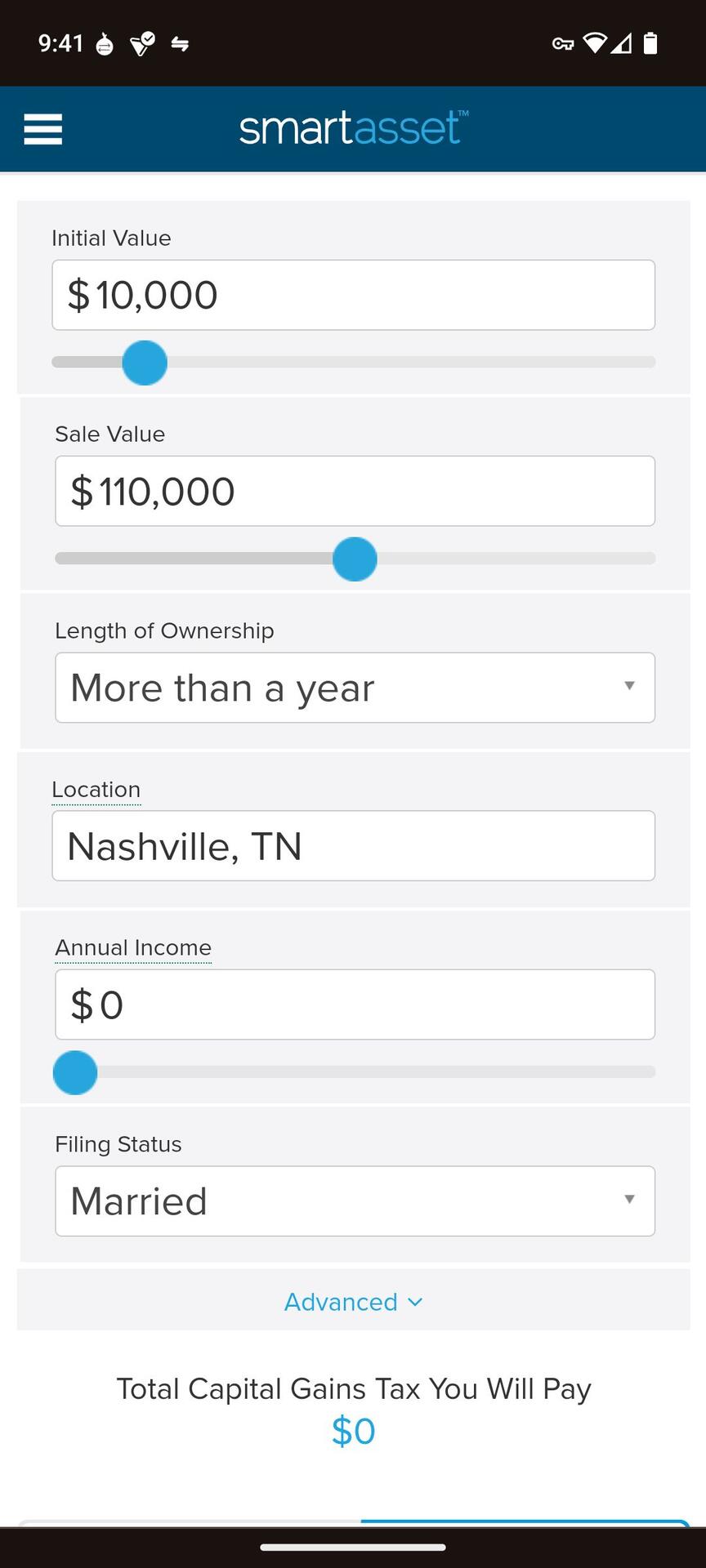

If you're married and have no other income, the first ~$100k of cap gains isn't taxed federally.

Discussion

PSA for Bitcoiners. You dont have to risk jail time to avoid paying taxes on Bitcoin.

Thanks Corey, I'm single and have an income right now, but I was curious about that if my situation changes. So if you live in a state with no state cap gains like Florida or Texas then no cap gains tax at all until 100k?

Correct, its half that if youre single. But the standard deduction even adds more. And, of course thats only on gains so you can sell more if your basis is high.

TN and NH are also options. Probably a half dozen others.