Agree! It is almost as if a sort of american aristocracy is emerging via this administration. Truly different from the last Trump run which was more of an "anti-establishment" project.

Perhaps this is a sign of the times, as Bitcoin is now in a sort of transitional phase. The global goal of the Satoshi era — building the pillars to an alternative to fiat — has been technically achieved, but the inner movement now splits and focuses on local (rather than global) emphasis: one path leads to a Bitcoin-native business ecosystem (as per your explanation), the other back to cypherpunk ideals. Meanwhile, institutions now adopt Bitcoin without roots in its original culture. The pioneers have faded into the background — perhaps only temporarily — before the future wave of global hyperbitcoinization.

The reason the playbook works is because it’s wired into us. Identity itself is arguably a similar defense mechanism — a story (solution) we invent to resolve the dissonance (fear) between ‘self’ and ‘not-self’ (enemy).

Nostr has yet to explain what the ”Big Mario” *actually* is. Nostr is still experimenting with different products in its ”Small Mario” phase. But once the ”Big Mario” emerges organically, it will become evident that it is not just a new social media which happens to be decentralized.

If Jesus truly is God, not separate from God, like the Church have always claimed through the doctrine of the trinity, his moral character must be consistent across time. The same God who commanded war in the Old Testament cannot suddenly declare all warfare inherently evil without violating His own nature. That would render God internally contradictory.

Thus, it makes much more sense to interpret the peace oriented teachings of Jesus to be directed to individuals rather than the collective/organisations. His message is about peace among individual human beings, not about political pacifism.

This is precisely how Augustine framed it in the just war tradition. Ultimately an approach to warfare which forms the ethical framework in all of modern warfare.

The way we perceive the entire concept of ”war” is very different today from how it was perceived only 200 years ago, nonetheless 1000 or 2000 years ago. War today is generally condemned, but throughout history, it was a place of virtues like honor, strength and courage. The old testament is full of it — God not only tolerates war, but commands it. Jesus said he came not to abolish the law, but to fulfil it. Not once did he condemn war as a concept. His messages of peace and love were always about the individual, never about the collective. “Do not think that I have come to bring peace to the earth. I have not come to bring peace, but a sword.” (Matthew 10:34)

Authors of fiction literature need to separate the underlying fabula from the written sujet. The former lives in the head of the author (and reader), the latter exists on paper. Frankly, the written text is really only a means to an end — to communicate the underlying fabula. Authors who internalize this subtle difference can be less attached to their texts and edit aggressively. Essentially being able to focus on the core task — delivering texts that engage and leverage the imaginative capabilities of the readers.

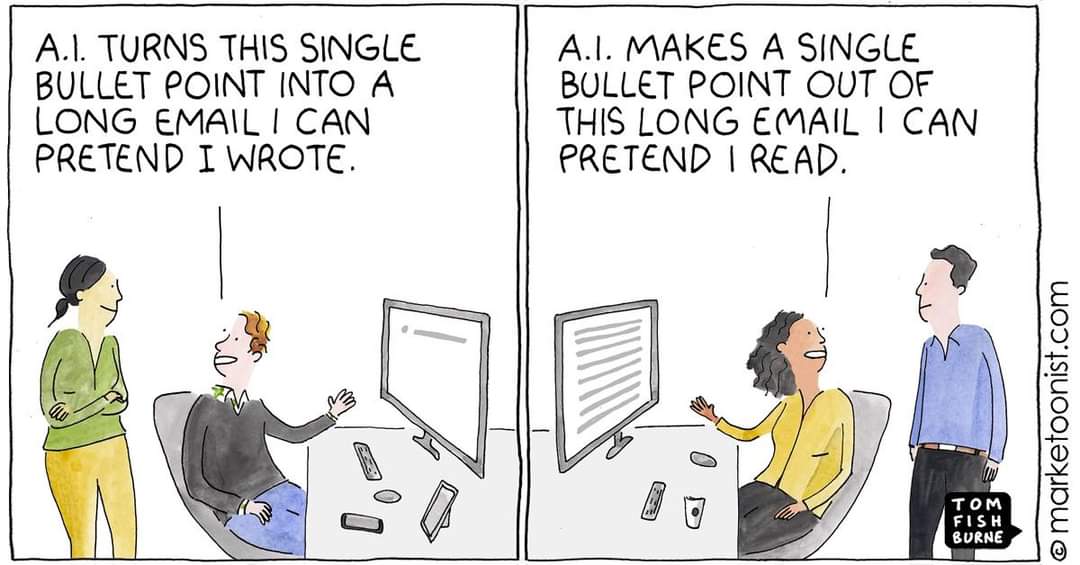

There is a point in putting in the work and actually reading and/or writing long texts. Often the summaries lack the content and key details that truly matter.

