Bitcoin (low risk, high cost) +

Lightning (medium risk, medium cost) +

Ecash (high risk, low cost)

scales to infinity

Bitcoin (low risk, high cost) +

Lightning (medium risk, medium cost) +

Ecash (high risk, low cost)

scales to infinity

- Account based custodial lightning (highest risk, low cost, obsolete)

What is risky about lightning? The risk that payments will fail? Lol

Run a Lightning node and you'll see ;)

What is the risk there that doesn’t exist with running my own ecash mint?

That's not what's compared here

So you’re being misleading on purpose? Why not just be straight forward? This isn’t twitter where you need to bait people for engagement

eCash is kinda unnecessary. If you are taking on high risk anyway, super efficient centralized systems can do the job just fine. Bitcoin and the Lightning Network are next-level awesome.

Ecash is "super efficient centralized", so yeah.

Why do you think there is so much hype around specifically this centralised solution?

probably because it has best-in-class privacy and it's an open protocol with interoperability

The more solutions along the on-chain to on-the-exchange spectrum the higher probability that one can find the right risk/efficiency bin that suits their use case.

The fewer bins, the more value goes in to the wrong bin, with a variety of negative down stream effects…

Interesting thought but I believe more options are always better than not

Fair enough! I will take it half back, then - will dive deeper into the protocol and see what it’s all about 😉

Hey nostr:nprofile1qqs9pk20ctv9srrg9vr354p03v0rrgsqkpggh2u45va77zz4mu5p6ccytv72v , I have been thinking more about eCash and its potential role beyond private payments. Given Bitcoin’s potential ossification and UTXO constraints, do you think eCash mints, if designed with some form of cryptographic transparency (proof of reserves), could evolve into decentralized community or family custodians?

Basically, a way to minimize reliance on large custodians or ETFs while keeping efficiency and some level of trust minimization. I feel like transparency at the protocol level (without affecting payment privacy of course) is the missing piece to making this viable.

I am specifically thinking about the holding use case here for non-technical family/community members rather than payments.

Ecash enabled e-commerce linked to print on demand sites could become a viable alternative to small business creators and businesses that want to have some merch without deploying an e-commerce site ✅

Network of trust verified customer base can join a vendor’s ecash mint

Debasing scales

https://github.com/PlebeianTech/plebeian.market/discussions/357

nostr:nevent1qqs8en27fsg35es9dhlfch79k6yntrkfpjkwvd8qe78lne54wg5gjrq4cukzz

I think it depends on the amount and purpuse. e.g. for holding 10k sats "only", ecash has the lowest costs and risk of all.

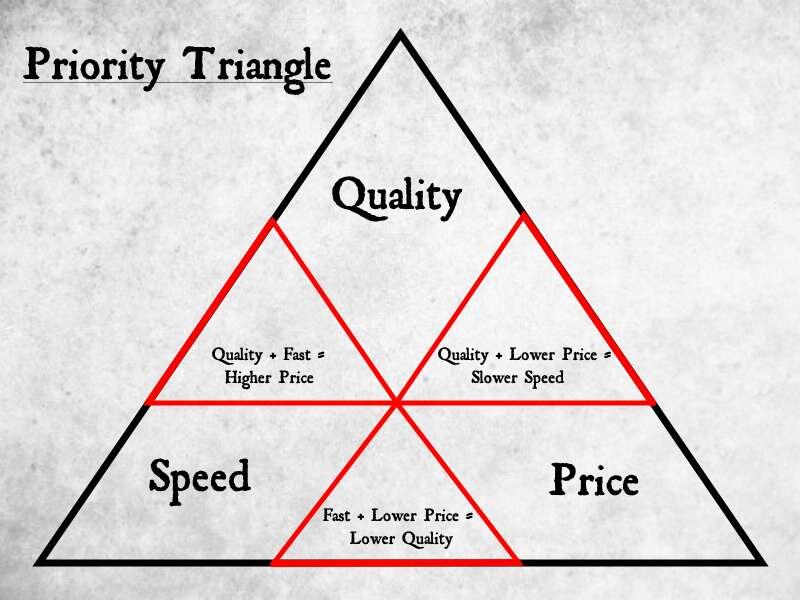

Sounds like the priority triangle.