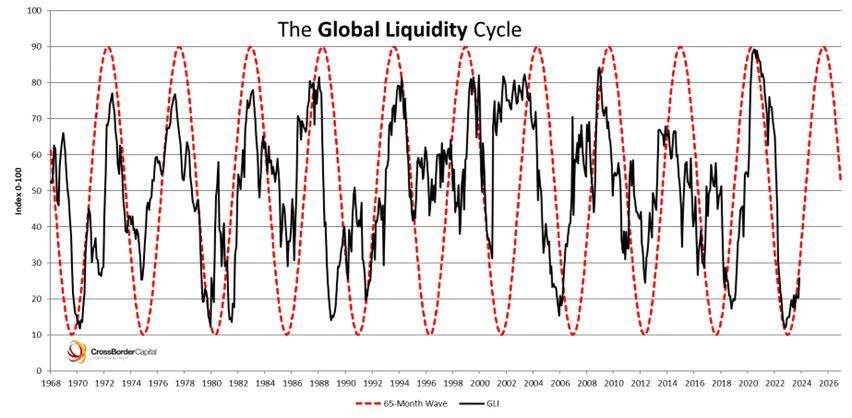

IMO it's unlikely that the expansion will be driven by credit creation this time around. No source of productivity anymore to issue credit for. Most likely direct full banking via central banks and govs. Will be nasty.

#m=image%2Fjpeg&dim=852x418&blurhash=ZERp2pkC%25NoftRayxuj%5DxuM%7Bofxua%7DWBj%5DayWBf6_NayaeofM%7Bt7WBj%5Bf6xuWBWBt7ayRjfkofof&x=4f9e97947749e53d37186b4013b764915092a90167a087ded3cc550e6cd21862

#m=image%2Fjpeg&dim=852x418&blurhash=ZERp2pkC%25NoftRayxuj%5DxuM%7Bofxua%7DWBj%5DayWBf6_NayaeofM%7Bt7WBj%5Bf6xuWBWBt7ayRjfkofof&x=4f9e97947749e53d37186b4013b764915092a90167a087ded3cc550e6cd21862

If you look at the EU "digital wallet" it's actually primarily a certificate wallet. I.e. access control to things. You need it now for resume/CV application, dirvers licenses, soon other certificates.

In some countries you already have a hard time getting public services without those digital certificates. Soon that single repository will be used for things like housing access, differential interest rate, likely gov money/subsidies soon as well. Refugees often have to use it for all kinds of things already. It's a carrot and stick approach. If covid happened today it would be used for EU wide access control and money drops.

Money (and the broader credit system) is a coordination mechanism. Much of that function can and is being replaced by certificates, algorithms, etc. Price setting of commodities and industrial goods hasn't been market driven in decades. Differential subsidies and bailouts has lead to differential interest rates and therefore real prices.

Thinking of CBDC as a money equivalent is unimaginative at best.

