Crypto is doomed and always has been…

All crypto suffers from the same risk and will ultimately reach the same end as #ETH is coming to.

The reason 90% of the "investors" buying any particular “crypto token” are there in the first place, is because they were excited about the “cool new hyped tech that will launch to the moon!” It’s only interesting to the majority of them because it’s illiquid and could rocket up quickly, and because it’s got a fresh new narrative that makes great marketing. Meaning after their token is already somewhat established, they all just look for its replacement. They are in love with the commercial for it, while the long term reality is boring, so they just move on to the next great looking commercial.

Only the new crypto with “better tech” can fulfill a narrative of being "new" and the promise of overnight riches. It must have low enough liquidity to jump 300% in a few days. In fact most only find their "new token" because they looked at a bunch of charts, saw a ton of green candles, and then went to read their website and join their discord. As soon as their current token can no longer provide that energy and hype, the overwhelming majority lose interest and move to the next one.

This is why there are MILLIONS of these things.

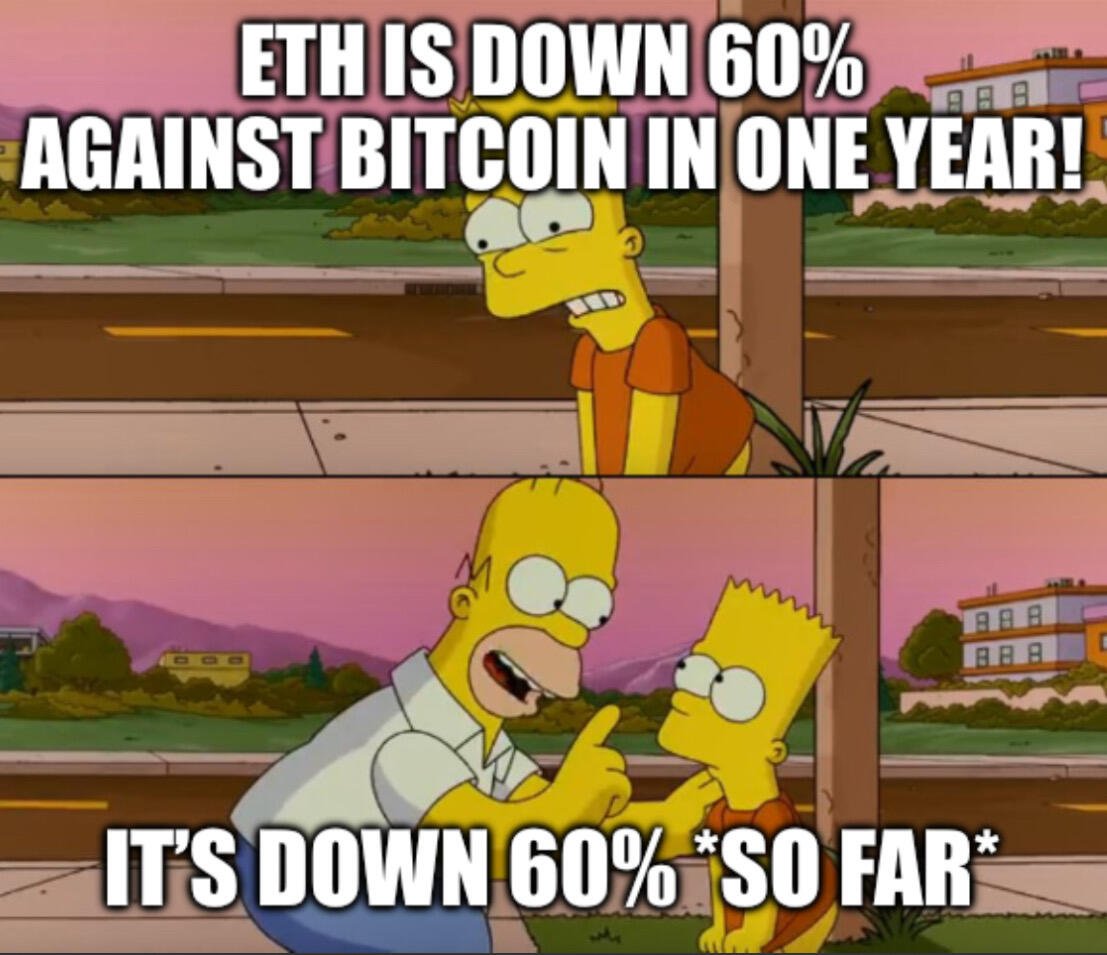

We will see this chart over and over and over again, but it will increasingly be on shorter and shorter time frames as the infrastructure matures and slowly Bitcoin eats any and every random "utility" that crypto bros are certain needs its own blockchain and consensus system -- for no good reason (which is a very small set of uses anyway).

Consider, what on earth can ETH not do in a world where almost every claim I’ve seen of “utility” that has any real use is about creating tokens and trading them in token swapping markets? Did ETH lose the ability to do those things, or has it just become old news?

The reality is that $ETH is literally the poster child for the entire crypto narrative... and it’s failing. The fall of ETH isn’t a signal that there is "better crypto," it’s the signal that the entire crypto narrative is nonsense.

The crypto ecosystem made one grave error due to ignorance of the role that money plays. Being a trustworthy, incorruptible set of rules for the definition and ownership of the money itself is the most foundational and, by orders of magnitude, the most valuable utility. Every last one of the 10s of millions of tokens they printed cannot even slightly compete with the assurances and consistency that Bitcoin provides. And because of that, they will all suffer the same fate together.

But that’s just my 2 sats.