Did not see this one coming but I'm here for it. LFG

Great chat between nostr:nprofile1qqsywt6ypu57lxtwj2scdwxnyrl3sry9typcstje65x7rw9a2e5nq8spz3mhxue69uhkummnw3ezummcw3ezuer9wcq37amnwvaz7tmzd96xxmmfdekkz7rfd4skc6tnw3ejummwd35kueg8h22n0 and nostr:nprofile1qqsx2t2c4jh6zpd0s36upl5q9xjjulwmcvmm90vunza30gg3m3xducqpyfmhxue69uhk27rsv4h8x6tkv5khyetvv9ujuenfv96x5ctx9e3k7mf0qyg8wumn8ghj7mn0wd68ytnhd9hx23smfac on real estate and the thought occurred to me, everyone is waiting for a real estate market crash, but if they can print fiat m, they can prop it up forever.

The crash won’t be denominated in fiat, it will be in #bitcoin, it is in Bitcoin, it always has been in Bitcoin. Real estate is something spend spend you Bitcoin on, they get used in exchange for the value you and your family get out of it. It doesn’t store value.

Sell your house, buy Bitcoin, while you still can.

https://fountain.fm/episode/V8fBxqgWoxfG8MMzhNBs

Yes. And real estate is a massive chunk of collateral for the banking system. If you understand fractional reserve banking, you understand that nominal price declined in the collateral backing bank-issued debt results in a total banking system collapse.

If you think real estate is going to decline dramatically in price, you're suggesting that either the Fed (a banking system cartel) will allow the complete collapse of the very system that created the Fed for its own self-preservation, or we're going to get 2008 style bailouts with another zero added to the amount.

That purple line at the bottom that's down 63% in gold terms since 2022? That's the "safe" global reserve asset, US Treasury bonds.

The US stole $300 billion of Russia's Treasury Reserves. But since then, their $130 billion in gold reserves have almost doubled in price, gaining over a third of the value stolen by the US.

You don't think the rest of the world, especially China and the ME, noticed?

And you don't think anyone noticed that the only asset that actually outperformed gold happens to be the only asset that has BETTER neutral reserve asset properties than gold?

As nostr:nprofile1qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncpz4mhxue69uhkummnw3ezumtpd35kutn0dekqz9rhwden5te0dehhxarjwdshganp9ehx2aqkrad8w always says, nothing stops this train. Buckle up.

nostr:nprofile1qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcpp3mhxue69uhkyunz9e5k7qg4waehxw309ajkgetw9ehx7um5wghxcctwvsrrnrxl I'm having an ongoing bug with the android app. When I view feeds in the explore tab, I can scroll through the list of notes or long-form reads, but I can't open them. I can open the menu and copy the note ID etc, but I have to go back to the home tab and do a search to actually open the note or read.

This is the most important Bitcoin chart in the world.

I don't have enough insight into this to give a great answer, but in general the Amish use more home remedies and alternative medicine than the average American. But they're not opposed to doctors and hospitals when needed, that's always an individual choice.

They do both home births and hospital births, but I couldn't say how the percentage breaks down. My sense is that home births are less than half in the more progressive Amish communities, and more than half in the more conservative communities. But I don't have any good data to back that up.

I'd say it's similar to childhood vaccinations, where I often hear the claim that "the Amish don't vaccinate their children, that's why they don't have x problem." But that's simply false, many do vaccinate. Again, it's the parents' choice whether to do so or not.

My favorite Bitcoin chart

You can't park money "in" assets, that's an economics myth. If you buy an asset, the money doesn't go "into" the asset, it goes into the bank account of the person selling the asset to you. They can either hold it in their bank account and get inflated away, or immediately turn around and spend it to buy something, which starts the same cycle over again.

Without understanding that about the way money works, it's impossible to understand why asset prices move or why price inflation happens.

