Listening to this read. nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev, does Bitcoin mining rely on real time availability of Internet access? Or can a block be verified offline and then synced to the block chain periodically (i.e., once per day)?

https://open.spotify.com/episode/2W7MuTETn73GMjJOkCEUES?si=uklow9IhS9qffDS887_ruQ

I imagine that as AI models proliferate to become more personalized, compute will adapt to treat GPUs less like physically attached hardware and more logically. Like storage volumes that are virtualized and dynamically scalable, so you can attach a H100 slice for a few minutes.

The Spirit of Satoshi industry report (listen to read by nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev in AI Unchained podcast) gives this insight. If a foundation model is trained on mainstream data, fine-tuning on good data is very difficult to correct the prior misinformation.

https://open.spotify.com/episode/1ckb2A3rPY7zGpcxW3jT9E?si=pARMwzPdQ9GEvmRM0MxWww

Now, apply this insight to humans who have been "educated" by state indoctrination, and our goal is to correct their mislearning using good information. How difficult is that task? (The phenomenon of cognitive dissonance is useful in both human and machine intelligence.)

When original training adjusts the model weights (is learned as knowledge in the neurons), it is impossible unlearn (irreversible). New fine-tuning can only make further adjustments that add to what is learned, hopefully with greater weight and without causing confusion.

The difficulty of unlearning can be understood by examining the concept of unit economy in epistemology. Optimizing knowledge compactness. Absorb concrete examples and learn the patterns and principles that are universal, committing the abstraction to one's knowledge. New knowledge contradicting those abstractions is difficult to reconcile.

Knowing this, we should appreciate (1) epistemic humility and (2) be sympathetic to those confused by cognitive dissonance. (1) is the recognition that past learning can be based on false data. (2) recognizes that others reacting badly is natural to their mistraining.

What is the capital of Ancapistan? Ancapistanople or Ancapistanbul?

"We" is a big club. And you ain't in it.

If the app gets deleted, do the keys get lost along with the Bitcoin? I don't see a way of exporting a recovery phrase from the app.

Can we sideload it in Android?

Across covid public health, climate change, and monetary policy, they believe that fear-mongering, lying, and suppressing inquiry and dissent are valid for manipulating collective action. That's why we don't recognize their authority.

