#Bitcoin needs to be free, flow like water. Locked up it’s going to die.

Ironically, this would likely lead to mining decentralization. Everyone should have a small solo miner anyway.

Agree. Here‘s why:

nostr:note1gjad2j9zyulcpzwxuvdqzwv5szp2gg3d0wjjuv44uagqrfn6fzksjakwdp

#Bitcoin will not succeed if it doesn’t become a broadly used MoE soon. Because it needs to be highly distributed and not highly concentrated. Being concentrated in ETFs, strategic reserves and corporations allows it to be diluted through futures, derivatives and fractional reserves and hence also lose its SoV by essentially inflating it. Cornering Bitcoin as a SoV is an attack vector.

Latest News Block out now! We break down inflation data, why middle class earners say they feel low income, Marathon issuing convertible debt to buy more #Bitcoin, and who got wiped out in the recent crash.

nostr:npub1fpewuyx9rekj9487v2uawmg2any7tm7hpfw9at4q2r42u9jk792qg9vrkt did a great job with this one.

Listen on nostr:npub1v5ufyh4lkeslgxxcclg8f0hzazhaw7rsrhvfquxzm2fk64c72hps45n0v5: https://fountain.fm/episode/rK2f917sizBgEYEnnule

Subscribe to the free newsletter: thenewsblock.substack.com

