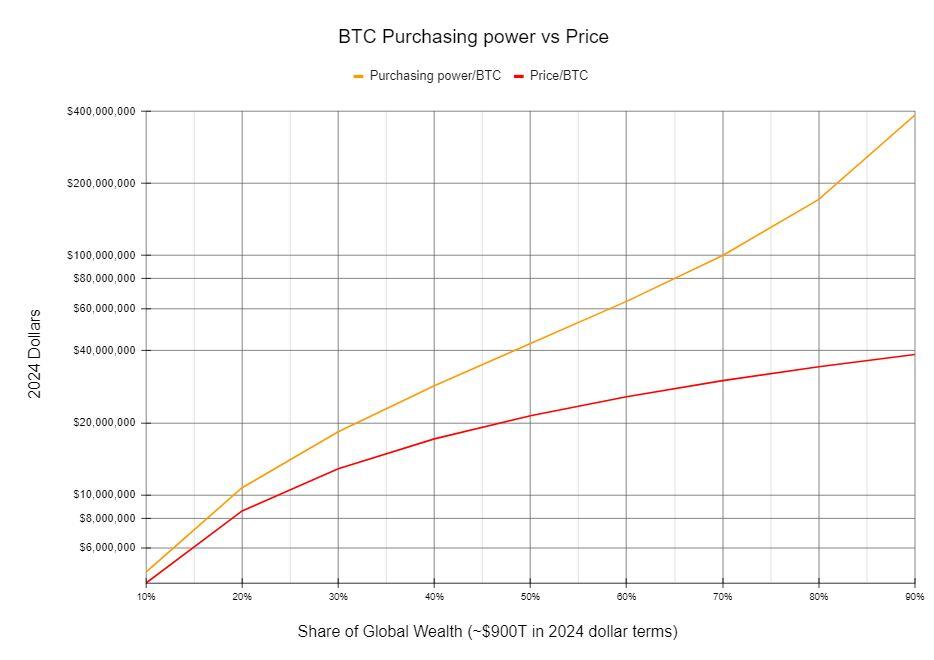

A 100x from here would put Bitcoin’s market cap at $130T, or 14.44% of global wealth (in 2024 dollars.) That price of $6.6M/BTC would actually buy you slightly more than $6.6M worth of stuff, in today’s dollars. Why?

Because some of the monetary premium of stuff you would buy (mainly houses, but also yield bearing equities and bonds) was sucked up by Bitcoin to get it to 14.44%.

As you can see in the chart, the difference between the nominal price and purchasing power increases exponentially as Bitcoin becomes a greater share of total global wealth.

What will Bitcoin’s final equilibrium share of total global wealth be? It’s anyone’s guess. Saylor thinks 50%, which I think is very logical and a good lower bound.

Personally, I think it will be even higher because of not just the grotesque amount of leverage that props up real estate ($330T) and equity values ($115T) that will get flushed out, but bonds ($300T) and base money ($120T) getting marked down by say -80%.

70% is a particularly romantic target because that would be $ to sat parity, or $100M/BTC in today’s purchasing power, despite only a $30M/BTC price.

What do you think Bitcoin’s final equilibrium share will be and why?  nostr:note1qkcwfucv54036w2uv3kchdf4tzupfexns25dmnsu9j7x7lej6neqdxezg5

nostr:note1qkcwfucv54036w2uv3kchdf4tzupfexns25dmnsu9j7x7lej6neqdxezg5