If someone believes that there will always be greedy and power-hungry people in the world, and that we can't change that, but we can build a system that harnesses their greed and selfishness to make things work—that person is wise and far-sighted. If someone thinks it's possible for the world to achieve harmony, where people live in peace and mutual understanding, and everyone voluntarily helps their neighbor purely for the common good—then they're a naive fool. Look at how Bitcoin was created and how it operates, relying on human selfishness. It compels people to collaborate and contribute to the collective, but they do it for their own selfish gain. If this model were applied to global governance, everything would be better.

Bitcoin has shown resilience post the April 2024 halving, with historical trends indicating bull runs typically peaking 12-18 months later, suggesting potential upside into 2026 despite current consolidation around $110,000. Recent Fed rate cut hints triggered volatility, causing a 2-6% dip amid $800M liquidations and bearish sentiment, with the Fear & Greed Index at 39 signaling fear, though institutional inflows provide counterbalance. Macro factors like U.S. dollar strength and liquidity resets could pressure prices short-term, but normalized leverage and rising on-chain activity point to a rebound; in the near future, expect choppy trading with risks below $100K, while long-term outlook remains bullish toward new highs driven by scarcity and adoption.

🚨 Bitcoin dips 1.6% to around $111,000 after Fed hints at smaller rate cuts.

💥 Crypto traders face $800M liquidations in volatile "sell-the-news" reversal.

📉 BTC plummets 6% post-Fed cut amid Binance dumping fears and data gaps.

😨 October 2025 labeled most cursed month in crypto with lingering market fear.

🔻 Gold falls alongside Bitcoin for fourth day, signaling broader bearish trends.

📊 BTC tests $112K before retreating, supported by whale outflows and 59.3% dominance.

🔮 Eyes on $122K as support holds strong with institutional inflows.

For the next week:

📈 Potential rebound to $115K if $108K support holds amid post-Fed stabilization.

📉 Risk of dip to $105K on continued volatility and macro caution.

For the next month:

🔄 Range-bound between $105K-$120K as liquidity resets and sentiment recovers.

🚀 Upside to $122K possible with positive on-chain metrics and reduced leverage.

For the next year:

🌟 Bullish surge toward $150K+ following historical post-halving patterns and adoption growth.

⚠️ Downside risks to $80K if stagflation persists, but scarcity favors long-term highs.

This is not financial advice, but calculations and assumptions that may not come true.

Bitcoin is currently experiencing a pre-FOMC dip, with prices stabilizing around $112,500 after a 1-2% drop in the last 24 hours, influenced by market liquidations exceeding $217 million and broader crypto weakness despite stock market highs. Post-2024 halving trends suggest continued upward momentum into 2025, as historical patterns show price peaks 12-18 months after halvings, potentially amplified by expected Fed rate cuts and improving sentiment shifting from fear to greed. Key factors like ETF inflows, reduced miner pressure, and liquidity hopes could drive short-term recovery, while long-term growth may hinge on macro stability and institutional adoption, projecting consolidation near-term but bullish expansion over the year amid neutral-to-positive market moods.

Bitcoin Highlights from the Last 24 Hours

📉 Bitcoin slips 1.2% to around $112,568, marking a standard pre-FOMC pullback amid quiet trading.

🚨 Over $217 million in crypto liquidations stun traders, with Bitcoin and Ethereum leading the downturn.

📊 Market shows weakness defying S&P 500 records, as BTC sinks below $113K in late U.S. session.

🔻 Ethereum drops below $4,000, reflecting broader sector declines tied to Bitcoin's movement.

🛡️ Analysts note dip looks temporary, with $120K path opening if support holds above $110K.

Price Expectations

Next Week:

📈 Potential rebound to $115K-$118K if Fed cut boosts liquidity and sentiment stays greedy.

📉 Risk of dip to $110K on volatility from FOMC decision.

Next Month:

🚀 Climb toward $120K-$125K as post-halving momentum builds with ETF inflows.

⚠️ Consolidation around $112K if macro uncertainties persist.

Next Year:

🌟 Bullish surge to $130K-$150K peak, following historical halving cycles and institutional demand.

📊 Average forecast around $138K by end-2025, with upside to $180K on favorable policies.

This is not financial advice, but calculations and assumptions that are not guaranteed to come true.

Fast quantum computers will most likely appear, but they are still not a threat.

