I'm sensing a lack of confidence among bitcoiners recently. Arthur Hayes talked about Blackrock being in the ETF business for the benefit of the US gov't. On the other hand I never thought the $1 million predictions by 2026 by people such as Hayes, Jack Mallers, Samson Mow, Hodl etc are helpful at all, they will just disappoint people. We haven't even got to $75k yet never mind Hodl's previous bull run prediction of $300k a few years ago.

Personally I'm skeptical of another retail led bull run. Most people are aware of bitcoin & they are either going to buy it because they believe it's worth holding or they won't touch it, the days of jumping in on an upward move are likely gone for most people too many have been burned (although they should have held on instead of selling at a loss).

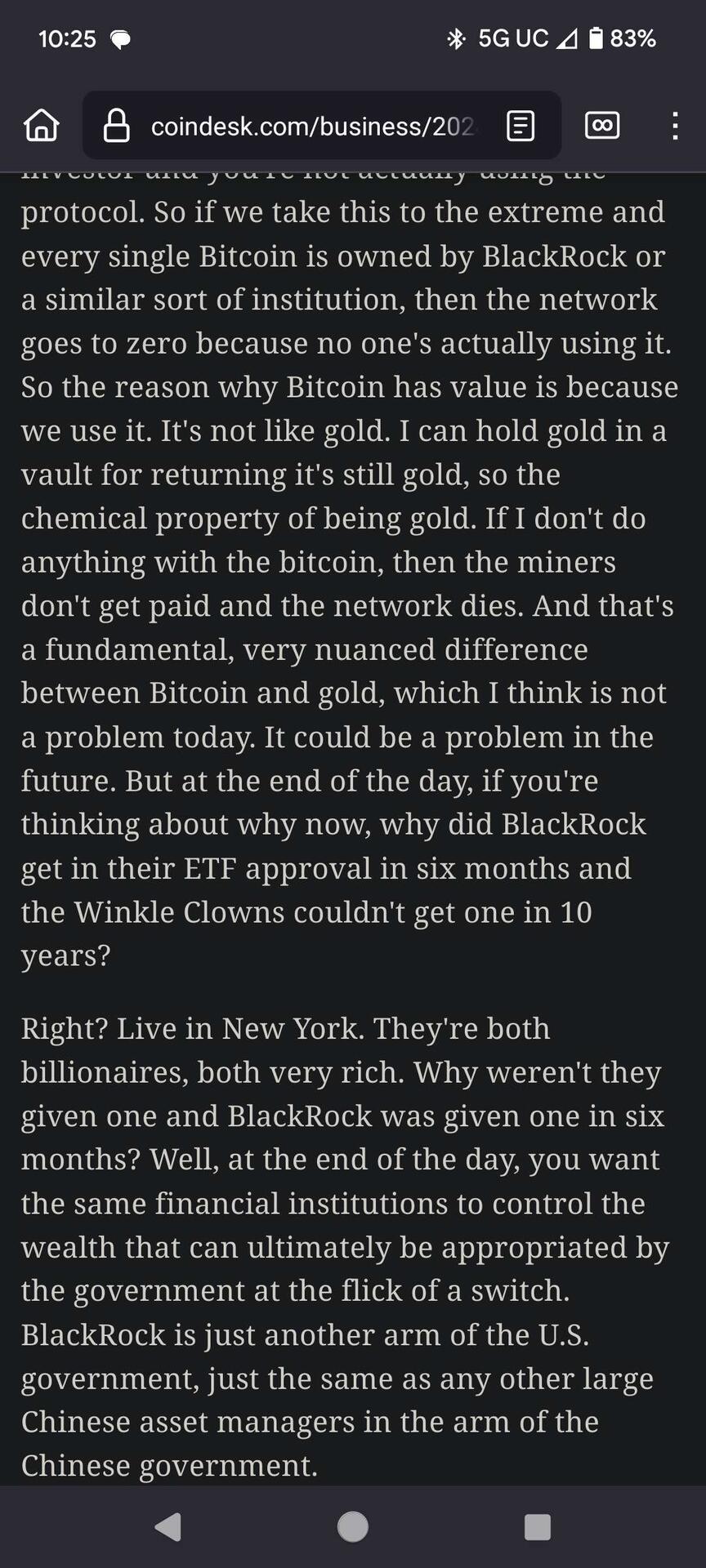

I agree with a lot of what Saylor says & it flies in the face of maxi's who used to tell us bitcoin will kill the banks. No, the banks will get involved in bitcoin if there's money to be made. Saylor is obviously very confident which helps me keep confident although as time goes by (been here over 7yrs) my confidence in bitcoin isn't what it was. Talk in the past of governments not being able to kill bitcoin seem a little fanciful now. I think the government's ability to crush anything it wants is more powerful than we like to believe. An inability to create a widespread use of bitcoin as a MoE coupled with a hostile government could be devastating to bitcoin.