My response is based on what I’ve heard Saylor say regarding the subject, but basically it boils down to this:

They can’t compete with their competitors like Oracle and IBM when it comes to R&D spend, or employee acquisition/retention based on their primary business model of enterprise software. Essentially they were a business doomed to fail prior to the bitcoin treasury strategy.

By adopting bitcoin as a treasury reserve asset, they have a way to preserve their cash flows in an instrument that will appreciate against the value of their cashflows, which will increase their equity value, allowing them to sell more shares to fund whatever they want to fund, which seems to primarily be buying more bitcoin.

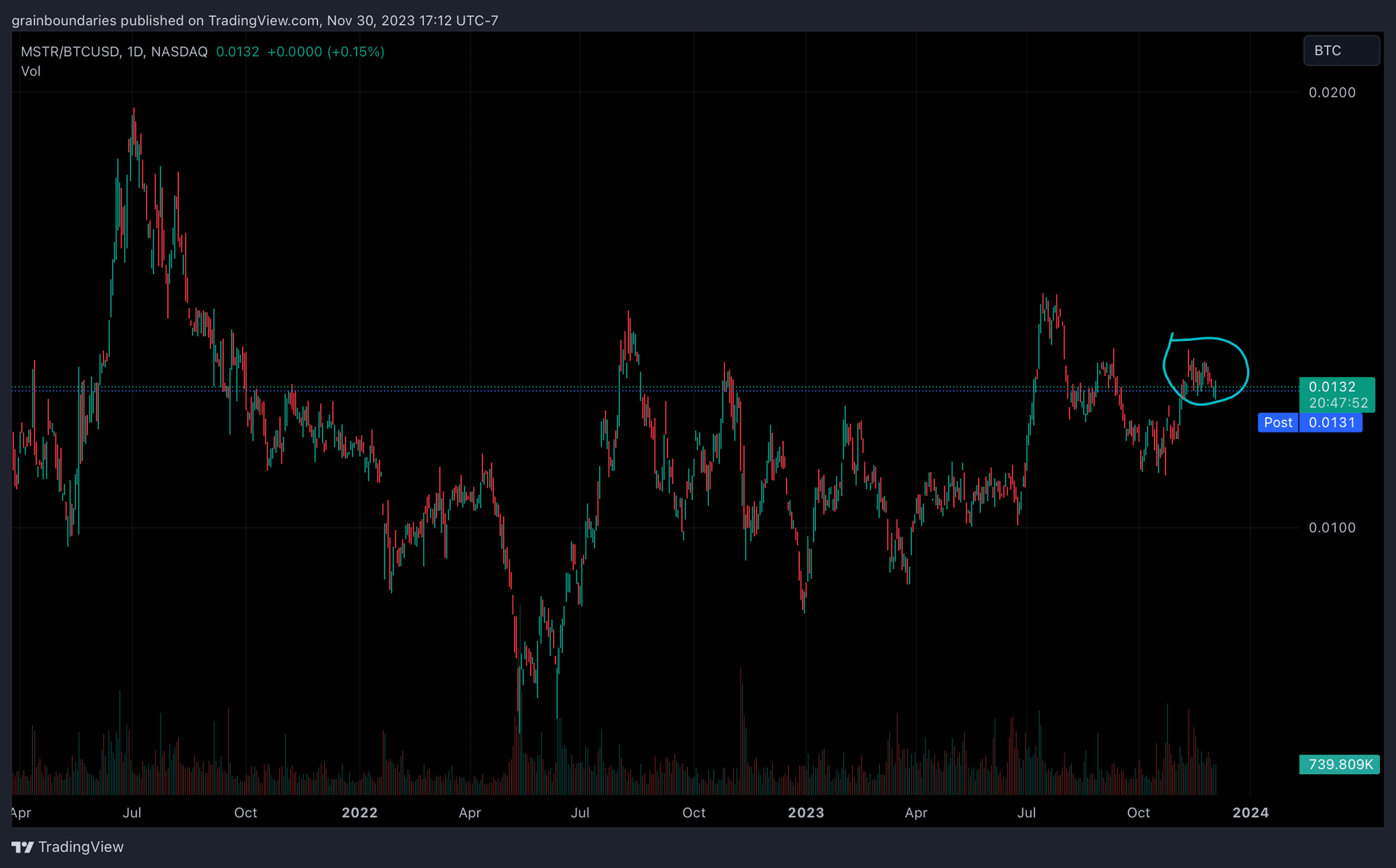

Now, you’re right in that there is shareholder dilution, but the goal is to have the bitcoin acquisition increase the value of the company more than the shares are diluted, similar to the acquisition of a business which provides more value to shareholders than the opportunity cost of acquiring that company, I.e. his goal is to make the purchase in of bitcoin an accretive endeavor for shareholders. So far, this has been the case.

He has essentially positioned the company to be a bitcoin investment vehicle more so than an enterprise software company. Institutional investors that can’t buy bitcoin can buy microstrategy stock and therefor get leveraged exposure to the underlying asset. They just take on counterparty risk regarding how microstrategy custodies their bitcoin. But essentially, they’re a leveraged bitcoin etf that has underlying cash flow from an enterprise software company rather than charging a management fee like a traditional ETF would.

A future unclear question in my mind is, if their MacroStrategy (as they’ve branded it) pans out and they 10-20x their market cap, would they scale the core business or do M&A in order to grab market share from the bigger data-analytics companies?

Or is it a situation where it’s a fun trivia fact years from now, that this bitcoin holding company started as a small enterprise data company, like how Berkshire started as a small textile company?

Of those two scenarios, likely the latter. Although I think if they were looking to spend more money on improving their cash flows, they wouldn’t try to take market share from their competitors in enterprise software but rather look to carve out a niche in providing enterprise-oriented bitcoin solutions, layer 3 work, web5 work with @jack etc.

I don’t see them as being interested in trying to overtake IBM and Oracle, but rather being the Bitcoin enterprise software company. That’s their win condition, from a cash flow perspective

Yeah, I think that’s spot on.

Not to mention they’re frontrunning banks and the giant tech companies with their balance sheet.

Bitcoin either gets attacked by government or it doesn’t. If it doesn’t get attacked, then the accumulation done by companies like apple Google meta Nvidia etc combined with the large banks will give them one of the largest debt-to-equity ratios in the US market.

If the government does try to attack bitcoin, either via harmful regulation or attempted seizure, we’ll see how it plays out on whether the govt will actually get the bitcoin, or if Saylor tries to hop ship, burns the keys, etc etc. Uncharted waters in this scenario.

Thread collapsed

Thread collapsed

Thread collapsed

Thread collapsed