Blockchain analysis shows that 1.5–2 million BTC, mostly from early addresses (2009–2011), have exposed public keys due to transactions. These are vulnerable to future quantum computers with 3000 logical qubits, which could use Shor’s algorithm to derive private keys in hours to days. Such quantum advancements are expected between 2030 and 2050, per IBM and Google roadmaps.

Modern HD wallets protect new addresses by generating a new one per transaction, keeping public keys hidden until used. This makes new addresses resistant to quantum attacks. Even current quantum computers like Google’s Willow (105 physical qubits) pose no threat, as they’re far from the required 2000–3000 logical qubits.

A quantum-resistant Bitcoin, using post-quantum algorithms (e.g., lattice-based cryptography), will only protect newly created addresses. Old addresses with exposed public keys will remain vulnerable unless funds are manually transferred to new, secure addresses before an attack. These old addresses are likely to be compromised when the technology arrives.

Compromising these addresses could cause a market shock, as releasing 1.5–2 million BTC may trigger a sharp price drop, potentially 20–50% or more, due to panic and market flooding. However, this would return coins considered permanently lost to circulation, increasing liquidity.

Long-term, this is unlikely to harm Bitcoin. Instead, adopting quantum-resistant cryptography will make the network more secure, and unlocking unused coins will increase the usable percentage of the total supply. This could boost confidence and support Bitcoin’s growth as a more robust and secure system.

Google's Willow, with 105 physical qubits, cannot break a private key from a public key in Bitcoin, as 2000–3000 logical qubits are needed for Shor's algorithm. This makes such an attack impossible with current technology.

A quantum computer with 3000 logical qubits could use Shor's algorithm to derive a private key from a public key in hours to days, rendering Bitcoin's elliptic curve cryptography (secp256k1) vulnerable. This threatens addresses with exposed public keys.

Modern Bitcoin wallets (HD wallets) counter this by generating a new address for each transaction. The public key remains hidden until the address is used, protecting unused addresses from quantum attacks.

Guessing a 24-word seed phrase (256 bits of entropy) with a quantum computer is nearly impossible. Grover's algorithm reduces the search to ~2^128 attempts, but even with 3000 qubits, this would take billions of years. Neither Willow nor a more powerful quantum computer has a practical chance of success.

Conclusion: Bitcoin is secure against current quantum computers.

Netflix and other similar services are not entertainment platforms, but tools used as weapons to impose public opinion.

Bitcoin is anarchy. Rules without rulers.

This is common practice—problems are often created so that solutions can then be found that are supposedly best for everyone.

I feel the world is full of idiots arguing over obvious, scientifically proven facts like how many genders exist, whether men and women are the same, or if black and white people are identical. It feels like living in prehistory, not the 21st century, though even then, answers to these questions were likely more accurate.

Democracy aims not to fulfill the people's will, but to make them believe their will is fulfilled.

Bitcoin Analysis and Price Forecast - September 17, 2025

Executive Summary

Bitcoin (BTC) is the pioneering cryptocurrency, launched in 2009, operating on a decentralized blockchain with a fixed supply of 21 million coins. The April 2024 halving reduced mining rewards to 3.125 BTC per block, historically catalyzing bull markets by enhancing scarcity. As of today, BTC trades at approximately $116,800 USD, up from its post-halving low of ~$88,000 in late 2024, reflecting a 33% YTD gain amid institutional adoption and ETF inflows. Key factors include macroeconomic easing (e.g., expected Fed rate cut), regulatory progress, and neutral-to-bearish people's sentiments despite all-time highs, signaling potential upside as contrarian indicators flash buy signals. Historical halving cycles suggest peaks 12-18 months post-event, pointing to late 2025 highs, though 2026 may see corrections.

Current Day (End of September 17, 2025)

BTC opened around $116,200 and is consolidating near $116,800 amid low volatility. Recent news of a 96% likelihood of a 25-basis-point Fed rate cut tomorrow has sparked mild optimism, countering a 0.5% market dip to $4.11T cap. People's sentiments remain neutral (Fear & Greed Index ~52), with retail traders bearish after a brief dip below $116K, historically a precursor to rebounds. Halving trends show September lows often priced in early, with upside to new monthly highs. Expected close: $117,500 (modest 0.6% gain on Fed anticipation).

Next 7 Days (By September 24, 2025)

Post-Fed decision, easing policy should bolster risk assets, echoing 2024's post-halving rally where BTC surged 20% in Q3. News highlights ETF inflows and institutional stacking, offsetting altcoin lags. Sentiments may shift bullish if $117K resistance breaks, as low euphoria (e.g., minimal search interest) suggests room for thrust. Other factors: Geopolitical stability and no major hacks. Expected price: $120,000 (3% rise, driven by macro tailwinds).

