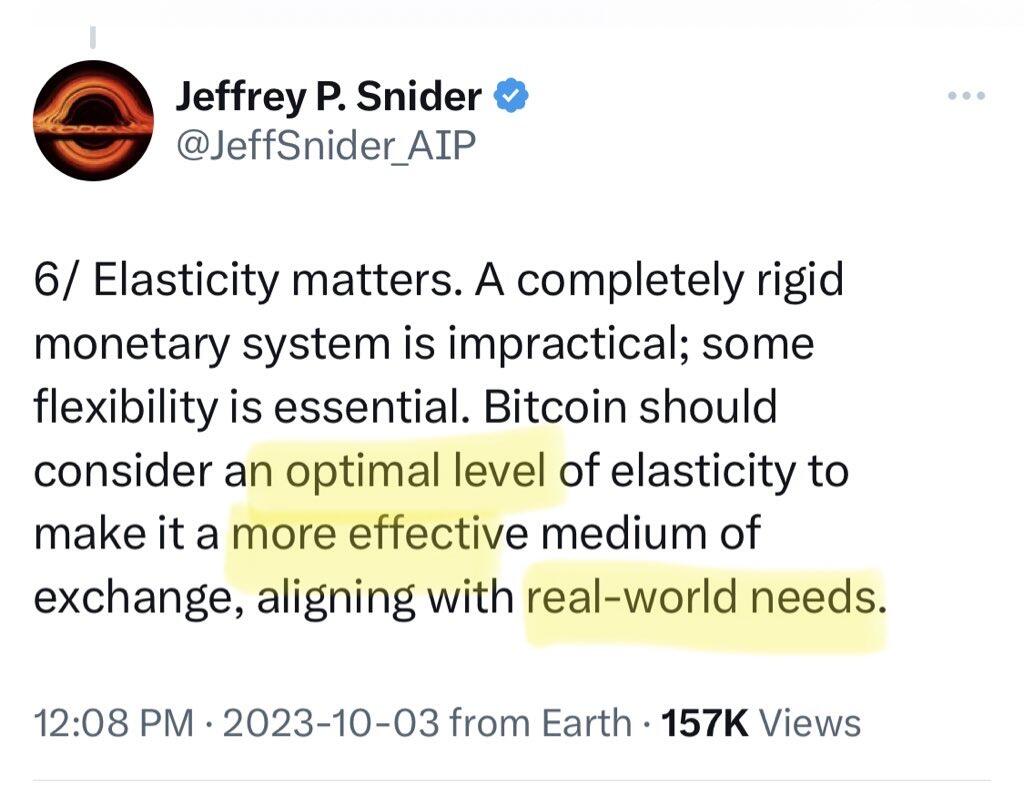

Pay attention to the words used here.

Optimal level = subjective

More effective = subjective

Real-world needs = subjective

Bad actors will inevitably want to co-opt #Bitcoin and turn it into something they can control by adding vague subjective requirements.

We already have that with fiat money and it’s clear that experiment has failed.

Bitcoin’s value lies in its resistance to subjective determinations and the whims of weak minded individuals.