Why? Well most of the money in Grayscale was simply betting on ETF conversion. What do I mean?

Until the ETF was approved 1 share of Grayscale did have 1 BTC attached to it but it was not pegged to price. Grayscale was a closed end fund, so it was not cash in cash out. You had to sell your shares ONLY to someone wanting to buy Grayscale.

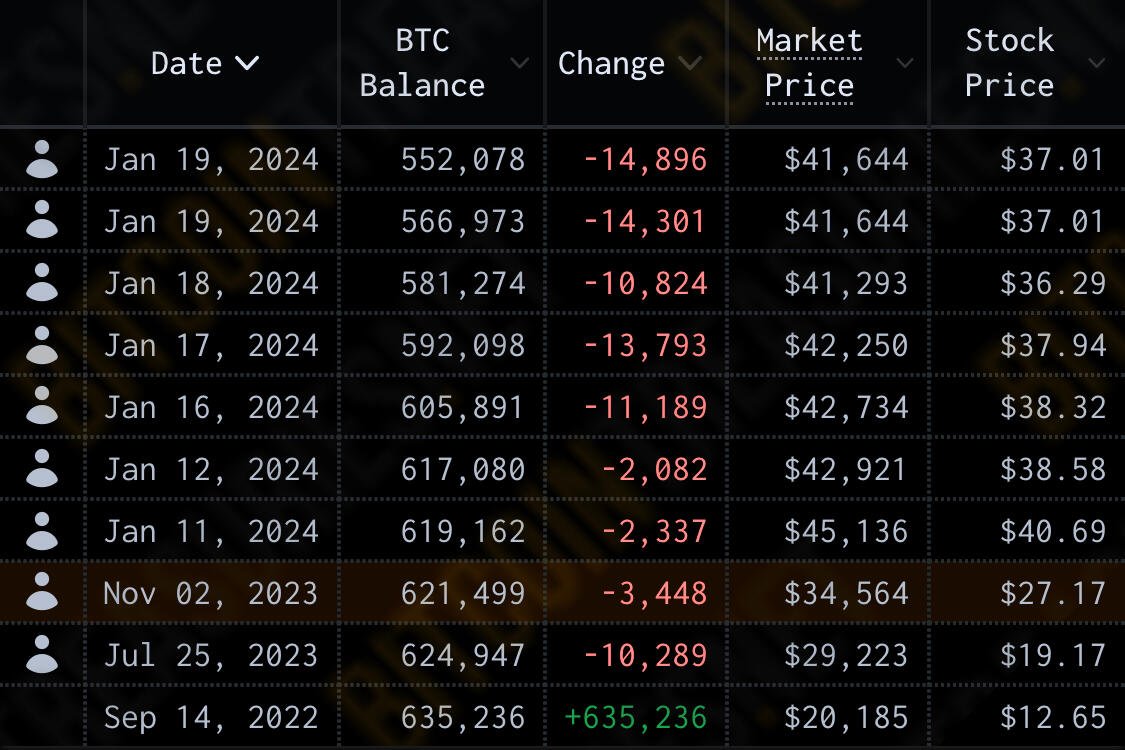

This was the "discount", upon conversion to a spot ETF that delta closed. So many holding Grayscale say bought when BTC was 20K but they paid say 15K, or bought at the bottom when BTC was 15K and paid 12K. This is cashing in chips folks.

Grayscale was never bought but hard core hodlers it was bought by traders. They don't care about BTC, they care about profit.

If they do care about BTC they are going to sell Grayscale and dump right back into on chain or another ETF with lower long term fees.

I know 3 different investment managers that did this with their money and client money. None of them are really believers in BTC they just saw and capitalized on fiat opportunity because the ETFs they knew were inevitable.

That said many have had some level of "conversion" during the process.

nostr:note12mt2dgdd9g5vtcu2v8sz306n5wmtsqzj784keeec0qmrq8td5vwq6yfvew