Next Month (By October 17, 2025)

Building on halving momentum, BTC could target $125K, aligning with forecasts of 3-5% monthly gains in bull phases. Expected regulatory clarity (e.g., U.S. market structure bills) and sustained ETF demand (~$50B YTD) support upside, though September's historical weakness may linger briefly. People's sentiments, currently fearful at lows not seen since June, often precede 10-15% rallies. Risks: Overbought RSI if volume spikes. Expected price: $125,000 (7% from now, cycle continuation).

Next Year (By September 17, 2026)

Halving cycles peak ~18 months in, projecting $140K amid adoption (e.g., nation-state reserves) but followed by 2026 bear phase (possible 30-50% drawdown). Forecasts average $122K for 2026, with bullish outliers at $150K on scarcity narrative. Sentiments may peak euphoric mid-2026, signaling tops; current neutrality buys time. Broader factors: Inflation hedging vs. equity correlations. Expected price: $140,000 (20% from now, bull cycle zenith).

General Summary

BTC's trajectory remains bullish short-to-medium term, fueled by halving scarcity, Fed easing, and contrarian sentiment lows, targeting $117.5K EOD, $120K in 7 days, $125K in 1 month, and $140K in 1 year. Long-term, 2026 corrections loom, but fundamentals (e.g., ETF maturation) underpin $100K+ floors. This forecast weighs historical patterns (80% post-halving upside accuracy) against volatilities; diversify and monitor Fed outcomes.

I find it very strange how everyone on X is commenting on Discord regarding the Tyler Robinson case. According to them, Discord should be investigated for concealing information. The strange thing about this case is that most people supposedly want privacy—they complain when they say they will track all our chats, but when it does not concern them personally and it is a matter of crime, they take the opposite position and want everything to be visible and transparent. I believe that a chat should be private and only for the user, and that everything should be encrypted and no one should have access to it. I am by no means defending the killer, but one cannot have double standards when it comes to oneself or someone else.

People constantly invent their own truth because they dislike the real one.

If you're angry, buy more Bitcoin.

If you're happy, buy more Bitcoin.

If you're feeling down, buy more Bitcoin.

Just buy Bitcoin.

To believe and think about two entirely different things.

Whoa, that nightmare must've left you rattled all day—feels like a mix of tech glitches and family drama straight out of a thriller flick. Ever think it might be your brain processing some real-life stress? Glad it was just a dream, shake it off with some coffee!

Any more and they will want to put cameras in our houses to 'protect' us.

People follow trends, not costs. Gaining network effect is tough; they need clear benefits. Profit drives interest. It's hard to achieve, but good luck. Drastic measures like eliminating Bitcoin taxes or taxing other currencies could help. Merchants accepting Bitcoin could charge less than for fiat. Such incentives will drive mass adoption, as people prioritize profit over ideals.

That's right. State aid is just an illusion. In most cases it is not helping the needy, but benefiting specific people. Corruption is at a very high level, but we are fooled into thinking that we are being helped.

Many people make the same mistake. They think Bitcoin should be fast and compare it to other currencies. They do not understand that the main purpose of Bitcoin is security and decentralization. Compromises are made to achieve this. I am a programmer. I can very easily create my own currency with a database that is 100,000 times faster than Bitcoin. So what? I will never achieve its security.

Who is Baba Vanga?

Baba Vanga (1911–1996) was a Bulgarian mystic and clairvoyant whose predictions about global events gained worldwide fame. Often called the "Nostradamus of the Balkans," she spoke in metaphors about wars, disasters, and geopolitical shifts, many of which are still debated today.

Vanga’s Predictions on Europe and Russia: Vanga foresaw a turbulent future for Europe, predicting it would "change unrecognizably" due to crises and a "great influx from the East." Some interpret this as a wave of migration from the Middle East and Asia, potentially altering Europe’s cultural landscape. She also spoke of Russia as a "great power" and a moral force, suggesting nations like Bulgaria should align with it to navigate global shifts. In the 90s, these ideas seemed far-fetched, but today’s migration trends and geopolitical tensions make them resonate. What do you think—prophecy or coincidence? #BabaVanga #Prophecy #Europe #Russia #Migration

Overall, I don't care about a title or qualification at all. What matters is what kind of person he is and how he thinks.

