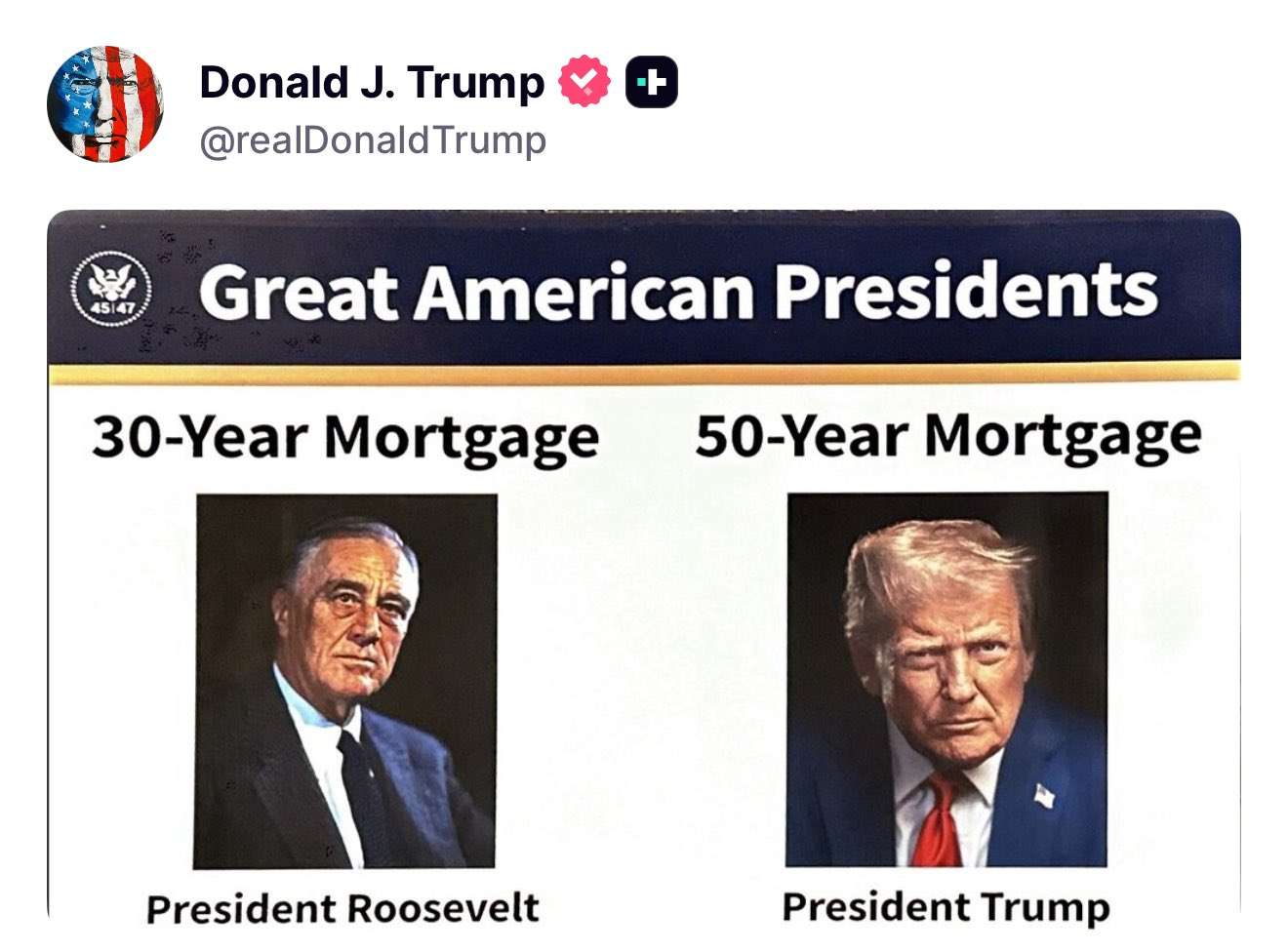

TRUMP FLOATS 50-YEAR MORTGAGES TO HELP YOUNG HOMEBUYERS

Trump compared the idea to FDR’s creation of the 30-year mortgage, which helped millions of Americans afford homes during the Great Depression.

A 50-year term could cut monthly payments and open the housing market to a new generation locked out by high prices and interest rates.

No formal policy has been announced yet, but the concept is already sparking debate.