Understanding How Bitcoin Keeps Track of What You Hold, the UTXO Model

Most people are unfamiliar with the way Bitcoin keeps track of your money, or your BTC coins.

I decided to explain it fully:

Do realize this is a person who wants to change OP_RETURN.

The Technical Details behind OP_RETURN Bitcoin Core initiative.

Sure.

Good news!

What data source did you use to get this chart?

It would be quite useful to compare with other nations of Latin America.

To be honest I did not understand the graph. It gave me the impression that small amounts were the norm in the Bitcoin commerce and among holders.

I was wrong, it is the polar opposite. Huge holders are now the one that move the Bitcoin market.

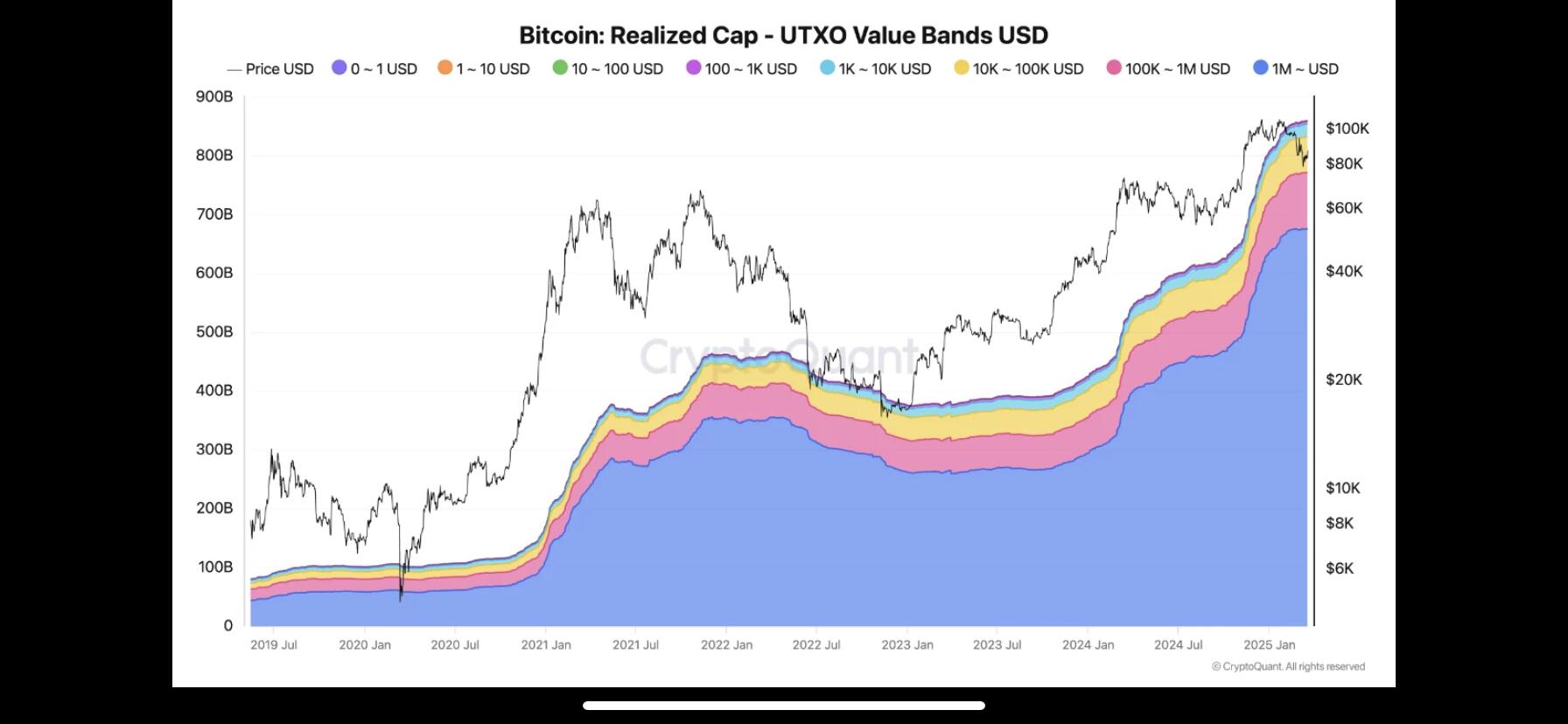

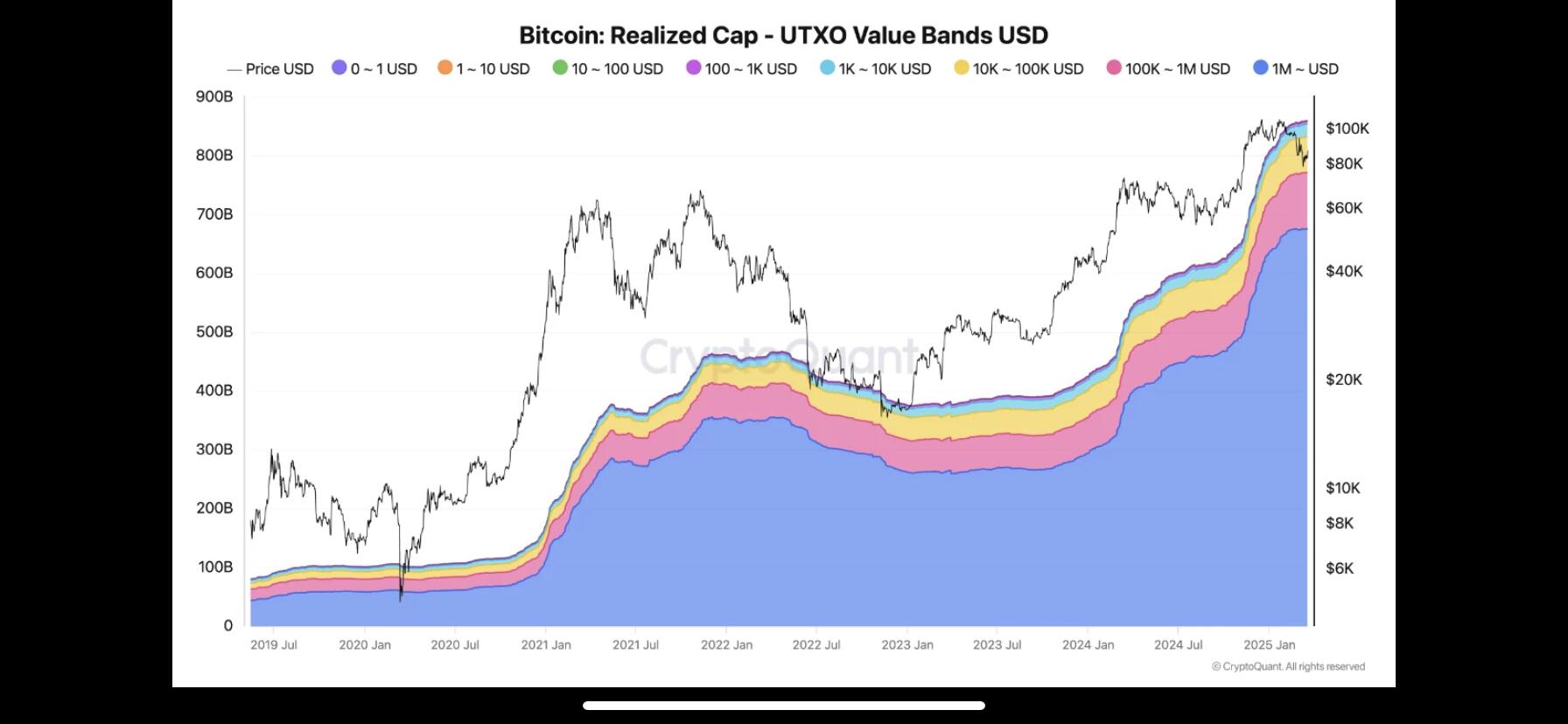

Here is a much better chart to understand this.

It is disappointing to see experts like nostr:npub18h0w55nsp839ezxnggf00jd2xc6yl0ht62mf5p8wwllu8s80wdcs83ws8m do zero effort to explain. But hey, I found out anyway.

