Unreal…

A friend mentioned to me today that the free market is complicated. I was quick to point out…the free market is NOT complicated.

You take risk and provide value, you receive your rewards. If you miss, you lose. Fairly simple.

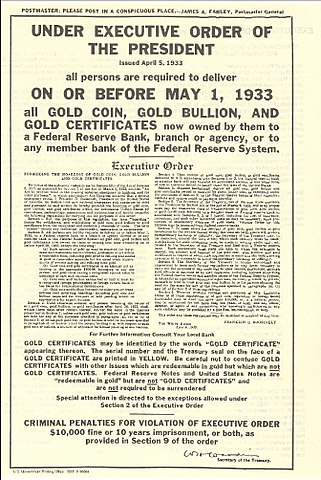

What we have created is what is complicated, and it is NOT a free market.

Crazy that people still think that’s what our system is, and that it’s the free market that’s to blame.

🤦🏻♂️

💯. The game has become so unfree & complex that these asshats don’t know what the fuck they’re doing at this point.

Thread collapsed

a pure, true free market is a thing of beauty

It’s an organism

Buyers and sellers converge around a product or service

and they trade

keep third-party rent-seekers the fuck away, you have a thing of beauty

#bitcoin #nostr

Thou speaketh elegant truths

😁⚡️

Thread collapsed

Thread collapsed

Thread collapsed