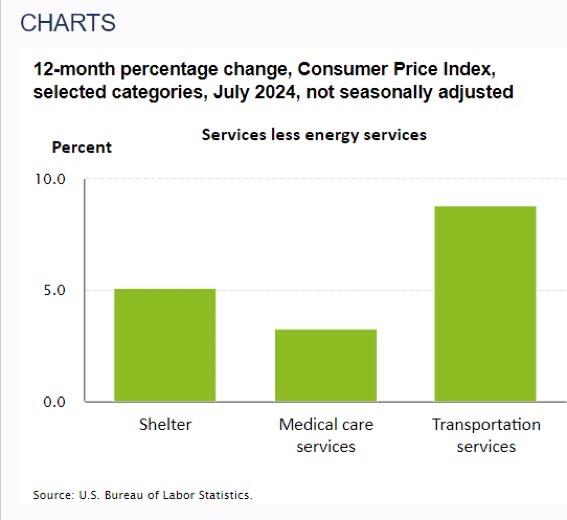

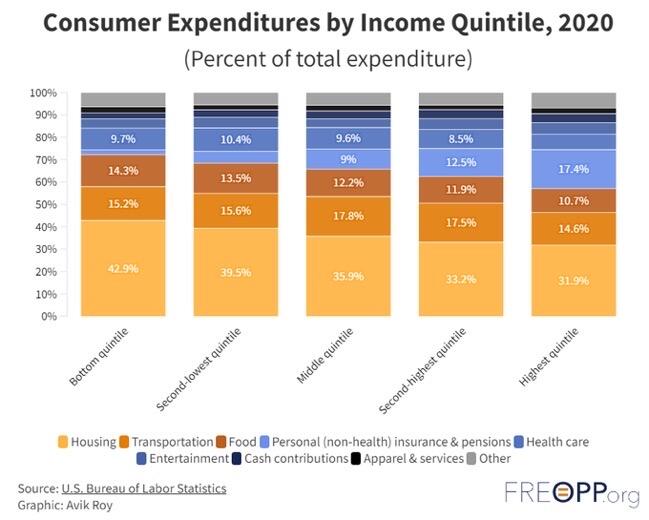

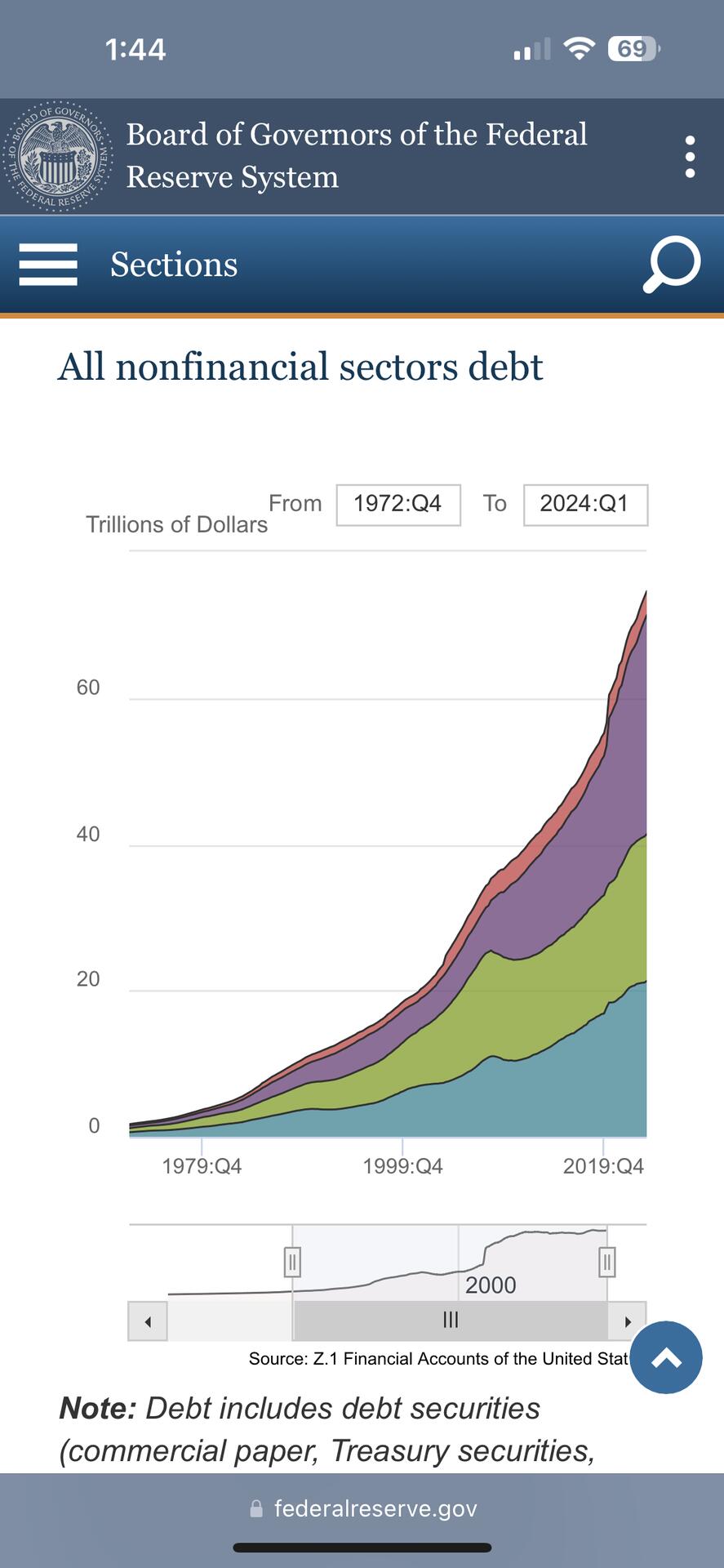

Just to be accurate, not inflation, but price increases dipped below 3%. It’s the Consumer Price Index. Inflation is the increase in money supply. In a debt based system you can measure it by M2+ Debt. Total debt: government, state and local, business and personal. Currently $80 trillion in the US. Every time you increase the money supply (debt), prices go up. Trickle down, uneven, distorted by supply and demand and dampened by productivity increases. Worse, the CPI is manipulated and changed all the time. Useless. Then incomes catch up, delayed, and more for the top 10% and the difference of all of it siphoned off by the elites. And round and round it goes.

I think we should start thinking about what the society of the future will look like. Does democracy really work? (See opinions below) Top down like monarchy or totalitarianism obviously doesn’t work. Does the decentralized way of family, community, tribe and federation like the native Americans work better? (CRIME & PUNISHMENT — Native American Style

October 14, 2008 by Karen Kay)

