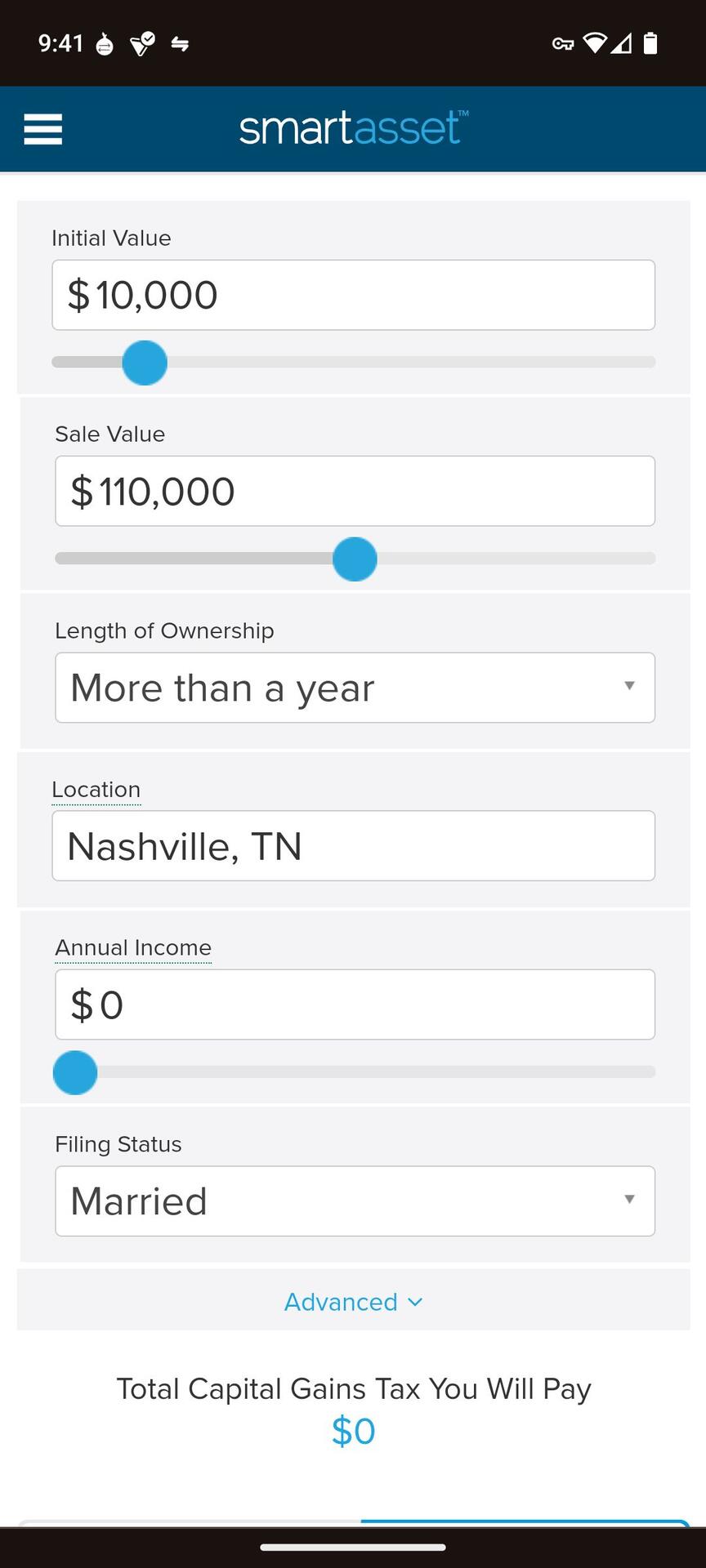

I'm curious, we have all these tools to self custody and protect our bitcoin, but how do we protect against the cap gains tax man? As an American we will pay 20% no matter where we live in the world, and in Cali it's 33%

Does it just come down to non KYC purchases only to avoid tracking? Will you have to earn it directly to avoid fiat paper trail from paycheck like a cash job would now?

What are the odds the U.S. abandons its federal cap gains tax?

#asknostr