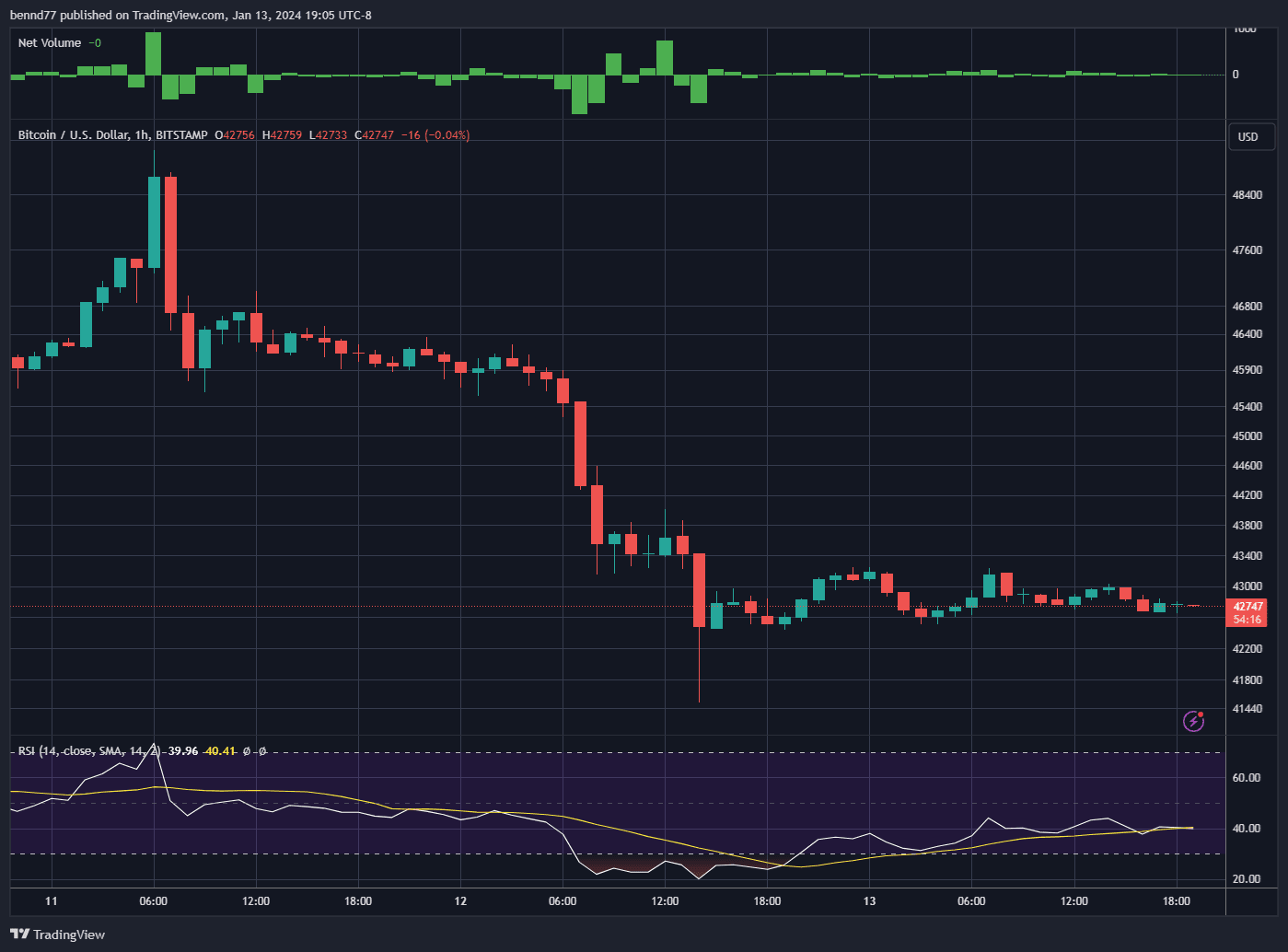

I don’t typically look at charts but the thing that popped into my mind is perhaps dueling high frequency trading algorithms, with the new ETFs or some other source? All The ETFs are supposed to be passive right? Maybe still passive but they are using the high frequency tech on their buys and sells. Or just a policy they have set to fill their buys and sells over time to not over flow the market in one direction or another + And the timing has randomly synced of this period like when you notice your turn signal is synced to the car in front of you.?

Discussion

I think you’re right. Some function has begun work. That shit is not organic.

I have never seen the USD/BTC hover around a value like it has the past 4-5 days and no one seems to be talking about it.

I think you are saying the USD to BTC ratio volatility has decreased? May need more time to actually prove that or measure it, I think it would make sense for BTC volatility to decrease with ETFs. More market participants, and a mechanism for a wider audience for shorting. ETF managers as a matter of policy probably have to buy or “unload responsibly” over time rather than making big waves in the market if they can help it. Fun to watch.