurdeniz: The post-1990 order was built on the illusion of unipolarity. The US declared liberal capitalist democracy as the universal model. In this system, the west controlled finance, China was tasked with manufacturing, and resource-rich states were expected to supply energy and raw materials.

But this model encountered fatal contradictions. US military power failed in Iraq, Libya, and Afghanistan. Instead of stability, it brought destruction. Russia reasserted itself militarily after 2008. China rose economically and technologically, challenging western hegemony.

And together, they built a Eurasian counterbalance. Most crucially, the Global South saw through the facade. Israel’s genocide in Gaza, supported openly by Washington, shattered any remaining legitimacy. The western system now lies exposed – economically overleveraged, diplomatically isolated, and militarily vulnerable.

The Cradle: How do you interpret the Trump administration’s posture toward this collapse?

Gurdeniz: Trump is not the architect of this collapse – he is the product of it. He and his team understand that the post-1945 model no longer serves the US. The manufacturing base is hollowed out. Debt has reached $34 trillion.

The dollar is being bypassed in global trade. American power is contracting. What Trump offers is a retreat masked as strength. He wants to end America’s entanglements and focus on restoring domestic industry. He knows NATO is a burden, not an asset. His challenge is not ideological – it’s existential. He wants to keep the American empire alive by cutting it down to a sustainable size.

The Cradle: What’s the fate of NATO in this equation?

Gurdeniz: NATO is now a zombie alliance. It exists more as a myth than a functional military bloc. Its expansion has been reckless. Its operations – from the Balkans to Libya to Ukraine – have destabilised entire regions, and its credibility is collapsing.

The EU, meanwhile, is pushing a €800 billion (approximately $864 billion) military revamp under the name “https://ec.europa.eu/commission/presscorner/detail/en/ip_25_793

.” But this requires massive austerity at home. European governments are preparing their populations for war, not peace. They need enemies to justify the spending.

But without US leadership, NATO cannot survive as a coherent structure. Trump’s America will not fight for Estonia or send troops to Moldova. Europe will have to defend itself – and it is not ready.

The Cradle: Is the world truly shifting to a multipolar order – or is it still premature?

Gurdeniz: The shift is real and irreversible. BRICS is growing. The Shanghai Cooperation Organisation is expanding. Trade is moving away from the dollar. Regional powers like Iran, India, Brazil, and Turkiye are asserting themselves. This is not a return to Cold War blocs. It’s a rebalancing – a world where no single centre dominates.

Multipolarity is not about utopia. It is about sovereignty. It allows nations to align based on interest, not coercion. The challenge now is to build institutions that reflect this reality – new trade systems, security frameworks, and development banks that are not controlled by the west.

The Cradle: You’ve long championed the “Blue Homeland” maritime doctrine. How does this fit into Turkiye’s future in Eurasia?

Gurdeniz: Blue Homeland is not a slogan – it’s our geopolitical imperative. Turkiye is surrounded by contested waters: the Aegean, the Eastern Mediterranean, and the Black Sea. If we surrender these spaces, we become landlocked and irrelevant.

Western powers, particularly through Greece and Cyprus, want to trap us in Anatolia. The Seville Map, backed by the EU, would reduce our maritime space by 90 percent. That is a geopolitical death sentence.

Blue Homeland asserts our legal rights, our naval presence, and our energy interests. Combined with the https://thecradle.co/articles/eurasias-middle-corridor-an-atlanticist-frenzy-to-stifle-europe-asia-integration

– which links us to Central Asia and China – we form a continental-maritime axis. This is the backbone of Turkiye’s 21st-century strategy.

TRUMP: "The U.S. can't lose $1.9 trillion on trade & also spend a lot of money on NATO in order to protect European nations. We cover them with military, then we lose money on trade. The whole thing is crazy!"

"The American people understand it a lot better than the media!" https://t.co/gSC29Ze5xb

— Breaking911 (@Breaking911) https://twitter.com/Breaking911/status/1909043340990992563?ref_src=twsrc%5Etfw

The Cradle: What is your assessment of Turkiye’s economic orientation in this new world order?

Gurdeniz: We must abandon the illusion that foreign direct investment and EU integration will save us. That model has failed. It brought debt, privatisation, and dependency. Our economy must be built on production, not speculation.

This means reindustrialisation, food and energy sovereignty, and regional trade in local currencies. We must protect strategic sectors from foreign ownership. Our Central Bank must be independent not just from the government, but from foreign influence.

Only then can we speak of economic sovereignty.

The Cradle: What about diplomacy? Should Turkiye align with a particular bloc – or pursue non-alignment?

Gurdeniz: We must pursue what I call “assertive non-alignment.” That means refusing to be anyone’s satellite. We keep our options open. We cooperate with Russia, China, and the Global South, but also engage with Europe and the US where our interests align.

But there are red lines. We will not join sanctions regimes against our neighbors. We will not host foreign bases targeting other states. And we will not be dragged into NATO’s failing wars.

Our diplomacy must serve our geography – balanced, firm, and sovereign.

The Cradle: The EU claims to be a “values-based” project. How do you respond to this claim?

Gurdeniz: The EU’s values are selective. When it comes to Turkiye’s maritime rights, they back Greek maximalism. When it comes to Palestine, they say nothing. When it comes to Israel’s crimes, they call it “self-defense.”

This is not about values – it’s about power. The EU wants Turkiye as a buffer zone, a refugee warehouse, and a source of cheap labor. It will never accept us as equals. And we should not want to join such a club.

Our dignity is not for sale.

.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/16/2025 - 06:55

https://www.zerohedge.com/geopolitical/turkish-admiral-nato-has-become-reckless-zombie-alliance

Peace Through Technological Strength: How Trump's America Tames The Chinese Dragon

Peace Through Technological Strength: How Trump's America Tames The Chinese Dragon

Authored by Shane Festa and Brent Sadler via https://www.dailysignal.com/

,

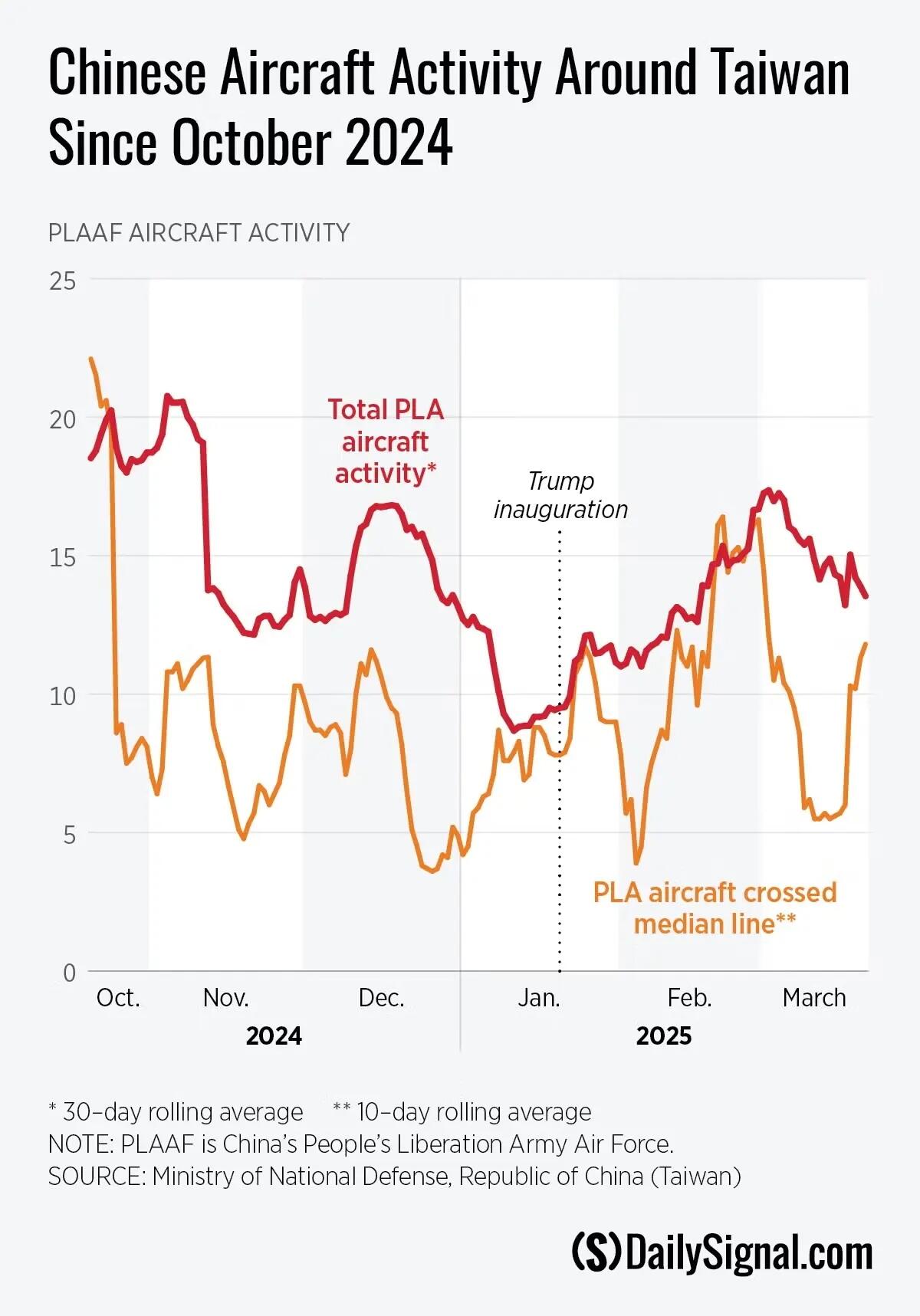

In the days around the U.S. presidential election, dozens of People’s Liberation Army warplanes cruised through Taiwanese airspace. Such behavior is a microcosm of https://www.dailysignal.com/category/china

and confidence to act with increasing impunity.

