are they being forced to sell in order to cover the costs of people exiting their gbtc positions? I thought the loses would be between buyers and sellers in the market....

Discussion

Good question.

Don't the fees mean that they make money no matter which direction the flows go?

Well.. "money"... They make fiat but you know what I mean

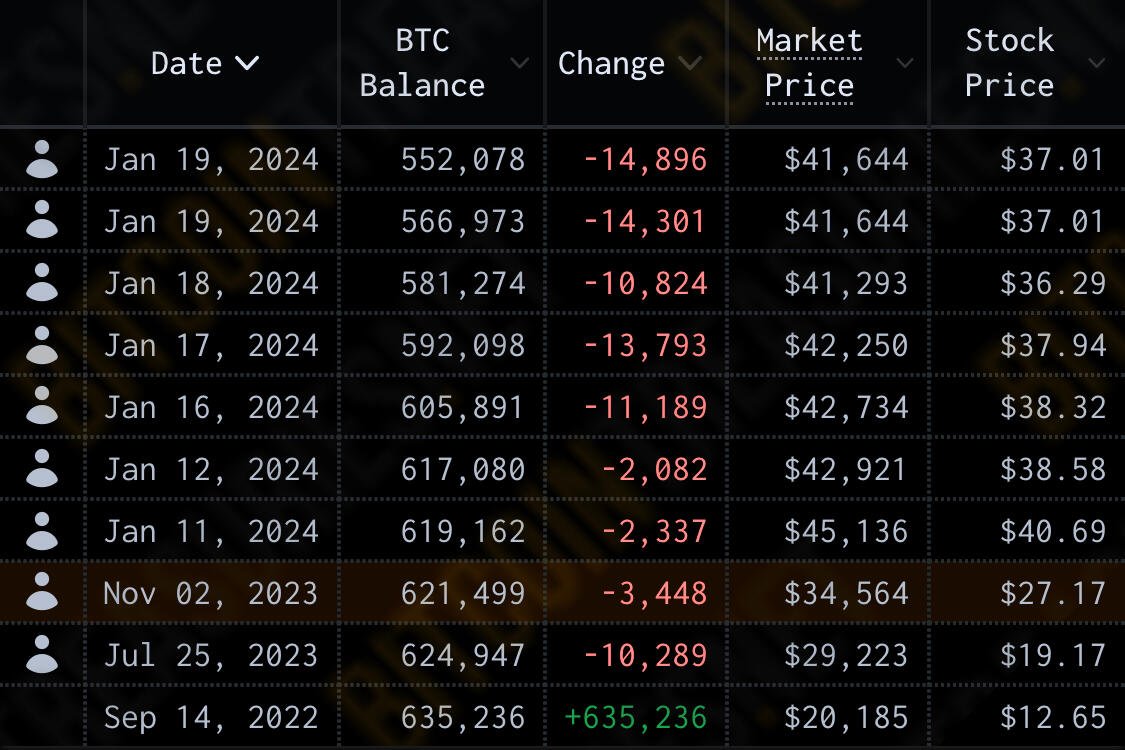

So the obvious thing I missed was now that it's been converted from a trust to an ETF the sale of GBTC results in sales of the underlying asset.

While fees could be a factor, I also didn't realize FTX's estate is (or was) holding 22 million units of GBTC. That is ~$800mm people are certainly eager to recover.

Their fees are a % of the ETF's assets under management each year, so they make money either way, but BTC price going up makes them more. E.g. $1bn assets, 0.2% p.a. fee = $2m p.a. . Suppose there's then noone buying or selling, but BTC price doubles, then assets would increase to $2bn and ETF issuer would get $4m p.a.