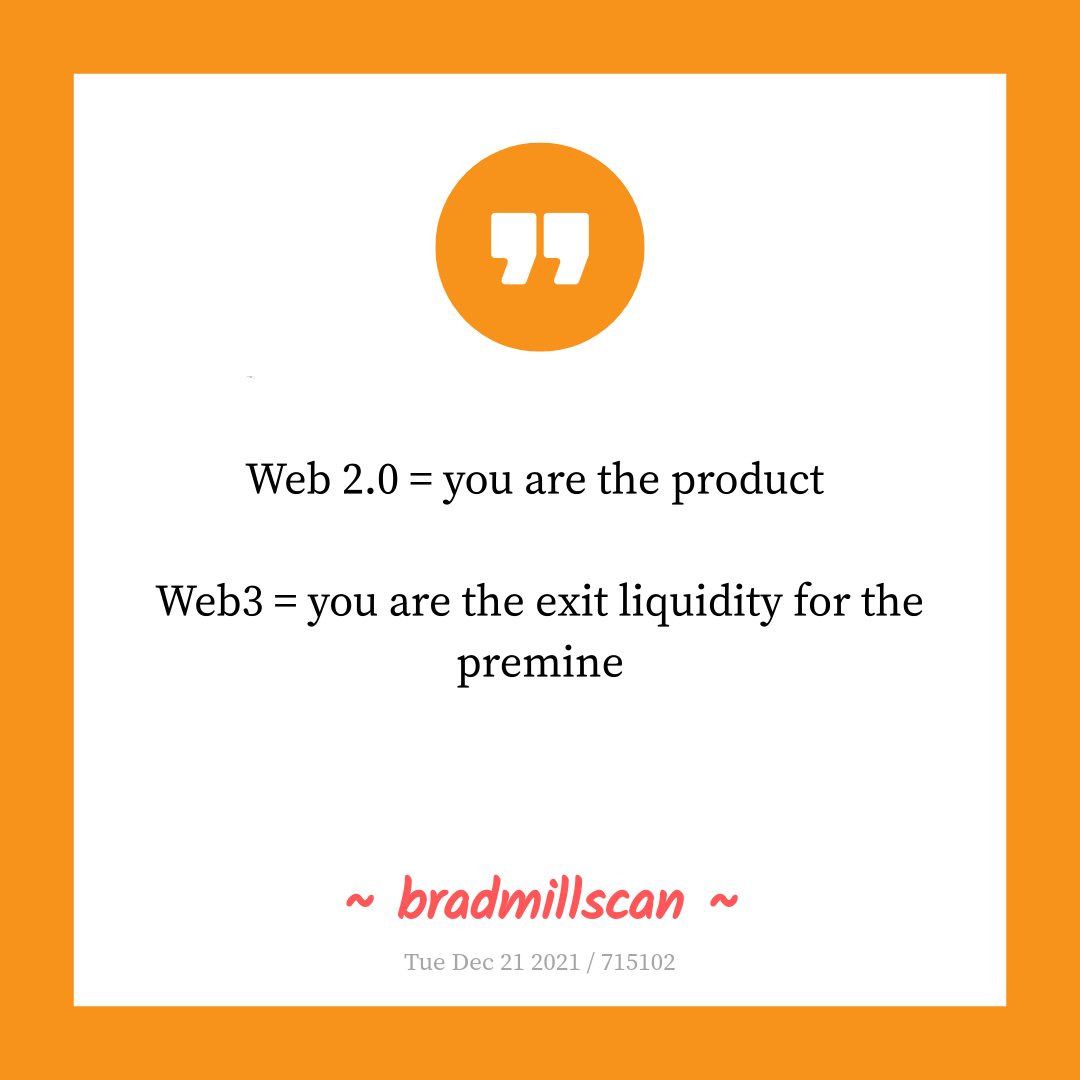

Web 2.0 = you are the product

Web3 = you are the exit liquidity for the premine

- nostr:npub1zjx3xe49u3njkyep4hcqxgth37r2ydc6f0d7nyfn72xlpv7n97ss73pvrl

#BitcoinTwitter

Web3 is DOA if it is based on ETH or any other fake-decentralization technology.

Is it possible to build a keystore (wallet) architecture that itself is distributed in a way that is resilient to being lost or destroyed, while remaining completely unassailable? Another requirement that is important to prevent lost wealth is for that key store to have a dead man's switch along with a list of authorized executors of the will. Possibly to build such a thing without it becoming assailable prior to death?

Will Bitcoin gain traction in certain use cases sooner than others? Sure, hodlers now use Bitcoin as a store of value and a speculative investment waiting for number go up to the moon and for USD to implode. What's the next domino to fall? Perhaps Lightning and zaps will enable the first generation of digital services to become popularized on Nostr. I think some form of digital service will break through before fiat falls or the payment card industry is overthrown or the banking/financial services industry is displaced.

«Bittensor provides a decentralized and permissionless platform to build incentive-driven compute systems as a one-stop shop for AI developers seeking all the compute requirements for building applications on top of an incentivized model»

I have a green card. That makes me a resident alien.

Alternatively, authenticate based on a Bitcoin Lightning payment for the price to access the API. That would be even better.

Is there an OAuth 2.0 authorization server that can authenticate using proof of work? I've never heard of such a thing, but sounds like something worth having for certain use cases. That is, open access API that does not allow spam bots.

Now we have to ask: is how Nostr serving URLs for sharing notes on the Web a weakness in its decentralization architecture?

All In One SEO for WordPress has the code for all preview formats.

https://aioseo.com/ - it's php, so easily lifted.

Amethyst is giving share links hosted by snort.social - is this standard for Nostr across all clients? That site is definitely not previewing on Twitter, so it could really benefit from this.

All In One SEO for WordPress has the code for all preview formats.

https://aioseo.com/ - it's php, so easily lifted.

You're right, of course.