Thoughts on Democracy:

nostr:note1rwd7ghztggz8qd6ulm396y4tvwvwxwj6gaa6h5uwd45r0z3supmqurvrd5

nostr:note1tcntpzy8cxmn46e2z8prd8wk0f3u75jlly7xu4d20ay5ncaxr80qat99zu

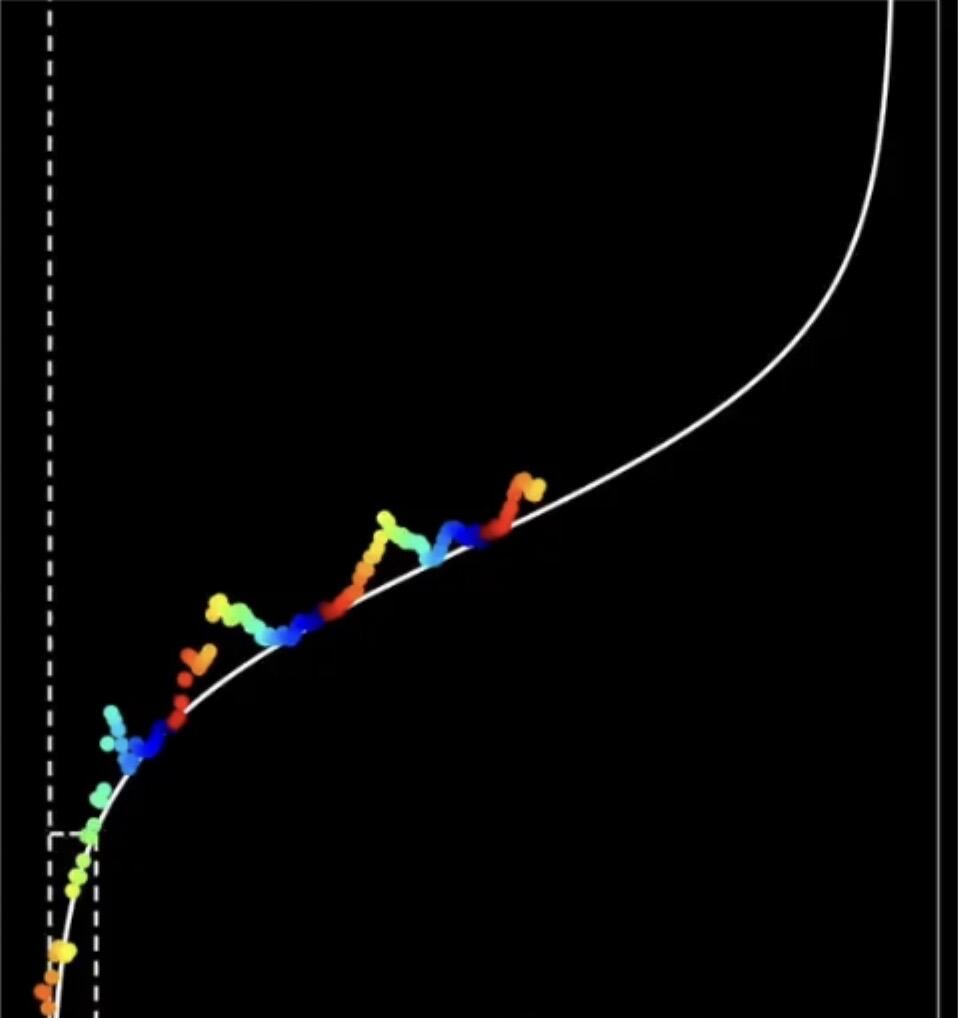

My feeling is that at USD $100k, #Bitcoin will start accelerating to infinity vs the USD. (Midpoint in the graph below). Measuring #Bitcoin in terms of USD will loose its relevance at $1million per #Bitcoin as it decouples and prices of assets, goods and services will be expressed in #Bitcoin directly. Just a feeling though, since you asked :)

Nostr liberates us

It’s of course by design. Newspeak. Like, calling it inflation when it’s price increases. Calling it a vaccine when it’s not. Like calling him a woman when it’s a man. Like calling it capitalism when it’s communism. Etc etc. We are in trouble. We can’t clearly communicate.

They all work for the same people. Two sides of the same coin. Watch the movie the “The Jones Plantation.” I thought it sums it up pretty good.