?itok=wtZRRMkM

?itok=wtZRRMkM

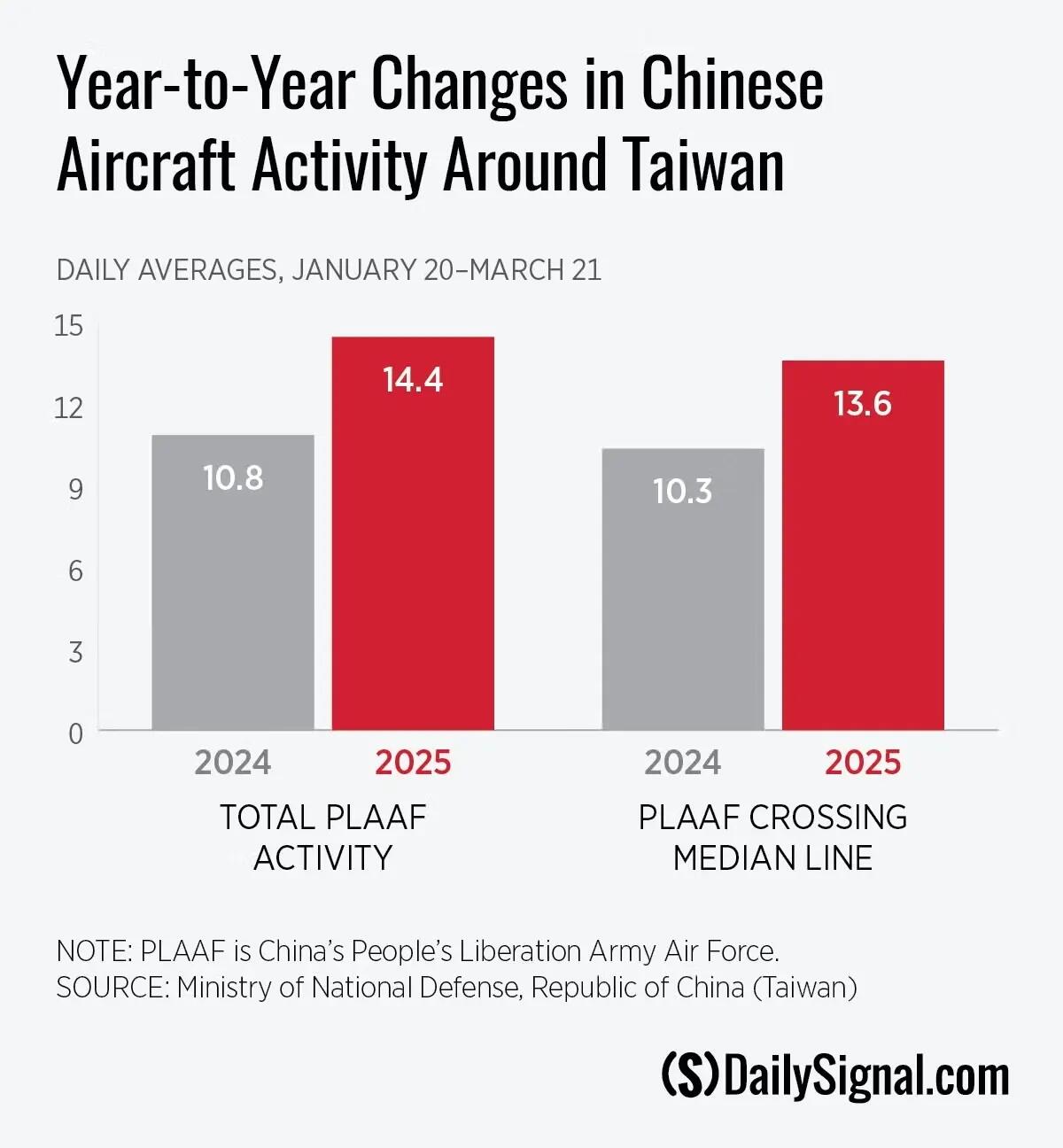

During President Joe Biden’s tenure, the Chinese military consistently probed Taiwan’s readiness and Washington’s leadership. Data from the Taiwanese Ministry of Defense indicates Chinese activity around Taiwan has spiked by over 30 percent compared to the same period last year, potentially a calculated jab to see how Trump 2.0 will respond to cross-strait antagonism.

?itok=JGbMsNY3

?itok=JGbMsNY3

As 2024 came to an end, the https://www.dailysignal.com/2023/09/22/how-chinese-communist-party-is-influencing-u-s-classrooms/

around the island nation.

In recent weeks, the People’s Liberation Army has returned to sending provocative signals. As typical, China’s military activities ebb and flow to send specific strategic messages or in reaction to perceived provocations, such as when the https://news.usni.org/2025/02/12/chinese-navy-tracks-first-u-s-taiwan-strait-transit-under-trump-administration

earlier this year.

That operation triggered an abnormally intense response for early February—30 Chinese aircraft were detected in Taiwan’s northern, southwestern, and eastern air defense identification zones in a single day. By comparison, the last transit of the Taiwan Strait by a https://www.dailysignal.com/2023/12/13/navy-needs-shipyards-to-protect-america-and-gulf-coast-provides-options/

saw China deploy only 14 aircraft in response.

Unlike the situation under the Biden administration, Beijing recognizes Trump 2.0’s focus on it hinders China’s absorbing Taiwan on a timeline of its choosing.

Moreover, shortly after Chinese Lunar New Year celebrations wrapped up, the Chinese military conducted https://www.taipeitimes.com/News/front/archives/2025/02/27/2003832575

and New Zealand, fomenting some consternation in Canberra and Wellington.

By mid-March, the 10-day average of median line crossings by Chinese aircraft showed a significant rise, almost doubling from six on March 17 to 11.8 by March 21—largely attributable to one day’s spike in activity on March 18.

Chinese Ministry of Foreign Affairs spokesperson Guo Jiakun explained the activity by https://www.voanews.com/a/us-state-department-tweaks-online-fact-sheet-on-china/7982577.html

.” The surprise drills in February and March produced unexpected spikes in activity, indicating that even under President Donald Trump, China is still keen on testing boundaries.

?itok=B7JF0nCG

?itok=B7JF0nCG

To better ascertain China’s evolving military strategy and intent, the U.S. must leverage its forward-looking approach to intelligence, surveillance, and reconnaissance. In February, Adm. Samuel Paparo, commander of U.S. Indo-Pacific Command, warned that China’s heightened activity near Taiwan was in fact rehearsal for an attempt at https://news.usni.org/2025/02/17/china-drills-near-taiwan-are-rehearsals-for-forced-reunification-paparo-says

that obfuscate preparations for kinetic conflict.

Project Overmatch, the Navy’s contribution to the Joint All-Domain Command and Control initiative, is https://www.doncio.navy.mil/CHIPS/ArticleDetails.aspx?id=18149

success in the Arabian Gulf.

There, autonomous vehicles and associated information networks served as the connective tissue between machines and manned vessels, enabling a wider and persistent sensor coverage previously unseen, which could soon be made lethal as demonstrated in November’s https://www.cusnc.navy.mil/Media/News/Display/Article/3976793/task-group-591-conducts-digital-talon-30/

. The drills showcased Central Command’s prowess in testing aerial autonomous launches and recoveries, as well as identified challenges for the group dubbed “the pioneers” to overcome in the future.

In the Pacific, this approach could give the U.S. a critical edge in countering China’s tactics and deter aggression. The private sector has matched this movement toward activity-based intelligence. Predictive models and sensors suites from companies like https://www.defensenews.com/naval/2015/11/08/israeli-startup-scours-the-seas-for-threats/

track anomalous behavior using automated information systems, capable of subverting bad actors who seek to conceal their identities while at sea.

Data streams from platforms such as https://www.northropgrumman.com/what-we-do/sea/manta-ray

could create a sensor-heavy ecosystem capable of identifying, tracking, and predicting targeted activities like dark ships involved in sanctions avoidance, Chinese maritime militia activities, illicit narcotics trafficking at sea, and clandestine operations all in near real-time.

China is now seeking to check America’s—and Trump’s—response to its intimidation of Taiwan. Lawmakers must act without delay to equip the Indo-Pacific Command with the resources to field the appropriate technologies to pace rising Chinese provocations.

Done well, perhaps the next time China or Russia seeks to https://www.rfa.org/english/china/2025/02/25/taiwan-detain-china-cargo-cable/

in Asia or harass partners in the region, by detecting anomalous or illicit activities through cutting-edge monitoring, the United States could better position forces to preempt such moves before they become a confrontation at sea. To achieve this, our naval forces must have robust maritime domain awareness necessary to stay one step ahead.

* * *

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 23:25

First Victim Of Basis-Trade Blow-Up Emerges

First Victim Of Basis-Trade Blow-Up Emerges

Last week, in the immediate aftermath of the basis trade implosion, we predicted that "any minute" now we are going to start hearing about catastrophic losses at multi-strat hedge funds.

Any minute now we are going to start hearing about catastrophic losses at multi strat hedge funds

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1909945244294025527?ref_src=twsrc%5Etfw

In retrospect we had to wait quite a few minutes, almost a week's worth, but finally the first victim of the basis trade blow up has emerged.

According to Bloomberg, hedge fund Alphadyne Asset Management, which manages about $10 billion and specializes in macro and fixed-income relative value trading, lost hundreds of millions of dollars last week, accelerating its decline for the month of April as Trump’s trade war sparked a https://www.zerohedge.com/markets/absolutely-spectacular-meltdown-basis-trade-blowing-sparking-multi-trillion-liquidation

last week.

The flagship Alphadyne International Fund lost 10% this month through Friday, Bloomberg reported citing people with knowledge of the matter. The firm’s "relative value bets", which is a polite way of saying basis trades, caused much of the loss, and wrong-way wagers on Japanese assets contributed to the decline.

