**Pentagon Seeks To Justify Syria Occupation Through More Raids On ISIS**

Pentagon Seeks To Justify Syria Occupation Through More Raids On ISIS

US Central Command announced Monday that US commandos conducted a successful early morning helicopter raid on an ISIS hideout in northern Syria, resulting in the death of a suspected senior Syrian ISIS leader.

CENTCOM said the target, Abd-al-Hadi Mahmud al-Haji Ali, has been confirmed killed, in an operation that was launched **based on intelligence saying ISIS was plotting to kidnap officials abroad**. But US officials didn't name any target countries where such plots might be executed.

?itok=txaUdlwP\

?itok=txaUdlwP\

_Illustrative: US Army image_ ( ?itok=txaUdlwP)

?itok=txaUdlwP)

"We know ISIS retains the desire to strike beyond the Middle East," CENTCOM spokesman Col. Joe Buccino asserted in a statement (https://thehill.com/policy/defense/3954639-senior-isis-leader-suspected-killed-in-us-raid/). "This raid deals a significant blow to ISIS operations in the region but does not eliminate ISIS’ capability to conduct operations."

"Two other armed individuals were killed on the target," the statement continued, and claimed that no civilians were killed or injured in the raid. Additionally, CENTCOM Commander Gen. Erik Kurilla described: "Though degraded, ISIS remains able to conduct operations within the region with a desire to strike beyond the Middle East," and vowed to **"continue the relentless campaign against ISIS."**

Lately there have been **bipartisan efforts to force President Biden to pull all American troops out of Syria**. So far these Congressional moves have failed (https://www.zerohedge.com/political/more-dems-republicans-voted-favor-gaetz-bill-end-occupation-syria), but it has increased the pressure on the administration and the Pentagon to seek to justify the years-long occupation.

The "answer" has been to attempt to show the American public that ISIS remains a threat that "requires" the Pentagon's ongoing presence. But the reality is that the US is occupying the country's oil and gas producing region, effectively blocking the Assad government and population from accessing its own vital resources, also at a moment of Washington's far-reaching sanctions which has increased the suffering of common people.

But it's also true that ISIS continues to strike, as international reports highlighted over the weekend (https://www.upi.com/Top_News/World-News/2023/04/16/syria-truffle-hunt-killed-isis/5241681679579/):

> _**A truffle hunter was killed Sunday by a suspected ISIS fighter in the Syrian desert**._

> _The civilian was in the Hama province, east of the city of Hama when an unknown gunman shot and killed him, the Syrian Observatory for Human Rights (https://www.syriahr.com/en/295954/) reports. The killing is the latest example of the dangers of hunting for the edible underground desert fungus._

>

> _Twelve more civilians were also attacked in the area. They were said to be members of the Al-Bosraya tribe, according to SOHR (https://www.syriahr.com/en/295942/). Four escaped while the other eight have not been unaccounted for. Hunters were also fired upon, again by suspected ISIS members, on Saturday._

>

> _Truffle trapping is a common practice in Syria where truffles command a high price on the market. They can be sold for up to $35 per kilogram, The New York Times (https://www.nytimes.com/2023/04/10/world/middleeast/syria-truffles-war.html) reports. Hunters may earn more than $400 per day by selling what they find._

There have been other reports of a **spate of killings related to impoverished Syrians collecting truffles**, likely by ISIS:

> Is ISIS killing truffle hunters in #Syria (https://twitter.com/hashtag/Syria?src=hash&ref_src=twsrc%5Etfw)?

>

> Both al-Monitor staff and SOHR report that they are.https://t.co/VjKcZIbrUB (https://t.co/VjKcZIbrUB) via @AlMonitor (https://twitter.com/AlMonitor?ref_src=twsrc%5Etfw)

>

> — Joshua Landis (@joshua\_landis) April 11, 2023 (https://twitter.com/joshua_landis/status/1645933636020064256?ref_src=twsrc%5Etfw)

The Syrian Army and its Russian and Iranian partner forces have also been directly waging war on remnant ISIS terrorists. All three countries have actually at various times **accused the US of allowing ISIS and other Islamist terrorists cells to fester**, in order to falsely justify the ongoing occupation of a sovereign country.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 20:25

https://www.zerohedge.com/military/pentagon-seeks-justify-syria-occupation-through-more-raids-isis

**Gun-Free Zones, Red Flag Laws Only Make Gun Crime Worse: Economist**

Gun-Free Zones, Red Flag Laws Only Make Gun Crime Worse: Economist

_Authored by Michael Clements via The Epoch Times (https://www.theepochtimes.com/john-lott-gun-free-zones-red-flag-laws-only-make-gun-crime-worse_5197796.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge) (emphasis ours),_

Two of the most popular gun control proposals have little to no effect on gun crime and actually exacerbate the problem for the people they’re supposed to protect, according to economist, researcher, and author John Lott.

**“Those are the people who are harmed,” Lott told seminar participants at the National Rifle Association’s Annual Meetings and Exhibits in Indianapolis.**

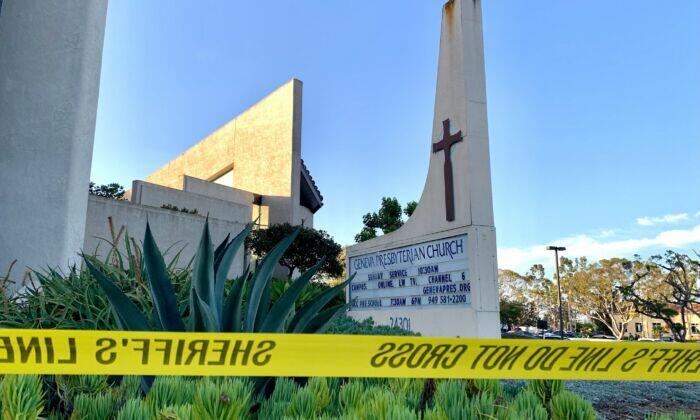

?itok=Ph_okpXf\

?itok=Ph_okpXf\

_Police tape at Geneva Presbyterian Church after a shooting left one dead and five injured in Laguna Woods, Calif., on May 15, 2022. (John Fredricks/The Epoch Times)_ ( ?itok=Ph_okpXf)

?itok=Ph_okpXf)

Lott is considered an authority on guns and crime, having authored more than 100 peer-reviewed articles and 10 books on the subject. He led two seminars discussing the effectiveness of gun-free zones, red-flag laws, and other gun control measures.

