I made a quick first reading pass through the latest satanic EU thing. It's a wide ranging 324 page document, covering things like trusts, football clubs, dubious / tax optimized jurisdictions, the distinction between in house lawyers and law firms, beneficial ownership, reporting requirements, etc, etc.

https://data.consilium.europa.eu/doc/document/ST-6220-2024-REV-1/en/pdf

I tried to collect the bits that might impact Bitcoin. A minuscule fraction of the paper surface area. It's not like Bitcoin or even 'virtual assets' has its own chapter: in classic design-by-commission it just pops up in random articles.

Notably I'm ignoring cash: someone else will have to save that. But beware that 'cash' is defined much more broadly than the word suggests. It doesn't explicitly cover bitcoin, but I would expect that to happen eventually.

The first 100 pages (items numbered up to 103) seem more like an introduction than actual proposed law. Some of it seems to oversell the actual legal text.

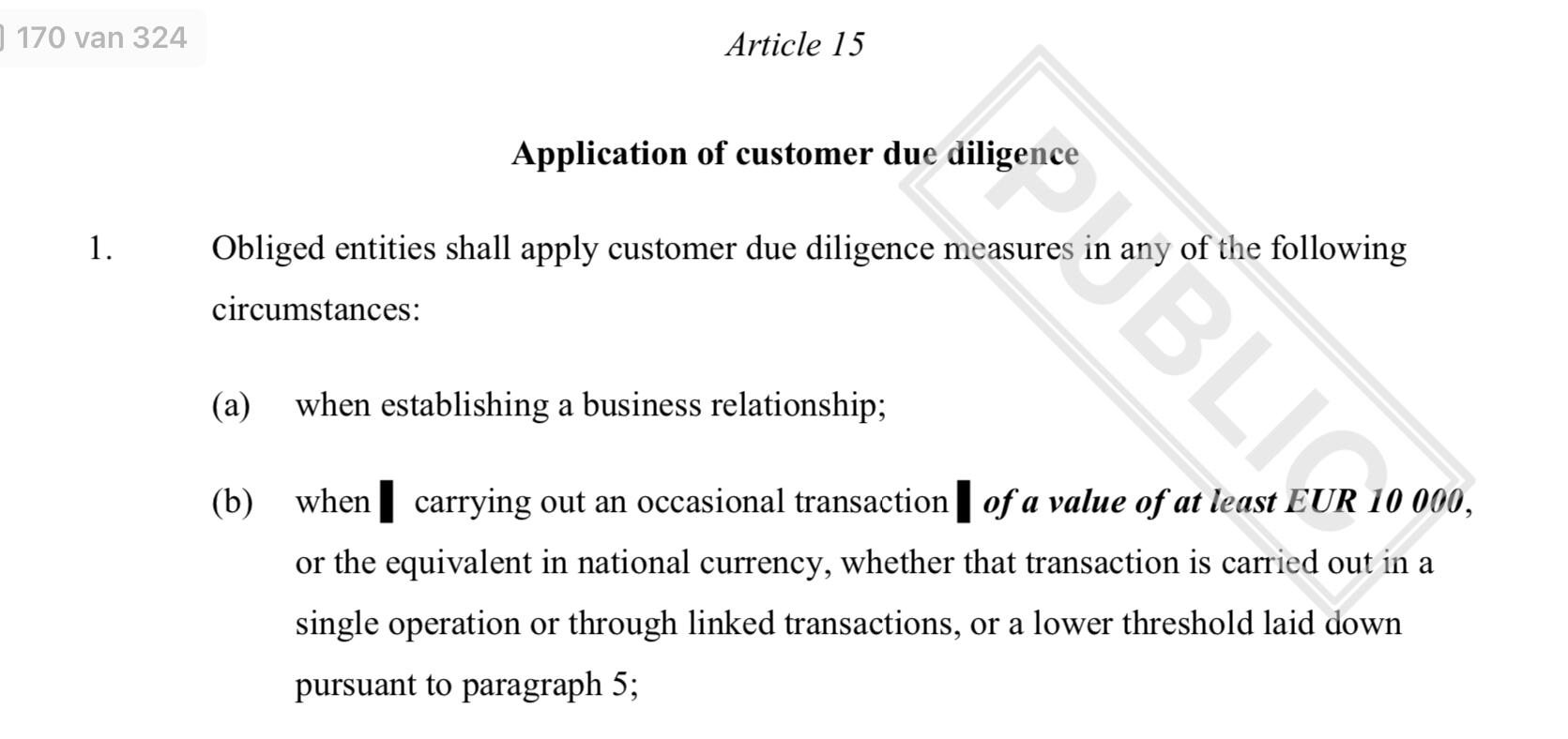

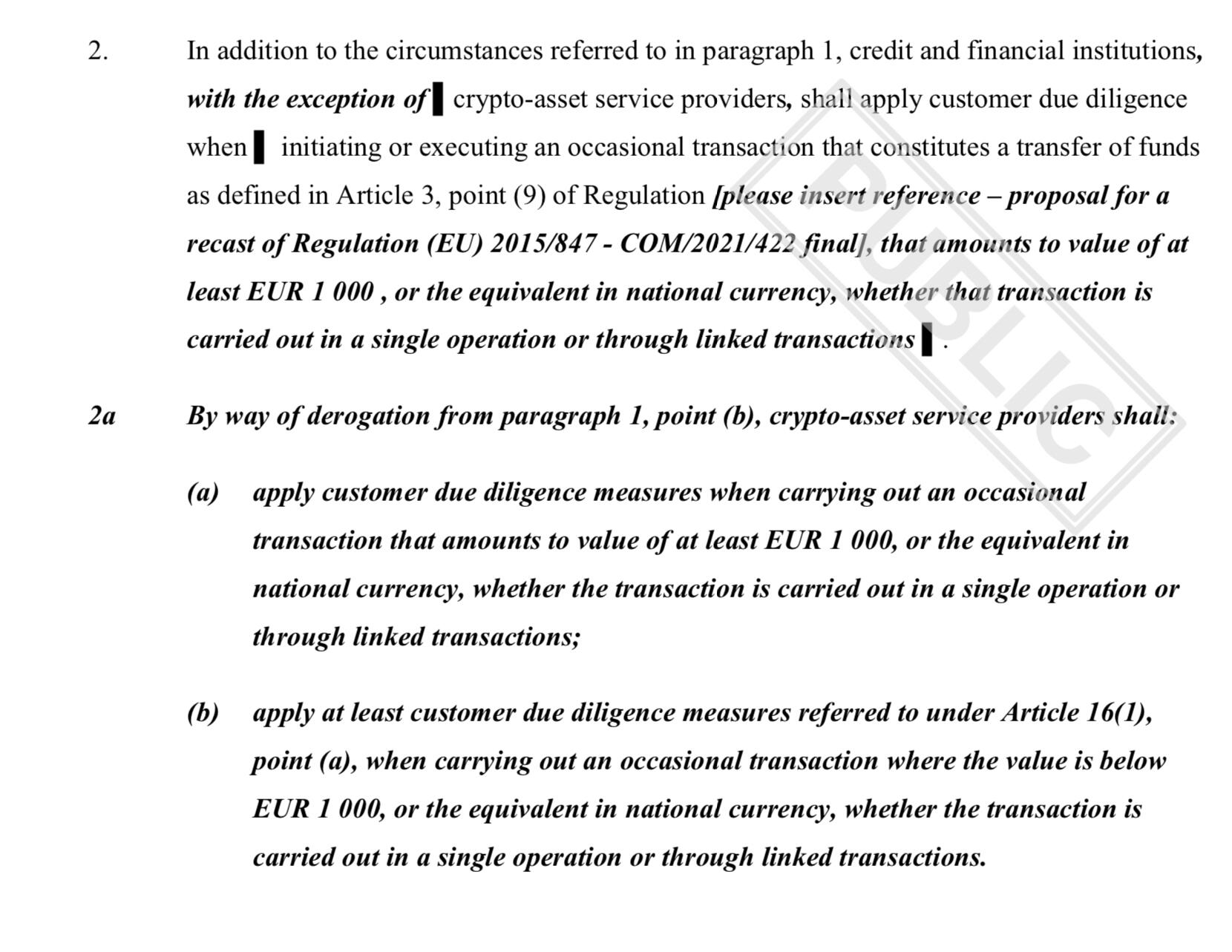

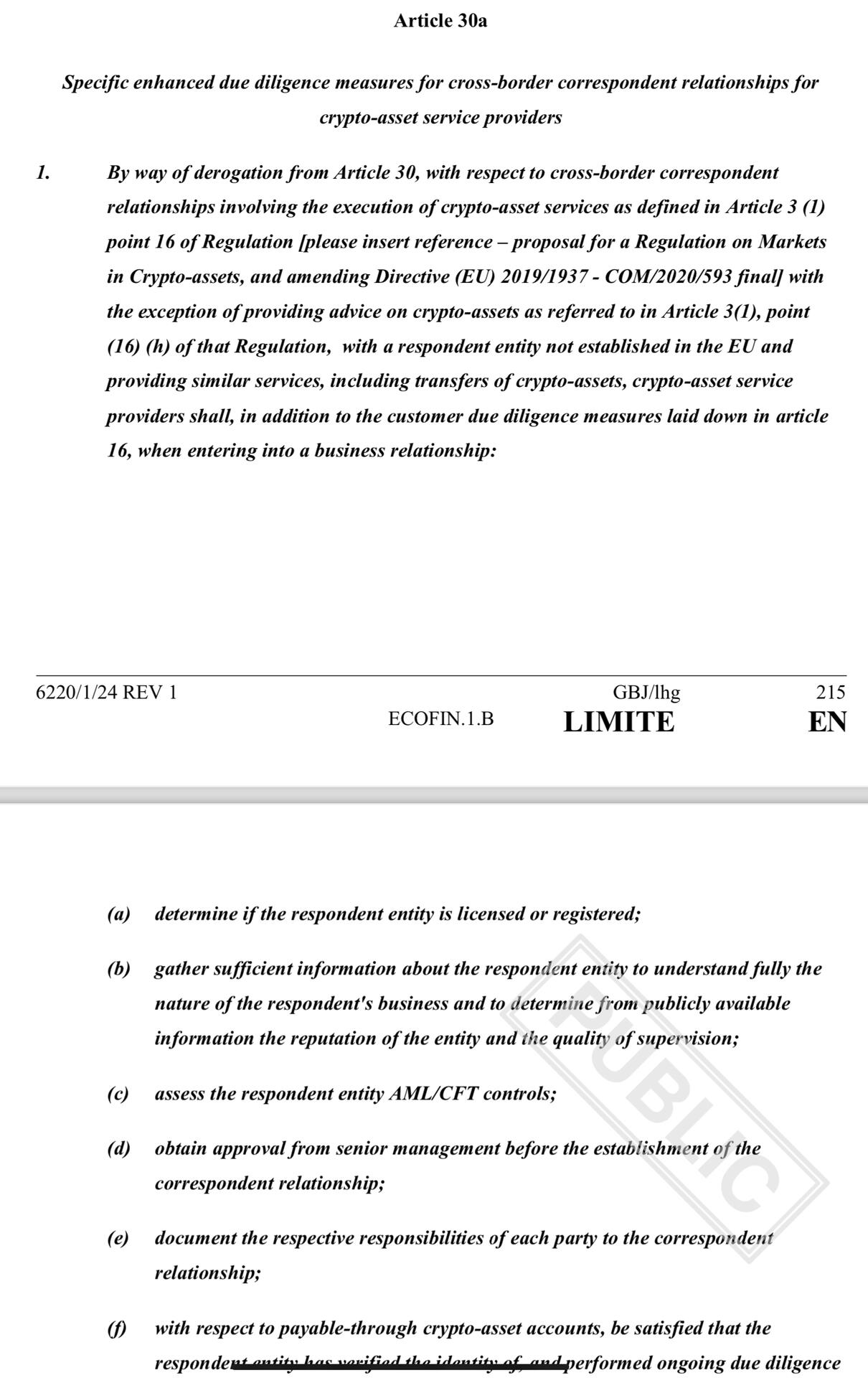

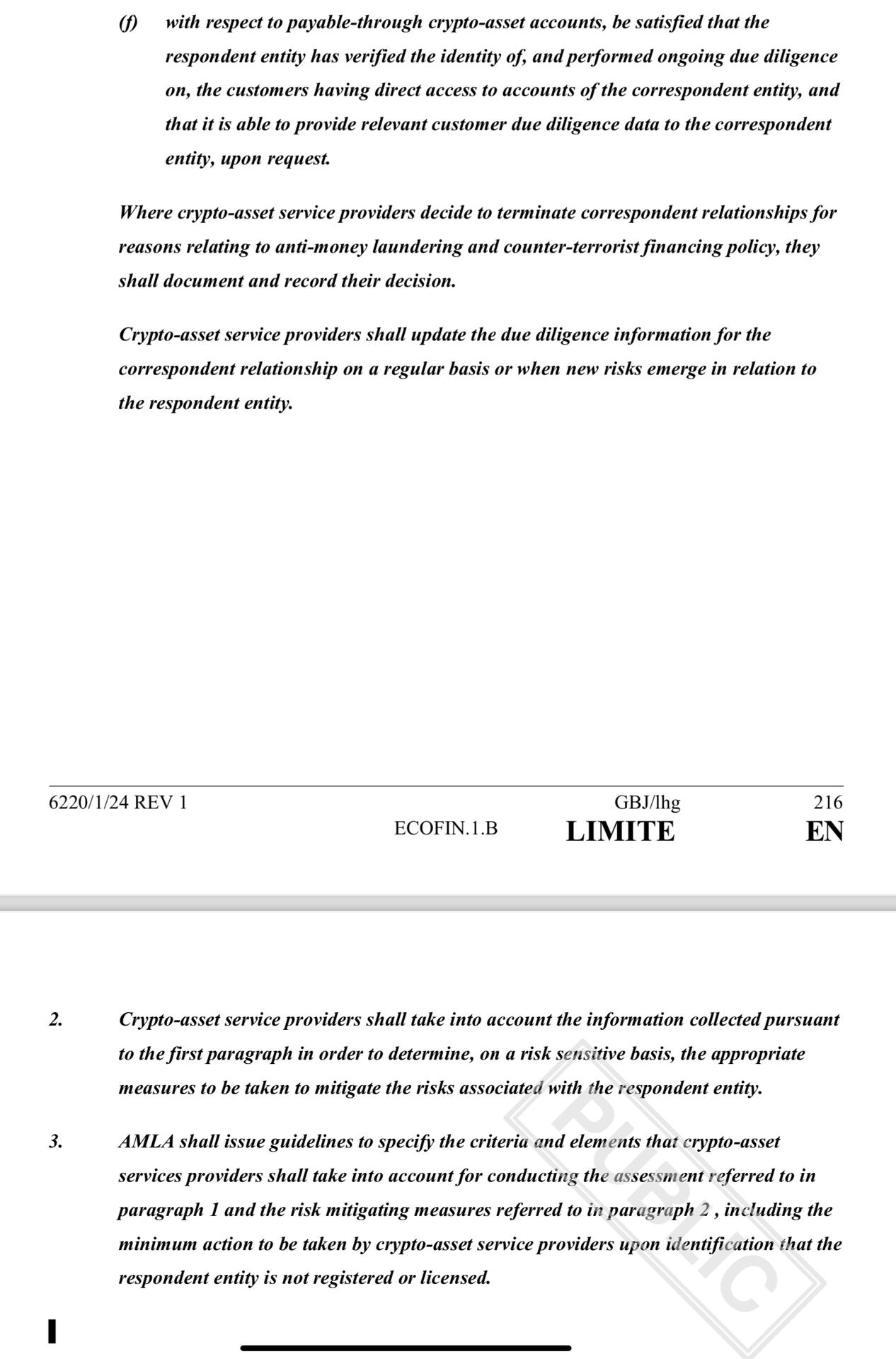

One observation is that 'virtual asset service provider' (VASP, or what Americans would roughly call custodians and exchanges) is now considered a Financial Institution(tm).

My impression now is that only _custodians_ are not allowed to:

1. Have anonymous customers (i.e. anonymous accounts): they explicitly mandate KYC rugging existing accounts, albeit with a 3+ year heads up

2. Operating a mixer

They also need to verify ownership of destination address (wallet verification), which is bad, but far from a ban on self-custody.

The 'intro' text mentions mixers along with anonymous coins in a way that suggests banning transactions with them. But the word 'through' makes it really unclear what they mean. In the law text they define 'anonymity-enhancing coins' in a way that obviously implies Monero and Zcash in that order. Article 58 uses the vague term 'through' again. Does it mean they can't let you withdraw to it? Or just that they're not allowed to offer a pseudo-mixing service that *uses* these coins.

Anyway I'll have to re-read this a few times to grok. Keeping in mind that the politicians who wrote this don't have the brain cells to process anything more sophisticated than "monero bad, make law with fancy words!" and then the bureaucrats who write the law have no idea what anything means either. No tech literate person was involved in this process, that's very obvious from the language. But that does make it less dangerous.

The next step for me is more deeply understand what the proposal actually says, if there's any potential direct impact on myself (which might give me legal standing - now or in five years or so when stuff has really taken effect and local judges can intervene) or if it's merely bad in general (in which case perhaps all I can do is write an angry letter).