Good question. Morals aside. I'd simply say one system is artificially centrally controlled (printing fiat) the other is a decentalised natural system (Bitcoin). You'll find that those who bought early will also reveal how they lost and spent UTXOs in proportional amounts. And in the end it plots out as a perfect distribution. Over time UTXOs will shift from those who do not produce value to those who produce more value. Granted, if you're a central bank and print fiat to buy Bitcoin you'll add a short term anomaly in the data but I'll smooth out eventually.

Discussion

partially agreed that in time, in the absence of any value production from those who now own many BTC will start to be redistributed according to production of each individual BUT still, isn't the current amount of BTC owned by a few allowing them to build a new world in such way that they will never run out of BTC (of most of BTC) just like it happened with the gold coins, gradually eliminated so that the gold end up in the same hands? For instance, if I had 10000 BTC, meaning what? $570.000.000, I would make sure that if I give those sats to others, they will come back ten folds to me...so no equity here...

I'll try and find the data. Because its all public and auditable on chain it shows the distribution is already happening as expected of a natural system. Flowing out into the population on a normal distribution curve. There will always be some with more and more with less as is expected by the math. But more doesn't give you power over others like fiat. You cannot economically take it through coersion or inflation so you have to exchange value through voluntary means. The person with more that produces less value in products and services will need to distribute theirs to those who have services and products of value. There's a reason Satoshi called it a time chain. It's truly finite. So the math will become as fair as nature can allow.

so you assume that let's say those 1% of BTC owners who own say...25% of total bitcoins will lose their btc to the masses because they won't be able to keep up with production? because as far as I understand, the more currency you have, the more you are able to buy those who produce, thus increase your production without you, physically produce something?

Your starting assumptions are off a bit. For example if the US Gov would put all its power and fiiat privilage to buy #bitcoin they'd be lucky to get a few percent. There is no small number owning 25%. Its already beyond that kind of concentration. Due to its pseudonymous nature you never really know if any entity still control keys or have lost them in an unfortunate accident 🌊 or to an irresponsible grandchild. Death is real so all coins eventually change hands or are lost forever. But yes, generally Austrian ecomics win out in time eith regards to economic distribution.