He said the story of Nikki Goeser encapsulates the shortcomings of these laws.

Goeser is the author of “ **Stalked and Defenseless: How Gun Control Helped My Stalker Murder My Husband in Front of Me.**” She’s also the executive director of the Crime Prevention Research Center (CPRC), of which Lott is the president.

?itok=O3CRLwUK\

?itok=O3CRLwUK\

_People walk past a “Gun Free Zone” sign posted on 40th Street and 7th Avenue in New York on Aug. 31, 2022. (Michael M. Santiago/Getty Images)_ ( ?itok=O3CRLwUK)

?itok=O3CRLwUK)

Goeser was scheduled to speak at the event but couldn’t attend because of family obligations.

Fourteen years ago, Goeser and her late husband, Ben, operated a karaoke business. A man the couple had met became infatuated with her and began stalking her.

While Goeser had a license to carry a concealed pistol, at the time, it was illegal in her home state of Tennessee to carry a firearm in any business that served alcohol.

One night, while running their karaoke business, Goeser’s stalker showed up and shot her husband seven times in front of her. Goeser’s situation was known to the police, but the stalker had been undeterred.

Lott said Goeser has stated that she isn’t sure she could have stopped the crime if she had had her pistol. But she’s confident that complying with the law ensured that she couldn’t protect her husband or herself.

“ **As the title of her book says, she was denied the chance**,” he said.

?itok=jF4yAdhL\

?itok=jF4yAdhL\

_Buffalo supermarket shooting suspect Payton Gendron in a jail booking photograph. (Erie County District Attorney’s Office via AP)_ ( ?itok=jF4yAdhL)

?itok=jF4yAdhL)

Lott told the gathering that Goeser’s story is a perfect example of the problems with gun-free zones.

According to statistics from the CPRC, **94 percent of mass shootings since 1950 have occurred in gun-free zones.**

Lott said one well-known mass killer explained his reasoning in a manifesto written the year before he struck.

The 19-year-old man who killed 10 people in a Buffalo, New York, grocery store on May 14, 2022, has been described as a right-wing racist, Lott said. But, while he was an avowed racist, Lott said the shooter described himself as an environmentalist and eco-terrorist.

In his manifesto, the shooter claimed that minorities were damaging the environment by having too many children, and that’s why he decided to attack black people.

“Attacking in a weapon-restricted area may decrease the chance of civilian backlash,” Lott quoted from the shooter’s writings. “… ‘areas where CCW \[concealed weapons\] are outlawed or prohibited may be good areas of attack,’ and ‘areas with strict gun laws are also great places of attack.’”

_Read more **here... (https://www.theepochtimes.com/john-lott-gun-free-zones-red-flag-laws-only-make-gun-crime-worse_5197796.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge)**_

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 20:05

https://www.zerohedge.com/political/gun-free-zones-red-flag-laws-only-make-gun-crime-worse-economist

**Manhattan Parking Garage Collapses, Kills One**

Manhattan Parking Garage Collapses, Kills One

Late Tuesday afternoon, shortly after markets closed, a parking garage in Lower Manhattan collapsed, resulting in the death of one person and five others injured, reported FDNY.

Footage posted on Twitter shows the twisted wreckage of steel and concrete resulting from the collapse of the second floor of the four-story parking garage at 57 Ann Street. Although the building remains standing, the entire structure is at risk of crumbling.

> Garage collapse in the Financial District in downtown NYC. 🙏 Praying that the garage workers made it out. pic.twitter.com/5CyBa1VcfB (https://t.co/5CyBa1VcfB)

>

> — Erasmo Guerra (@erasmoguerra) April 18, 2023 (https://twitter.com/erasmoguerra/status/1648419093496700928?ref_src=twsrc%5Etfw)

There is video footage from inside the building during the collapse.

> 🚨#UPDATE (https://twitter.com/hashtag/UPDATE?src=hash&ref_src=twsrc%5Etfw): The incident was caught on footage from a vehicle parked inside the garage after there was reports of an explosion and collapse in a parking garage at Ann St and William St in Manhattan. Multiple people reportedly trapped possibly feared dead. Some buildings near the… pic.twitter.com/Y5G0n0FgKR (https://t.co/Y5G0n0FgKR)

>

> — R A W S A L E R T S (@rawsalerts) April 18, 2023 (https://twitter.com/rawsalerts/status/1648432091741257728?ref_src=twsrc%5Etfw)

According to the FDNY, six workers were in the building during the collapse, and all have been located. Of the six, one individual was killed, four were hospitalized and are in stable condition, and the other worker refused medical attention.

> FDNY officials provide an update on a parking garage collapse in Lower Manhattan https://t.co/nTinhAuMZy (https://t.co/nTinhAuMZy)

>

> — FDNY (@FDNY) April 18, 2023 (https://twitter.com/FDNY/status/1648438309595795457?ref_src=twsrc%5Etfw)

FDNY's robo-dog surveyed the incident area.

> The FDNY’s robot dog is a Dalmatian - it’s checking the parking garage collapse in lower Manhattan pic.twitter.com/OeHuAyvm9t (https://t.co/OeHuAyvm9t)

>

> — LilEsBella 💅🏽 (@LilEsBella) April 18, 2023 (https://twitter.com/LilEsBella/status/1648449359686828034?ref_src=twsrc%5Etfw)

The cause of the building collapse was not yet known.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 19:45

https://www.zerohedge.com/markets/manhattan-parking-garage-collapses-kills-one

**Why "Net Zero" Is Not A Rational U.S. Energy Policy**

Why "Net Zero" Is Not A Rational U.S. Energy Policy

_Authored by Jonathan Lesser via RealClear Wire (https://www.realclearwire.com/articles/2023/04/17/why_net_zero_is_not_a_rational_us_energy_policy_893528.html),_

**Despite Germany’s last-ditch attempt at realism, the European Union recently approved (https://link.edgepilot.com/s/60a0b2f9/V6Ad5hBKc0qxmWV6vNAWqg?u=https://e360.yale.edu/digest/eu-gas-car-phaseout-2035) a 2035 ban on gas-powered cars, moving ahead with its “net zero” emissions agenda (https://link.edgepilot.com/s/7a4c4522/Y-ySS2WHIEWX_OnBbxtfjA?u=https://twitter.com/TimmermansEU/status/1640673961624084480).** In the U.S., the cost (https://link.edgepilot.com/s/ae0a188b/h8lEQaIFhEiTWlxNNxj_Ng?u=https://netzerowatch.us4.list-manage.com/track/click?u=c920274f2a364603849bbb505%26id=ff163ce64a%26e=41215d19b8) of achieving net-zero carbon emissions would be staggering – $50 trillion if the goal is reached by 2050 – as would the demand for raw materials, which in most cases would exceed current annual worldwide production.