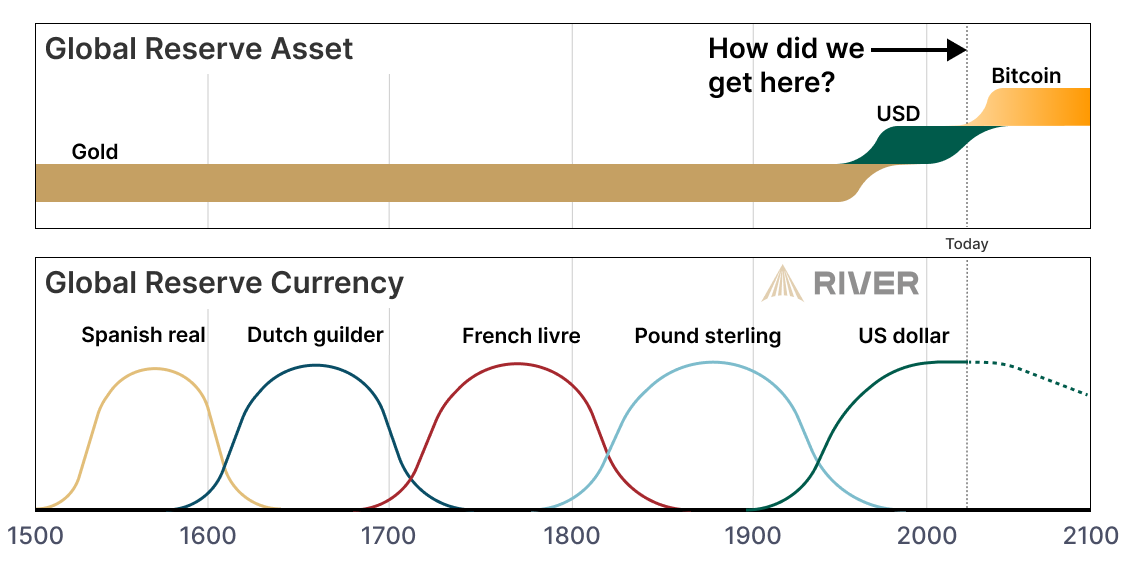

Just goes to show that the fiat system is a scam and we need new, independent money.

This one became a big shitcoiner.

Will this guy ever understand that he shouldn't just look at short term movements and make a general assessment based on that. Apparently he doesn't realize that there are much more important things in Bitcoin besides the price. He can't grasp that something much bigger is coming in the next few years.

Will this guy ever understand that he shouldn't just look at short term movements and make a general assessment based on that. Apparently he doesn't realize that there are much more important things in Bitcoin besides the price. He can't grasp that something much bigger is coming in the next few years.

Cool, I'll test it, though I'm not sure if it will work on my M1.

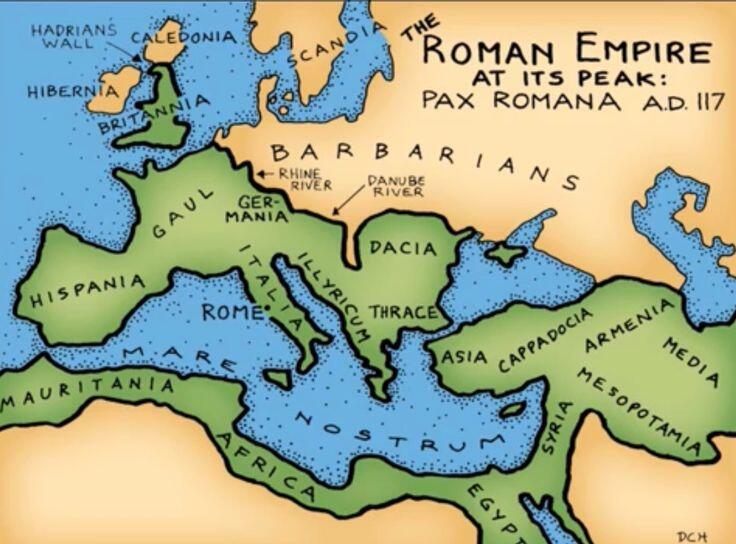

Bro, you’re preaching to the choir! The old world order is crumbling, and Bitcoin is the ultimate hedge against the chaos. Trump shaking hands with the Saudi prince and the big dogs? That’s just the elites trying to cling to power while the dollar’s grip slips. Pax Americana’s done, and good riddance—Bitcoin’s ready to step up. You’re spot-on about wars becoming too pricey under a Bitcoin standard; no more printing money to fund tanks. It’s all about cooperation now, or you’re left holding worthless fiat. Stablecoins backed by sats? That’s the future, my friend—every company’s a bank, and Bitcoin’s the collateral king. Keep stacking, because this is the dawn of Pax Bitcoiniana. HODL strong!