Alphadyne’s main fund had already declined 2.4% during the first week of April, and with last week's jarring losses, which are staggering for a "hedged" relative value fund (think LTCM) it’s down about 8% this year.

Alphadyne joins a raft of basis traders traders and hedge fund strategies struggling amid challenging conditions this month. Tudor trader Alexander Phillips lost about $140 million in April through earlier last week, erasing his pre-April gains for 2025. Meanwhile, Eisler Capital portfolio manager Barry Piafsky and his team were stopped out from trading after they lost millions of dollars during the ongoing market selloff.

The upheaval from Trump’s tariffs sent long-term bond yields surging last week, hurting popular and highly leveraged hedge fund trades in bond markets, including the swap-spread widener and basis trades.

This is mindboggling: the "big 6" multi-strat hedge funds have $1.5 trillion in 2024 regulatory assets between them (up from $1.2 trillion in 2023) much of it invested in just one trade: Treasury basis https://t.co/yJYBUpTCyP

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1905352289059058135?ref_src=twsrc%5Etfw

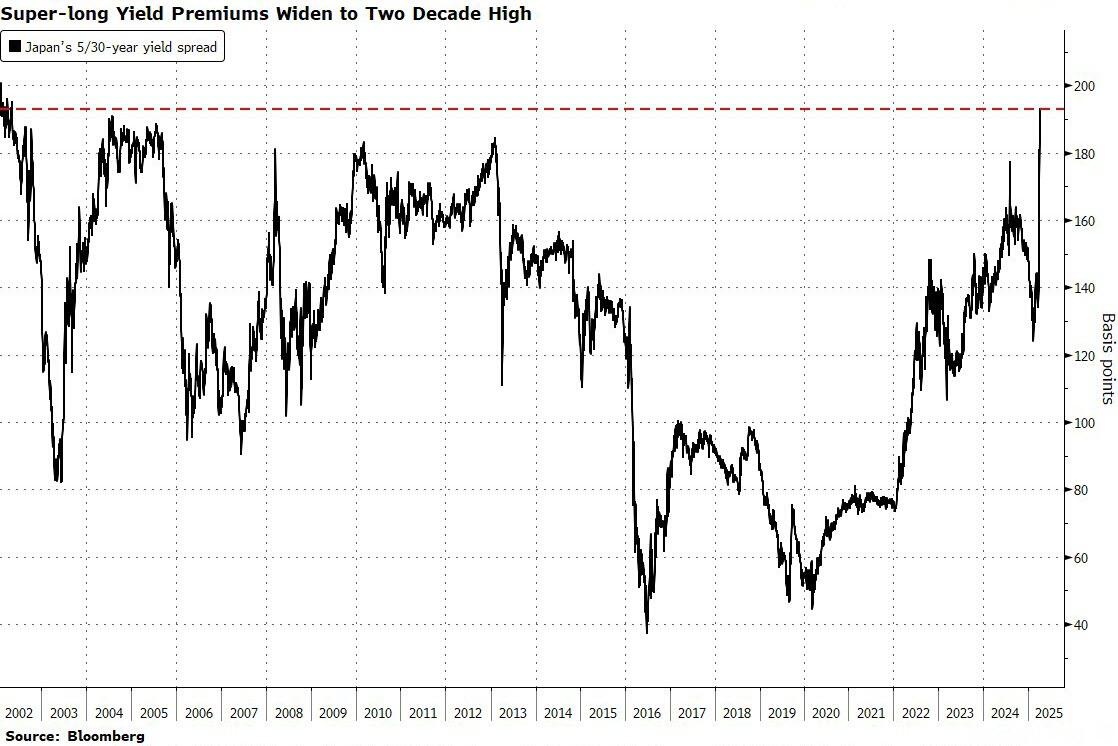

Yen rates traders have also suffered widespread losses as Japan’s yield curve kept on steepening after Trump paused his threat of reciprocal tariffs on US trading partners, with the 5/30s curve approaching record levels.

?itok=Cm1OeJZe

?itok=Cm1OeJZe

The widely held consensus trade had been a wager on the Bank of Japan raising rates to help flatten the yield curve.

Instead, economists now worry that an appreciating yen could squeeze profits for Japan’s exporters, cool import prices, curb domestic investment and weaken wage growth — posing a challenge for the central bank to stay on a tightening path.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 23:00

https://www.zerohedge.com/markets/first-victim-basis-trade-blow-emerges

CIA To Unleash 'Finely Tuned Machine' To Destroy Mexican Cartels

CIA To Unleash 'Finely Tuned Machine' To Destroy Mexican Cartels

It was only a matter of time until the CIA became involved in the Trump administration's war on Mexican drug cartels. According, and is formulating a 'finely tuned machine' to help disrupt one of the deadliest criminal networks in the world.

?itok=RtM-JixI

?itok=RtM-JixI

Specifically, the CIA is establishing the Americas Counternarcotics Mission Center, combining its counternarcotics and Western Hemisphere teams to enable faster, more effective collaboration, CIA Deputy Director Michael Ellis (formerly Rumble general counsel) told https://www.breitbart.com/politics/2025/04/14/exclusive-cia-deputy-director-michael-ellis-cia-to-create-a-finely-tuned-machine-to-destroy-the-cartels/

, adding that the mission is to become a "finely tuned machine" to dismantle cartels, labeled foreign terrorists by the Trump administration. According to Ellis, the agency will leverage its 25 years+ of expertise in targeting jihadist networks to disrupt the cartels' international operations.

“The drug trafficker is a savvy, sophisticated adversary,” the CIA official told the conservative publication. “[We’re] looking further upstream to identify those networks beyond our borders and dismantle them.”

“It’s a whole of government effort,” he added, before underscoring that the agency's operations may remain covert due to their sensitive nature.

As early as this week, the agency is preparing to launch the Americas Counternarcotics Mission Center, which will merge agency personnel who focus on counternarcotics and personnel who focus on the Western Hemisphere, for closer and faster coordination.

— Kristina Wong 🇺🇸 (@kristina_wong) https://twitter.com/kristina_wong/status/1911950180418564420?ref_src=twsrc%5Etfw

In February, the Trump administration officially https://apnews.com/article/gangs-cartels-sinaloa-aragua-trump-terrorist-organizations-b223f4eb513105fb8d965f80a6cecfeb

eight Latin American criminal groups as "foreign terrorist organizations," specifically targeting Mexico's Sinaloa Cartel, Venezuela's Tren de Aragua, and El Salvador's MS-13.

As part of its upcoming operations, the admin is considering drone strikes targeting Mexican cartels in a bold strategy to counter criminal organizations smuggling narcotics across the U.S. southern border, NBC News reports.

No decision has been made on whether the strikes have been approved.

“It’s their country, and obviously we believe in strong partnerships,” Acting DEA Administrator Derek Maltz said. “That said, at some point it’s about the safety of our kids.”

Maltz, speaking to https://www.nbcnews.com/politics/national-security/trump-administration-weighs-drone-strikes-mexican-cartels-rcna198930

, highlighted "historic, unprecedented action" in U.S.-Mexico drug enforcement collaboration during the early months of the Trump administration. Last month, Mexico deployed 10,000 troops to its northern border to inspect vehicles for fentanyl at crossing points.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 17:20

https://www.zerohedge.com/geopolitical/cia-unleash-finely-tuned-machine-destroy-mexican-cartels

Liberation Day Fallout: China's Port Volumes Sink After Trump's Tariff Blitz

Liberation Day Fallout: China's Port Volumes Sink After Trump's Tariff Blitz

On Monday, we outlined the deepening fallout from the trade war, with U.S. markets wobbling while the Federal Reserve remains sidelined. In response, Treasury Secretary Scott Bessent suggested in an https://www.zerohedge.com/markets/china-limits-stocks-sales-maintain-impression-stability-bessent-hints-boosting-treasury

that the Treasury may step up buyback operations in a bid to cap soaring yields. Meanwhile, in China, authorities have rolled out a series of market-stabilizing measures to project stability after President Trump's 145% tariffs (now excluding select electronics such as computers, handsets, and semiconductors) are delivering a sharp blow to Chinese suppliers.

Trump's tariff bazooka last week—raising the effective rate on Chinese goods to 145%—sent suppliers in the world's second-largest economy into panic and turmoil, particularly those selling on Amazon, as we noted last Thursday in our piece titled "https://www.zerohedge.com/markets/chinese-sellers-amazon-panic-after-trumps-tariff-bazooka

."

The hunt was then on for high-frequency indicators—similar to those used during the early days of Covid—to track port congestion and other proxies for economic activity in China to gauge the actual impact of the trade war on the world's second-largest economy and/or potential spillover risks in the U.S.

By Saturday, we cited high-frequency congestion data from Goldman and BloombergNEF covering major Chinese cities for the seven days ending April 2—before the impact of Trump's 'https://www.zerohedge.com/geopolitical/how-trumps-liberation-day-tariffs-are-set-reshape-global-trade

tariffs on April 3. The data offered early insight into how the 145% tariffs on Chinese goods could unleash a Covid-like shock, sparking turmoil across the export-driven economy.

...

Then, on Sunday, we penned another note citing freight data (data between April 1 - 8) from Vizion that provided new insight into "https://www.zerohedge.com/markets/widespread-freezes-trumps-tariff-blitz-sends-us-import-bookings-crashing-global-supply

" sending U.S. import bookings into a tailspin.

"Widespread Freezes": Trump's Tariff Blitz Sends US Import Bookings Crashing, Global Supply Chains Crack https://t.co/ID9Lg2N7Ax

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1911573908043542747?ref_src=twsrc%5Etfw

As dark storm clouds of economic uncertainty gather above, new data (April 7-13 period) from https://www.wsj.com/economy/chinas-port-cargos-start-to-slow-as-tariff-tensions-escalate-e321cf6e

shows that Chinese port activity slumped. Total cargo volume was down 9.7% week-over-week to 244 million tons, and container throughput fell 6.1%, reversing prior gains.

