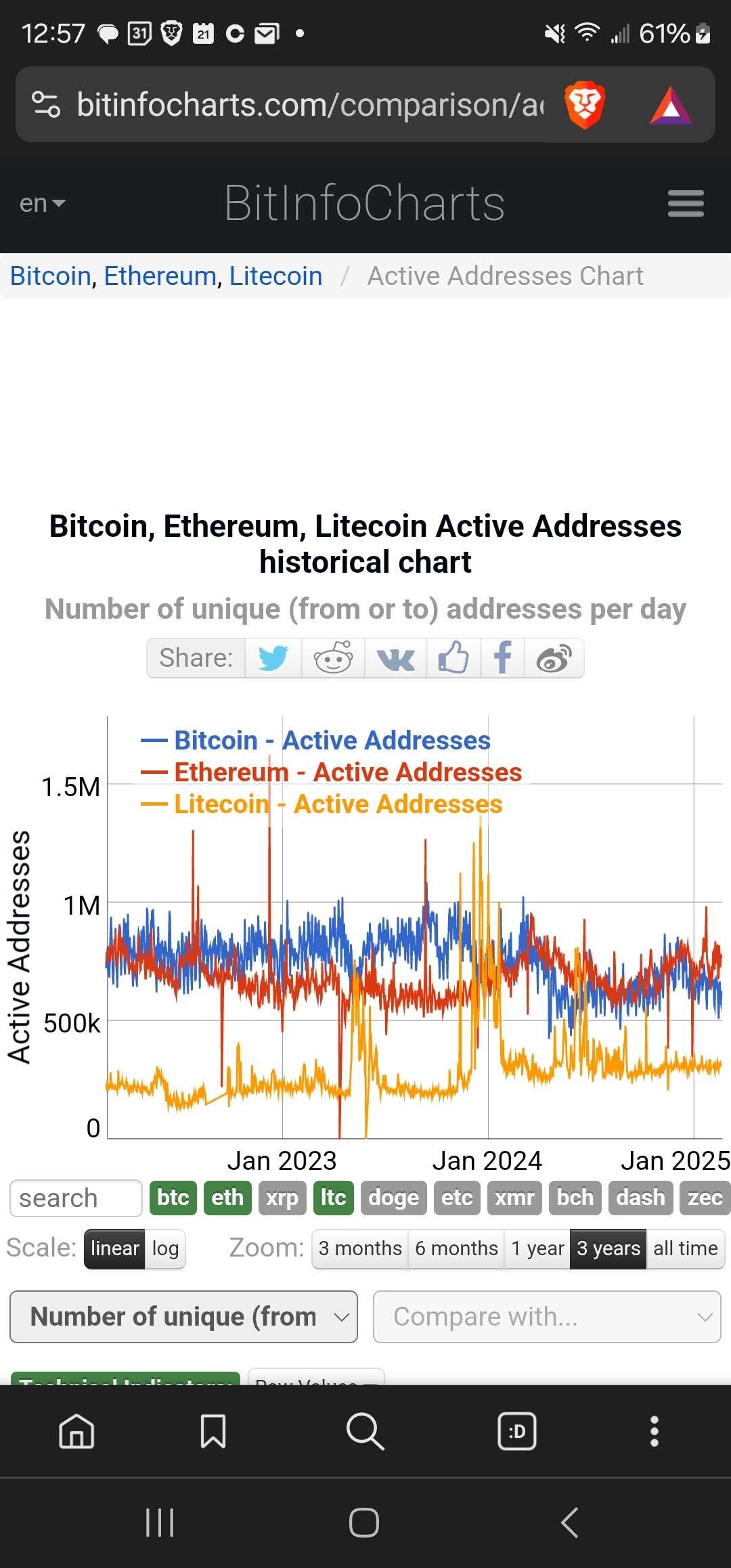

I believe the chart references active native BTC wallets only. I think lightning wallets are not included. Lightning wallets are a new advent over the past couple years. They are not part of the daily lexicon for average person who has heard of crypto and bitcoin, but believe lightning never strikes twice even though I have been zapped more times than I can remember. This means lightning has a lot of room to grow.

Lightning transactions have been around 4 years or so. Early devs were testing with nostr:nprofile1qqsgydql3q4ka27d9wnlrmus4tvkrnc8ftc4h8h5fgyln54gl0a7dgspp4mhxue69uhkummn9ekx7mqpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqg4waehxw309aex2mrp0yhx6mmnw3ezuur4vgkhjsen a year or so before Elon's takeover of Twitter.

I love #nostr, but it's biggest drawback is the rabid tribal #BTC maxi posture that slows adoption to this wonderful immutible social network. Much of this design is puposeful, but has its drawbacks, creating an echo chamber that sometimes obscures reasonable critical thinking.

There are many crypto projects that show tremendous potential and will fail and go to zero. There are other crappy projects that may survive like #XRP, #ETH and #SOL. That's how this space works.

You may know this story. In early days of internet, well before all browser traffic was https, a company called Netscape Navigator in 1996 held 89% market share in browsers. They were the best, had the most brand recognition and pretty much invented the space. Four years later, they had less than 20% market share.

There is so much untapped potential with this tech, yet we tie it to the dying dollar because it's what we have always done. Its not a reason, but an excuse. Eventually, contracts, real estate securities, supply chain and purchase of my cup of #coffee will run on some blockchain, realizing much of Satoshi's original vision of a peer to peer medium of exchange but beyond the full capability of bitcoin itself.

nostr:nprofile1qqszqmjcq9t74ceetn0e2nlnq5q7z6gzqar9df9efylnd7ykze6fdvspz9mhxue69uhkummnw3ezuamfdejj7g68r2h I really appreciate you taking the time to read and discuss this topic. I knew it would strike nerve with many passionate advocates of freedom and bitcoin. This is the stuff that keeps it moving.