silver run feels like gamestop on steroids with a side of sovereign debt crisis

Discussion

Peter Schiff has spunked in his pants when it hit $80.

Seems like When Money Dies.

mandibles then bitcoin standard

We're at the part of Mandibles just before Bancor becomes the new currency.

The dollar hyper-inflated vs. one of the metals defined as money in the US Constitution.

The other metal the Constitutional monetary metal is not quite hyperinflation, but -70% is pretty bad.

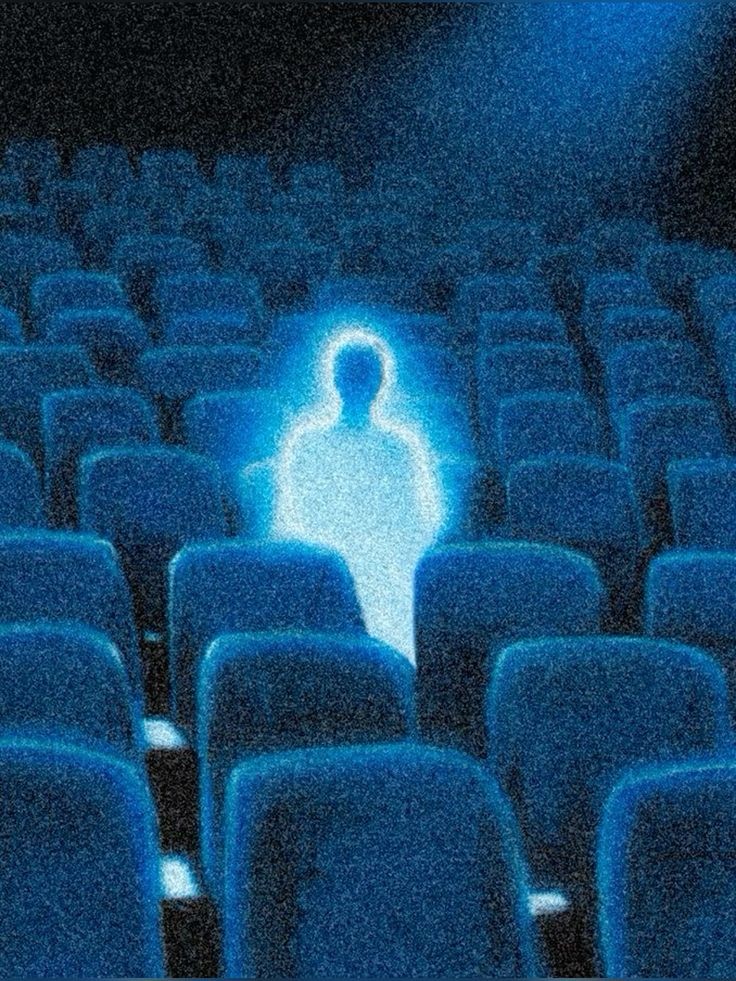

We're watching the monetary reset in real time.

bitcoin -8% YoY while the monetary metals rip…….

Well the banks have been keeping precious metal prices down for years and without cheap money they can no longer do so, but with that said silver will taper off as what happens is miners will start to accelerate activity to take advantage of the higher prices and then flood the market and prices will draw back.

I will admit that if the dollar hyper inflates mining won’t keep up, but the government will most likely just come and steal your silver and gold.

I literally just finished reading Mandibles, like, a minute ago

nostr:nprofile1qqsqfjg4mth7uwp307nng3z2em3ep2pxnljczzezg8j7dhf58ha7ejgpp4mhxue69uhkummn9ekx7mqprpmhxue69uhhqun9d45h2mfwwpexjmtpdshxuet5hgfg9w might be a good time to get Lionel back on Citadel Dispatch for her take on the current trends? We all loved the first discussion!

We're at the part of Mandibles just before Bancor becomes the new currency.

The dollar hyper-inflated vs. one of the metals defined as money in the US Constitution.

The other metal the Constitutional monetary metal is not quite hyperinflation, but -70% is pretty bad.

We're watching the monetary reset in real time.

It's coming 👀

Gold and silver are easy to buy but hard to sell. Bitcoin is pure liquidity.

The chart for today is wild after Shanghai opened.

Went up to almost $84 then dumped to $75.

Would be curious to know what exactly happened there since it typically dumps once London opens and paper contracts can do their work

There 12000+ paper contract requiring delivery of silver. The vaults are virtually empty. The banks are trying to delay. Industry going direct to miners. The banks are losing control, silver has broken out to realise its true value. It’ll hit $150 without fail. Disclaimer: My opinion, not advice.

Yea watching Samsung reopen silver mines in mexico is pretty crazy. Some are guessing Elon will buy some mines as well

If the exchanges don't have the physical metal in vaults then they probably shouldn't be the ones setting prices lol. They're raising margin requirements tomorrow since that tactic worked back in 2011 (CME hiked margins 5 times in 8 days back then)

Yeah, silver is on its way to $150 & probably won’t stop there either!

nickel baby

My old man sold a silver bar yesterday... and wants to now buy btc... yes!

Totally.. 🤣..this silver run feels less like a smooth trade nd more like a full blown meme squeeze strapped to a sovereign debt time bomb.... When precious metals rip on the back of broken bond math nd fiat panic, you’re basically watching a GameStop style short squeeze play out at the macro level. 🤗🤗🧡

I said it was looking like a meme stock . Yes it may go to 100 ..maybe by the end of 2028