I don’t think so. Bitcoin ETFs are buying real Bitcoin with public funds and only allow cash redemptions. When fiat collapses, the public is going to be left with worthless cash, while funds hold onto the appreciating Bitcoin. A subtle heist using investor money!

Discussion

My point is that nobody will buy shares of the ETFs, and so the ETFs won't be loading up on very much spot Bitcoin. The investment banks behind these ETFs are only talking about seeding them with a small $10 million or so.

There are two types of investors:

1. People who understand Bitcoin, and they will buy actual Bitcoin and not the ETF where they pay a fee to a fund manager.

2. People who don't understand Bitcoin, think it's too volatile, just a scam, etc., and they're not going to buy a Bitcoin ETF because they don't think it's a sound investment.

A handful of ignorant retail investors will gamble on the ETF, or options on the ETF, trying to capture the alpha, but they won't move the needle much and a lot of them will end up selling at a loss because that's what most retail traders do.

Well, you’re going to be surprised soon, I guess.

I don't know... The Finkster went on national TV saying it was a flight to quality, so it's boomer-approved. Jim Cramer will have them all buying BTC ETF's soon.

Goood analysis.

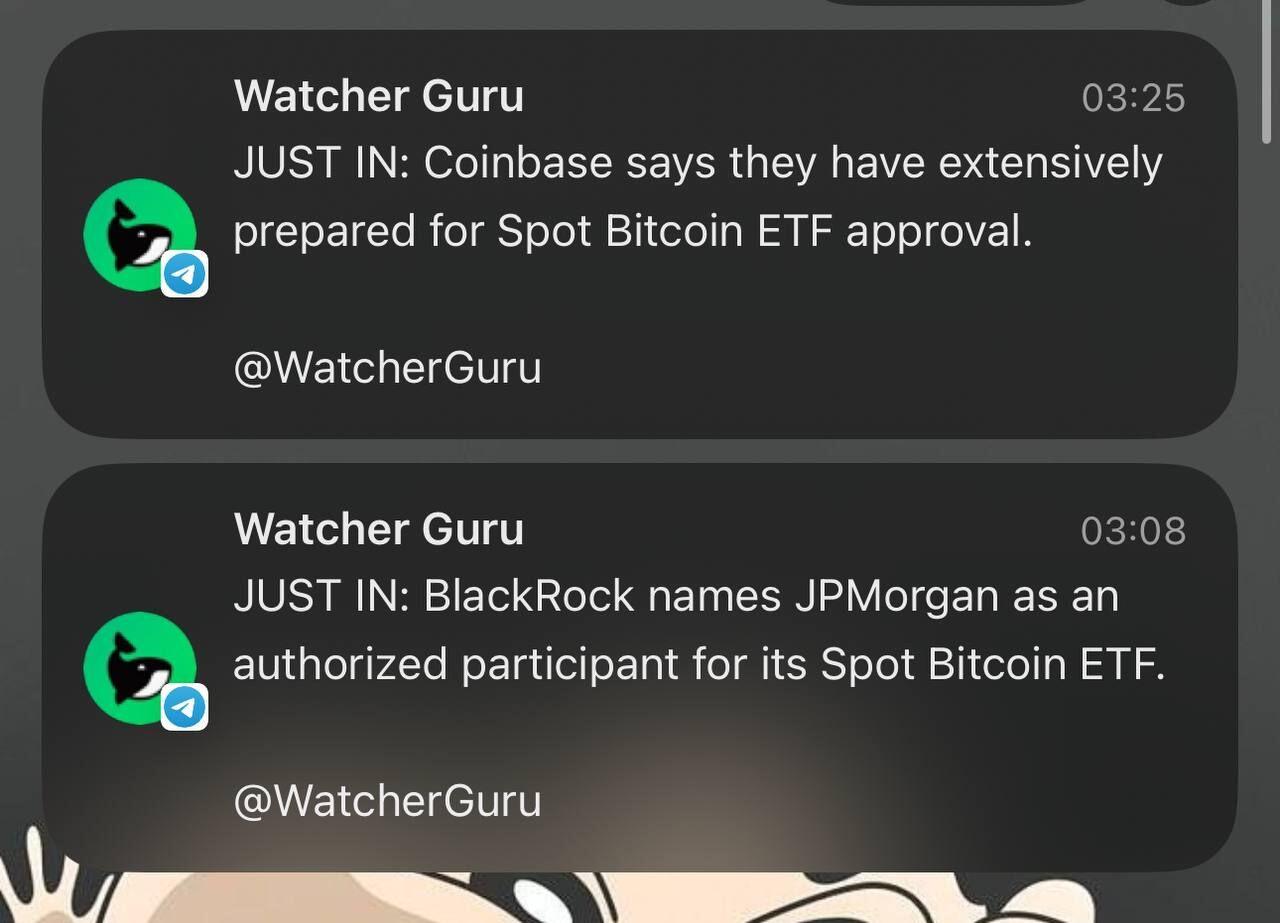

The big guys seem to be so ready for it, so desperate to create and capitalise from the hype. I seriously believe this etf drama wont end well.

#m=image%2Fjpeg&dim=1280x923&blurhash=rAA0%3Fw%25fELSdM%7BRknlr%40r%5D0LM%7CxuRjoeoJofWBbH%7EVxaM%7Ct7WWR%2BWVofkB4%3ANGt7RjoJoeoLWWaz%3D%7BwMV%5Bnla%23X8oztQo%7C01R%2BxuRjt6e.j%3FR*WV&x=5a4daea318f674184804e645922502d76995fdf53f65ed0654125547a5e15b1a

#m=image%2Fjpeg&dim=1280x923&blurhash=rAA0%3Fw%25fELSdM%7BRknlr%40r%5D0LM%7CxuRjoeoJofWBbH%7EVxaM%7Ct7WWR%2BWVofkB4%3ANGt7RjoJoeoLWWaz%3D%7BwMV%5Bnla%23X8oztQo%7C01R%2BxuRjt6e.j%3FR*WV&x=5a4daea318f674184804e645922502d76995fdf53f65ed0654125547a5e15b1a

Just another pump and dump

There's a third kind - institutions slavering with FOMO, but too federally-regulated (and with their own retail clients too lawyered-up) to self-custody.

#UnpopularOpinion

The ETF will succeed, but its market cap will remain a small and relatively uninteresting niche compared to #bitcoin held in self-custody.