_

?itok=MsdtHWdU)_

**The impact on world climate, however, would be negligible.** Emissions in developing countries will continue to increase as those countries’ focus is economic growth for their citizens, not permanent economic misery to “save” the climate. Although a recent _Washington Post_article (https://link.edgepilot.com/s/b1879915/PcYO7e3T1EiBFuectPbLMQ?u=https://www.washingtonpost.com/opinions/2023/03/15/rebecca-solnit-climate-change-wealth-abundance/) suggests that wealth be viewed in terms of “joy, beauty, friendship, community, \[and\] closeness to flourishing nature,” impoverished individuals who cook with animal dung – such as 80% of the population in the African nation of Burkina-Fasso – aren’t likely to find much joy and beauty in economic misery. Granted, having to cook with animal dung ensures “closeness to nature,” although probably not the one the article’s author envisions.

Rather than approaching energy policy clearly, the U.S. (and most of the western world) is pursuing so-called “net zero” energy policies aiming to fully electrify western economies, while relying almost entirely on wind and solar power. **The additional required electricity – after all, the wind doesn’t always blow, and the sun sets nightly – would supposedly be supplied by energy storage batteries or hydrogen-powered generators. Two factors drive these policies.**

First, there is climate hysteria, which promotes claims that have either proven to be false (the “end of snow (https://link.edgepilot.com/s/4003b0c9/9Tt0_cUEJkKKqjmAmSkg3g?u=https://www.the-american-interest.com/2013/06/01/64062/)” in Great Britain, the disappearance of glaciers (https://link.edgepilot.com/s/a2b3acde/KaC_M4pgOkmhb3fsRcwgrg?u=https://earthobservatory.nasa.gov/WorldOfChange/Glacier) in Glacier National Park) or posit extreme (https://link.edgepilot.com/s/76148ce2/cJPr9aq6C0uLeqAHnkQPkA?u=https://cei.org/blog/worst-case-emissions-scenario-rcp8-5-is-dead-bbc/) scenarios (complete agricultural collapse (https://link.edgepilot.com/s/e9ae0294/KFC3HZevF0yO9aRIwXTzCQ?u=https://time.com/6152615/ipcc-report-climate-change-agriculture/), massive sea level increases (https://link.edgepilot.com/s/134eb405/_7LFqiYvK0ux4sP-xQFfRQ?u=https://www.theguardian.com/environment/2015/jul/10/scientists-predict-huge-sea-level-rise-even-if-we-limit-climate-change), more frequent hurricanes (https://link.edgepilot.com/s/c1fcf3eb/esX3aY_Oykqu3GWPAFuM2w?u=https://www.reuters.com/business/environment/how-climate-change-is-fueling-hurricanes-2022-09-20/)). The actual evidence is to the contrary, including increased (https://link.edgepilot.com/s/aef25698/G4eMDASxME6ByN9KLzp7Ag?u=https://www.usda.gov/media/blog/2020/03/05/look-agricultural-productivity-growth-united-states-1948-2017) agricultural yields, minimal (https://link.edgepilot.com/s/1508453a/k1pWl-dYdkKhz3VKp5Ua1g?u=https://wattsupwiththat.com/2023/02/21/further-exploration-of-historical-sea-level-rise-acceleration/) sea level rise, and no increases (https://link.edgepilot.com/s/95e923fa/O5FpTeDllUy8muNTrmtqeg?u=https://link.springer.com/article/10.1007/s11069-020-04219-x%23citeas) in observed hurricane frequency.

Second, **these policies are driven by old-fashioned greed.** Green energy subsidies, which were already large, have been hugely expanded under the Biden Administration’s Inflation Reduction Act (IRA). The IRA is a virtual smorgasbord of green energy subsidies for offshore wind, solar power, electric vehicles, and charging infrastructure. The green energy pork (https://link.edgepilot.com/s/7e6e4c0a/_IuTsDb75kOv_JgD761_dw?u=https://www.wsj.com/articles/why-pretend-green-pork-will-s…