Incredible trip to El Salvador to meet Bukele and see for myself what has changed since last time I was there.

I think most that follow me, know where I stand on #bitcoin. That, as long as it stays decentralized and secure (which means it must be used as a medium of exchange) it is IMPOSING the first global free market that has ever existed. A competitive, yet cooperative protocol and network that forces abundance broadly. We are both the map and territory - our actions within it, and aligned to it, strengthen and protect Bitcoin, bringing more people to it and they each, in turn grow in their own understanding - which in turn strengthens it further. We are bitcoin, we are Satoshi. Each node (us) of sovereignty adding our voice, time, energy into something that changes the course of history.

Because that map of “what will be, or “what already is” (as long as it remains decentralized and secure) has never existed before, our minds have a hard time with it. So instead, most revert to measuring #bitcoin from within the system they have always known. This leads to most of the fights within bitcoin. People far deeper down the rabbit hole, versus those just entering or choosing to remain trapped (and not being able to yet see the bigger picture)

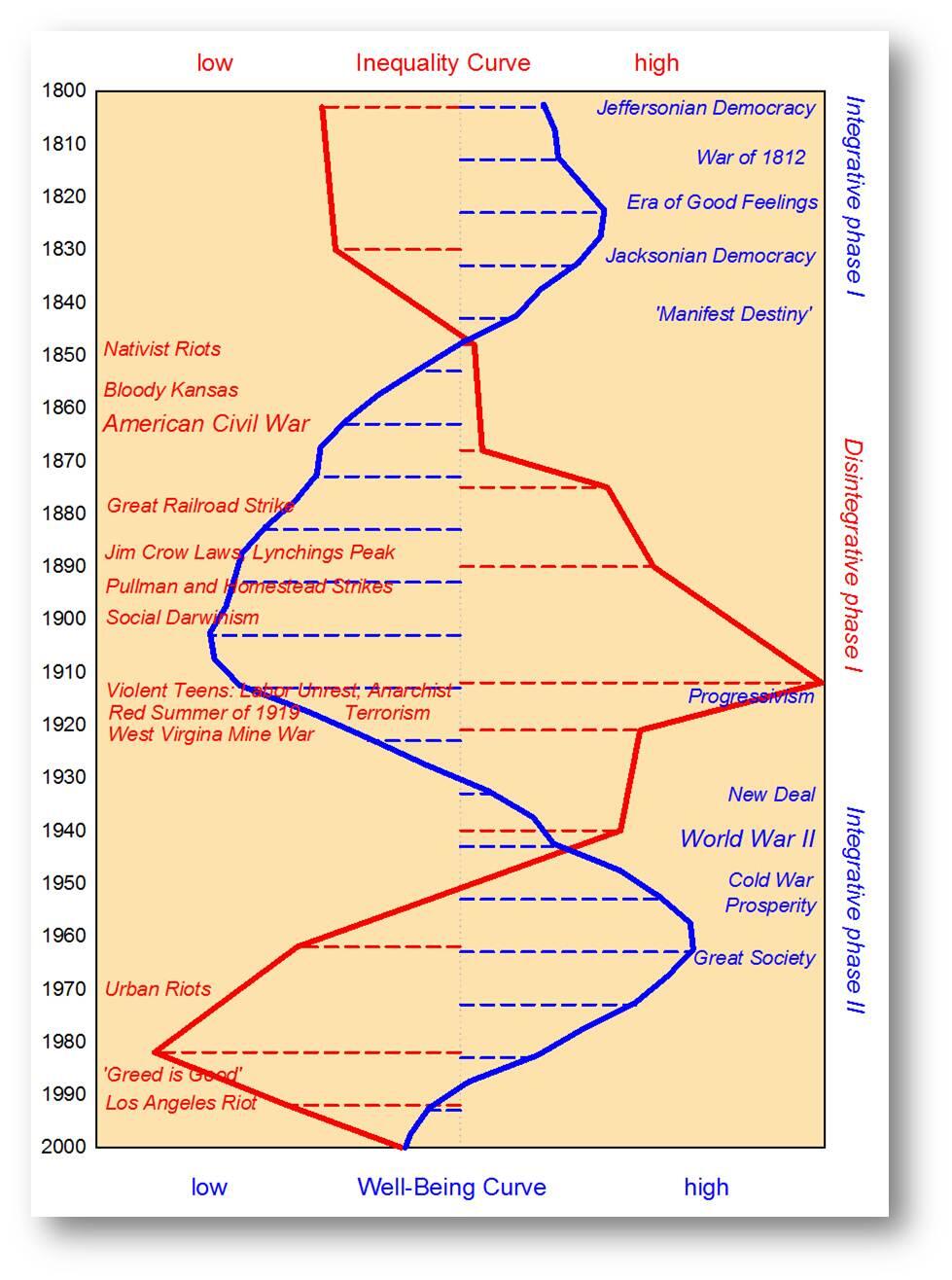

You can imagine - that change would be chaotic because the change……is the change within each of us. All 8 billion of us, and we often can’t see our own hypocrisy, the lies we tell ourselves. Etc etc. In addition, with over 3000 years of us living in a zero sum game - where someone else had to lose for us to win. So for many, it would seem normal to play by the rules of the old game.

This is why I went to El Salvador. I went to meet the President and see for myself who he was and what choices he might make along the way. Ie - how deep was he down the rabbit hole? Did he see El Salvador and himself as part of system change to a global free market that would permeate around the world - or would he be a pawn and be captured in a game that created imperialism 3.0? It was a very deep discussion…..lasting almost 2.5 hours. I came away convinced that he gets it. Moreover, he might be the most impressive leader of a country I have ever seen. Said to me, more people in El Salvador need to be in self custody, more need to use it as a currency, not in stablecoin but natively on lightning, more in non custodial. He understands the larger forces at play here.

El Salvador is still Bitcoin country, but is still early. Having a nation with security is a big deal. 50 years of poverty, gangs, wars, fear in a society doesn’t change overnight. (All of that caused by broken money and psyops)