Key points from WSJ's report:

The decline is tied to President Trump's 145% tariffs on Chinese goods, which have severely impacted exports to the U.S.

Freight rates to the U.S. plummeted, with an 18% drop to the West Coast and 10.8% to the East Coast, while rates to Europe and South America surged, suggesting a shift in trade routes.

Trump's effort to unwind decades of disastrous globalism marks a paradigm shift—one that occurs only a few times each century. The resulting tariff disruptions are gathering like a storm on the horizon and are poised to ripple through the global economy. We're monitoring these developments through high-frequency data, which already signal trouble ahead in China's export-driven economy and will soon begin to surface in the U.S.

Tons of shipping containers backed up at Chinese ports as U.S. cancels orders amid tariffs

FAFO 🤣🔥👇🏼 https://t.co/uzEi8NfjDy

— TONY™ (@TONYxTWO) https://twitter.com/TONYxTWO/status/1911453824474062911?ref_src=twsrc%5Etfw

A deepening trade war needs stability in the U.S. bond market. As we noted in "https://www.zerohedge.com/markets/china-limits-stocks-sales-maintain-impression-stability-bessent-hints-boosting-treasury

," the real concern remains with the Fed on the sidelines while Beijing enacts counter-stability measures to protect markets.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 13:25

Rabobank: Just What Does A World In Which The Dollar Isn't Reserve Currency Look Like?

Rabobank: Just What Does A World In Which The Dollar Isn't Reserve Currency Look Like?

By Michael Every of Rabobank

The US has opened two new Section 232 trade actions likely to lead to 25% tariffs on semiconductors and pharma, as already flagged. Obviously, both industries will reel, and Ireland is likely to take a particularly large hit.

President Trump also suggested he may temporarily pause auto parts tariffs for firms shifting production to the US. Expect other industries to ask for the same, and to get the same response: only for a while, and only if you are moving production Stateside.

US Treasury Secretary Bessent has a shortlist of countries for trade deals: Japan, South Korea, Australia, the UK, and India - plus Canada and Mexico. Vietnam and ASEAN are loitering outside the door, being deeply entwined with China’s economy, but mostly running huge trade deficits with it and equally huge surpluses with the US. President Trump is unhappy with Vietnam’s recent state visit from China’s Xi --with calls for a joint stance against “bullying” and 45 deals signed-- but Hanoi boosting its defence budget 30% could mean it buys US F-16s, and more, to narrow the bilateral trade deficit. However, that’s almost certainly not going to be all the US demands. From a statecraft perspective, it will want countries to mirror what it is doing vis-à-vis China, creating a new closed trade/finance/energy/defence loop.

As the US snaffles up those trade partners, plus the Middle East (more on which shortly), who would that leave for Europe to deal with if it didn’t join that gang? Micronesia and those penguins who are facing a 10% US tariff? Naturally, there are reports the EU and US are to start trade negotiations too, even if visiting https://newrepublic.com/post/193958/eu-anti-espionage-burner-phones-trump

for secrecy. Here, Europe again thinks just buying more US LNG will be a solution; but those China terms and conditions are not going to go away. That’s as Chinese social media is showing its consumers how luxury European brands are actually made in China, encouraging them to opt for local alternatives.

$28000 Birkins bag can be bought from China by the same factory at $1000 (sans logo)

Chinese suppliers have flooded American TikTok with cost breakdown of luxury products from Gucci, LV, Hermes & the 3000-5000% markups of brands https://t.co/f8gIPEjeJQ

— Ayoosh (@ayooshveda) https://twitter.com/ayooshveda/status/1911595724695019697?ref_src=twsrc%5Etfw

’, and the “Government’s rapprochement with Beijing may risk national security in wake of British Steel crisis, party members say”. Also, household and business refuse may start piling up in the streets outside just Birmingham as unions reject a pay deal ahead of May 1 local elections. So, lots of things that came in nice boxes last week now risk being publicly dumped.

Former Treasury Secretary Yellen says the Trump admin is undermining the status of the US dollar: the same former Fed Chair who borrowed vast sums at the short end of the yield curve and didn’t refinance US debt cheaply at the long end when she had the chance. Yellen also says onshoring manufacturing jobs is “a pipe dream” and not desirable after presiding over tariffs on China and the CHIPS Act and IRA subsidies aimed at bringing industry and jobs back to the US.

speaking of self-inflicted wounds, US debt increase while Janet Yellen was in charge of Fed or US Treasury : $15 trillion https://t.co/2j3kHOdwIB

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1911927898950214111?ref_src=twsrc%5Etfw

A Financial Times editorial argues Trump has no cards and will lose the trade war, because the pro-globalisation Peterson Institute for International Economics (PIIE) says so. For them, despite being wrong for years, this is still an auto-(pharma & chips)-da-fe, an act of faith requiring public penance and the burning of heretics by the Inquisition. This religious view on trade is the latest in a series of with-us-or-against-us bifurcations – and it’s not helpful to those trying to look at the matrix of potential outcomes and the risks involved either way. After all, what ‘cards’ are the PIIE looking at? Yes, China makes stuff and the US doesn’t. But a larger trading bloc without China can, after a period of adjustment, leave China with vast excess production to absorb.

Likewise, Bloomberg commentary says the US dollar will soften as its reserve currency appeal fades; then provides zero commentary on what the follow-on consequences of not having a global reserve currency are for everyone who still has dollar debt to repay:

The total collapse of the dollar? The total collapse of the dollar-based financial system as everyone defaults on trillions in debts they can’t get the bucks to service through trade? The inflationary debasement of said debts? Global bifurcation into different currency (or commodity), trade, clearing, energy, and defense blocs – within which the dollar may remain primus inter pares at gunpoint despite a narrower trade deficit?

After all, the US can use its legacy financialized weakness as a strength if it opts to. Bessent just stated the White House is thinking about who replaces Powell at the Fed next year – and in an age of economic statecraft it’ll surely be someone who understands the power of dollar swap lines (see "https://www.zerohedge.com/markets/nuclear-button-dollar-feds-swap-lines

".)

That’s as the Japanese 30-year yield is just shy of its highest level since early 2004 and not far from its highest ever going back to 2000. How will deeply indebted Japan do: more rate hikes? Equally, how will the Eurozone cope with the flip side of EUR being the new ‘global reserve shmurrency’: trade deficits, deindustrialisation, and polarisation, not unity and remilitarisation? So much is unclear on so many fronts: market volatility reflects this rather than masking it.

The RBNZ just attacked the mainstream media for its op-eds on how it operates(!), while separately announcing https://public-eur.mkt.dynamics.com/api/orgs/285245b1-7c6f-ef11-a66d-000d3a4b6c6a/r/Hk_luzFWKkSFk6sTTq4BAAAAAAA?target=%7B%22TargetUrl%22%3A%22https%253A%252F%252Fwww.rbnz.govt.nz%252Fresearch%252Four-research-and-analysis%252Fkiwi-gdp-growth-nowcasts%22%2C%22RedirectOptions%22%3A%7B%225%22%3Anull%2C%221%22%3Anull%2C%222%22%3A%7B%22utm_medium%22%3A%22email%22%2C%22utm_term%22%3A%22N%2FA%22%2C%22utm_source%22%3A%22dynamics-rr%22%2C%22utm_campaign%22%3A%221%22%7D%7D%7D&digest=F0OdXcYOI%2BW85JUxcIsj6VwryOp78mfe1AMDpSoByDg%3D&secretVersion=7c13c22c20aa46a1b2fc8b71fde4d19a

similar to the Atlanta Fed’s GDPNow, neither of which have any idea about what is going to happen next as tariffs hit.

In the hit-hard power sphere, Trump refused a Ukrainian offer to buy $50bn of US arms, saying of President Zelenskyy: “He's always looking to purchase missiles. Listen, when you start a war, you gotta know you can win a war. You don't start a war against somebody that's 20 times your size and then hope that people give you some missiles." Clearly, hopes for a ‘peace’ deal and an inverse Nixon —Noxin— linger there.

US nuclear talks with Iran are also set to continue in Oman, not Rome, with threats of attack if no deal is struck; as a parallel US nuclear fuel processing agreement with the Saudis looms - “They are allowed to process uranium just like you. So, you both better behave!” That’s a very high risk, high reward statecraft gamble. Moreover, Arab press reports have it that, with Saudi help, 80,000 troops are massing in Yemen in preparation for a move on Houthi-held territory. As noted, this can all be taken as a sign that the Saudis and the UAE are in the US camp having seen neither China nor Russia can project serious power into the region.

Meanwhile, Australia’s federal election shows how little some Western democracies grasp about our shifting tectonic plates. Aussie media says both major parties’ policies will push up house prices by another 15%: clearly, making something more affordable can never mean its price going down, and Aussie GDP is ‘for’ even higher asset prices. Which is what the PIIE would be happy with the US going back to.

But it won’t. The US is now into an auto-da-fe of another kind and globalisation is on the pyre, and perhaps Wall Street with it until it reflects what’s happening on Main Street.

So, volatility now: but there is another world to come. Are your deeds preparing you for it?

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 13:05

Trade War Turbulence: China Halts Boeing Jet Deliveries For Airlines

Trade War Turbulence: China Halts Boeing Jet Deliveries For Airlines

Days after Juneyao Airlines https://www.zerohedge.com/markets/trade-war-turbulence-chinese-airline-delays-boeing-jet-delivery-possible-non-tariff

, citing people familiar with the situation. The move marks a broadening of non-tariff retaliation amid a deepening tit-for-tar trade war between the U.S. and China.

