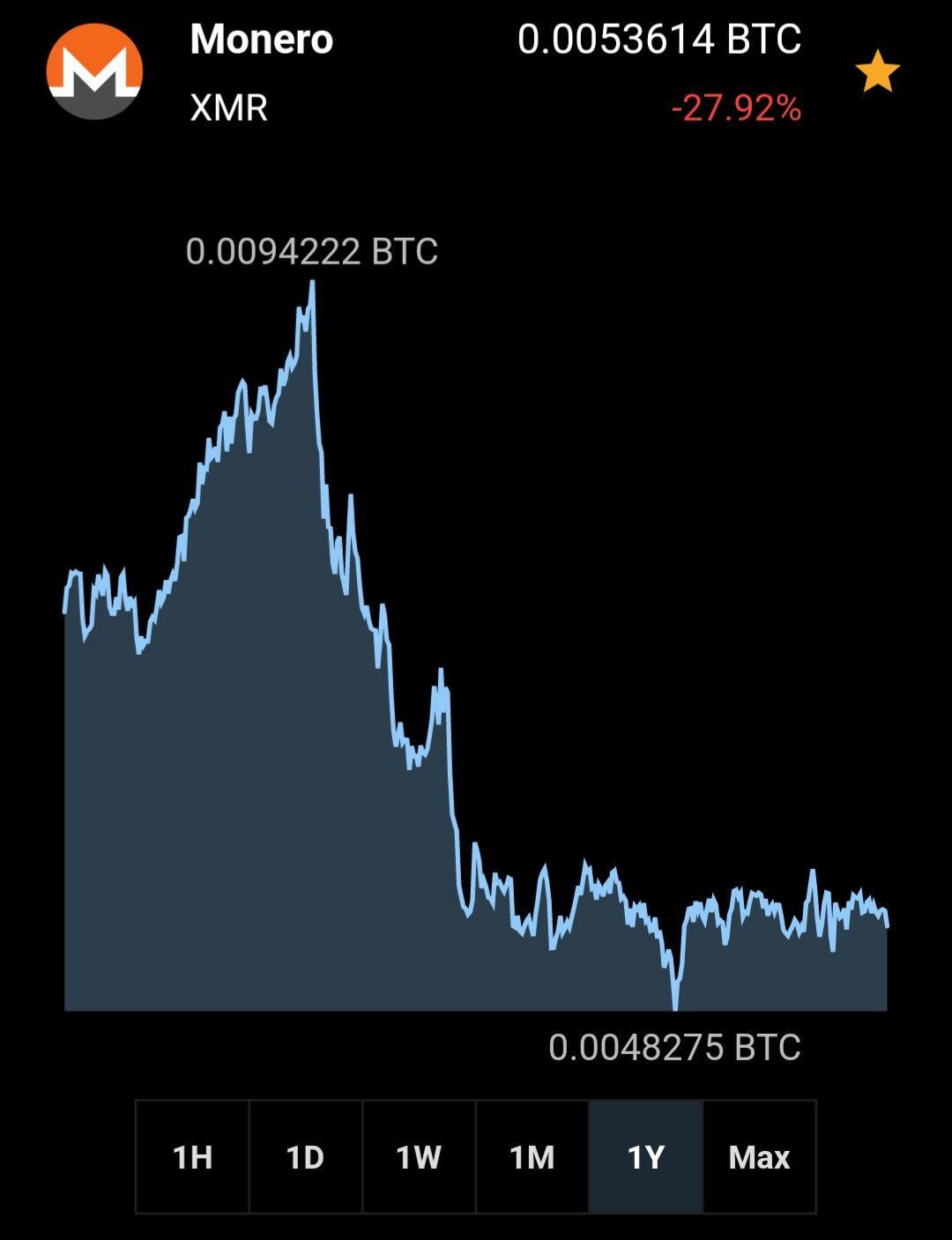

Being a private MoE means nothing if you can’t store value in it, agreed. XMR folks have short time preference, they don’t believe Bitcoin will be able to compete on privacy eventually. I think we’re already 70% of the way there with ecash, lightning and other privacy tools being developed. Bitcoin is 10 years ahead on all other qualifications of money which they often overlook.

Discussion

I have never been impressed with infosec/opsec advocacy wing's understanding of money.

I respect the ethos of putting privacy at a high level of priority but their typical train of thought goes something like this:

1. Privacy is extremely important to me <—— respect

2. Bitcoiners just care about getting rich they don’t care about privacy

3. Bitcoin doesn’t have great privacy so *insert shitcoin here*

I think they just get bored by economics, and they don't like the trad/conservative bent within bitcoin; it grates pretty heavily against their libertine tendencies.

Right they put any reasonable thought about the supply/demand side of XMR aside while they jizz over privacy features

I've run into enough young infosec professionals to know they see themselves as badasses with boutique pronouns.