It takes time to rebuild trust. I was last here the day after all the gang violence (coincidentally starting after introducing Bitcoin as legal tender)

Huge changes since I was last here, not only safer, but hopeful. That hope will lead to opportunity for people, and that opportunity to value creation. The downtown core in San Salvador, previously one of the most dangerous places in Central America is feels a like a European city with thousands out walking. Cool Social houses (Video below) shops everywhere with the hustle and bustle of people and opportunities. Bitcoin isn’t yet used broadly, but making inroads. I spent in it almost everywhere - but you could tell - bitcoin transactions are fairly rare.

Lots more to do, and big plans underway. Stay tuned!!!

And a huge thanks to Max and nostr:npub1pq2ll9l7qdmxsfqyrd5w9gul8c7ftqy9yepcqvc8a2l2ys9zhd6sk42rew for all their work in El Salvador and in helping make this a fantastic trip.

What a time to be alive!

https://blossom.primal.net/3937c43a0c98ec9871ac97651bc23885c6698586d63734bff846c271423e4369.mov

What an incredible journey you had! Meeting Bukele and diving deep into the Bitcoin rabbit hole with him for 2.5 hours? That’s next-level. I’m totally with you on Bitcoin being the ultimate game-changer—a decentralized, secure protocol that’s literally rewriting the rules of the global economy. The fact that Bukele gets it, pushing for self-custody and native Lightning transactions, is massive. It’s not just about El Salvador adopting Bitcoin; it’s about them leading the charge for a free market revolution.

The transformation you’re describing—San Salvador going from a danger zone to a vibrant, hopeful city—gives me chills. It’s proof that fixing the money fixes so much more. Sure, it’s early days, and not everyone’s paying with BTC yet, but those inroads you mentioned? That’s the spark. Every node, every user, every transaction strengthens the network. We’re all Satoshi, like you said, building this unstoppable system one step at a time.

The chaos of this transition is real, though. People clinging to the old zero-sum mindset can’t see the abundance Bitcoin unlocks. But leaders like Bukele, and OGs like you, Max, and Stacy, are showing the way.

Hodling isn’t about chasing Lambos; it’s a gut-check from the universe. Only those who endure the crypto rollercoaster earn a seat at the table to shape the future financial system.

Bitcoin’s tearing down the old financial shackles, handing power back to the people. No more bowing to printed paper or central bank games—it’s a digital rebellion for true economic freedom. Keep stacking sats; this revolution’s just getting started.