https://www.zerohedge.com/energy/why-net-zero-not-rational-us-energy-policy

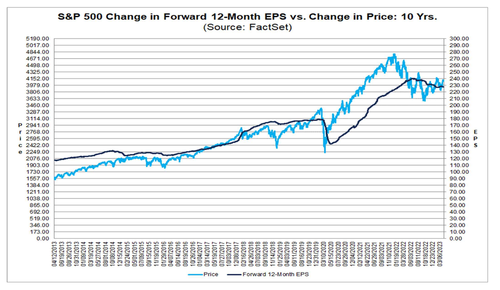

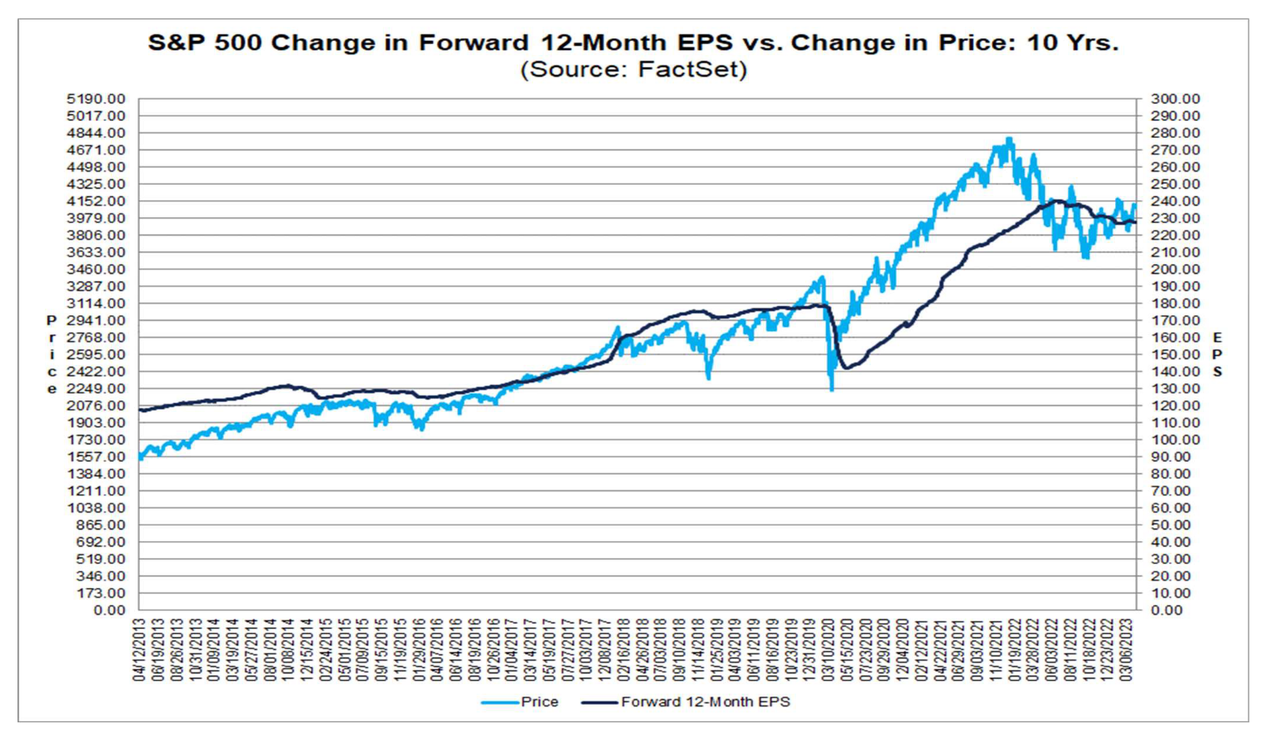

**Q1 Earnings Season Starts Off With A Bang... And The Best Beat Rate In Over 10 Years**

Q1 Earnings Season Starts Off With A Bang... And The Best Beat Rate In Over 10 Years

Week after week, starting in December 2022 Morgan Stanley's Mike Wilson was swearing up and down to anyone who listened that _**only he**_ sees just how bad this earnings season will be, and _**only he**_ has a clue how unprepared investors are for the coming carnage. Eventually, his fire and brimstone sermon became so grating and contagious that other banks - such as Goldman - jumped on the bearish board, and eventually consensus S&P expectations did in fact drop, if nowhere near low enough to catch down to Mike Wilson's expectations. But the bottom line from a growing number of analysts and experts was clear: earnings would be terrible and possibly worse.

?itok=kZpQx7dh (

?itok=kZpQx7dh ( ?itok=kZpQx7dh)

?itok=kZpQx7dh)

And then something remarkable happened: earnings in the first quarter, the quarter when according to Mike Wilson would see everything crash down (actually he said that about Q4 22 but when it didn't happen he just pushed forward his forecast one quarter up), are coming in much stronger than the morose consensus expects.