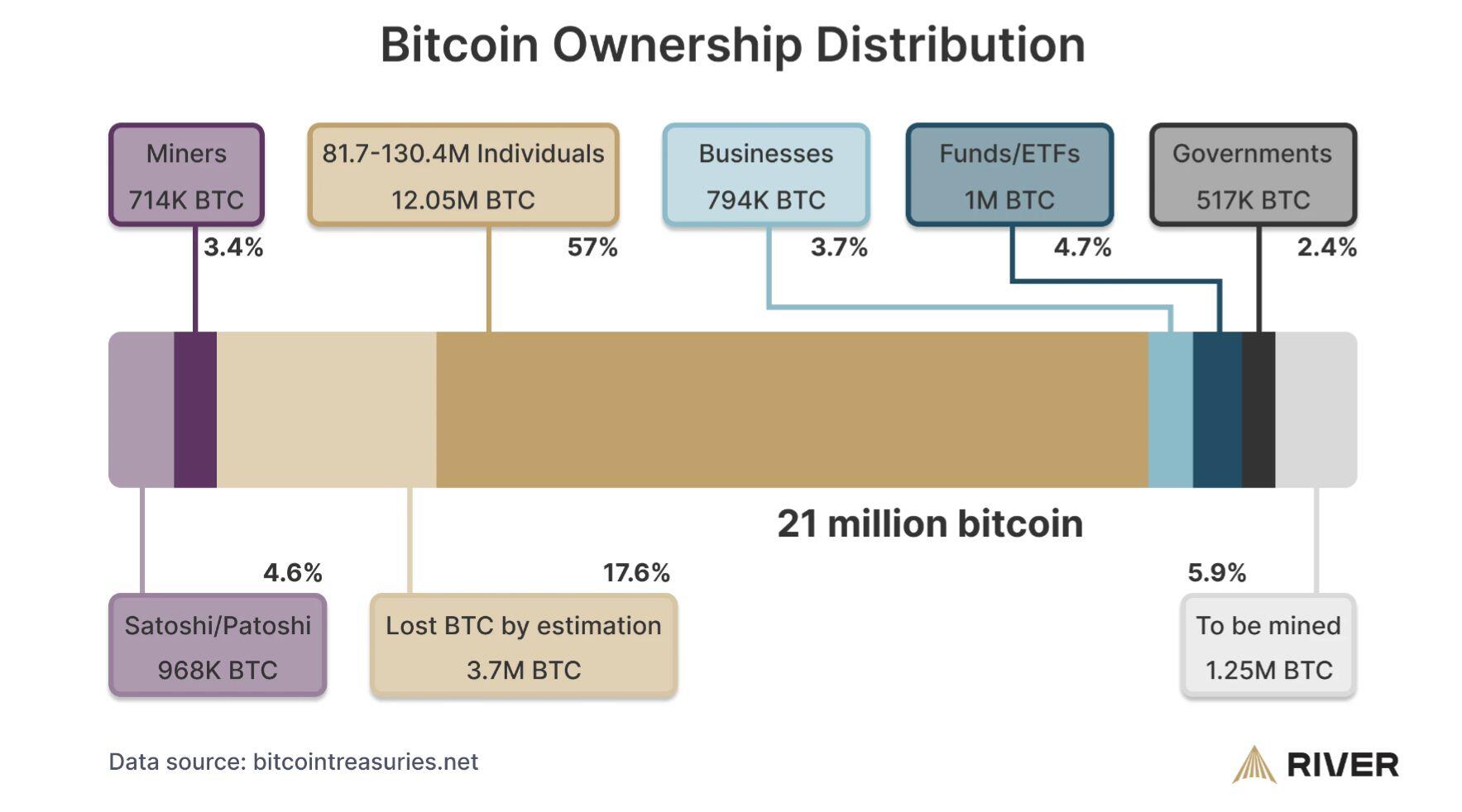

As of 2024, there are roughly 19.45 million Bitcoin mined. The distribution of these coins is highly uneven:

•Top 0.01% of Bitcoin addresses hold 27% of all Bitcoin.

•Top 0.1% of addresses control approximately 60% of Bitcoin.

•Top 1% of addresses hold roughly 90% of the Bitcoin supplly

According to the most recent on-chain data, the BTC distribution is as follows:

Whales (1,000+ BTC): These addresses control 42% of Bitcoin supply. There are around 2,000 such addresses.

Humpbacks (10,000+ BTC): A few hundred addresses belong to exchanges or institutional investors, holding a combined 10%+ of supply.

Large Fish (100-1,000 BTC): These wallets hold around 20% of supply.

Retail Investors (0.1 - 10 BTC): The bulk of addresses fall within this range, but they collectively hold less than 10% of the Bitcoin supply.

Dust wallets (under 0.001 BTC): These small wallets make up the majority of addresses but hold a minuscule amount of BTC.

So, I think it's clear as of today that Bitcoin is highly uneven distributed, just like fiat money.

If we assume that there will be a shift from the Whales towards the smaller wallets (because it represent the bulk of BTC addresses/and humans owning them) then what makes you think that the Whales won't use the BTC they own to amass more BTC from the other categories?

" if you're a central bank and print fiat to buy Bitcoin you'll add a short term anomaly in the data but it'll smooth out eventually."

Short term blip... This reminds me of Matthew Kratter mentioning that government owning Bitcoin is like government setting up a trust fund for itself.

It will be interesting to see if any of the central banks figure it out, but ultimately they will have to spend it. I assume as individuals who work there figure it out, they will either try convincing bank decision makers or just leave. The last one will turn the light off.

The tide's direction has changed from centralized and very unfair to decentralized and fair.