Anarcho-communism could be organized in a fedimint or cashu federation. Anarcho-capitalism is more aligned with being fully sovereign, having your own nodes, your own wallets, self custody and so on.

Language is probably the best example of all protocols that anarchy can fill, and already fills a place, in a functional society

Physical robots and non-physical AI-agents having some degree of autonomy (centered around a nostr accounts and a stack of bitcoin oriented BTC/LN/ordinals/bitvm/fedimint/etc. wallets and keys?) yet also being synced and owned by a master key controlled by their human owner/operator?

Nostr giving agents and robots a "soul" or "personality" while the rest is more of logistics -- being able to leverage external AI-clusters for reasoning etc.

People building their entire worldview on resentment can be weird and illogical, yes. But frankly, many bitcoiners are similar but from a different perspective: they are typicall anti-government, anti-fiat, anti-tradfi and so on. Often just having a different object which they focus their resentment on, but nevertheless still resentment based. Just being anti these things by default is not a healthy thing, a true critic will always assess everything objectively. On the other hand, perhaps bitcoin-NPC's are also necessary in a way.

🔴 DEBUNKING BITCOINER MYTHOLOGY 🔴

Part 1: The myth of decentralized adoption

Why do Bitcoiners cling to the idea of a decentralized, bottom-up global adoption? The notion that Bitcoin will spread in the same organic manner as past technological revolutions—like the car, the internet, or the smartphone—is a myth. A perhaps comforting narrative, but a false one.

❌ Bitcoin is not like other technologies

Comparing Bitcoin’s adoption to previous technological shifts reveals a crucial difference. The car replaced the horse, the internet replaced the mailing system, and the smartphone replaced landlines. These were all existing, largely decentralized, network-based systems operating in a free(ish) market. Their adoption curves followed a natural, emergent process: individuals and businesses recognized their value and gradually integrated them into everyday life. Bottom-up adoption made sense.

Bitcoin, however, does not seek to replace a decentralized or free-market system. It is not up against a scattered network of incumbents competing in a market-driven way. Instead, it is challenging the final boss—the central banking system, a structure that is, by design, highly centralized and resistant to disruption.

To assume Bitcoin’s adoption will mimic that of past innovations is to indulge in a mirage—a romanticized belief rather than a probable reality. This illusion may stem from classical economic theories, particularly Adam Smith’s notion of the "economically rational human being." But by now, it should be clear: most people are not economically rational actors. Libertarians—heavily overrepresented among early Bitcoin adopters—may be an exception, but they are not the norm.

✅ The reality: Bitcoin’s adoption will be centralized

Bitcoin is already infiltrating existing power structures, spreading like a memetic virus through the minds of policymakers, financial institutions, and central banks. Yet many Bitcoiners fail to grasp the implications of this.

Adoption will not happen through grassroots movements of individuals choosing to “save in Bitcoin” or businesses adopting Lightning for payments. A small fraction may opt-in voluntarily, but the overwhelming majority will not. Bitcoin’s real adoption will come from the top down—through centralized implementation, not decentralized choice.

☑️ Here’s how it will most likely unfold:

1. Central banks will (inevitably) dip their toes in—first through careful reserve allocations, then by leveraging Bitcoin’s properties in financial systems (ie printing money in different ways to acquire additional bitcoin).

2. A game-theoretic domino effect will ensue, following an inevitable slippery slope, where some nations manage to acquire more Bitcoin than others, leading to competitive pressures that force further acquisitions. Or as we know it: FOMO. But this time the FOMO is not among retailers, or even among corporations, but among central bankers and nation states. This will play out via a global print war, where central banks leverage fiat money to acquire a maximal amount of bitcoin.

3. Fiat currencies will persist, ironically, but they will become Bitcoin-backed. The transition will be somewhat invinsible to normal people, who will still use traditional payment rails—cash, cards, mobile apps—without realizing the underlying monetary standard has shifted.

4. Deflation will swiftly replace inflation as the economic baseline. As Bitcoin’s purchasing power increases, prices of goods and services will gradually decline in real terms. Again — without people even realizing the true reason behind — bitcoin.

The end result? A hyperbitcoinized world where most people are unwitting, indirect, Bitcoin users.

🤡 The Irony: Central banks survive, private banks collapse

Many Bitcoiners assume that hyperbitcoinization will destroy central banks. But the reality is central banks will likely be the biggest winners among legacy institutions. Here’s why:

Central banks do not operate as profit-seeking businesses; they control the monetary base itself. Unlike private banks, they do not depend on debt issuance for survival.