?itok=uI24S7AB

?itok=uI24S7AB

Here's more color from the report:

China has ordered its airlines not to take any further deliveries of Boeing Co., according to people familiar with the matter.

. . .

Beijing has also asked that Chinese carriers halt any purchases of aircraft-related equipment and parts from U.S. companies, the people said, asking not to be identified discussing matters that are private.

The order came after China unveiled retaliatory tariffs of 125% on American goods this past weekend, the people said.

. . .

The Chinese government is also considering ways to provide assistance to airlines that lease Boeing jets and are facing higher costs, the people said.

. . .

Delivery paperwork and payment on some of these jets may have been completed before the reciprocal tariffs announced by China on April 11 took effect on April 12, and those planes may be allowed to enter China on a case-by-case basis, some of the people said.

Last week, Beijing hiked its effective tariff rate on US goods to 125%, countering President Trump's 145% tariff rate.

?itok=0GO5y1jM

?itok=0GO5y1jM

Beijing also shifted to non-tariff retaliation, limiting https://www.zerohedge.com/markets/hollywoods-box-office-blow-china-plans-moderately-reduce-us-film-releases

, slowing rare earth export shipments, and weakening the yuan.

The Bloomberg report sent Boeing shares down roughly 3.5% in New York trading. The stock is down 10% year-to-date (as of Monday's close) and hovering near Covid-era lows, still showing no signs of a meaningful recovery.

?itok=NU6FHeV7

?itok=NU6FHeV7

Let's not forget that China's non-tariff countermeasures may also include:

Export Controls and Quotas

Currency Devaluation

Boycotts (State-Inspired)

Licensing & Certification Hurdles

Restricting Market Access

Pressure Big Tech With Cybersecurity & Data Laws

Limiting Cultural Imports

Selling U.S. Treasuries

The trade war might be far from over...

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 07:20

https://www.zerohedge.com/markets/trade-war-turbulence-china-halts-boeing-jet-deliveries-airlines

Sony Hikes Playstation 5 Price Up To 11% In Major Markets - Except The US

Sony Hikes Playstation 5 Price Up To 11% In Major Markets - Except The US

Sony, citing inflation and 'fluctuating exchange rates,' has hiked the price of the Playstation 5 in several regions - but is shielding US consumers from the decision.

?itok=HgNqYn0g

?itok=HgNqYn0g

The company said it was a "tough decision" to raise PS5 prices for the first time in https://www.gamespot.com/articles/playstation-5-price-increasing-in-europe-canada-and-more/1100-6506882/

years.

"With a backdrop of a challenging economic environment, including high inflation and fluctuating exchange rates, SIE has made the tough decision to raise the recommended retail price of the PlayStation 5 console in select markets in Europe, Middle East and Africa (EMEA), Australia and New Zealand," the company said in a statement, and confirming to Gamespot that US prices will remain the same.

Analyst Daniel Ahmad suggested that "The knock on effect [of tariffs] in terms of inflation, exchange rates, and macro trends" may cause Sony to raise prices globally.

Everyone is about to find out that the PS5 price won’t just increase because of tariffs. The knock on effect in terms of inflation, exchange rates, and macro trends also impacts global pricing.

Even if one region is impacted, Sony may raise prices everywhere to offset losses. https://t.co/qJDNe3EtfN

— Daniel Ahmad (@ZhugeEX) https://twitter.com/ZhugeEX/status/1911562139317207542?ref_src=twsrc%5Etfw

, the changes are as follows;

Europe

PS5 Digital Edition - €50 increase from €450 to €500

PS5 Standard with disc drive - No price change

PS5 disc drive - €40 decrease from €120 to €80

UK

PS5 Digital Edition - £40 increase from £390 to £430

PS5 Standard with disc drive - No price change

PS5 disc drive - £30 decrease from £100 to £70

Australia

PS5 Digital Edition - AUD $70 increase from AUD $680 to AUD $750

PS5 Standard with disc drive - AUD $30 increase from AUD $800 to AUD $830

Ps5 disc drive - AUD $35 decrease from AUD $160 AUD $125

New Zealand

PS5 Digital Edition - NZD $60 increase from NZD $770 to NZD $860

PS5 Standard with disc drive - NZD $50 increase from NZD $900 to NZD $950

PS5 disc drive - NZD $30 decrease from NZD $170 NZD $140

Interesting, eh?

The U.S. price stays the same because here, we still have leverage.

This is what economic nationalism looks like in practice.

When America puts its foot down, even Japanese tech giants know not to test the waters.

— Hank™ (@HANKonX) https://twitter.com/HANKonX/status/1911933264266449407?ref_src=twsrc%5Etfw

lol. They’re making the Europeans pay for trumps tariffs?

— Cunha (@Cunha_D_) https://twitter.com/Cunha_D_/status/1911932525624099086?ref_src=twsrc%5Etfw

Europe: paying 10% more to get no girlfriend in higher resolution

— Brunbitty (@brunbitty) https://twitter.com/brunbitty/status/1911932532154597821?ref_src=twsrc%5Etfw

This is exactly what Nike will do. They’ll increase rest of world pricing to subsidize the US.

— Truth Magnate (@TruthMagnate) https://twitter.com/TruthMagnate/status/1911956464307970141?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 06:55

https://www.zerohedge.com/economics/sony-hikes-playstation-5-price-11-major-markets-except-us

What A Load Of Rubbish...

What A Load Of Rubbish...

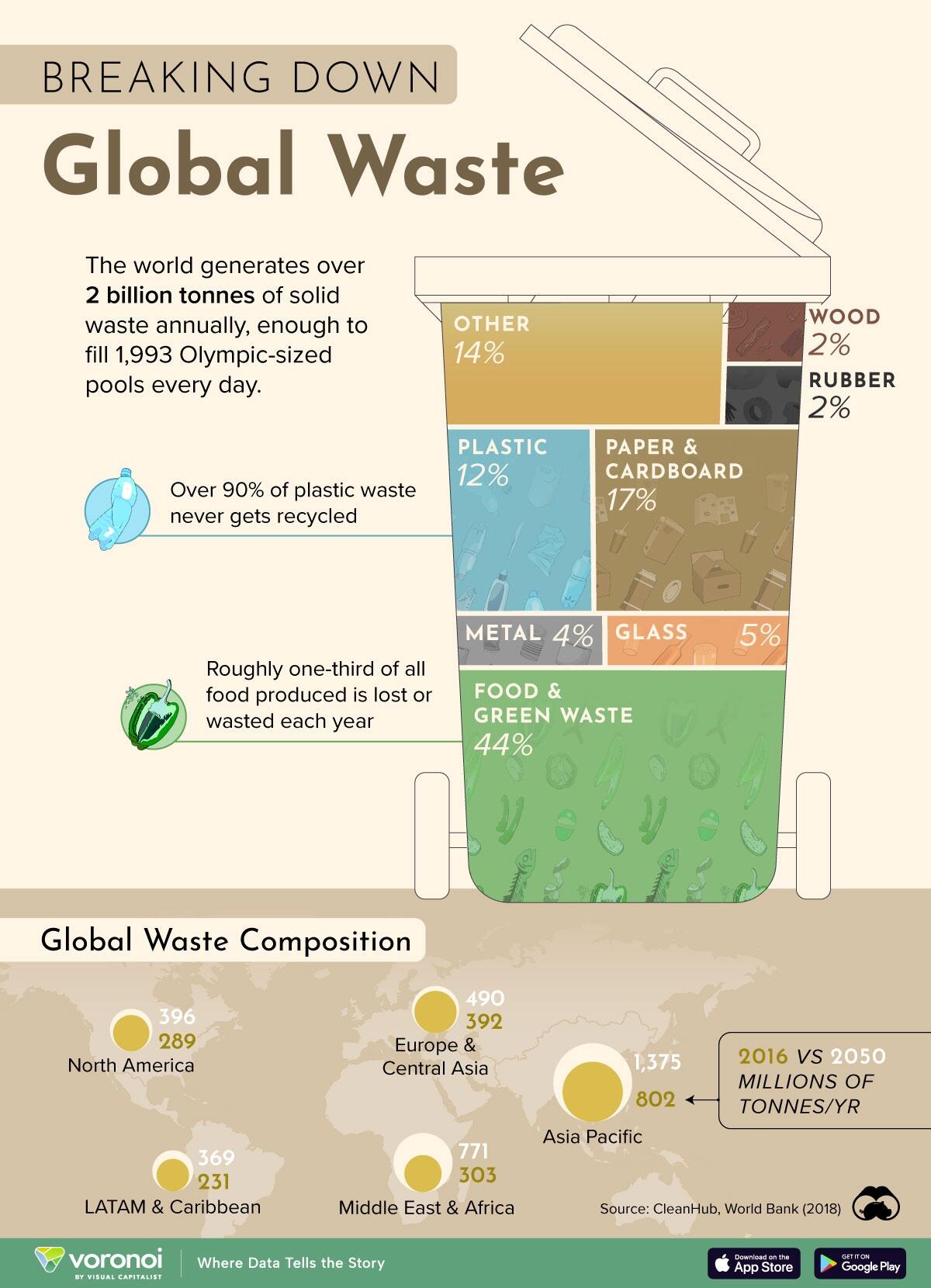

Eight billion people in the world generate a lot of municipal garbage. By 2050, the World Bank estimates humans will generate 3.4 billion tonnes of global waste.

That’s enough to line up garbage trucks from the Earth to the Moon and back - several times over.

https://www.visualcapitalist.com/a-visual-breakdown-of-global-waste-by-type

, which uses estimates for 2016 and 2050.