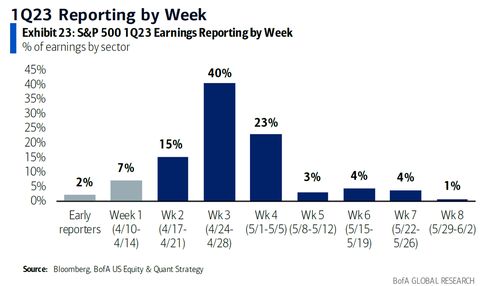

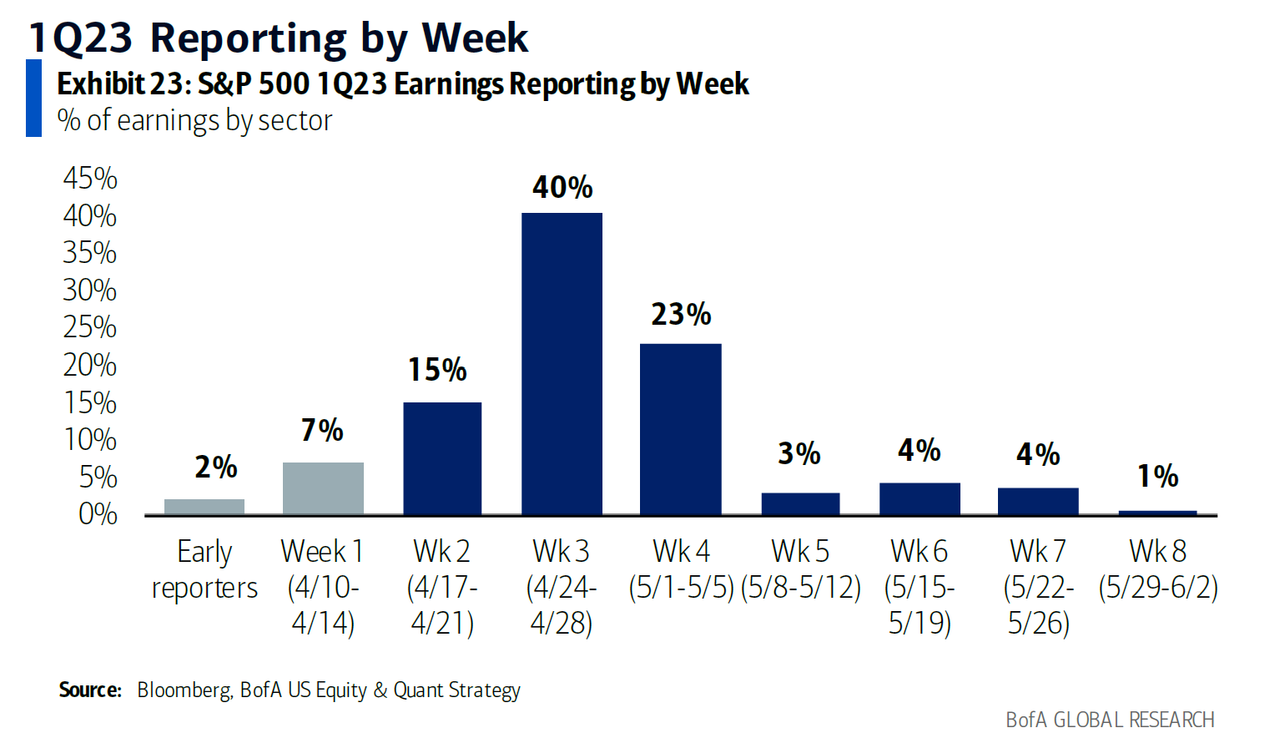

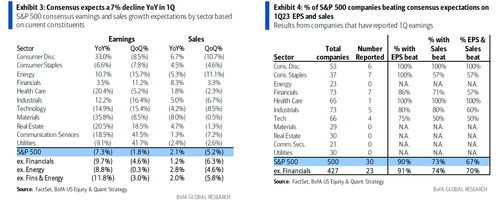

As Bank of America's Savita Subramanian writes in her first weekly Earnings Tracker for Q1 (available to pro subs in the usual place (https://www.zerohedge.com/premium)), following Week 1 in which 30 S&P 500 companies (including early reporters) comprising 10% of earnings reported...

?itok=SBZNr4Ws (

?itok=SBZNr4Ws ( ?itok=SBZNr4Ws)

?itok=SBZNr4Ws)

... results have been blowout: **90% of companies beat on EPS, 73% on sales, and 67% on both,** well above last quarter’s 54%/83%/46% post-Week 1 and historical average of 67%/64%/48%. Fueled by big bank beats, **Q1 EPS is tracking a 30bp surprise.**

?itok=sUTOgldd (

?itok=sUTOgldd ( ?itok=sUTOgldd)

?itok=sUTOgldd)

Putting this in context, according to Savita this is the " **best beat rate after Week 1 since at least 2012"**(at least for now).

To be sure, there is a reason for this blowout start to Q1 earnings season, and it has to do with the big banks, which as we said have emerged as massive beneficiaries from the bank run that crippled that small and regional banking sector in March. Here is Savita:

> **Big banks’ solid results (JPM, C, WFC beat on revenue and EPS) despite March’s bank scare helped performance.** JPM saw increased deposits vs. peers declining 3% in 1Q23 but warned on outflows from here. Other non-banks benefited from March’s regional outflows – e.g. mega-cap Blackrock saw $40B+ inflows into cash-management products. Banks may be tightening credit standards, but larger ones are operating with excess capital vs. prior crises. JPM/WFC bought back stock in 1Q and expect to continue in 2023, an increasingly scarce positive amid potentially slowing buybacks in general.

Still, despite reporting on what may end up being the best earnings season relative to dramatically slashed expectations in over a decade, Bank of America - which like Mike Wilson - is very bearish on the outlook, suggests that - what else - the earnings drop may not have started but it will come... eventually... the same argument Mike Wilson trots out every Monday when he has to explain to his client how he kept them out of the 3800 to 4200 rally in the past 5 months.