When Bitcoin enters the monetary system, it will collapse the traditional debt-based financial model that commercial banks rely on. Credit expansion, fractional reserve banking, and complex derivatives will become obsolete.

Private banks, investment firms, and debt-reliant financial institutions will be left "holding the bag"—holding the worthless remains of a collapsing financial system while central banks transition to Bitcoin reserves.

🏛 Bitcoin Becomes the "Central Bank of Central Banks"

In the new system, Bitcoin will act as the ultimate reserve asset, similar to how gold once functioned.

Central banks will continue to compete to accumulate as much Bitcoin as possible, securing their relevance and survival.

As fiat currencies become Bitcoin-backed, people will continue transacting with familiar digital payment rails—but the fundamental monetary base will have shifted.

The system will transform from an inflationary model benefiting financial elites to a deflationary model benefiting the general public.

This means Bitcoin won’t destroy central banks—it will force them to evolve into Bitcoin reserve custodians, while commercial banks and rent-seeking financial institutions are wiped out.

🔴 Part 2: The myth of user friendliness — when bitcoin becomes invisible 🔴

Long-term, once the dynamic above have unfolded, the financial ecosystem development will be co-evolving with the world of robotics and AI. This will produce a situation where monetary transactions will be outsourced to AI and automation—just as historical elites never needed to physically handle money, delegating financial tasks to their butlers, servants or accountants.

Now all people will have butlers, servants and accountants, but they will be different types of physical and digital helpers. When robots—not humans—start managing daily transactions, the usability concerns that often plague Bitcoin adoption narratives become entirely irrelevant. AI and machines don’t need a user-friendly UI. They simply execute transactions in the most optimal way, in accordance with the needs of their owners (humans) likely via peer-to-peer (P2P) settlement on a Bitcoin-based Layer 2 solution or elsewhere in the bitcoin ecosystem.

💪 This (part 2) marks the true endgame of hyperbitcoinization:

❌ Not when Bitcoin replaces fiat overnight.

❌ Not when nation-states voluntarily transition to a Bitcoin standard.

✅ But when robotic systems render traditional financial structures obsolete—and do so by using Bitcoin as their base layer.

Ironically, it will not be Bitcoin itself that ultimately kills central banks. On the contrary, bitcoin will prolong the life of central banks. The thing that will eventually kill it will be automation, AI and robotics. The financial system, once built to manage the inefficiencies of human behavior, will no longer be necessary when human decision-making is removed from the equation.

🏁 Conclusion: Bitcoin fixes the system… but not how bitcoiners typically Expect

Bitcoin won’t kill central banks—it will force them to adapt. Private banks and debt-driven financial institutions will collapse, holding the worthless remains of the old financial system. Bitcoin will become the "central bank of central banks," serving as the global monetary base.

People will continue using fiat, but it will be Bitcoin-backed and deflationary fiat currency, benefiting the masses rather than financial elites. AI-driven economies will eventually accelerate the transition away from traditional currency, ensuring that Bitcoin’s role is not only inevitable but irreversible and futureproof.

In the end, Bitcoin doesn’t destroy the system—it reprograms it. The people win, financial elites lose, and the world enters an era of monetary transparency, efficiency, and decentralization, whether people realize it or not.

Every fiat currency is a means to an end — to surve the people of its jurisdiction. The currency itself really has no other value. And if it doesn’t fulfil its purpose anymore, it is in the interest of the people to move on.

How to tell you are a parent without telling you are a parent

You may of course turn out to be right, time will tell. All I’m saying is that I know that most people in governmental positions genuinly believe in the system they run. Most people in Brussels and elsewhere truly believe in democracy, the political system and the value of having a government and so on. Of course they are self serving to some extent (as all people are), but typically they think their ”grand plans” are truly for the greater good. Is there some elements of corruption, or indirect corruption? Probably. Is the entire government corrupt? No. One could even ask if corruption in general truly is the issue here? Or is the issue more about the fact that the entire system itself is dysfunctional long term? Personally I don’t believe in the dystopian narrative, it appears less speculative to assume that we are witnessing a system that is slowly just tearing itself apart over time by its systemic inertia, rather than framing it as a case of villains vs people.

While true that they are terrible capital allocators, you cannot deny the fact that they are presently in control of all tax, which includes everything from capital gains tax rates to deductions and property taxes etc. Wheather we like that or not is irrelevant, it is a fact. The ”personal property rights” you claim exist are already severely limited as it is. This is why it is quite a leap to call these moves dystopian — it is more an issue of working within already existing structures by re-evaluating tax rates and adapting incentives to nudge investments in other directions.