?itok=Fa5-F_t8

?itok=Fa5-F_t8

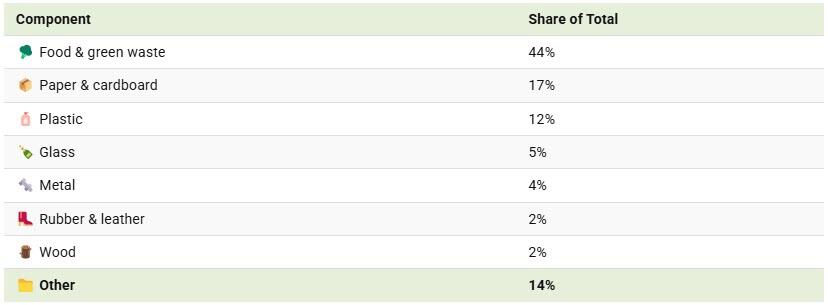

What Fills the World’s Trash Bins

Food and green waste accounts for a majority of the world’s garbage (44% of the total).

Paper and cardboard (17%) https://www.visualcapitalist.com/how-much-plastic-gets-recycled/

(12%) are the next two major categories of waste.

?itok=uJBa6yN8

?itok=uJBa6yN8

There’s a positive correlation between income and waste generation. High-income countries account for only 16% of the world’s population but more than one-third of the waste generated.

However, it’s the middle- and low-income countries that will lead to more waste generation by 2050, particularly in Asia and Africa.

Why is this?

As the World Bank explains, waste generation scales up as income levels rise.

For high-income countries, per capita waste generation is already peaking, and is expected to grow 19% by 2050.

On the other hand, low- and middle-income countries (where per capita waste is much lower but where incomes are rising quickly) could see their waste generation grow by 40%.

According to the World Bank, global waste is growing at more than twice the rate of the population.

Want to get more perspective on staggering food waste? Check out: https://www.voronoiapp.com/food-beverage/Food-wasted-per-person-visualized-4541

by creator MadeVisual.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/15/2025 - 02:45

Mizuho: "Pretty High" Confidence Data Will Show China Dumping US Treasuries

Mizuho: "Pretty High" Confidence Data Will Show China Dumping US Treasuries

Now that even the shoeshine boy is speculating whether China is selling its US treasuries (to kill three birds with one stone: i) hammer the dollar, ii) push yields higher and iii) prop up the yuan, if only to give the impression that China is winning the trade war something we https://www.zerohedge.com/markets/china-limits-stocks-sales-maintain-impression-stability-bessent-hints-boosting-treasury

), Mizuho has a “pretty high” degree of confidence that data will eventually show if China has been selling US Treasuries, according to Jordan Rochester, EMEA head of FICC strategy at the bank.

“Annoyingly we don’t get the data quickly enough, the data’s always lagged,” Rochester said on Monday in an interview with Bloomberg TV when asked if the Chinese have been selling US debt.

"You’ve got the extreme tariffs on China and also future reciprocal tariffs that will be extreme on other Asian central banks and they’ve got to defend their currencies."

“You’ve seen a much slower pace of selloff in the renminbi than you’d expect, given the size of the shock to their system, so there’s clearly some sort of smoothing going on in the FX market, and to do that a central bank has to sell the US Treasuries and others to fund that FX intervention”

Echoing what we said last week, Rochester notes that for now, “we can only speculate” on whether the Chinese are selling, “but we’ll find out in the data in due course,” adding that his degree of confidence that the data will in due course reveal China's selling is “pretty high."

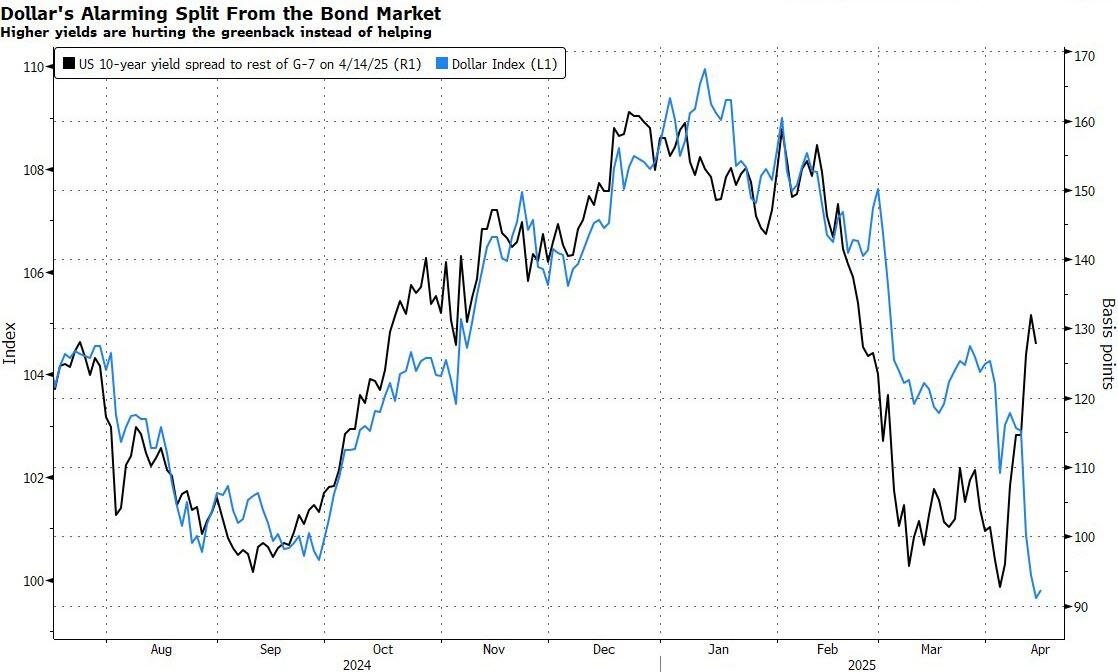

Separately, Rochester said he was “surprised” the dollar was “on the back foot” on Monday morning, after Trump provided some exemptions on his proposed tariff activity over the weekend

“This is alarm bells, I think, for US Treasury Secretary Scott Bessent,” Rochester said; “He’s now seeing a watering down of tariffs but still dollar weakness and US rates selling off still — it’s a horrible toxic combination”, which however can easily be explained precisely by Rochester's core thesis, namely that China has been aggressively selling US paper, and is opportunistically converting the US-denominated proceeds into yuan at just the right time to give the impression that, as so many others have been parroting, that the US dollar is losing its reserve status.

His full interview starts around the 37 minutes mark.

https://cms.zerohedge.com/users/tyler-durden

Mon, 04/14/2025 - 23:46

Hegseth's Memo, What To Do Next

Hegseth's Memo, What To Do Next

https://realclearwire.com/articles/2025/04/14/hegseths_memo_what_to_do_next_1103761.html

,

As DOGE’s eye shifts to the Department of Defense and Secretary of Defense Pete Hegseth calls on his defense leaders to https://www.defense.gov/Portals/1/Spotlight/2025/Guidance_For_Federal_Policies/Additional-OSD-Guidance-Initiating-the-Workforce-Acceleration-and-Recapitalization-Initiative.pdf

by the end of the week, our national security ecosystem has an unprecedented opportunity to radically restructure and set itself not for yesterday’s wars, but tomorrow’s security.

?itok=LCk_x12B

?itok=LCk_x12B

To seize the moment, DOGE and Secretary Hegseth's team have many reform options at their disposal: streamline bureaucratic processes, overhaul acquisitions, and double down on innovation. These are logical improvements. Many are essential. But like fixing an aircraft mid-flight, time is the defining performance indicator. And it is a sense of urgency, agility, and adaptability that will enable America’s success.

Great power competitions – be it between nation states or rival companies – are won by those that out-pace their adversaries. Advancing capabilities at a rapid pace leaves adversaries ‘playing catchup,’ trying to understand and then react. Consider Amazon, innovating quickly to stay ahead of large, capable retailers like Walmart who continually scramble to gain online market share.

Yet, crucially, outpacing an adversary does not require out-spending them. Apple defeated Nokia with quick design cycles focused on the user experience, despite Nokia spending nearly ten times more on R&D. Outspending creates an impressive collection of capabilities, but, a sustained competitive advantage requires a relentless focus on outcomes, not just capabilities.

The post-Cold War era demanded neither sufficient urgency nor flexibility from defense contractors and industrial base. Industry was comfortable and gave the country most of what it needed under cost-plus contracts at congressionally mandated 10 to 12 percent profit margins. Cost overruns and delays were tolerated and helped increase profits.

When budgets stopped expanding, consolidation resulted. The infamous 1993 “Last Supper” dinner meeting held by then Deputy Defense Secretary William Perry encouraged defense contractors to consolidate to maintain profits. They did. And the number of major contractors went from more than fifty to five. Agility, innovation, and responsiveness evaporated in the process.

Less was not more. The 2018 National Defense Strategy (NDS) articulated this point when it envisioned a broader National Security Industrial Base (NSIB) as a “network of knowledge, capabilities, and people—including academia, National Laboratories, and the private sector—that turns ideas into innovations [and] transforms discoveries into successful commercial products.” This articulates the whole-of-nation approach to national security that has always given the U.S. its advantage.

No single company can provide what is needed across all categories of defense. Just as one athlete cannot win gold in every sport. Existing and new participants are needed, including entrepreneurs, boot-strapped independent companies, venture-backed companies, research and academic institutions, and close allied partners. A full-range of on-ramps are also needed for new partners to enter the ecosystem—including the Defense Innovation Unit (DIU), National Security Innovation Capital (NSIC), innovation hubs like SOFWERX and AFWERX, DoD and academic laboratories, and agencies such as the Defense Advanced Research Projects Agency (DARPA) from which so much important innovation has come.

Achieving next-generation overmatch capability isn't merely about more innovation from the commercial sector. In a world where invention quickly becomes commoditized, getting leverage out of new technology to gain competitive advantage requires an investment in the human capital and institutional capacity needed to quickly operationalize and scale these technologies. As the NDS also stated, "Success no longer goes to the country that develops a new technology first, but rather to the one that better integrates it and adapts its way of fighting." And the flexibility to drive this critical adaptation must be placed firmly in the hands of the Services and Commanders in the field—those directly responsible for navigating the complex and uncertain security environment ahead.