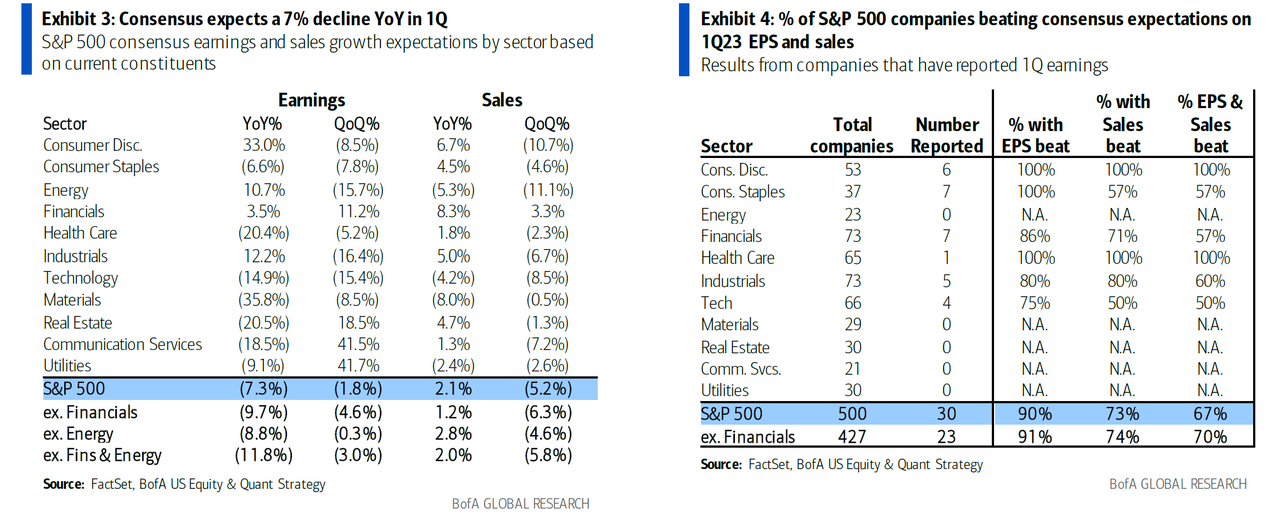

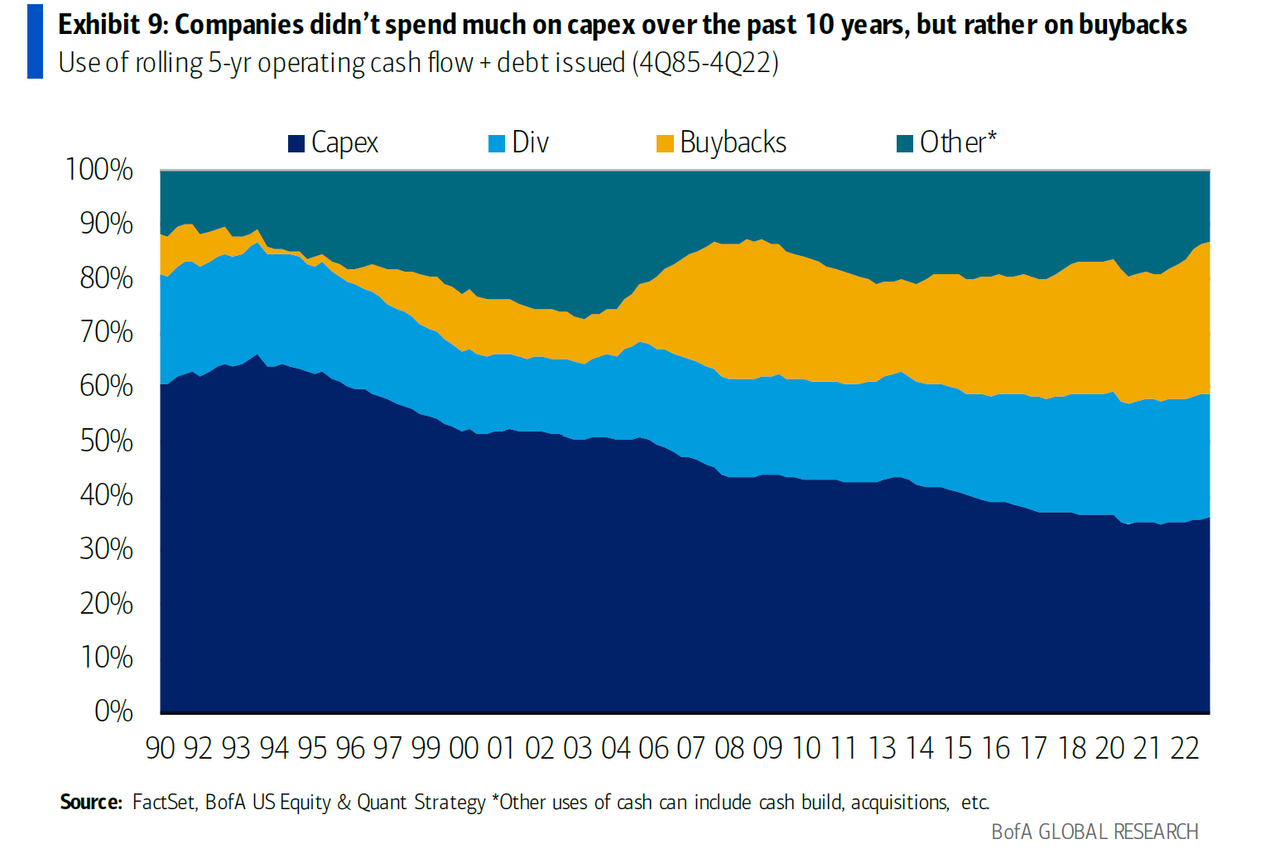

> A massive, systemic financial confidence shock appears to have been averted, **but tighter credit is manifesting in the real economy:** Fastenal, an industrial bellwether, cited softer March sales especially in manufacturing, and consumption slowed in March across income cohorts. **Capex, usually hit hard by a credit cycle, has remained robust and could buck trend given multiple secular tailwinds.**

>

>  ?itok=C12mI-na (

?itok=C12mI-na ( ?itok=C12mI-na)

?itok=C12mI-na)

>

> Tech capex and stock buybacks may be more at risk, where Tech, Communication Services, and Health Care have been the biggest beneficiaries.

That said, Bank of America is ready to capitulate on its bearish outlook should the strength in earnings persists, and as Subramanian writes, " **our 2023 EPS forecast ($200 vs. $220 consensus) could be too low if March’s events prove to be idiosyncratic and temporary."** Furthermore, the recent decline in rates has catalyzed some early cycle leadership like housing, where demand is recovering. Bu…

https://www.zerohedge.com/markets/q1-earnings-season-starts-bang-and-best-beat-rate-over-10-years

**Then There Were Nine: Comer Alleges A Wider Range Of Potential Biden Beneficiaries from Possible Influence Peddling**

Then There Were Nine: Comer Alleges A Wider Range Of Potential Biden Beneficiaries from Possible Influence Peddling

_Authored by Jonathan Turley via jonathanturley.org (https://jonathanturley.org/2023/04/18/then-there-were-nine-comer-alleges-a-wider-range-of-potential-biden-beneficiaries-from-possible-influence-peddling/),_

House Oversight Committee Chairman James Comer has revealed that **there are not three but nine members of the Biden family (https://nypost.com/2023/04/17/six-more-bidens-may-have-gained-from-family-business-schemes-comer/) that may have benefitted from suspected influence peddling efforts.** For those of us who have long criticized the corrupt practices of the Biden family, the identity of these other family members is intriguing after the Committee secured new bank and financial records. Democratic members again insisted that there is no need to investigate such influence peddling.

?itok=D-_ExcQo (

?itok=D-_ExcQo ( ?itok=D-_ExcQo)

?itok=D-_ExcQo)

The new information on the Biden family is due largely to the takeover of the House by the GOP. Previously, Democrats blocked efforts to investigate influence peddling by the Biden family for years.

After assuming control of the Committee. **Comer sought suspicious activity reports (https://nypost.com/2023/03/15/house-panel-set-to-review-biden-family-suspicious-bank-reports/) sent by banks to the Treasury Department alerting of potential criminal activity in transactions involving President Biden’s family.**

He stated on Monday that “We’ve identified six additional members of Joe Biden’s family who may have benefited from the Biden family’s businesses that we are investigating, bringing the total number of those involved or benefiting to nine.” Those are six names beyond the previously discovered payments to linked to at least three Biden family members (https://nypost.com/2023/03/16/comer-reveals-new-biden-family-member-who-got-china-cash-prez-dined-with-her-friday/)and two associates from China in 2017. That $3 million was wired Biden family associate Rob Walker in March 2017, who then allegedly divided and distributed the funds later.

**There remains an “Unknown Biden” who received four payments in 2017 totaling $70,000.**

The investigation into the Bidens has made many in the Beltway uncomfortable. Influence peddling has long been the favored form of corruption in this city, but few families seemed to have cashed into the extent of the Bidens.

I frankly do not understand the willingness of so many Democrats to cover for the Bidens. Democratic members have gone all in with censorship, but this is an effort to scuttle investigations into corruption that may have resulted in millions of dollars going to Biden family members.

