#coffee

#coffeechain

#proofofwork

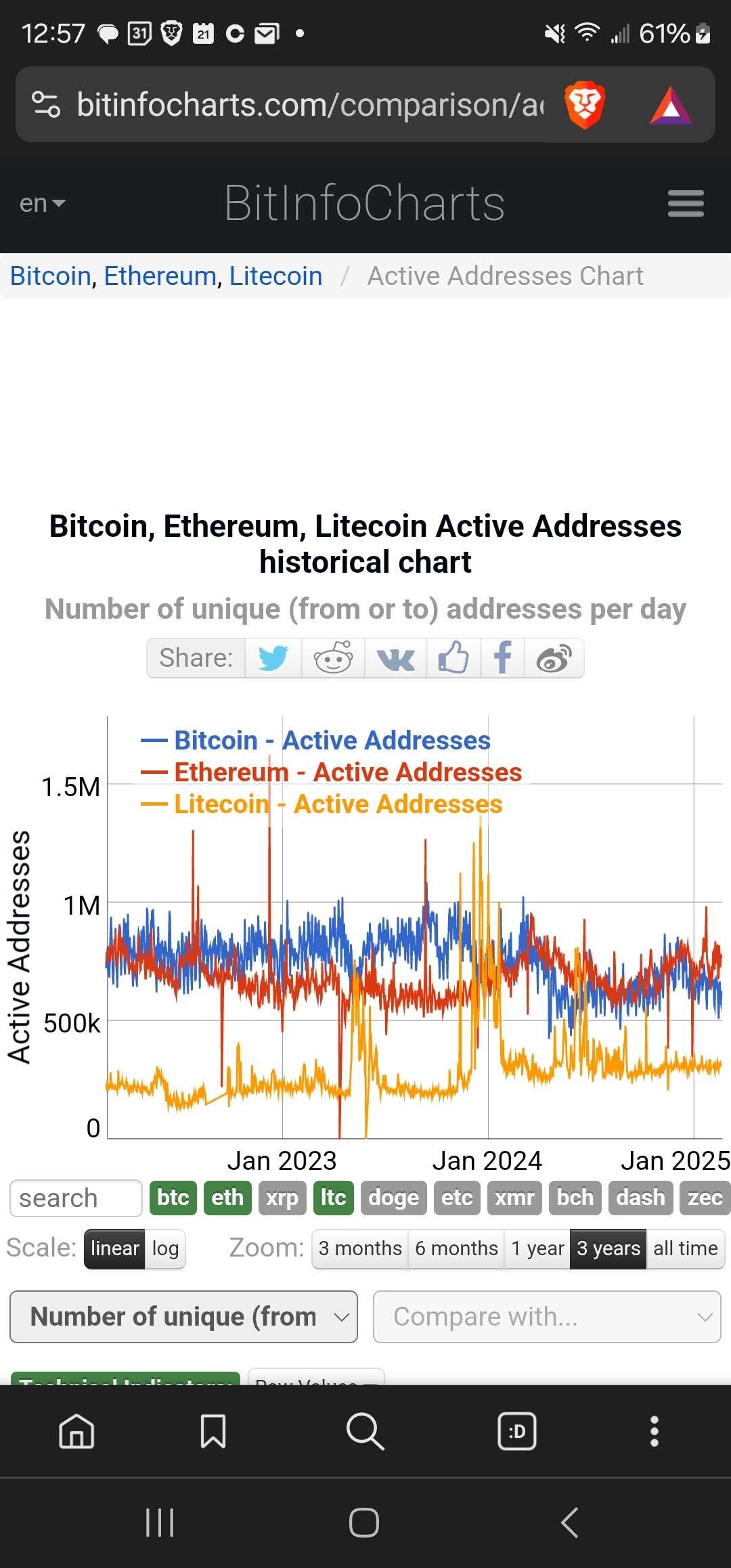

GM, watching #BTC climb back 99k. I know most of you are Bitcoin Maxi's. I do think there is room for other POW coins.

Lightning transfers instantly across the lightning network, so that speeds up the historical slowness of native BTC. I do think that the Scrypt protocol (#LTC and #Doge will play an important role going forward, so I watch these coins closely.

First DOGE is more like fiat as there is potentially unlimited supply, but with a caveat. The supply needs to be mined. Does that cause inflation within the chain? Maybe. Still it needs to be mined.

LTC is interesting as it transacts much faster that native BTC and it has limited supply. I think this coin is often undervalued and overlooked. There is some big support in the mining community for litecoin. I think it's worth watching and it is affordable to be a whole coiner.

We #zap here and we keep #sats in our lighning wallet. Keep in mind that the speed of these microtransctions are off chain until we move them on chain.

It is possible that lightning gets more adoption and that is one of the main tenants of #nostr, but ultimately it is off chain.

I don't believe in proof of stake because POS has another meaning in my mind. I generally won't take small amounts of ethereum because the cost is too great, and I'm a bit suspicious of Solana. Standing up large nodes has drawbacks. I think Solana is better than Ethereum, but it is still POS.

I'll step down from soapbox now.