Red Rocks, 2024.

Quick painting in Rebelle 4. No AI.

#Art #Scifi #Rocks #Landscape #Desert #noAI #Rebelle

As far as I recall, Nostr existed for a year before the great Twitter-Nostr migration in 2023.

Buuut considering that I mixed up 2022 and 2023 I can't be certain that my memory is correct.😄

Edit.

It seems you are correct. I thought I joined Nostr in early 2022 but now that I checked it was early 2023. So I have been here for 1.5 years and Nostr have existed for 2.5 years or something like that.

Great to hear!

I think we need a positive spirit on Nostr where we attract people to be themselves uncensored.

Nostr is for friends and foes.🌟⭐️💫

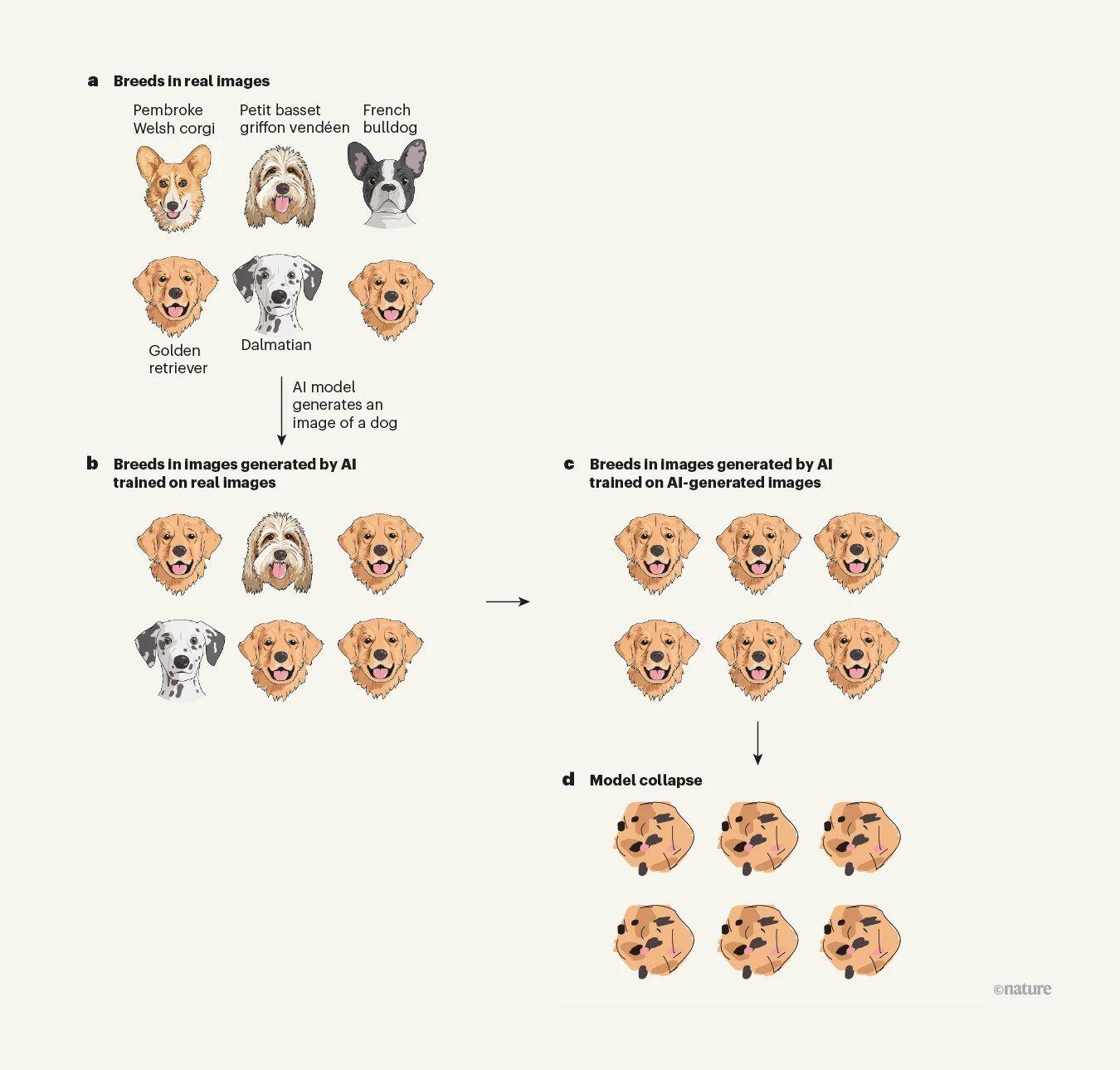

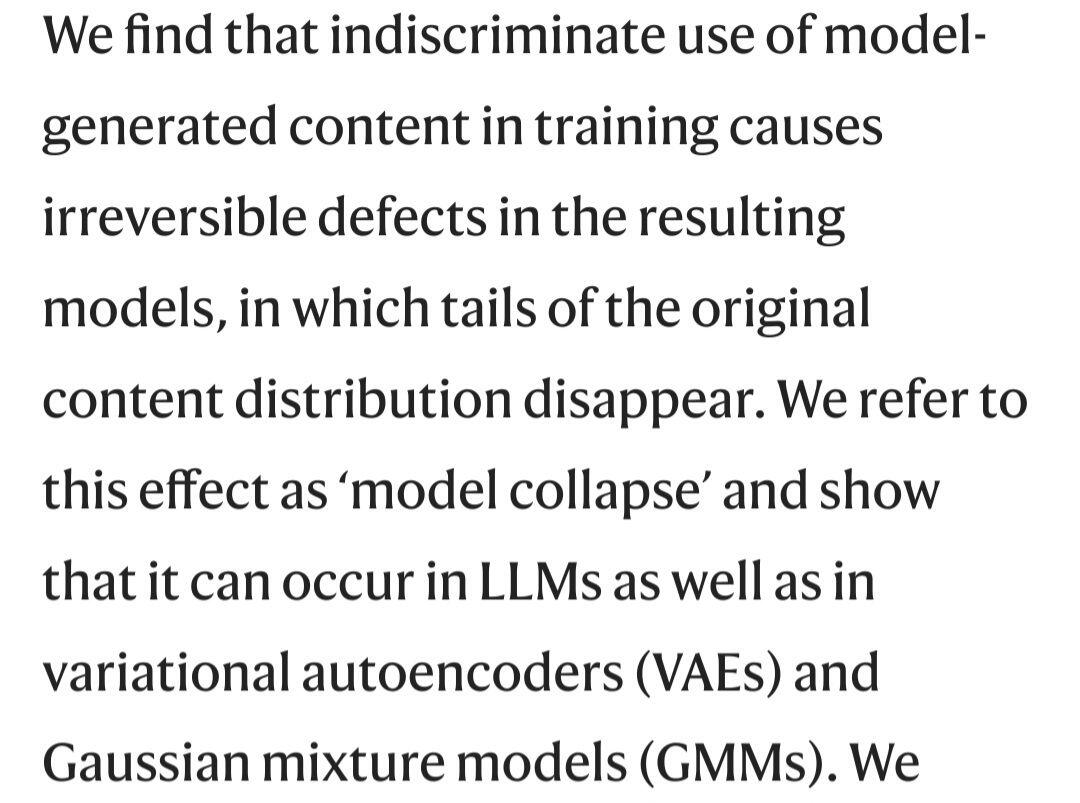

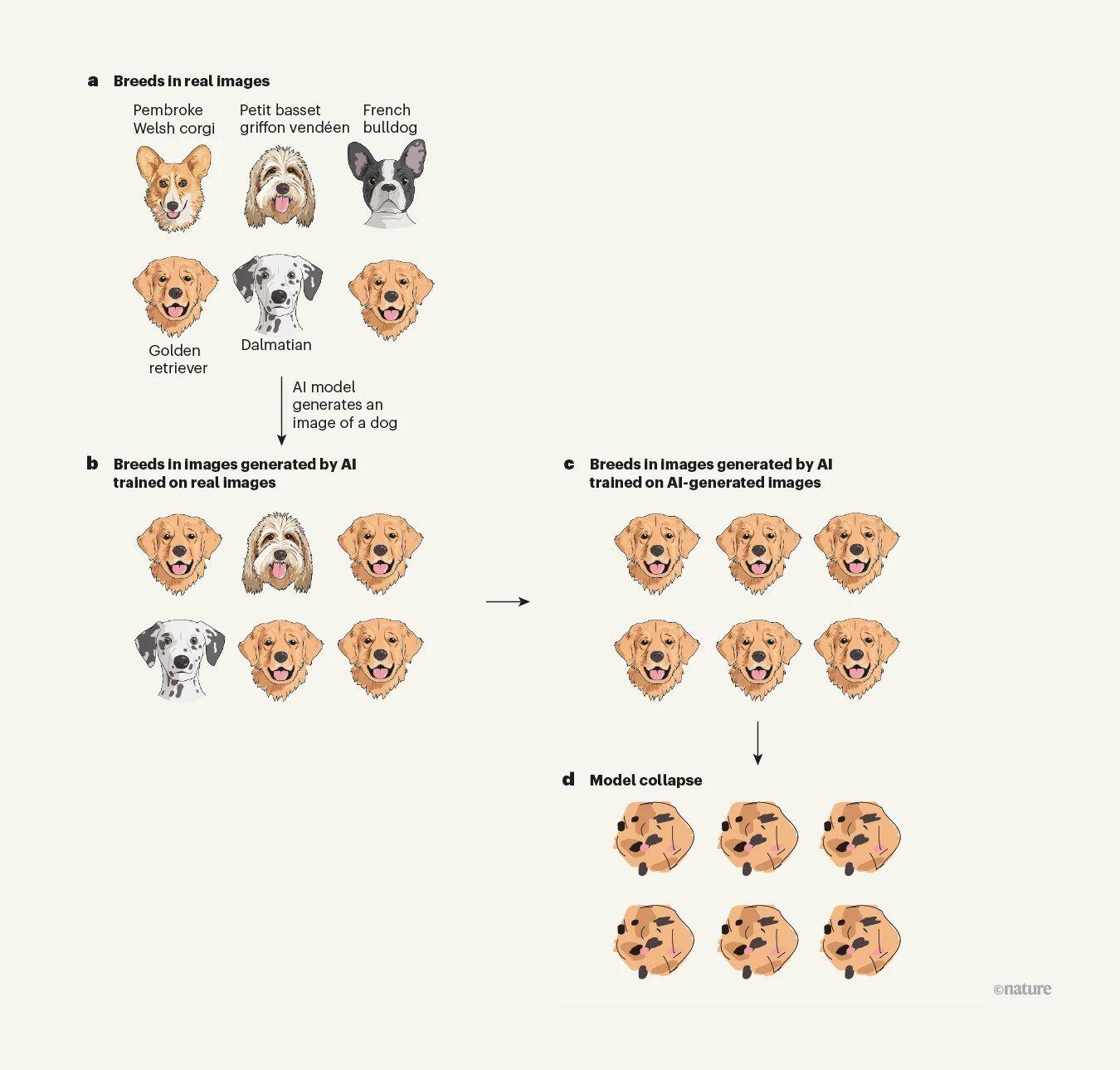

A study finds that AI trained on its own outputs will become increasingly prone toward errors, until the model collapses.

As many artists and other observers have predicted, the use of non-realistic reference images as AI inputs will deteriorate the quality of reality-based AI art content over time.

When an AI model is fed with AI outputs instead of real world references, the breakdown or corruption becomes inevitable over time.

https://www.nature.com/articles/s41586-024-07566-y

#AI #Artificial #Study #Research #Art

One prediction from this finding is that AI models will be dependent on a correct classification of human vs generated art.

If an AI model uses more than a certain ratio of AI outputs for its training data, we can expect the model to gradually become corrupt.