Here is the truth behind transactions in the Bitcoin market, and the influence of large wallets over the whole system:

https://primal.net/e/nevent1qqs2tkjh6xqpsm86xqwdq3p8c2xq9u5ua0vkny7rmyt3kmp7wudxh8sva9eut

Bitcoin Wallets Show Dominance of Large Holders

“The dominance of large wallets in the network's Realized Cap indicates that major BTC holders are in a strong position, potentially supporting price stability or even driving future growth…

Onchained's data reveals that wallets holding transactions valued at over $1 million

collectively account for $675 billion, making up approximately 78% of BTC's total realized capitalization. This suggests that institutional investors and high-net-worth individuals are playing a dominant role in shaping Bitcoin's current market structure.

Tracking UTXO Value Bands, Onchained explains that segmenting BTC transactions into different value categories (such as $1-$100, $1K-$10K, and $1M+) allows analysts to determine which investor classes are actively accumulating or distributing their holdings…

The dominance of large wallets in the network's Realized Cap indicates that major BTC holders are in a strong position, potentially supporting price stability or even driving future growth…

Another crucial insight from Onchained's analysis is the growing involvement of institutional investors. The research suggests that the movement of Bitcoin's Realized Cap within the UTXO Value Bands indicates steady accumulation by these high-value holders.”

What all this means is that the use of Bitcoin as cash and the overall Lightning Network activity is much smaller than the use of Bitcoin as an alternative investment.

Source: Trading View, March 2025.

To be honest I did not understand the graph. It gave me the impression that small amounts were the norm in the Bitcoin commerce and among holders.

I was wrong, it is the polar opposite. Huge holders are now the one that move the Bitcoin market.

Here is a much better chart to understand this.

It is disappointing to see experts like nostr:npub18h0w55nsp839ezxnggf00jd2xc6yl0ht62mf5p8wwllu8s80wdcs83ws8m do zero effort to explain. But hey, I found out anyway.

Probably BS.

MS stock now depends a lot on investors love for AI.

This is very encouraging.

What universe of data you considered. All Bitcoin transactions last month, or in year? Can you please share the full information behind this encouraging pie chart?

CATCH THE WAVES

New beautiful Bitcoin waves are coming.

The ocean of crypto is choppy.

Wipeouts are happening.

But in Bitcoin beach the waves are nicer.

Easier to ride.

Is time to Surf.

Catch your wave 🌊.

Canada just elected an anti crypto Liberal. Not good news.

Good news for us Primal user a new iOS version was just released!

America 🇺🇸 is Watching Canada 🇨🇦.

A globalist government has been elected in Canada, and Mark Carney will continue to “improve” Trudeau’s failed policies.

Difficult days ahead for Canada.

America will be watching.

Trump has a new foe at the border.

Not Canadians, but their government.

Huge congratulations! 🎉🎈🍾

Where propaganda is the strongest is where freedom of speech is persecuted.

When democracies like UK 🇬🇧, Canada 🇨🇦, France 🇫🇷 or Australia 🇦🇺 say they are putting laws and jailing people because of their ideas and words propaganda grows, and tyranny reigns.

ON THE MYTH OF HIGH AGENCY AND LARGE CORPORATIONS

Why is it that most large corporations discourage, and even punish high agency in their employees?

Indeed on the surface it seems they would welcome it with open arms, but facts at most large corporations suggest otherwise.

Did you now the now vilified Scrum and Agile movement calls for High Agency, but few in management actually agree?

High Agency in employees requires a corporate culture that encourages disagreement and meritocracy. A culture that is willing to cut waste, and innovate.

This culture is not the norm but the exception. That said a culture where management decisions support High Agency is precisely what brings breakthroughs, innovation and prosperity to us all.

There is also a Bitcoin connection. Low agency cultures thrive in places where centralized power rules, it is a key characteristic of Bureaucracy. Defend the status quo!

Bitcoin on the other hand represents the opposing forces: Decentralization and Freedom, both foundational for High Agency.

Where can we find a culture of High Agency? Usually in much smaller businesses, startups and communities where freedom and meritocracy is welcome and rewarded.

Always move forward.

Even when bad news hit.

Always move forward.

No excuses.

Observe.

Orient.

Decide.

Act.

Learn from the legendary

Bible Patriarch Abraham.

He never gave up.

He moved with his feet and wealth.

He served the Almighty God.

How Evil Uses Our Good Heart To Destroy Us

"When I am weaker than you, I ask you for my freedom because that is according to your principles; when I am stronger than you, I take away your freedom because that is according to my principles."

Frank Herbert, author of Dune.

GM. Looks like great coffee!

Good news Bitcoin is rising again.