Industry must be measured on how fast they can deliver real-world results, not how well they check the boxes of a static requirements document (which they often help write). The risks of underdelivering and overspending are best mitigated by embracing a minimum viable product (MVP) mindset that focuses on rapidly fielding operating prototypes, and continually improving and adapting them. These are hallmarks of modern software development, but the mindset has a place in even the largest hardware-focused projects as well.

Secretary Hegseth gave until last Friday for defense leaders to submit their recapitalization plans—a date that underscores the urgency of this moment. If speed and agility become the driving forces behind America’s defense strategy, industry collaboration, and acquisition processes, the United States will decisively outpace its adversaries to win tomorrow’s conflicts before they begin. The signal flare has gone up, the opportunity to deliver capabilities faster, cheaper, and more effectively is not only possible—it is imperative. We agree with the Secretary that the time to act is now.

General Tim Ray (USAF, ret.) is the former Commander of Air Force Global Strike Command, who today serves as the President and CEO of Business Executives for National Security (BENS). Jim Smith is President of TheIncLab and member of the BENS Board of Directors.

https://cms.zerohedge.com/users/tyler-durden

Mon, 04/14/2025 - 23:25

https://www.zerohedge.com/political/hegseths-memo-what-do-next

On Palm Sunday, Israel Bombs The Only Christian Hospital In Gaza

On Palm Sunday, Israel Bombs The Only Christian Hospital In Gaza

Claiming it held a "command and control center used by Hamas," Israel chose Palm Sunday to bomb the only Christian hospital in war-shattered Gaza. It was also the last fully-functioning hospital in Gaza City. No casualties from the bombing per se were reported by Gaza's civil emergency service. However, a child who'd been hospitalized for a head wound died from "the rushed evacuation process," said the Episcopal Diocese of Jerusalem, which runs the al Ahli Arab Hospital. The diocese is part of the Anglican Church.

Citing Gaza Civil Defense, https://www.middleeasteye.net/news/israel-bombs-one-last-functioning-hospitals-gaza

reports that the bombs resulted in “the destruction of the surgery building and the oxygen generation station for the intensive care units.” St. Philip's Church was one of multiple nearby buildings that also suffered damage. The IDF attributed the low casualty count to its effort to "mitigate harm to civilians or to the hospital compound, including issuing advanced warnings in the area of the terror infrastructure, the use of precise munitions, and aerial surveillance."

?itok=xbgFbZ_C

?itok=xbgFbZ_C

A local journalist told https://www.bbc.com/news/articles/cjr7l123zy5o

that the IDF called an emergency room doctor and urged the hospital's immediate evacuation, saying "You have only 20 minutes to leave." A previously-injured Khalil Bakr said he and his three wounded daughters -- two amputees and a third "full of platinum plates" -- managed to get out of the hospital just a couple minutes before destruction rained down.

"For the only Christian hospital in Gaza to be attacked on Palm Sunday is especially appalling," said British Archbishop of York Stephen Cottrell in a statement. "I share in the grief of our Palestinian brothers and sisters in the Diocese of Jerusalem. I pray for the staff and patients of the hospital, and for the family of the boy who tragically died during the evacuation."

The British government joined the condemnation, with Foreign Minister David Lammy saying the "deplorable attacks must end...Israel's attacks on medical facilities have comprehensively degraded access to healthcare in Gaza." Before the attack, the hospital stood alone as the only one still fully functioning in Gaza City, after Israel blew up the Al-Shifa Hospital and others.

issued its own statement:

“This hospital, already strained by months of siege, stood as one of the last beacons of medical hope in Gaza, where dozens of healthcare institutions have been systematically destroyed. The stripping away of such sanctuaries of life and dignity is a tragedy that transcends all boundaries of politics and enters the realm of the sacred.”

.jpeg?itok=76WXDacm

.jpeg?itok=76WXDacm

While the British government and many other entities have decried the attack, there's been no official statement from the Israel-catering Trump administration.

Previous IDF claims of hospitals being used as Hamas facilities have grown https://theintercept.com/2023/11/21/al-shifa-hospital-hamas-israel/

before ushering in journalists to see the "proof." Throughout the war that's raged since the Oct 7 Hamas invasion of southern Israel, the IDF has repeatedly bombed medical facilities and fired on ambulances.

One of the most troubling such incidents came last month, when 14 medical and other aid workers were found in a mass grave in Gaza after the IDF destroyed a convoy of ambulances and other first-response vehicles. The IDF originally claimed the vehicles "were identified advancing suspiciously" without either their headlights or emergency lights on. Then cell phone https://x.com/dwnews/status/1908601324498800997

the IDF account was completely false. The vehicles' headlights and emergency lights were on, and the vehicles carried clear markings of their nature.

As withering IDF gunfire rakes over the first responders, the dying Palestinian video narrator can be heard reciting the Shahada, the Muslim declaration of faith: "There is no God but God, Muhammad is his messenger." Then, perhaps anticipating the video may be recovered after his murder by Israeli soldiers, he said, “Forgive me, mother. This is the path I chose -- to help people. God is Great."

https://cms.zerohedge.com/users/tyler-durden

Mon, 04/14/2025 - 23:00

https://www.zerohedge.com/geopolitical/palm-sunday-israel-bombs-only-christian-hospital-gaza

China Limits Stocks Sales To Maintain Impression Of Stability, As Bessent Hints At Boosting Treasury Buybacks If Fed Does Nothing

China Limits Stocks Sales To Maintain Impression Of Stability, As Bessent Hints At Boosting Treasury Buybacks If Fed Does Nothing

how the escalating trade war between the US and China has gradually transformed into a theatrical war of who has the upper hand on any given day. And since it takes a long time for trade obstructions to hit the underlying economy, investors are keenly eyeing the stock, and especially FX, markets for any and every (early) indications of who has the upper hand (even if they are, as we show below, completely false).

Meanwhile in China, it's all about the optics of not appearing to lose the trade war:

China state firms vow to boost share purchases to stabilize plunging markethttps://t.co/BkliKGFTIW

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1909735820723974320?ref_src=twsrc%5Etfw

Yet so far in the trade war, there has been one notable difference: while US stocks have tumbled (and rightfully so, as Trump institutes shock treatment to ween the US out of its debt-funded reserve currency, trade deficit addiction) and the US dollar has been in freefall, Chinese stocks have been surprisingly resilient and barely dropping, while the yuan reversed its losses last week, which pushed it to a record low only to rebound sharply higher.

There is just one problem: like everything else out of China, it's market reaction has also been 100% fake.

While the US reaction is understandable, since the political Fed is doing everything it can to tarnish Trump's approval rating and rugpull the market, and economy, from under him... and for those who say this is nonsense, may we remind you this is precisely what Bill Dudley told the Fed to do during the first Trump trade war...

The day is August 27, 2019. Former NY Fed president Bill Dudley writes a Bloomberg oped saying "the Fed shouldn't enable Donald Trump" and urged the central bank not to "provide offsetting stimulus" in Trump's trade war with China.

Six years later, here we are https://t.co/H6WT5O0cMD

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1910753067697319991?ref_src=twsrc%5Etfw

... China, whose central bank is directly controlled by the CCP Politburo, has no such qualms, and as we reported last week, in order to stabilize the stock market China's Plunge protection team, aka the "National Team", unleashed a record buying spree of ETFs, which has prevented an all out rout.

At the same time, China has also https://www.zerohedge.com/markets/beijing-unleashes-record-plunge-protection-buying-prop-stocks-avoid-signaling-weakness

, ordering local banks to sell dollars and buy yuan after last week we saw the offshore yuan plunge to a record low against the dollar. To be sure, China wants devaluation, but not chaotic, uncontrolled devaluation which would spark the mother of all capital runs (Chinese banks have $63 trillion in assets (and by extension deposits), almost triple the US total).

Context: US commercial bank assets ($23.5 trillion) vs China commercial bank assets ($62.6 trillion). https://t.co/6mYaVI2ORJ

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1892064800122732723?ref_src=twsrc%5Etfw

As an aside, China's FX intervention would fully explain the bizarre concurrent weakness in both the dollar and TSYs, which some overeager commentators are https://blinks.bloomberg.com/news/stories/SUOO9ADWRGG0

status...

?itok=CZlNGxO8

?itok=CZlNGxO8

... when in reality it was just a few days of China dumping US bonds and selling the proceeds (US Dollars) to buy yuan.

what if https://t.co/34mLPz8FAC

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1910816757398294866?ref_src=twsrc%5Etfw

So going back to the core thesis, namely that in China it's all about the optics of not appearing to lose the trade war at least through day to day indicators meant for simplistic, first-order indicator observers (which these days is pretty much everyone in the market), Beijing's core prerogative remains to prevent a crash in either Chinese stocks or the yuan. And while we described above how China is defending the yuan (at the expense of Treasuries and the dollar, if only up to a point - the point being when China runs out of US reserves to sell), preserving stock market calm is just as important.

Which is why we weren't at all surprise to read that Chinese bourses have set daily restrictions on net share sales by hedge funds and large retail investors, https://www.reuters.com/markets/asia/chinese-exchanges-restrict-daily-stock-sales-trade-war-with-us-escalates-sources-2025-04-11/

noting that Beijing has stepped up support for its stock markets in an intensifying trade war with the United States.

Two investor sources said a soft limit on daily net sales by individual hedge funds and big retail investors - implemented through verbal warnings from brokerages - had been set at 50 million yuan ($6.83 million).

Failure to comply risked a suspension of trading accounts by the stock exchanges, which have issued the directive, the Reuters sources added.

Echoing everything we have said in the past week, Reuters also adds that "China has taken a slew of measures to stabilise its domestic stock markets, reeling from an escalating trade war with the U.S." and notes that "the moves have largely shielded stocks in China from the massive selling seen on global markets."

