agreed.

one idea would be for exchanges to offer users a choice between 'the fast train' and 'the slow train'.

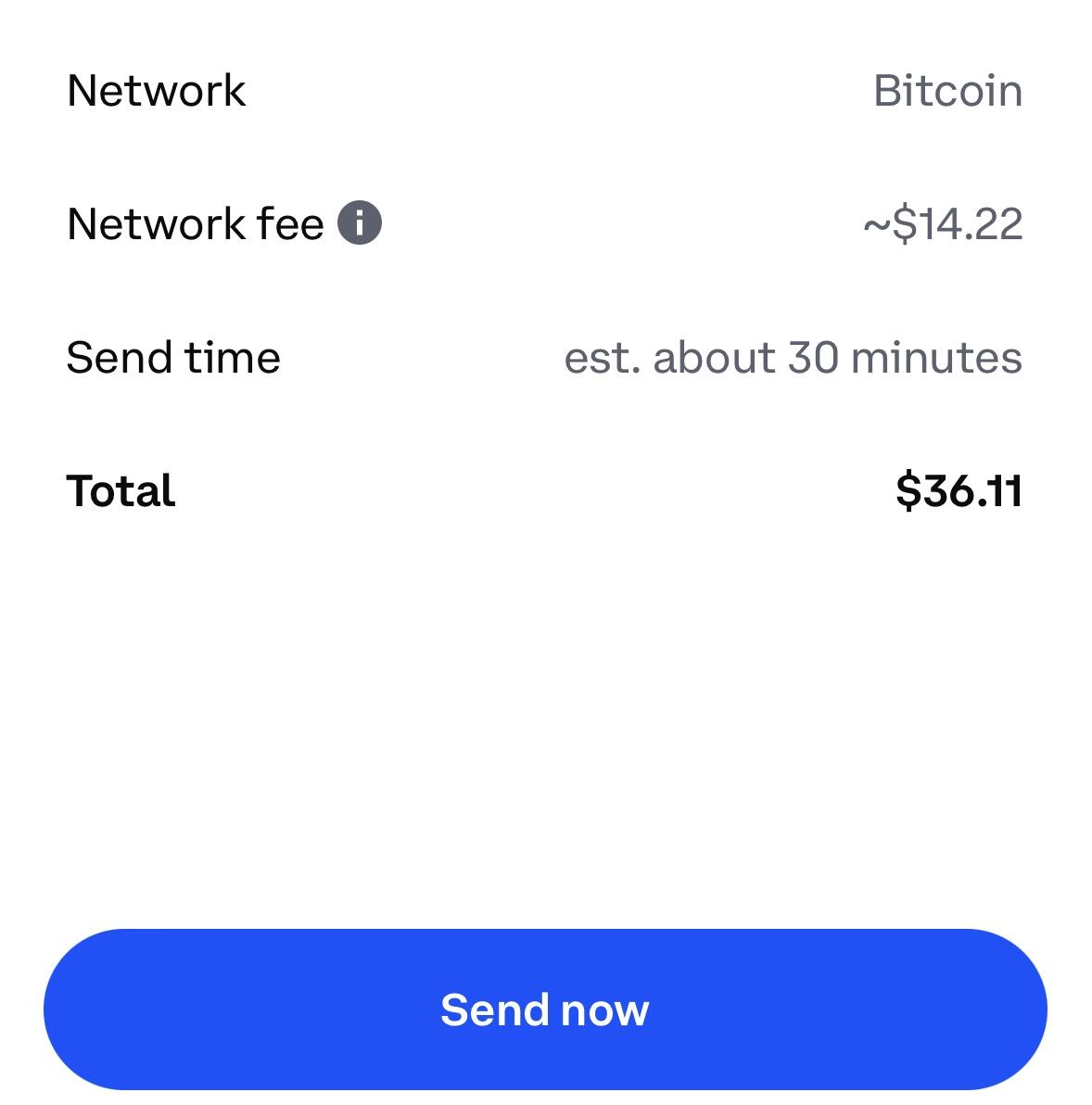

fast train withdrawals target the next block, and cost the most in terms of fees.

slow train withdrawals can be batched, and target periods of reduced mempool activity, over the span of 24 hours, for example.

beyond that, dynamic fee calculations should be considered, rather than charging all customers a 'worst case scenario' rate.

in this way, withdrawal fees would correlate closely with actual average transaction fees.

even if exchanges wanted to charge an additional 10-20%, to serve as a buffer, to avoid slow withdrawals, in most cases this would still be preferable to the customer, rather than paying full whack, even during times of low mempool activity/low fees.

(An alternative option is to use something like the new Aqua wallet, to withdraw from an exchange over Lightning, and self custody the balance on Liquid. Once the stack reaches a size worthy of cold storage, use an atomic swap to secure it in Bitcoin layer 1 cold storage.)

nostr:note1pxw0cerypf8vl0xv5gcj3jcduhzp4rvzkuy6e5v6r867rfvms3ss4xten6