**The Biden family has long been associated with influence peddling to the degree that they could add an access key to their family crest.** Influence peddling has long been a cottage industry in Washington. For decades, I have written about this loophole in bribery laws. It is illegal to give a member of Congress or a president even $100 to gain influence. However, you can literally give millions to their spouses or children in the forms of windfall contracts or cozy jobs.

James Biden has been remarkably (even refreshingly) open about marketing his access to his brother. Former Americore executive Tom Pritchard and others allege the Biden openly referenced his access to his brother and his family name in his pitch for clients. James has faced a wide array of litigation over allegedly fraudulent activities as well as a personal loan acquired through Americore before it went into bankruptcy.

Hunter worked with his uncle but also branched off on his own in the family business. While his father recently emphasized that his son was a hopeless addict, that defense stands in glaring contradiction to the fact that he maintained a multimillion-dollar influence-peddling scheme. The question is why foreign figures (including some associated with foreign intelligence) rushed to him international money transfers and complex deals worth millions from Moscow to Kyiv to Beijing.

However, the Biden most concerned may be the president himself. **Joe Biden has repeatedly denied knowledge of Hunter Biden’s business entanglements despite numerous emails and pictures showing him meeting with Hunter associates**. That includes at least 19 visits to the White House by Hunter’s partner, Eric Schwerin, alone between 2009 and 2015.

While emails on Hunter Biden’s laptop make repeated reference to his father as a possible recipient of funds derived from influence peddling. Indeed, in one email, Tony Bobulinski, then a business partn…

**Saudi Foreign Minister Lands In Syria, Meets Assad, In 1st Since War's Start In 2011**

Saudi Foreign Minister Lands In Syria, Meets Assad, In 1st Since War's Start In 2011

This is the visit that Washington policymakers and establishment Middle East "experts" have been dreading, and **signals that the West's proxy war to oust Assad is definitively over - at least in terms of the end of hawks and neocons' longtime hope of seeing Assad overthrown**...

Saudi Foreign Minister Prince Faisal bin Farhan landed in Damascus on Tuesday for the first time since the start of the war in 2011.

?itok=lg04ojFu\

?itok=lg04ojFu\

_Image: Saudi Foreign Ministry_ ( ?itok=lg04ojFu)

?itok=lg04ojFu)

It's also an image that many thought would never happen, and paves the way for a possible future visit of Assad to Saudi Arabia, where he could eventually meet directly with King Salman or crown prince Mohammed bin Salman.

The high-level visit comes just following last week's "surprise" trip by Syrian Foreign Minister Faisal Mekdad to the kingdom. Clearly, relations are fast being restored and rumors are that the next move is for Assad to be invited back into the Arab League.

According to a summary of Tuesday's visit in regional news source Al-Monitor (https://www.al-monitor.com/originals/2023/04/saudi-foreign-minister-arrives-syria-meets-assad):

> _Farhan was received by Syrian President Bashar al-Assad. **The two discussed efforts towards finding a "political solution" to the Syria conflict that would "preserve Syria's unity, security, stability, Arab identity, and territorial integrity."**_

>

> _They also talked about the **"return of Syria to its Arab fold and the resumption of its natural role in the Arab world,"** according to a statement from the Saudi Ministry of Foreign Affairs._

Already the United Arab Emirates (UA) had resumed relations with Syria in 2018. Other regional countries now seem to be lining up to restore normal relations.

> 📷 \| pic.twitter.com/YxjC766s5T (https://t.co/YxjC766s5T)

>

> — Foreign Ministry 🇸🇦 (@KSAmofaEN) April 18, 2023 (https://twitter.com/KSAmofaEN/status/1648334447605952515?ref_src=twsrc%5Etfw)

For example, Tunisia and Syria agreed to fully restore relations last week, after a three-day visit of Syrian FM Mekdad to Tunis.

This wave of thawed relations between Assad and Arab states was without doubt helped to a large degree by the China-brokered peace deal between Saudi Arabia and Iran. Syria is Iran's closest ally in the Levant, and is also a hub of support to Lebanese Hezbollah. It's likely to complicate the US-brokered Abraham Accords, and may hinder recognition between Saudi Arabia and Israel.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 18:25

**Texas Coordinates With ATF To Share Income Of Residents For Warrantless Monitoring**

Texas Coordinates With ATF To Share Income Of Residents For Warrantless Monitoring

_Authored by Emily Miller via The Epoch Times (https://www.theepochtimes.com/exclusive-texas-coordinates-with-atf-to-share-income-of-residents-for-warrantless-monitoring_5200341.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge) (emphasis ours),_

**Texas secretly gives its citizens’ incomes to the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).** Documents show this has led to at least one person being monitored by the feds (https://www.theepochtimes.com/atf-gains-financial-information-on-potential-gun-buyers-for-warrantless-tracking-documents-show_5119085.html) without a warrant through the federal gun background check system. The Texas Workforce Commission (TWC) told The Epoch Times that it has written contracts with ATF for “sharing income information” for criminal investigations. The revelation may lead to oversight by the legislature.

?itok=UcuxT8Pc\

?itok=UcuxT8Pc\

_Firearms in Houston, Texas, on February 18, 2023. (Mark Felix/AFP via Getty Images)_ ( ?itok=UcuxT8Pc)

?itok=UcuxT8Pc)

Texas state Rep. Briscoe Cain, a Republican, is “deeply troubled” about this coordination with the state’s unemployment agency and federal government.

“ **My office will be looking into whether the Texas Workforce Commission is assisting the ATF in the Biden Administration’s mission to violate the constitutional rights of law-abiding Texans**,” Cain told The Epoch Times after reviewing the emails obtained by Gun Owners of America (GOA) as part of its ongoing FOIA lawsuit.

This is the third part in an exclusive Epoch Times series (https://www.theepochtimes.com/atf-gains-financial-information-on-potential-gun-buyers-for-warrantless-tracking-documents-show_5119085.html) on the ATF giving information on innocent suspects to the Federal Bureau of Investigation (FBI) for daily monitoring through the National Instant Criminal Background Check System (NICS). The FBI uses NICS as a database of people who are prohibited from possessing or buying guns.

