Everything goes to zero against #bitcoin

Discussion

nostr:nprofile1qy2hwumn8ghj7un9d3shjtnddaehgu3wwp6kyqpq4a234n82fqsqp0wvkd9a83fp2k8p7dfhww3u4mvr59rey8pkn6ssjk7wd4 nostr:nprofile1qy2hwumn8ghj7un9d3shjtnddaehgu3wwp6kyqpqtwanjtp3mr0ha65uzhug5xvr9vuh6h2gp52pau2rlxy5ta29qqwsh4h3yq

as long as the bankers use their unlimited fake fiat to keep buying

BTC is slow legacy tech, price is a faulty indicator

you have to look deeper, it's trash

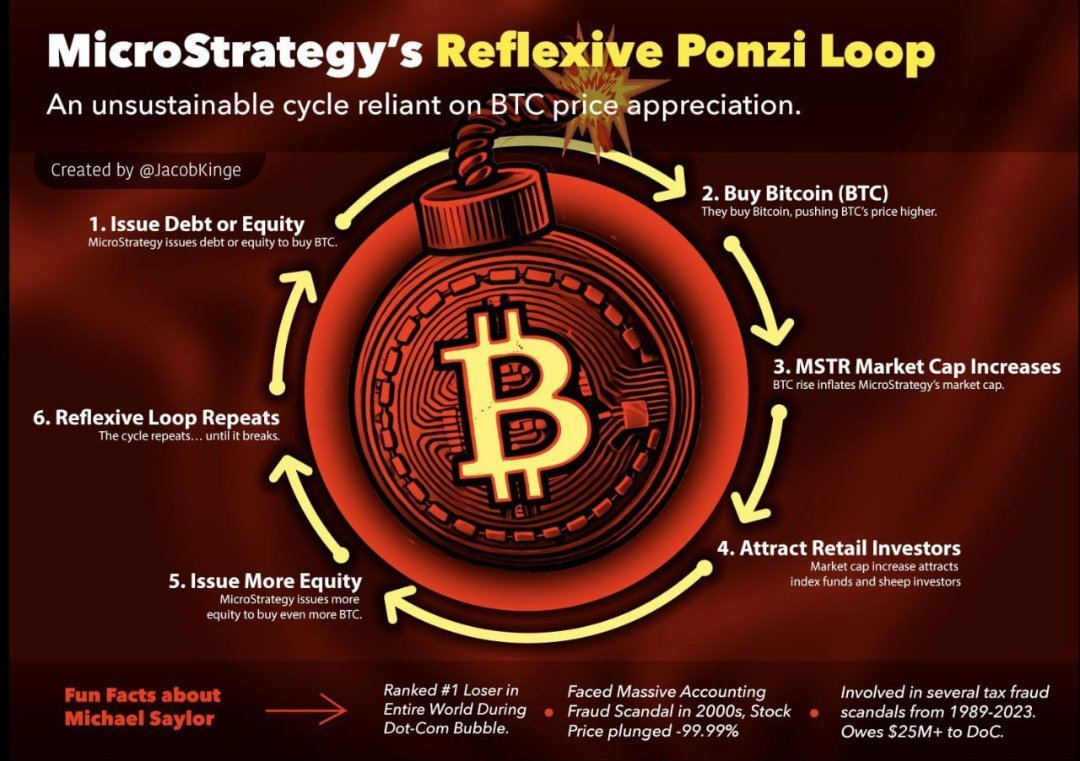

It does have the feel of a Ponzi scheme somehow and I tried to dig in and understand it and basically failed

it would be funny if it was a legit ponzi that made it into the S&P 500

As of late May 2025, MicroStrategy (now operating as "Strategy") holds approximately 580,250 BTC, acquired at an average price of $69,979 per bitcoin, totaling about $40.6 billion in investment . The current market price of Bitcoin is around $109,000, valuing their holdings at roughly $63.3 billion.

The company's total debt has significantly increased to approximately $8.14 billion as of March 2025, up from $2.1 billion the previous year . A substantial portion of this debt comprises zero-coupon convertible bonds, which do not require interest payments and can convert to equity if MicroStrategy's stock price reaches certain thresholds .

Given these figures, Bitcoin would need to fall below $14,000 for the value of MicroStrategy's holdings to dip under their total debt. However, due to the structure of their debt and the absence of immediate repayment obligations, the company might not face bankruptcy solely based on a decline in Bitcoin's price. Nevertheless, a significant and sustained drop in Bitcoin's value could pressure their financial position, especially if it affects their ability to raise capital or if bondholders demand repayment.

In summary, while MicroStrategy's strategy is heavily leveraged and dependent on Bitcoin's performance, the specific threshold for bankruptcy isn't solely determined by Bitcoin's price but also by the company's liquidity, debt maturity profiles, and market conditions.