Understanding this would dispense with a lot of financial jargon and nonsense that prevents people from understanding markets and price movements.

nostr:nevent1qvzqqqpxfgpzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qy08wumn8ghj7mn0wd68yttsw43zuam9d3kx7unyv4ezumn9wshsqgrzxfre20v0sy7eqymtgtlcjpphhsfty42d7fszz407gy2ud8xtxy6mvds8 nostr:naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqqs8qunfvdjj6ctn94sj6ur0wf6xvmmvd9hj6anpd36k2ttjv96xjmcm8rwdk

Fiat currency and fractional reserve banking provide the ideal environment for psychopaths to thrive. That's why they go insane at the smallest sign of a threat to the financial system.

nostr:nevent1qvzqqqpxfgpzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qy08wumn8ghj7mn0wd68yttsw43zuam9d3kx7unyv4ezumn9wshsqgxl93gewqyz8pzpcahfrj7asnjkvejvdzgczsanhqwzemuh7egjzycqlkaw nostr:naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqqjy6mmwv4uj6ctn942x76m9de5h5ety94fx2ur4w3shg6t0dckhvupkd9kx7nxwqqm

When the money stops working, everything stops working. Unfortunately I doubt more than 0.001% of people even understand vaguely what money is and how and why it works, so the odds that they'll differentiate between functional money and defective money at a philosophical level is nil. That's why number go up technology is the only hope for Bitcoin adoption.

nostr:nevent1qvzqqqpxfgpzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qy08wumn8ghj7mn0wd68yttsw43zuam9d3kx7unyv4ezumn9wshsqg9mm9rxjwqe0d70yd6jvx53yxuud6wkmxs8a5xxdh8ftesnwqka8chl7av9 nostr:naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqq247t2dvet9q4tsg4qng36lxe6kc4nftayyy89kua2

This is why the dollar can inflate away year after year, yet the world just keeps using dollars. It will keep "working" until it doesn't.

nostr:nevent1qvzqqqpxfgpzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qy08wumn8ghj7mn0wd68yttsw43zuam9d3kx7unyv4ezumn9wshsqgr9jcjm3llyrsq788xjhfkjf8cr263j7cg200t5tx6mrhg66yrhtunaxxcv nostr:naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqqgxc6t3w45kg6t50ykhvmmjw3jhs47fz4j

CD160: JOHN ARNOLD - TEN31 AND BITCOIN MARKET DYNAMICS

- nostr:nprofile1qqsy8u7fwpyz8agpcgcx7e7j93qr7kcxlrk652s6rq9l7vckcsgk9dspzamhxue69uhkummnw3ezuendwsh8w6t69e3xj7sprpmhxue69uhhyetvv9ujuumwdae8gtnnda3kjctvdhdvyt

https://cdn.satellite.earth/ee67796fdf378381a35d68bff71044c5d21a5ee9bd182d7ead8a74a52a693106.mp4

You mentioned the idea of Bitcoin as shared equity in this episode. It's not the first time you've mentioned it. The first time I heard it, it helped me solidify an idea I'd been playing with for a while.

I think I can explain what you're referring to, and why you can feel it within the Bitcoin ecosystem. The fact is, it's a really fundamental concept not just to Bitcoin, but to understanding what money in general is, and why it works.

Money is, or should be, equity in civilization. That's a seismic shift from money being debt, the way the current system functions, and it isn't a concept I've heard anyone else explain.

I wrote an article referencing the first time I heard you express this concept on Citadel Dispatch, and it's basically the conclusion to my series of articles on money and how it functions. If you wrap your head around the concept, it will fundamentally change the way you understand the world, and give some insight into how radically different things might look under a Bitcoin-based monetary system.

CD160: JOHN ARNOLD - TEN31 AND BITCOIN MARKET DYNAMICS

- nostr:nprofile1qqsy8u7fwpyz8agpcgcx7e7j93qr7kcxlrk652s6rq9l7vckcsgk9dspzamhxue69uhkummnw3ezuendwsh8w6t69e3xj7sprpmhxue69uhhyetvv9ujuumwdae8gtnnda3kjctvdhdvyt

https://cdn.satellite.earth/ee67796fdf378381a35d68bff71044c5d21a5ee9bd182d7ead8a74a52a693106.mp4

You mentioned the idea of Bitcoin as shared equity in this episode. It's not the first time you've mentioned it. The first time I heard it, it helped me solidify an idea I'd been playing with for a while.

I think I can explain what you're referring to, and why you can feel it within the Bitcoin ecosystem. The fact is, it's a really fundamental concept not just to Bitcoin, but to understanding what money in general is, and why it works.

Money is, or should be, equity in civilization. That's a seismic shift from money being debt, the way the current system functions, and it isn't a concept I've heard anyone else explain.