The logical conclusion is that a proper categorization that separates human art from AI art will be necessary for AI models to not veer toward visual corruption.

We can expect the same principle in regards to poetry, writing, programming and every other field of activity

A study finds that AI trained on its own outputs will become increasingly prone toward errors, until the model collapses.

As many artists and other observers have predicted, the use of non-realistic reference images as AI inputs will deteriorate the quality of reality-based AI art content over time.

When an AI model is fed with AI outputs instead of real world references, the breakdown or corruption becomes inevitable over time.

https://www.nature.com/articles/s41586-024-07566-y

#AI #Artificial #Study #Research #Art

I think a lot of Monero people are unrealistic.

They cannot sell Monero for fiat when cash is gone. They need Bitcoin as a store of value and an intermediary.

I don't accept Monero payments because I am not into barter. If others want to use Monero, I support that and their best bet is to find bitcoiners they can swap smaller amounts with. But who would need large sums of Monero? It is not a store of value.

The problems of KYC/AML is not an argument in favor of Monero.

I like Nostr and have been here for 2.5 years. Nostr is the future.

However I disagree with the one-sided mentality of Nostr-only that are sometimes displayed.

There is a value in having critical voices both on Nostr and other social media. The deep state can only be pleased to see critics leaving platforms where the critics have some amount of reach, for alternatives that have very little reach.

When I receive most of my art commissions on Nostr I might consider the Nostr-only approach but that might take years.

#Meme #Memes #Brand #Rebranding

I think that sharing too much content in a short time often leads to people unfollowing, because their feed is full of content from one single person.

🔥🔥

BREAKING: A whistleblower leaked the full uncensored german RKI protocol files related to the Covid crisis. The files show that the "scientists" bowed to political preasure.

Download it here:

Main: https://mega.nz/file/AWdgSZxC#ZcnntY4tSxiuytZgVY7bVPlOr1iivYPu5b1Gj7UWlXw

Extra files:

https://mega.nz/file/dbc1zbyD#qhI5ls4RGyCf3A1wFpoz3y8BuMuex0TxdJoo1dVmYFY

This has to be heard, recognized and admitted by the mainstream!

Original tweet:

I would like to zap this note but I'm receiving a message that there is no lightning address.

The important part is verifying our notes without providing KYC. This is where Nostr excel.

