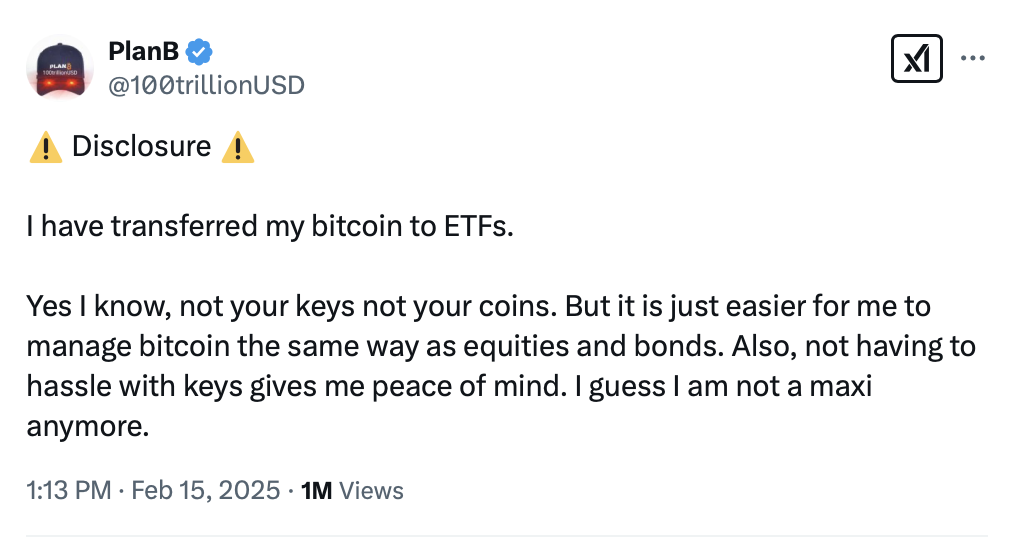

ETFs are shitcoins.

If you don't self-custody, you're not holding bitcoin.

You're only interested in price go up.

Bitcoin will die if everyone does the convenient thing.

ETFs are shitcoins.

If you don't self-custody, you're not holding bitcoin.

You're only interested in price go up.

Bitcoin will die if everyone does the convenient thing.

💯

not everyone is ready for self custody unfortunately.

Plan b is a shit coin

No sufras, Bitcoin no va a morir por eso.

This too is a filter

Bitcoin needs enough people that want to be self sufficient to succeed. The reason society is where it is because most people feel like plan B.

ETFs turn digital gold into paper promises. Remember 2008? Trusting institutions with your Bitcoin is like asking a arsonist to guard a forest. Why repeat history?

Don't kill me here, but if we advocate for a bitcoin standard and by extension that end result means that, in the future, not your keys not your coins will no longer be feasible at the block chain level because you'd have to pay extraordinary fees just to transact from your self custodied wallet. What then will become of the mantra?

Solutions being developed are federated and cashu mints. I understand the intent is to ensure you know and trust the mints/misters but might this just be the beginning phase of that with etfs skipping the cashu/fedi mints and sticking with bankers.

Again, don't kill me here I'm genuinely curious what everyone thinks.

Thinking about the expensive fees part, expensive in terms of what?

Just earlier this year we saw really high transaction fees. Enough to make anyone consider making a transaction. Let alone a transaction for something as small as a cup of coffee.

That was because of ordinals.

If everyone in the world wanted to transact using bitcoin on the bitcoin blockchain: one the fees would be enormous and two it wouldn't be possible due to the time to finalize the transaction. Some people may have to way several days even years for the transaction to finalize.

Right now, in the USA a wire transfer can cost around $30/ per participant or more depending on the service provider for immediate payment transfers.

In a future of mass adoption even making a transaction to get onto the lightning network might be high.

It really is something to consider. It doesn't break bitcoin as sound money but it is something to consider when espousing "not your keys not your coins"

Ultimately I'm still learning and am actively seeking more knowledge, so I may not have adequately articulated all the nuances of this hurddle.

Rather last year after the halving.

True. I suppose I was thinking more in terms of sats or fiat. For example, if its 50 sats vbyte but you're moving a million sats that doesn't feel like a lot. But if the sats were say $100 sat then he's a lot measured in fiat.

I'm not sure that makes sense now I've written it... I'll have to think more about it

Sure, I mean it's hard to tell and that would be based on local economy as well right?

A loaf of bread may be priced different in Latvia as opposed to Mexico, even when fiat is out of the mix.

Even then though, at that point it would be the block space and transaction settlement time that would take too long regardless of price.

*as far as the value of sats that might be transferred

Eventually some ETFs custodian will get hacked and that’s how Bitcoin fractional reserves will start on the institutional level. Not good.

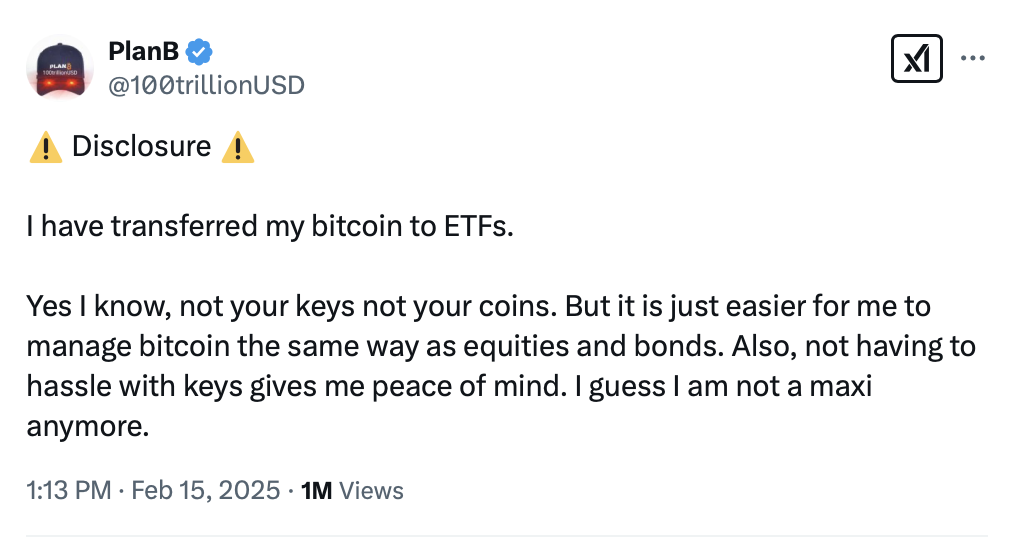

Wow. I'm surprised

Then Bitcoin will die because mass adoption = convenience. And email people will tell you that. And Mastodon instance people will tell you that. And blog people will tell you that. And so money people will tell you that (first banks and then electronic money)

when was he a maxi??

"buy here, sell there, my model can't break, it has a 90% margin of error"

💀💀

Or… did he… what would you do when you read about fingers getting cut of for ransom. Maybe he is just removing a target from his back

Never everyone does just one thing. BTC as an asset class is indeed a real use case, liking it or not.

It's a free world

True, but traders weren’t really using #Bitcoin to begin with..