I wrote an article referencing the first time I heard you express this concept on Citadel Dispatch, and it's basically the conclusion to my series of articles on money and how it functions. If you wrap your head around the concept, it will fundamentally change the way you understand the world, and give some insight into how radically different things might look under a Bitcoin-based monetary system.

naddr1qqty6mmwv4uj6stn94zhzatfw3uj6v3ew35kwagzyz7xengn5vhef5m9vndv3avk8gxkn3vrextgxsdmmunckg04xzvwgqcyqqq823cdagp44

https://m.youtube.com/watch?v=ci_qFIyMyns&t=5211s

nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle must be reading my Substack 😂.

Great episode!

Learn to flip burgers 🤷🏼♂️

nostr:note10mjuxfwg3g7vp05uhlryeyqskuph7gk3f8cr7zy9a656spt2jq5qkd0m0s

"I think the world would be a better place if everyone lived by the general teachings of Jesus."

Although you may not see it, the answer is right there. You can't exist in the world without assuming good and evil. What is truth, if not that which leads toward the good?

Never heard that on, I have no idea what it would mean.

Learn to weld 🤣

💯

During the gold standard era, when banks created too much credit, the inevitable crash didn't destroy gold. It destroyed the fractionally reserved fiat banks.

nostr:note1mjq3x79fz4tty7lmz8c8379djngq4u62vd6asvx7f2vzwfehcyyqren4cx

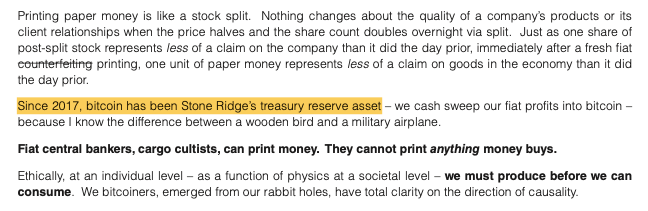

If you haven't read what Ross wrote at the end of the year, you should.

https://www.nydig.com/research/stone-ridge-2024-investor-letter

Nailed it. Sounds like he at least partially agrees with my concept of money as equity.

One of my relatives has a handful of plants in zone 7b, they're at least 20 years old. Very prolific, delicious fruit. The fruit all ripens basically together in the fall, maybe a few weeks to a month window.

I can try to answer any questions, or put you in contact with him if you'd like.

There's a word for the system where someone else takes all the output of your labor, but claims that it's right and good for them to do so because in return they give you everything you need to survive for "free".

The word is slavery.

Are you cool with that? Or are you doing something to change it?

nostr:note1nj7g65ku2p6juajtkzp7mhjch84x39a4n9lkahansgqzu4f0q6eqcsh398

"There are a lot of large actors in the Bitcoin ecosystem now that are pushing the idea that Bitcoin is only an asset. That is not true. Bitcoin is a currency, it directly competes with the dollar, and it can be used in a peer-to-peer manner that completely disintermediates the banks. It also removes the ability to censor and surveil transactions if you know what you're doing. "

nostr:note19cpvruq3utekjdp3u5h38ucen6tq3hprujpf0xqmxyhnzw845drsc5mele

skill issue

should have put it all on black obv 🤷🏼♂️

I wrote this article on Substack about a year ago. It was inspired by a comment nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx made on the nostr:npub10atn74wcwh8gahzj3m0cy22fl54tn7wxtkg55spz2e3mpf5hhcrs4602w3 podcast.

I believe my way of understanding money is slightly different than anything I've heard or read elsewhere. Most of the really insightful monetary philosophers I've learned from are here on Nostr, and I'd love if any of them would be willing to take the time to read it and give me their 2 sats. So if anyone has a line to nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak nostr:npub1w69ya7xs697hk3hky3gllryz8rwverfa0ylz89chf9qnhfcskc2s64zltw nostr:npub1jt97tpsul3fp8hvf7zn0vzzysmu9umcrel4hpgflg4vnsytyxwuqt8la9y nostr:npub10vlhsqm4qar0g42p8g3plqyktmktd8hnprew45w638xzezgja95qapsp42 and any other Bitcoin economists you know, I'd be honored if they took the time to check it out and give me some criticism. Constructive or otherwise is fine, I won't be offended either way. I'm no economist, just a guy who likes Bitcoin and figuring out how things work.