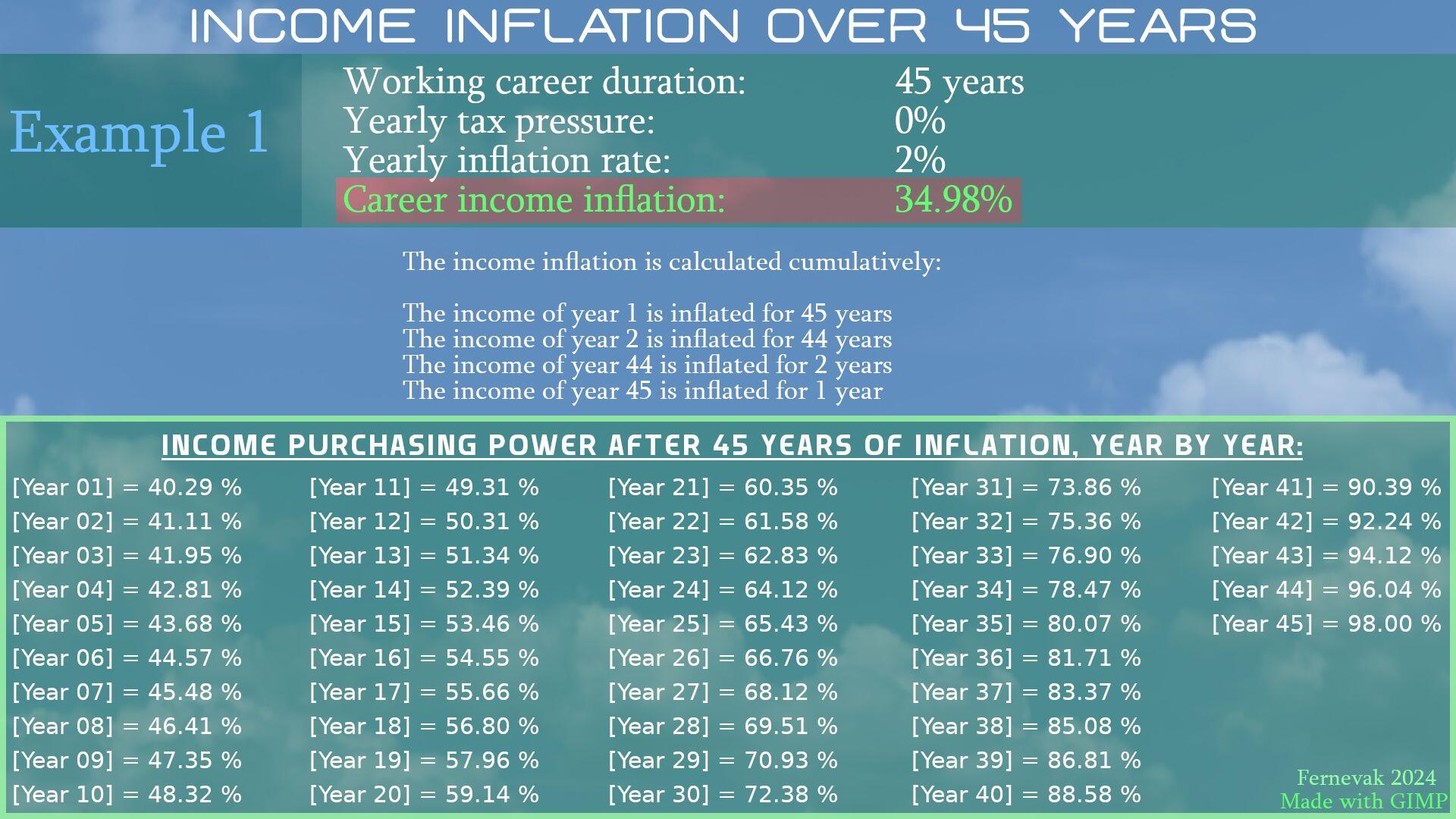

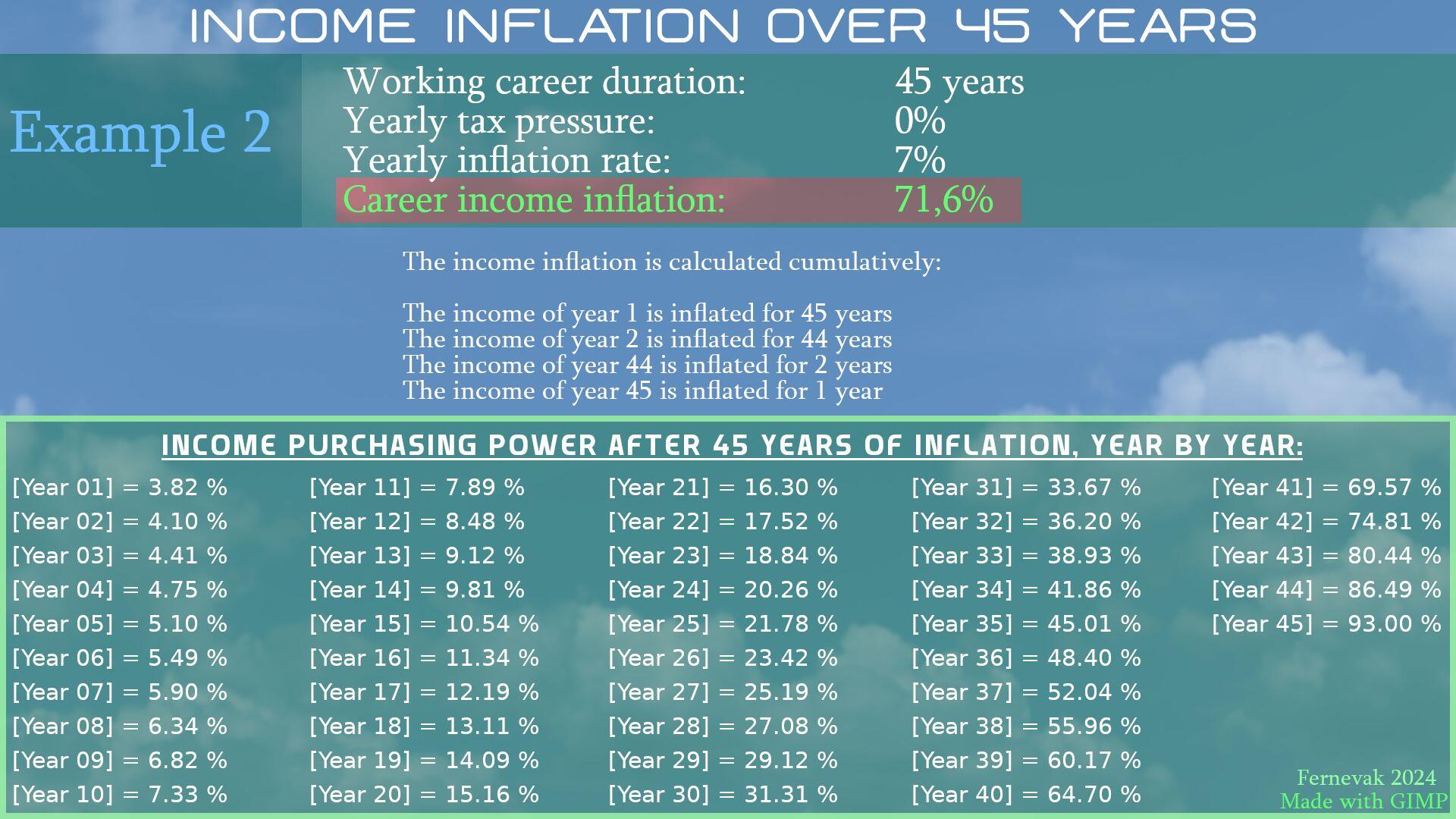

I meant that you started to inform the public about inflation some 20 years ago, so you have planted the seeds for a long while even if you had a break. I only recently heard about you last year but I respect the long term commitment in exposing the moneyprinting scheme.

🙏 Thanks for your work ovee the past 20 years Rune.