Lmao. It’s funny I’m an IT professional for fiat mining and I relate to this on a deep level. See these people that tout themselves as high IQ badasses fighting for cybersecurity and freedom then you see their delusions in their email signature

Most of them aren't really that smart. Their confidence is just the adderall and low public school standards doing the talking

I find many Monero users more often than not are disaffected Bitcoiners who are hardcore ancaps/voluntaryists/agorists/austrian econers. There are many who are synergists who use Bitcoin/Monero for different purposes.

Fungibility is an underplayed aspect of sound money. Absolute scarcity is not a preqrequisite. Especially because you cannot control the demand side of the equation no matter how absolutely scarce something is. We've had an inflationary SoV for thousands of years: Gold. Monero has even less inflation than gold that is actually predictable. So it isn't that crazy of a jump.

https://mises.org/wire/why-fungibility-important-understanding-money-and-crypto

1 BTC = 1 BTC the “fungibility” argument is some of the worst cope I’ve seen in crypto. Shitcoiners trying to grasp at straws for an excuse why we need multiple coins. If a government decided to steal your kyc bitcoin does that mean they can’t go and spend it on the blockchain like any other user could? No. If I spend KYC btc does the store I spend it with give a flying crap if you’ve KYC’d? no.

1 BTC = 1 BTC on a protocol level, not in the real world. You have to make one Bitcoin technically indistinguishable from another to achieve that. And it can't because it is a public blockchain and they each have unique histories.

As chain analysis services and tools become more sophisticated, accessible, and easier to use, and regulations increasingly clamp down, all those businesses will be forced to be more choosy to save their own asses. You already see this with KYC/AML laws. Automatically assumed guilty if you can't prove the history/source of your money.

We will see a bifurcation of black/white market bitcoin at different premiums/discounts based on history. There are already examples of this: https://sethforprivacy.com/posts/fungibility-graveyard/#compliant-mining-and-virgin-bitcoin

Of course, this won't matter as much for gray and black markets, but will still matter to some degree.

I'm saying this as someone who also holds Bitcoin.

Protocol/code is law. Having UTXOs with different history has no implications of how it is spent on the protocol. Thats what matters. You can put all the goofy identifiers like “omg this was owned by this KYCd person”! But doesn’t change how it is spent or how the protocol receives it. When everyone is dead in 200 years and they find kyc bitcoin do you think they are just going to toss it aside and say “that’s not bitcoin it was KYC’d 200 years ago, toss it in the “fungibility grave yard”. Nah they are going to spend that shit like any other coin. A UTXO has a unique identifier, yes, I don’t see how this makes it any less valuable or interchangable than another UTXO with the same amount that is nonKyc. Increase your time preference and see how nonsensical this is.

Not to say people won’t pay a small premium for acquiring privately, but saying that it’s not fungible is ridiculous

It's more that white markets won't want to deal with the risk of tainted funds because of increasing regulation. Tainted coins might not be accepted or undervalued at other places for the same reasons. So businesses and people will either refuse them and ask for coins with "clean" histories. Or they will accept them for a discount.

I think Bitcoin/Monero were always meant to be black/gray market money.

I just feel more cynical about it and don't see how this isn't the outcome. But I rather have what you are saying be true.

Like I said earlier in this chain I truly respect the privacy ethos on the infosec coiners. But I also have to look at “who benefits the most from this rhetoric?” Which is obviously the privacy coin holders who would love to benefit off of Bitcoin’s downfall. I guess I’m just cynical in a different regard.

That said, what you’re saying is not entirely baseless shit can get pretty whacky in the next 10-20 years as governments come to terms with losing printing power of currency which is why we’re having this discussion. I think everyone wants to improve Bitcoins privacy and find a quick solution like “this coin does this!”. L2s are going to improve, and users aren’t going to know the difference between kyc/nonkyc in 20 years bc it won’t matter.

I'm not saying Monero would be accepted on white markets. But whether it is or isn't, doesn't effect it's fungibility, unlike Bitcoin. Monero must either all be accepted, or all be banned, because each monero is indistinguishable. There is no historical transaction graph. It can't be bifurcated into clean and tainted Monero based on history.

A great MoE can be a lesser SoV and vice versa. Bitcoin's has been a great SoV so far, but you would go broke quick using it for daily transactions. And this problem increases with more adoption.

Ecash is probably the only great privacy contender to Monero, but is custodial and the mints can arbitrarily create tokens out of thin air.

Lightning receiver privacy is shoddy, and sovereign UX is the reason everyone gives in to WoS. Incentivizes middlemen that centralise the network for cheaper/succesful routing also at the expense of privacy.

L2s will always sacrifice core aspects of Bitcoin. Trade offs to all of it.

This is all going to be seamless from a users perspective in 10-20 years. This is like saying the internet was flawed in the year 1998. Ya no shit, but it gets better every year. Will monero even be around in 20 years?