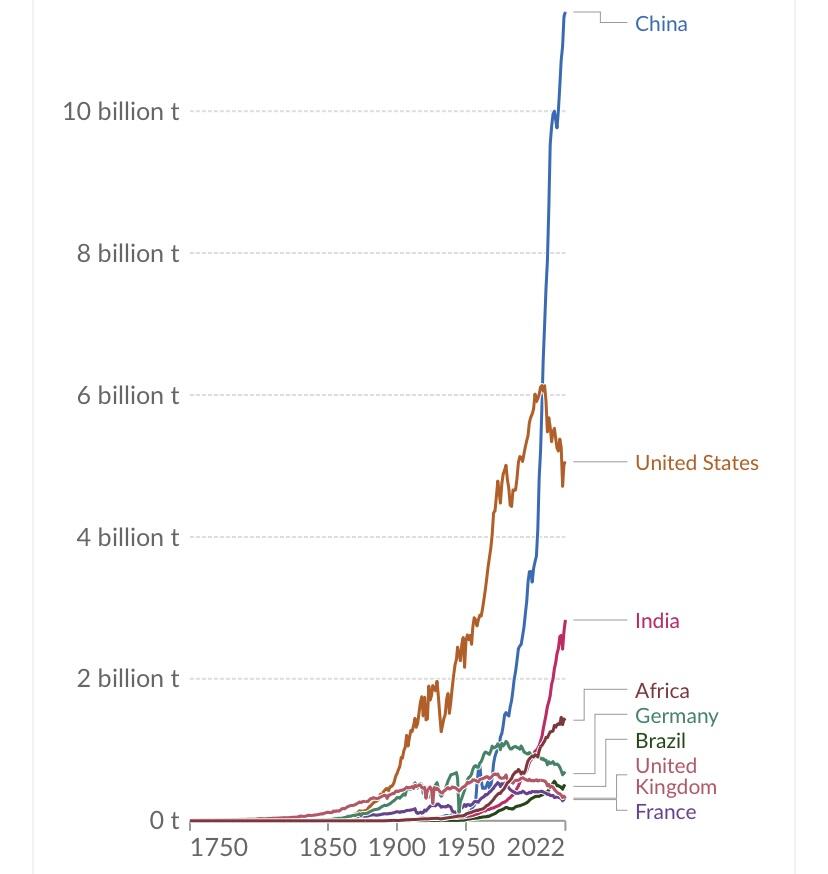

Should be adjusted for:

- methane emissions

- Carbon sink opportunity cost (e.g. Brazilian Forrest turned soybean for cattle)

- adjusted for net consumption, not as is the case in this graph production.

With the replacement of labor slowly becoming electricity (via AI and robotics) rather than fossil fuels this graph starts to become meaningful. BTC would represent the marginal replacement cost of labor, and therefore using BTC as a denominator becomes possible.

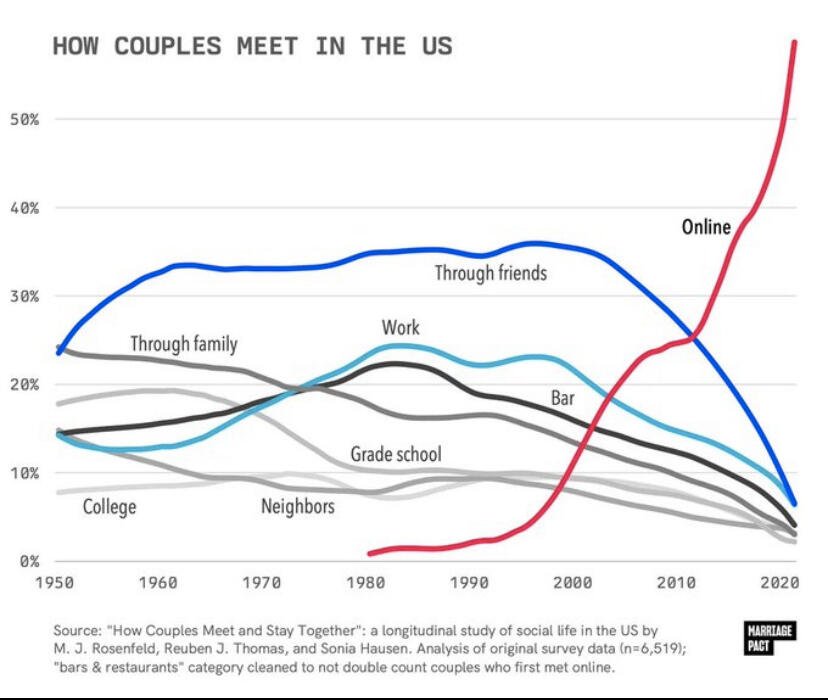

Looks like the graph shows *couples*. Now imagine what that graph looks like just for sexual encounters.

Futureshock.

This assumes there is growing surplus value extraction afterwards. That's the difference today.

https://wiki.p2pfoundation.net/Vectoral_Class

It's the Vectoral class.

Difference is

1. Zuck is easily dislikeable.

2. Sam put on a good show on in DC, similar to SBF's strategy.

3. Libra from a US perspective didn't add anything at the time, and created more risks. Now US regulators are scared from AI so anything that is pitched as protection is an easy sell.

You're not wrong, but the possible yield gains and overal efficiency gains can be enormous.

The Haber-Bosch method was used for war, to expand "lebensraum" as land was used for primary energy. Therefore agrarian land was a primary constraint of empire which morphed into cultural assumptions about expansion.

They could not imagine that the Haber-Bosch process made land grabs practically obsolete for the expansion of primary energy. Culture did not catch up.

Same is happening with AI now. Assumptions about labor, identity, etc, leading to strange "solutions" due to culture not catching up.

Futureshock.