I guess less network switches are also required

I guess less network switches are also required

Hardware turns into a commodity too . They just should buy bitcoin lol

Interesting point. Better to convert money in hardware commodity to digital commodity. Those ANET switches can't get zapped around the globe.

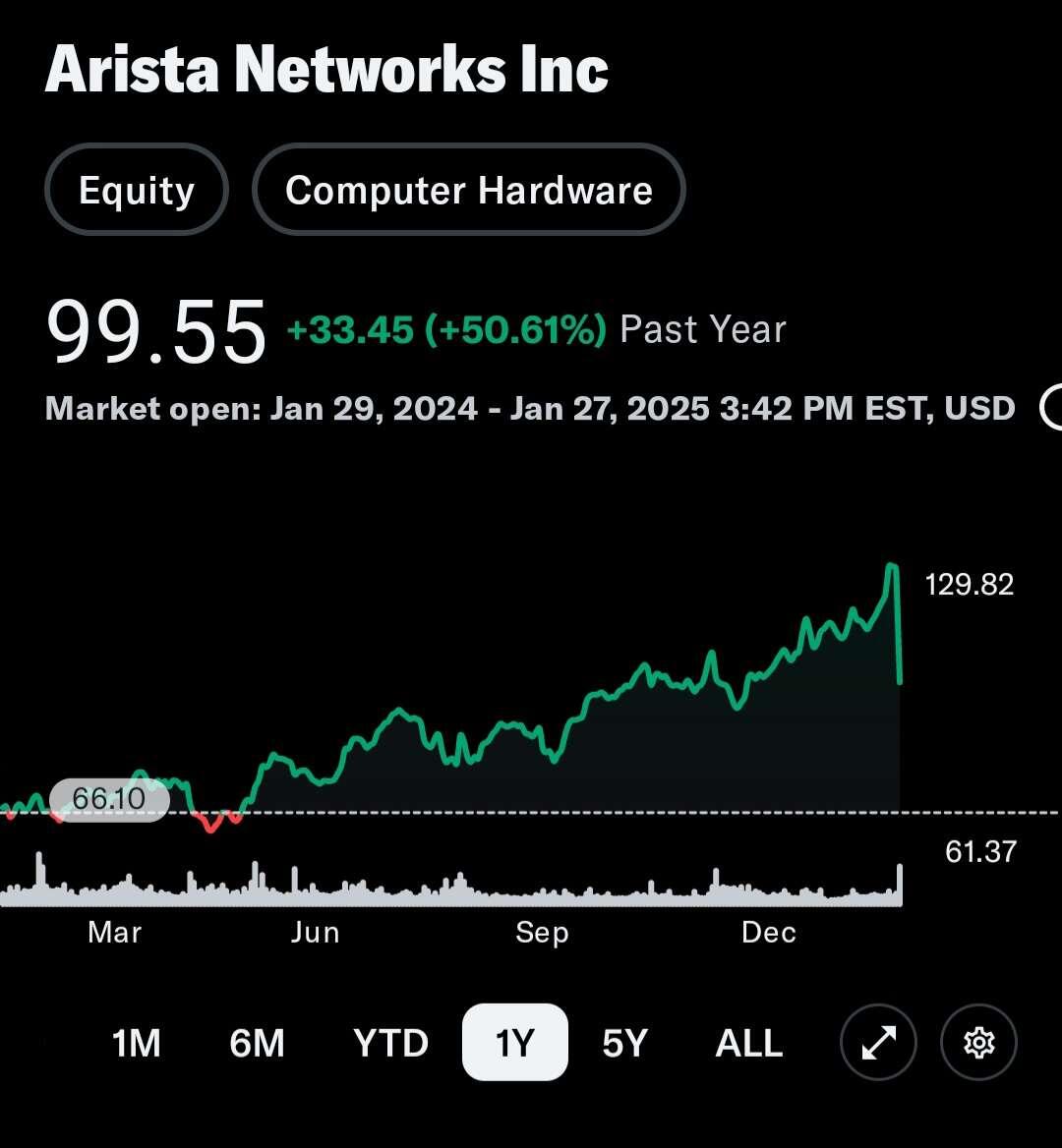

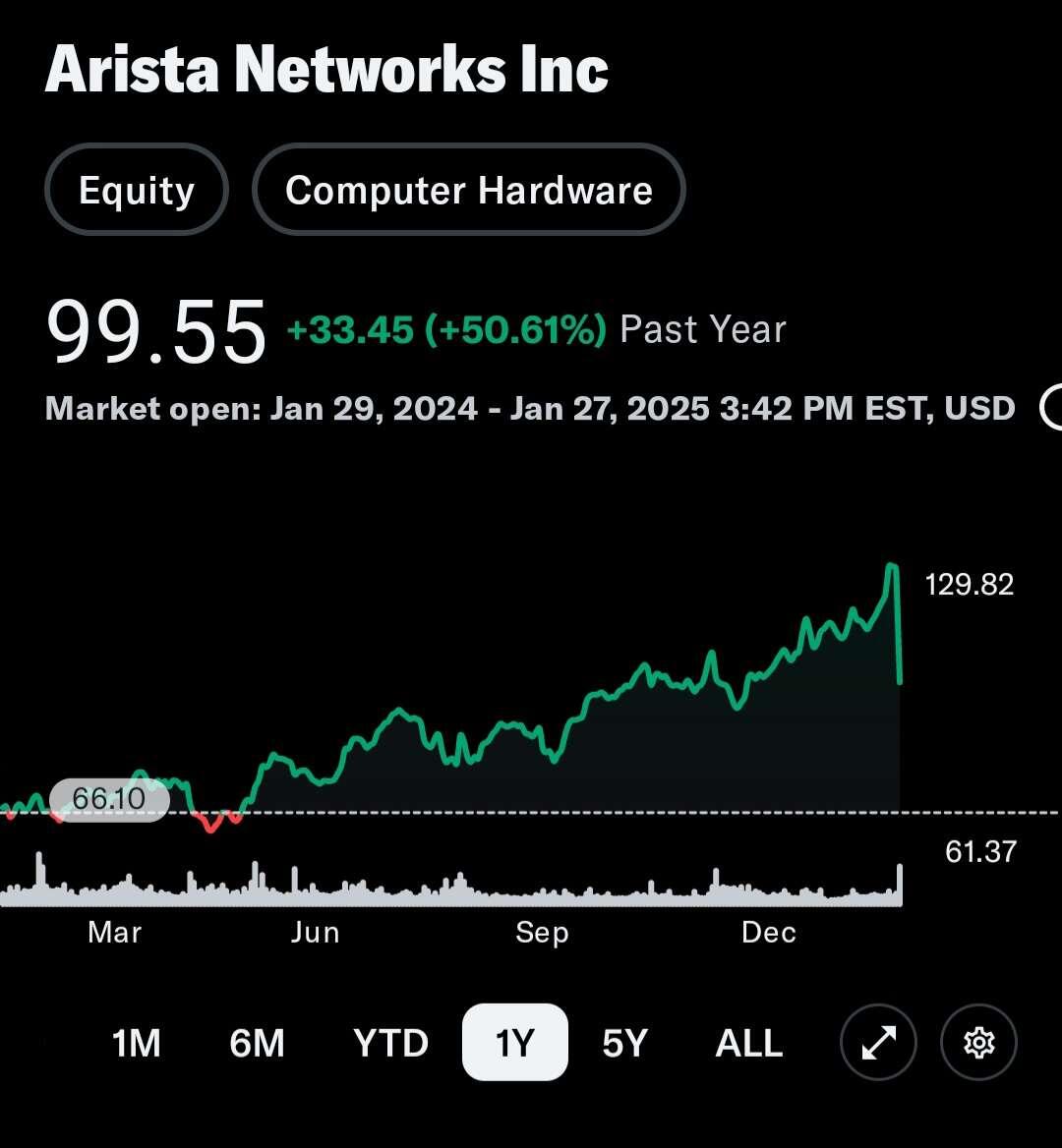

PE of 48. Seems incredibly risky.

A lot of these boomer stocks are ridiculously priced to me . Today seems to be a big wake up call in the market tho

It feels like the dot com era, everybody jumping on without any real thought just hopium

Grok says PE ratios were

1880s to 1890: below 10

1900: 10 to 15

1920s: up to 20 and some beyond

1950s 10 to 15

1960s:18 to 20

Grok also says 4 trillion would need to exit the S&P500 to bring average PE down to 10

These companies better start buying bitty lolll

So wild to me that most companies haven’t adopted the Saylor playbook. 90% of S&P500 is dead weight returning a loss in real terms.

Gradually and then suddenly

This is the suddenly year. Can’t ignore a MSTR at a $500B marker cap or $1T

Get on board or die a not so slow death

It’s becoming very obvious having no bitcoin in your treasury is a very bad idea. And when USA start buying more bitcoin to hold on reserves it’ll be the suddenly moment

Similar to ASICS I imagine