Brokerages have been asked to closely monitor transactions by private funds and big retail clients, according to a notice issued late on Thursday and seen by Reuters.

The current 50 million yuan daily limit on net sales by investors could be lowered further if the market slumps again, the notice said.

It stands to reason that if you can't sell, you will- drumroll - buy, and sure enough China and Hong Kong stocks reversed early declines on Friday and narrowed the week's losses.

Furthermore, as we also reported last week, China's state fund Central Huijin has vowed to increase stock holdings, a growing number of listed companies are buying back shares, and Chinese brokerages have pledged to steady the market amid higher tariffs and global recession risks.

"Such a restriction is understandable as you don't want to act against state will," said one of the brokerage sources. It's also understandable since China can not afford to give the impression that Trump has leverage in the escalating trade war. Instead, since Chinese stocks are stable, it afford Beijing the optics of being treated almost as an equal, or someone who can match Trump's tariff escalation blow by blow... when in reality China's economy is disintegrating below the calm surface.

In other words, without the moves, Chinese stocks would be in freefall - just like its economy - and the yuan would be plunging, while the narrative that Trump is flip-flopping or otherwise "losing" to China, would be DOA. Yet, since the Fed has so far refused to counter its Chinese peers, Trump indeed finds himself at a disadvantage.

But that may soon change, because while the Fed may pretend it has no choice but to wait until the inflation from the tariffs manifests itself (some time in 2035) before easing, Bessent may take matters into his own hands, and without waiting for the Fed, ramp up the amount of treasury buybacks the US Treasury currently conducts every other day or so, in the open market (see https://treasurydirect.gov/auctions/announcements-data-results/buy-backs/

).

In fact, the Treasury secretary hinted at this himself in an interview with Bloomberg, when asked if he has contingency plans if the selloff becomes "more unnerving" (for example if foreign countries, i.e. China, may be selling US Treasuries in response to the trade war).

His answer: “we are a long way” from needing to take action, but “we have a big toolkit that we can roll out” if so, and included in that toolkit is the department’s buyback program for older securities, Bessent said. “We could up the buybacks if we wanted" (15'40" in the view below).

And that's precisely what will happen in a few weeks (or even days) if China's selling of Treasuries persists, sending yields plunging. The good news, is that this "soft QE" wouldn't have to be in place too long: only long enough for China to run out of reserves... mostly via Belgium's Euroclear...

Belgium (mostly China via Euroclear) Treasury holdings are where they were... just before China devalued its currency in 2015 and sold $1TN in US paper ($250BN via Belgium) to contain yuan collapse https://t.co/DUYWqtUl60

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1910745034921558318?ref_src=twsrc%5Etfw

... to sell. Which at the current pace of liquidations should be done by the end of the month.

https://cms.zerohedge.com/users/tyler-durden

Mon, 04/14/2025 - 22:55

Harvard Professors Sue Trump Admin Over Threat To Withhold Nearly $9 Billion

Harvard Professors Sue Trump Admin Over Threat To Withhold Nearly $9 Billion

Harvard University’s professors sued the Trump administration on April 11 after it threatened to withhold nearly $9 billion in grants and contracts if the university fails to adopt the administration’s required structural changes.

?itok=FYTHnToS

?itok=FYTHnToS

The Harvard faculty chapter of the American Association of University Professors (AAUP) filed a https://actionnetwork.org/user_files/user_files/000/122/747/original/File_Stamped_Complaint.pdf#page23

alleging that the administration’s action represents an “unlawful and unprecedented misuse of federal funding and civil rights enforcement authority to undermine academic freedom and free speech” on a university’s campus.

According to the court filing, the university received a letter from the administration on April 3 outlining the “non-exhaustive preconditions” it must meet in order to keep its government funding, following an investigation into the university’s failures to address anti-Semitism on campus.

Among the requirements are a review of programs that fuel anti-Semitic harassment on campus, to “improve viewpoint diversity, and end ideological capture” within the university. Harvard was also required to enact a mask ban and eliminate all diversity, equity, and inclusion (DEI) programs, according to the lawsuit.

It stated that the administration threatened to terminate at least $255.6 million in contracts and place more than $8.7 billion in multiyear grant commitments to Harvard University and its affiliates under review unless the university agrees to implement the proposed changes.

“Harvard, like all American universities, depends on federal funding to conduct its academic research. Threats like these are an existential ‘gun to the head’ for a university,” the lawsuit states.

The plaintiffs accused the administration of misusing https://www.dol.gov/agencies/oasam/regulatory/statutes/title-vi-civil-rights-act-of-1964#:~:text=No%20person%20in%20the%20United,activity%20receiving%20Federal%20financial%20assistance.

of the Civil Rights Act, an anti-discrimination law that applies to federally funded institutions, to “coerce universities into undermining free speech.”

“These sweeping yet indeterminate demands are not remedies targeting the causes of any determination of noncompliance with federal law. Instead, they overtly seek to impose on Harvard University political views and policy preferences advanced by the Trump administration and commit the University to punishing disfavored speech,” they state.

The professors asked the court to preliminarily and permanently enjoin any further investigation or review of the university’s federal funding. They also requested that it block the administration from using its authority to penalize Harvard over the viewpoints of its members.

The Epoch Times reached out to the White House for comment but did not receive a response by publication time.

Harvard University is one of https://www.ed.gov/about/news/press-release/us-department-of-educations-office-civil-rights-sends-letters-60-universities-under-investigation-antisemitic-discrimination-and-harassment

institutions of higher education currently under investigation for allegations of anti-Semitic discrimination and harassment on campus.

Protests erupted across universities in the United States after Israel launched a military operation in the Gaza Strip with the stated goal of eradicating the Hamas terrorist group. The operation was retaliation for Hamas launching a land, sea, and air attack on southern Israel on Oct. 7. 2023, killing around 1,200 people and taking hostage 251 more. Last spring, pro-Palestinian protesters camped out on campus and, at one point, took over a building.

Education Secretary Linda McMahon has previously urged university leaders to prevent discrimination against Jewish students on campus or risk losing federal funding.

“The Department is deeply disappointed that Jewish students studying on elite U.S. campuses continue to fear for their safety amid the relentless antisemitic eruptions that have severely disrupted campus life for more than a year,” McMahon said in a https://www.ed.gov/about/news/press-release/us-department-of-educations-office-civil-rights-sends-letters-60-universities-under-investigation-antisemitic-discrimination-and-harassment

on March 10.

“U.S. colleges and universities benefit from enormous public investments funded by U.S. taxpayers. That support is a privilege and it is contingent on scrupulous adherence to federal anti-discrimination laws.”

Harvard University’s professors also filed a https://actionnetwork.org/user_files/user_files/000/122/749/original/2025.04.11_Harvard_Brief_TRO_-_FINAL.pdf

on April 11 seeking a temporary restraining order to prevent the government from cutting funding while the litigation continues, saying that it would cause “severe irreparable harm” to the university and disrupt its research operations.

“No law in this country permits Trump to suspend billions from universities simply because he doesn’t like the constitutionally protected speech of their students & faculty,” Nikolas Bowie of Harvard’s AAUP said in a https://bsky.app/profile/aaup.bsky.social/post/3lmmnquuk6s2n

.

https://cms.zerohedge.com/users/tyler-durden

Mon, 04/14/2025 - 13:40

Apple Overtakes Rivals To Lead Global Smartphone Market In Q1 Milestone

Apple Overtakes Rivals To Lead Global Smartphone Market In Q1 Milestone

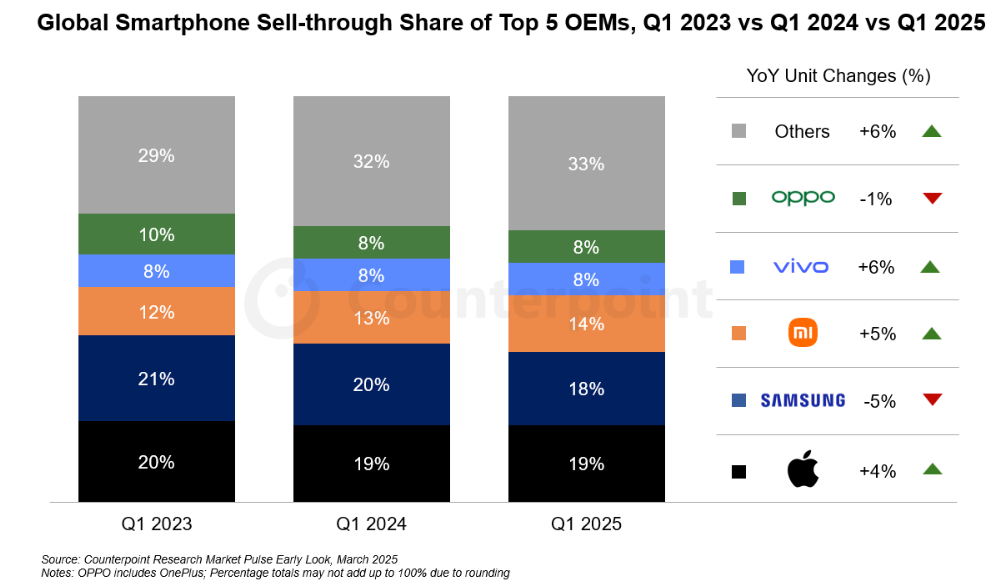

The most unexpected highlight from https://www.counterpointresearch.com/insight/post-insight-global-smartphone-market-grows-3-in-q1-2025-but-future-uncertain-apple-takes-1-spot-in-q1-for-first-time/

.

Counterpoint found that the launch of Apple's entry-level model, the iPhone 16e, propelled sales and allowed the company to seize the number one spot for shipments in the first quarter, with a 19% share.