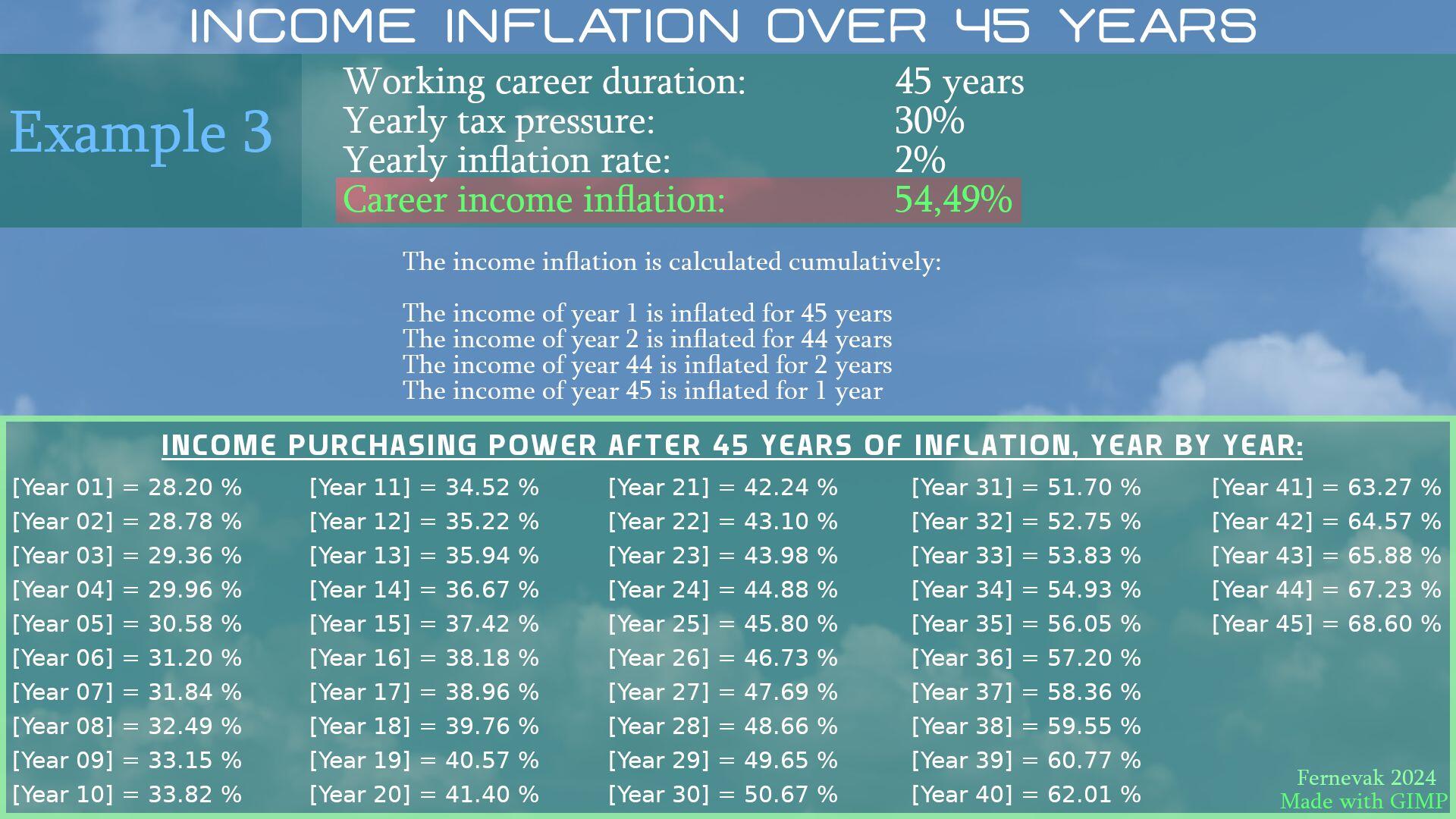

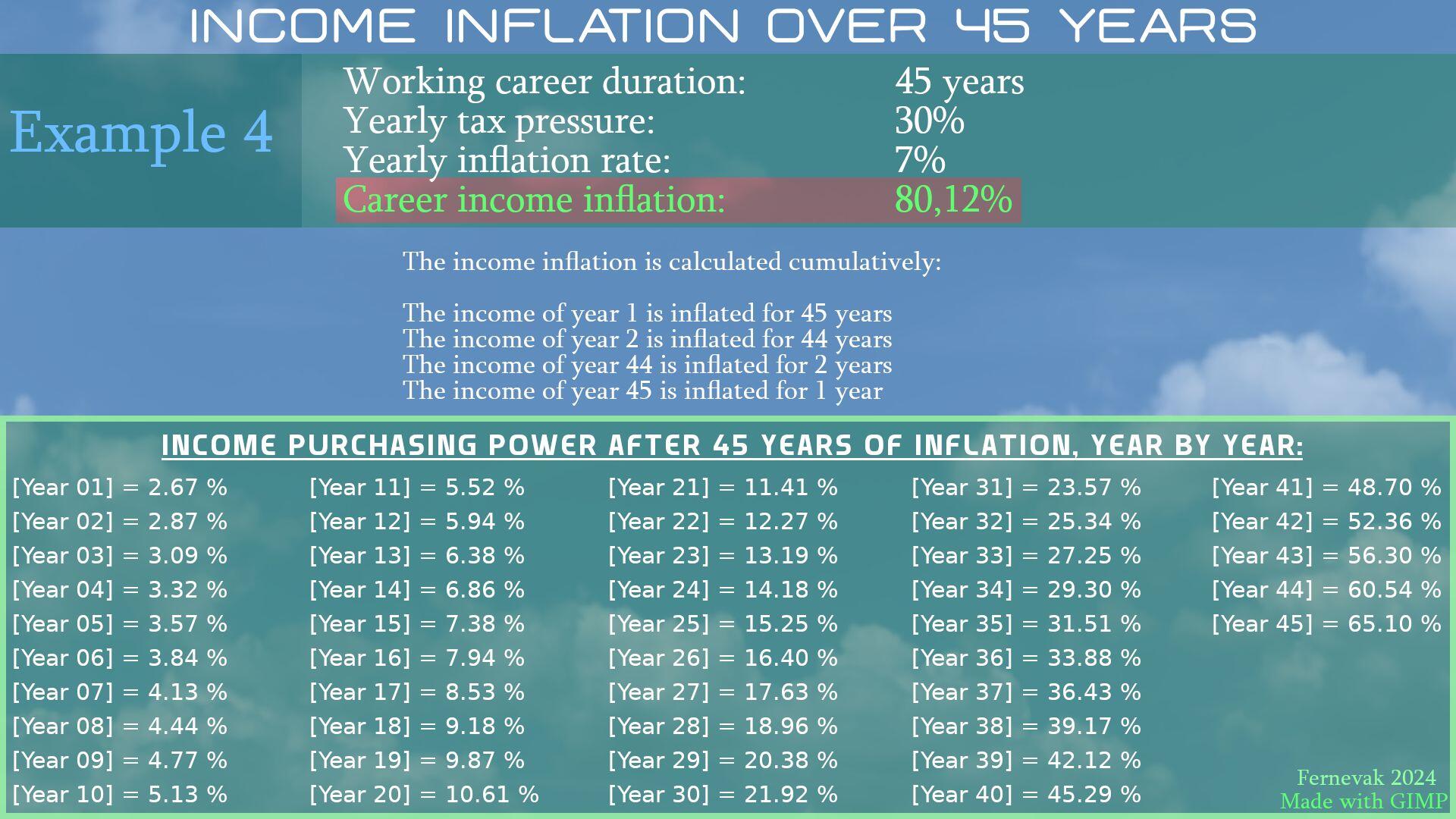

I was curious about these results so I had to write a program! I decided to visualize all the years so that others can confirm or error-correct my results.

Thanks! Without free speech we slip down toward feudalism and ancient priest-class proclamations that cannot be questioned. Great to connect!

Thank you nostr:nprofile1qqsz84ynj3sjtptsd3efpzj78yz0j5thagy8kqedm07d9p3rqnranqcpz3mhxue69uhh5cts9ehx7um5wgcjucm0d5q36amnwvaz7tmwdaehgu3dwp6kytnhv4kxcmmjv3jhytnwv46qz9thwden5te0dehhxarj9ekkjmr0w5hxcmmvqyv8wumn8ghj7mn0wd68ytn8da3ksctjd35k2tnpdyy3p4g9 , my friend! You’re an amazing artist yourself and I’m looking forward to another chat with you and collaborating on a new project! Have a great weekend. 💜🫂☀️

🙏 You are doing a wonderful work for music, liberty and Bitcoin, my friend! I'd love to hear about your new project! Best wishes for your weekend, hope you and your wife are well!🌟⭐️💫✨️

🙏 Thanks Pleb Rebel.

Nostr is the place to be for long format content and debates.

?cid=9b38fe91r3irasn8cdrg5rmp7ptiy2ilg11vx5c9bcq4l3kp&ep=v1_gifs_search&rid=giphy.gif&ct=g nostr:note1499zpf83gznsccp35svftx6uh5jmnhlzke0ftv472whvqemfg0xqk3flts

?cid=9b38fe91r3irasn8cdrg5rmp7ptiy2ilg11vx5c9bcq4l3kp&ep=v1_gifs_search&rid=giphy.gif&ct=g nostr:note1499zpf83gznsccp35svftx6uh5jmnhlzke0ftv472whvqemfg0xqk3flts