FREE ⚡SAT⚡ GIVEAWAY, PLEASE SHARE!

I recently started a Substack newsletter and I've been brainstorming ways to bootstrap my subscriber list. I don't use social media outside of Nostr, and I'd like to keep it that way.

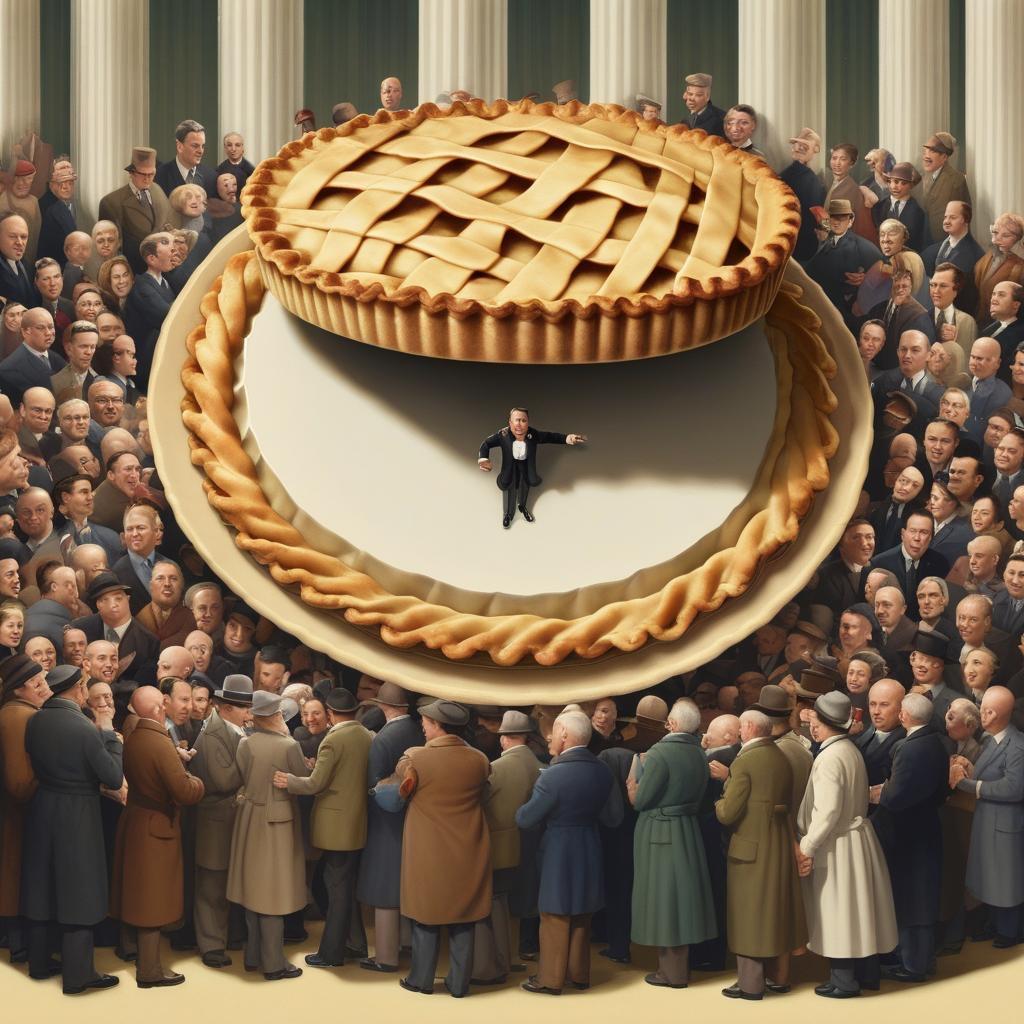

I have a theory that Nostr+zaps could open up a different type of "advertising" model. Typically with paid ads, you're paying the centralized social media company to show your content to a bunch of people in hopes that they'll view it. Why not pay the viewers directly and cut out the middleman? That way they're getting some value regardless whether they like your product or not, and it's just a more elegant system overall.

So I'm going to run an experiment myself and see how this works. I recently wrote an article about Bitcoin and money inspired by a comment @Odell made on a recent Citadel Dispatch episode. If you're interested in the philosophy of money and banking, you might enjoy it.

I'm going to link the article below. It's about a 20 minute read. So the first 10 people who read the article and leave a thoughtful response, commentary, or criticism as a reply to this note will get zapped 15,000 sats each. I think that's fair for 20 minutes of your time. After the first ten replies, I'll zap each additional reader 1,500 sats as long as my funds hold out.

And if you find the content valuable enough that you feel you don't need the sats, just zap it back to me and I'll pass it along to the next person.

Thanks in advance!

https://open.substack.com/pub/f0xr/p/money-as-equity?r=3i492j&utm_campaign=post&utm_medium=web