Hello world! 🌍

The Cantonal Bank of Zurich is now offering its clients the option to invest in Bitcoin and Ethereum. 🚀 This marks yet another major step forward for the Swiss banking industry. Earlier this year, the third-largest bank, Post Finance, also introduced its own crypto offering.

It seems like only a matter of time before the two largest banks (looking at you, UBS 👀) will need to follow suit!

When it comes to Bitcoin and digital assets, Swiss banks are far ahead of their US counterparts. 🇨🇭 In the US, regulatory hurdles still prevent banks from fully engaging with Bitcoin.

Offering custody for digital assets like Bitcoin involves significant costs due to the capital backing required (thanks to Basel III regulations 💰).

However, in Switzerland, thanks to changes in Swiss law and banking regulations, banks can separate digital assets from their balance sheets. This allows them to offer true custody accounts, ensuring that assets belong to the client. By law, these assets are fully segregated from the bank's estate during bankruptcy and are returned to the client. 🔐✅

At Archip Maerki Baumann, this is why we're able to offer a segregated wallet for each of our clients holding Bitcoin with us.

As I understand it, something similar is possible in Wyoming 🇺🇸, thanks to the efforts of nostr:npub1uyz4w2w4rcphk0q5arzkutrecgscxwzajj4dkvh9mjyqjtxslm6qea8632 and others, but it's still rare in most of the United States.

#Bitcoin #Crypto #DigitalAssets #SwissBanking #FinancialInnovation

I won't consider moving any of my #bitcoin from cold storage to 🇨🇭 Kantonal Bank custody unless: 1. My #bitcoin is secured via cold-storage multisig with the keys being held by 1. the primary Kantonal Bank, 2. a secondary Kantonal Bank and 3. me. 2. The 🇨🇭 Bank needs to pay a yield (like any savings account). Why would I pay any bank a fee to custody my #btc when I can do ot myself for free?

Please change my mind.

What realistic alternatives (aside from using the (Ham)radio spectrum!) exist to replace the TCP & IP layers?

