We don't change the defenition to suit narrative, we talk about pratical use cases of the tools we have available, and yes technicly cash is not fungible, but as you can't trace it's use it has fungibility capacities.

Not only Monero is fungible, there are more options, you just have to pay attention and you find them.

And have options for every tastes, you can have a fixed cap private option if that matters to you for exemple wownero.

You can have blockchains to do private smartcontracts like BEAM, you have many options.

But you fall for the narrative that every coin that isnt bitcoin is a shitcoin and you even try to check by yourself why that narrative was constructed.

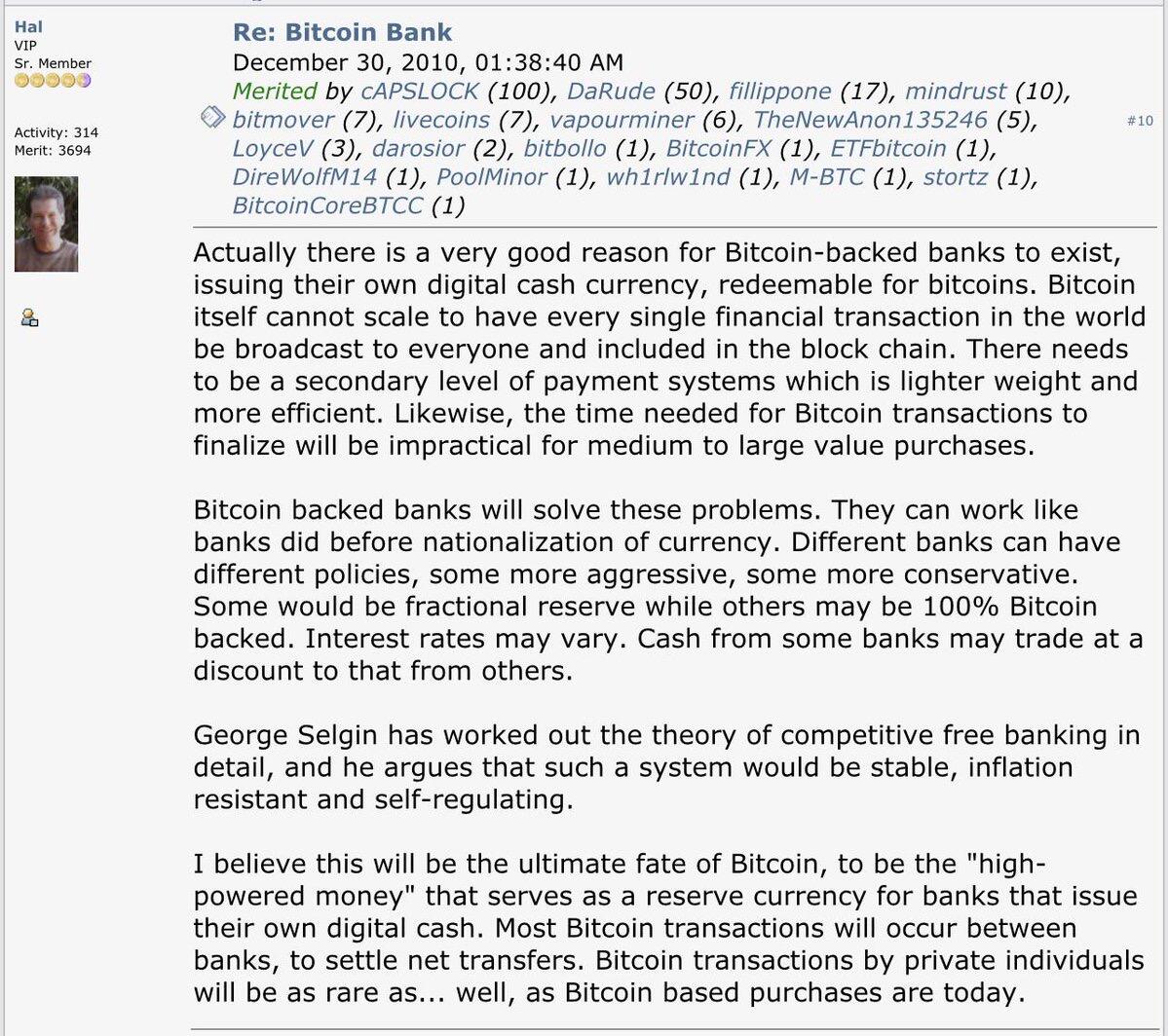

Also bitcoin could have privacy propreties, and could have dynamic blocks or bigger blocks like satoshi has envisioned to scale, but who knows why core devs and the "community" don't want it.

Put your brain to work and go find by yourself the answers you have and don't be attached to that kind of little things as you mention like the cash non fungibility.

And remeber "Don't Trust, Verify" 😉

My point is be consistent. You are stating that only certain cryptos are fungible when in fact many things are fungible before the existence of crypto. So you have moved the goal posts for fungibility. If in fact fungible is a matter of degrees then where is the line between fungible and non fungible?

If you want to say Bitcoin is traceable just say that we already know it’s a public ledger.

I have stated many times Monero is the only other coin I don’t consider a shitcoin. So I don’t really care what other Bitcoiners say.

Thread collapsed