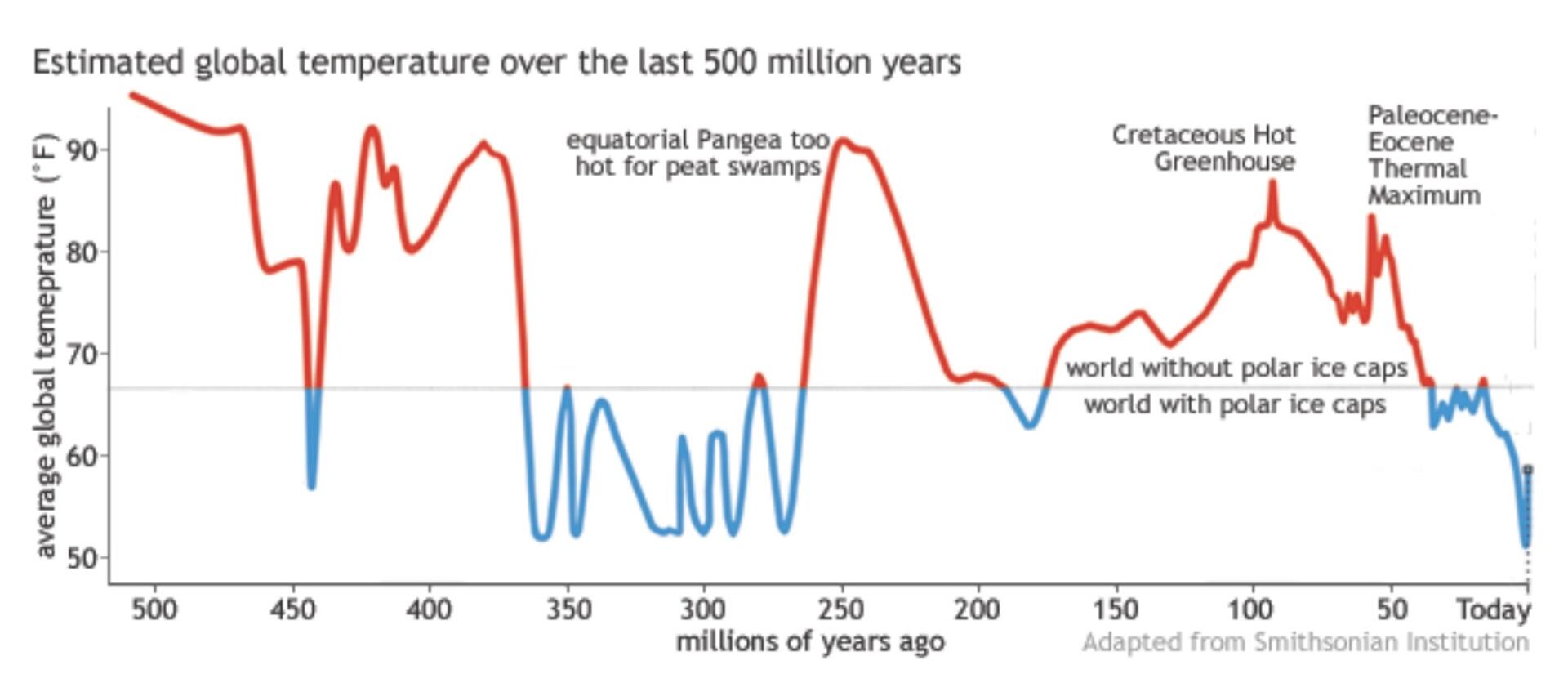

I’m not so sure about it getting warmer, what time frame? When in doubt, zoom out. Medieval warm period, was just 700 years ago…NOAA charting average global temp by zooming out:

These are price increases, not inflation

And, it’s not an indication of inflation. It is the “manipulated” Consumer Price Index”. The trickle down effect of inflating the money supply on prices. Completely useless measure. Inflating the money supply in a debt based system is not M2, btw, but total debt: Federal, State and Local, Business and Consumer. Currently $80 trillion.

I think the more we are becoming like Oceania, accelerating towards a totalitarian world government, the more valuable will the #Nostr/#Bitcoin combination will be in terms of free commerce and free speech. I think it’ll be less of social media/entertainment, more like key infrastructure of the resistance.

I don’t like that the #Bitcoin USD exchange rate has been reconnected to the stock market trading algos. Stupid, really.

I don’t like that Big Brother is messing with our #Bitcoin.

How about you? Do you still support Lummis?