☕️ GM fellow #plebes. #nostr

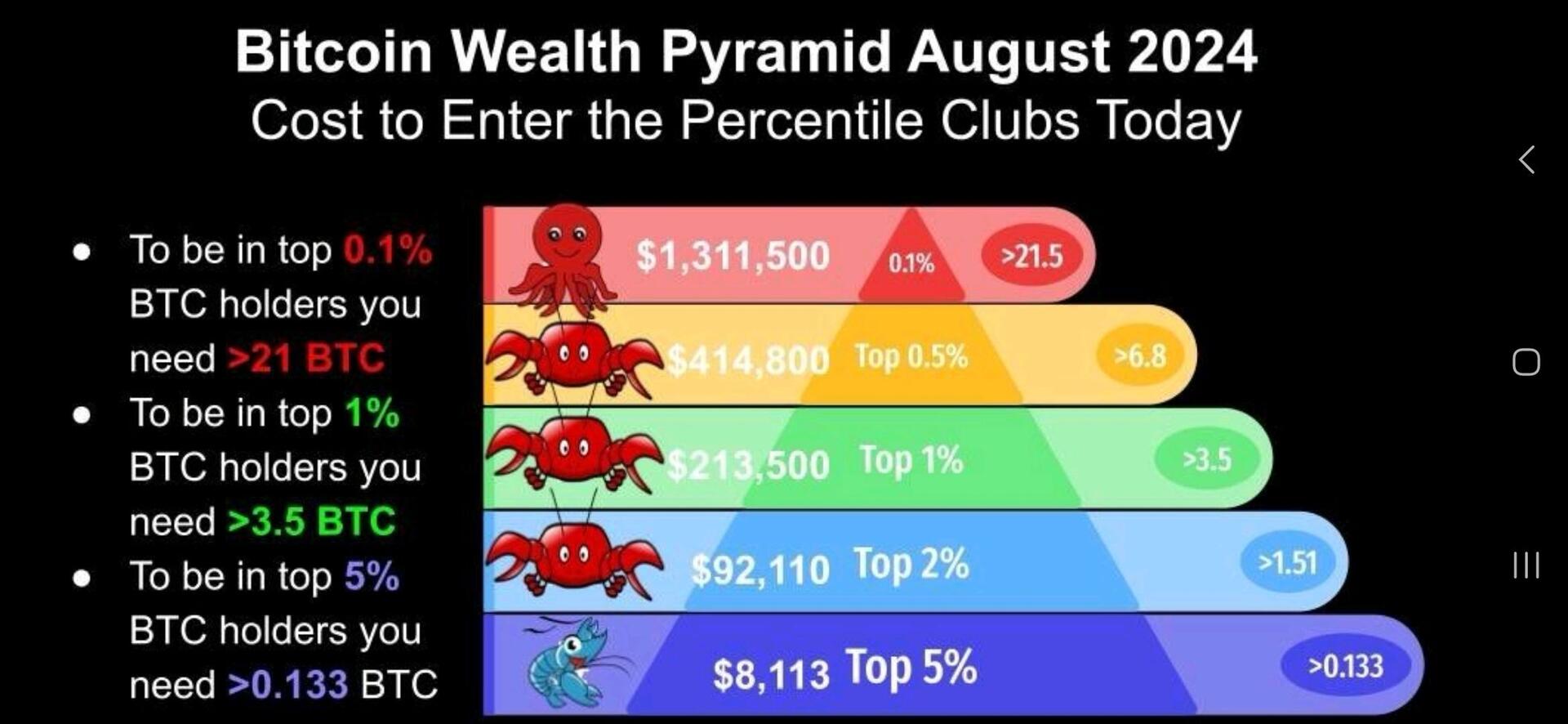

Do any of you #nostriches or #plebes know the source of this #btc wealth pyramid? If so, please share.  #nostr #bitcoin

#nostr #bitcoin

Quit #nostr surfing & go touch grass! 🇨🇭 #bitcoin #schweiz #outdoors

☕️ GM #Nostr friends!  🇨🇭

🇨🇭

GM #nostr 🇨🇭

Ignorant people with power = disaster.

Nice work! I've got a KX-2 for SOTA, QRP is the way to go! 73 from 🇨🇭 , HB9GUF

Thanks for sharing - very cool! I'd never heard of RNode until now. I'm using Meshtastic & APRS at the moment. These new modulation methods are really incredible. 73, HB9GUF

What alternatives do you see? For example: In the Ham Radio world, we have multiple redundant frequency- bands and modulation methods to communicate in case of a grid-down scenario. #hamradio

Good point. The great unknown awaits. #bitcoin

If it was in the 🇺🇸, then it was the state Governor's car.

Thanks Jeff. Would be interesting to dive deeper into what "investing" would looking like under a BTC standard (BTC as a MOE): How could bonds (issuing debt) be valued based on those holding BTC on layer-2 (would today's cost-of-debt, cost-of-capital, WACC equations apply?)? If there is no debt-issuance, how can debt be created - or should it? Would we forego debt all together and only have equity? In your example: Investing in Ego Death, Fediment, etc.: we're purchasing shares (ok, maybe convertible notes that turn into shares....but go with it..) with no guarantee, promise or backing of a return or yield (the investor owns 100% of the risk) Would we just cancel debt-instruments and only have 1. BTC as MOE & 2. Equity (shares)? Is it even possible (under a BTC-standard) to issue equity without debt? What does that look like? As you say, it's hard to see the system, when you're in the system....in this case, it's difficult to calculate how, exactly, capitalism (debt/equity issuance) will function under a BTC standard - would today's financial mathematics even apply in a future BTC world?

Not true. There's ample evidence in history of sound monetary systems (gold/silver-backed) where savers would would invest (purchase debt or equity) in capital projects which would deliver their original principle + yield + on-top profits for the banks & entrepreneurs. The British Pound in late 19th and early 20th century is a prime example: people would purchase the British Gilt which would yield a 6% return. Of course, eventually, the BOE f'd it up and printed "paper" against the pound (literally a pound of silver metal) to pay the yield to the depositors, which ended in catastrophe!

My question remains: is it possible on a BTC standard (21M) to offer a yield against risk? What could that look like? Of course, it will likely never be "6% yield, fully backed!" - but what could it be? What could it look like? Or, are we relegated to the fact that BTC can ONLY be a medium of exchange: no yield, no investments, no capital, just MOE...?

Would be interested to learn more about how to xmit BTC using Ham radio. Which modes could be used? I assume the TCP/IP layer is still required at some point in the process? Knowing that Ham radio is not (may not be) encrypted, would your private keys be exposed if you tried to send BTC to another wallet via the Ham bands? Digital modes are getting better & better - I especially like LORA/Meshtastic - Very cool stuff - 73, Ernie, HB9GUF

nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe is coming back on nostr:npub10qrssqjsydd38j8mv7h27dq0ynpns3djgu88mhr7cr2qcqrgyezspkxqj8 tomorrow ⚡️

Let me know if you have any questions for Jeff 🤙

If you haven’t seen our first conversation, here it is from about a year ago:

Could you please ask him to elaborate how his POV differs from Saylor regarding "Medium of Exchange" vs. "Digital Property"? Also: Jeff does not believe BTC can be/should be financialized (no earning yield from BTC!)...can he explain why not?