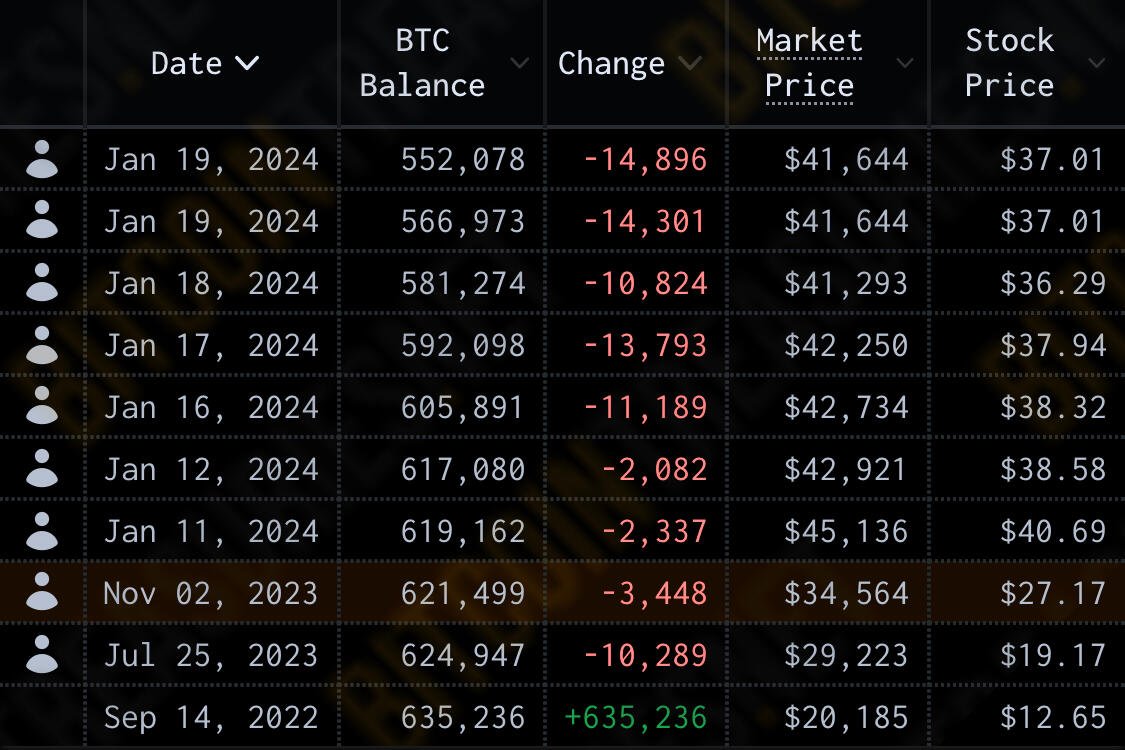

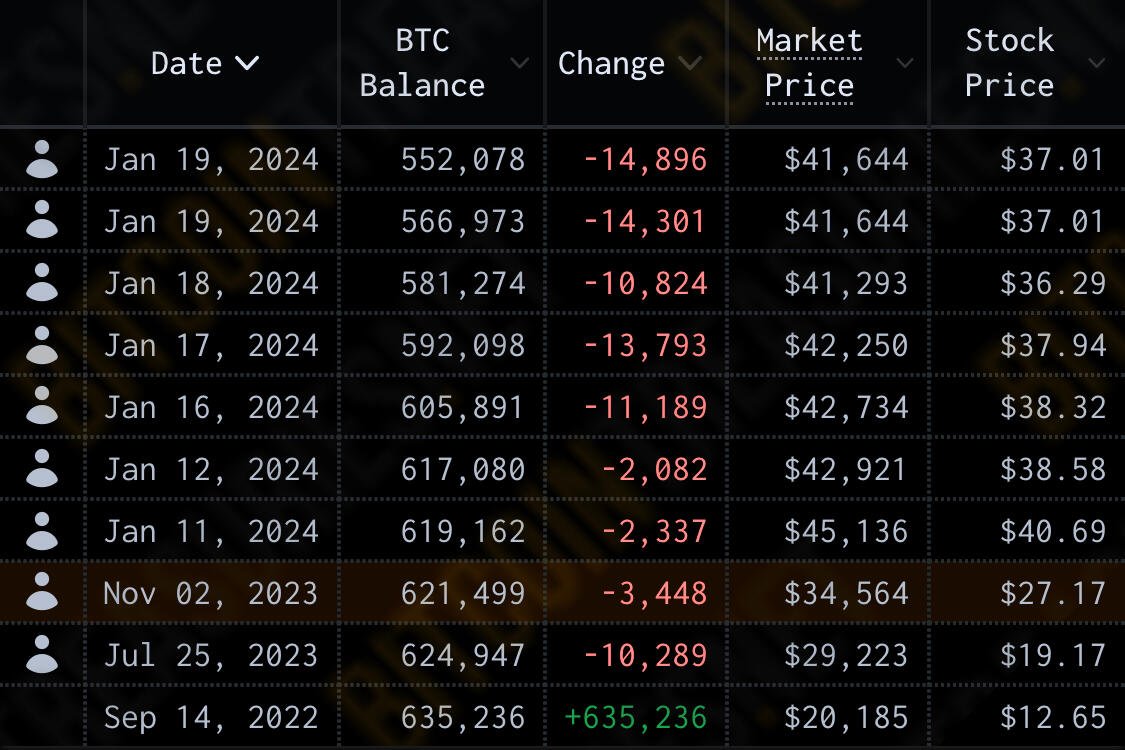

Wild seeing Grayscale casually dump 10,000-25,000 BTC each day.

May end up being the biggest blown lead in the history of #Bitcoin, and all because they refuse to lower fees.

Wild seeing Grayscale casually dump 10,000-25,000 BTC each day.

May end up being the biggest blown lead in the history of #Bitcoin, and all because they refuse to lower fees.

Good. Scumbags.

Which is just absolutely wild. I don't understand why they wouldn't have foreseen this.

Makes zero sense.

Unless there is some deeper reason.

Why? Well most of the money in Grayscale was simply betting on ETF conversion. What do I mean?

Until the ETF was approved 1 share of Grayscale did have 1 BTC attached to it but it was not pegged to price. Grayscale was a closed end fund, so it was not cash in cash out. You had to sell your shares ONLY to someone wanting to buy Grayscale.

This was the "discount", upon conversion to a spot ETF that delta closed. So many holding Grayscale say bought when BTC was 20K but they paid say 15K, or bought at the bottom when BTC was 15K and paid 12K. This is cashing in chips folks.

Grayscale was never bought but hard core hodlers it was bought by traders. They don't care about BTC, they care about profit.

If they do care about BTC they are going to sell Grayscale and dump right back into on chain or another ETF with lower long term fees.

I know 3 different investment managers that did this with their money and client money. None of them are really believers in BTC they just saw and capitalized on fiat opportunity because the ETFs they knew were inevitable.

That said many have had some level of "conversion" during the process.

nostr:note12mt2dgdd9g5vtcu2v8sz306n5wmtsqzj784keeec0qmrq8td5vwq6yfvew

are they being forced to sell in order to cover the costs of people exiting their gbtc positions? I thought the loses would be between buyers and sellers in the market....

Good question.

Don't the fees mean that they make money no matter which direction the flows go?

Well.. "money"... They make fiat but you know what I mean

So the obvious thing I missed was now that it's been converted from a trust to an ETF the sale of GBTC results in sales of the underlying asset.

While fees could be a factor, I also didn't realize FTX's estate is (or was) holding 22 million units of GBTC. That is ~$800mm people are certainly eager to recover.

Their fees are a % of the ETF's assets under management each year, so they make money either way, but BTC price going up makes them more. E.g. $1bn assets, 0.2% p.a. fee = $2m p.a. . Suppose there's then noone buying or selling, but BTC price doubles, then assets would increase to $2bn and ETF issuer would get $4m p.a.

Soon they are going to run out to dump