**Texan’s Income Exposed**

In one of the documents, an ATF agent emailed the FBI that a person suspected of straw purchasing or firearms trafficking needed to be put into the gun background check database. The agent wrote that “per TWC,” the man’s “reported wage earnings with the State of Texas do not appear to supply the financial means to afford the firearms purchased.”

**The ATF agent requested on Dec. 28, 2020, that the Texan’s gun purchases be monitored daily for 90 days.** However, as previously reported (https://www.theepochtimes.com/exclusive-documents-show-fbi-and-atf-warrantless-surveillance-through-gun-background-checks_4981696.html), the FBI wrote to ATF that its agents could request an extension of the monitoring for as long as they wanted.

Texas’s role in the program was uncovered in the ATF’s ninth production of documents to GOA as part of a Freedom of Information Act (FOIA) lawsuit. The 42 pages are more heavily redacted than the previous ones given to GOA. There are seven pages of blacked-out information before the source of the income of the person in Texas is shown as TWC.

“One would think that a pro-gun state like Texas would not be handing over gun owners’ confidential financial information to the federal government without a warrant or likely even without probable cause,” Rob Olson, an attorney for GOA, told The Epoch Times.

**Second Amendment Sanctuary?**

A spokeswoman for TWC said in a statement: “Federal and State law provides a path for sharing income information with a federal governmental agency if the federal agency can establish a purpose that is permissible under law and enters into a written agreement which sets forth legal requirements regarding allowable use and protection of the information.” She also said a warrant to release salary information is not required by law.

_Read more **here...** (https://www.theepochtimes.com/exclusive-texas-coordinates-with-atf-to-share-income-of-residents-for-warrantless-monitoring_5200341.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge)_

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 18:05

**Mysterious Russian T-90 Tank Appears At Louisiana Gas Station**

Mysterious Russian T-90 Tank Appears At Louisiana Gas Station

A Russian third-generation main battle tank seized by Ukrainian forces was left in a parking lot off Interstate 10 highway in Louisiana last week. Photos of the tank were posted on Reddit and shared with the military blog The War Zone (https://www.thedrive.com/the-war-zone/russian-t-90-tank-from-ukraine-mysteriously-appears-at-u-s-truck-stop).

Employees at Peto's Travel Center and Casino in Roanoke, Louisiana, told the military website that someone had left the T-90A battle tank after the truck hauling it broke down.

?itok=x6vbOZf1 (

?itok=x6vbOZf1 ( ?itok=x6vbOZf1)

?itok=x6vbOZf1)

"I've been here seven years," assistant manager Valerie Mott told _The War Zone_ on Thursday. She added, "I've never seen \[a tank\] here before."

?itok=A2IMulaM (

?itok=A2IMulaM ( ?itok=A2IMulaM)

?itok=A2IMulaM)

The extent to which the tank was demilitarized remained unclear. The War Zone reported that its machine guns had been removed, but there was no information if the main gun was sealed up to prevent future use.

?itok=huZ9gQxQ (

?itok=huZ9gQxQ ( ?itok=huZ9gQxQ)

?itok=huZ9gQxQ)

Both Mott and truck stop manager Cody Sellers are unaware of who left the tank, its origin, or its intended destination.

Mott said whoever was hauling the tank returned to Houston to retrieve a new truck and asked if they could store it at the truck stop.

?itok=Y5YiuFv1 (

?itok=Y5YiuFv1 ( ?itok=Y5YiuFv1)

?itok=Y5YiuFv1)

According to one Twitter user "Naalsio," a self-proclaimed OSINT expert, the tank in Louisiana "belonged to Russia's 27th Separate Guards Motorized Rifle Brigade, 1st Guards Tank Army."

They continued: "It was abandoned in Kurylivka, Kharkiv Oblast around 25 September 2022. It was captured by Ukraine's 92nd Separate Mechanized Brigade, hence the yellow 9s on the tank while in Louisiana (this is the marking the 92nd puts on their equipment)."

> It's rather this T-90A that was captured in Kurylivka, Kharkiv Oblast in September 2022.https://t.co/hMLq76T1gY (https://t.co/hMLq76T1gY)

>

> Interesting that the tank is now in the US. pic.twitter.com/vnxwNiY7Cm (https://t.co/vnxwNiY7Cm)

>

> — Naalsio (@naalsio26) April 13, 2023 (https://twitter.com/naalsio26/status/1646370061693640704?ref_src=twsrc%5Etfw)

As for the owner of the tank, it continues to be a mystery:

> _"My opinion is this tank is probably owned by a private citizen or company._

>

> _"It doesn't seem likely the military would leave something like that unattended," a spokesperson from US military base in Lousiana told The War Zone._

So where's the tank headed?

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 17:45

https://www.zerohedge.com/military/mysterious-russian-t-90-tank-appears-louisiana-gas-station

**The US Could Use Some Separation Of Media And State**

The US Could Use Some Separation Of Media And State

_Authored by Caitlin Johnsone via medium.com (https://caityjohnstone.medium.com/the-us-could-use-some-separation-of-media-and-state-ec0667edb2eb),_

**The US State Department’s spokesperson Ned Price is being replaced (https://thehill.com/homenews/administration/3944961-obama-era-doj-spokesman-matthew-miller-tapped-for-state-department-role/) by a man named Matthew Miller**. Like Price, Miller has had extensive prior involvement in both the US government and the mass media; Price is a former CIA officer and Obama administration National Security Council staffer (https://apnews.com/article/us-state-department-diplomacy-ned-price-6728385b18b29bab86ec7fd461658041) who for years worked as an NBC News analyst (https://archive.is/2SdqB#selection-1770.2-1793.58), while Miller has previously had roles (https://vianovo.com/people/matthew-miller) in both the Obama and Biden administrations and spent years as an analyst for MSNBC.

?itok=H5u5rigI)

Like every high-level government spokesperson, **Miller’s job will be to spin the nefarious things the US empire does in a positive light and deflect inconvenient questions with weasel-worded non-answers.** Which also happens to be essentially the same job as the propagandists in the mainstream media.

In journalism school you are taught that there’s supposed to be a sharp line between government and the press; journalists are meant to hold the government to account, and there’s an obvious conflict of interest there if they’re also friends with government officials or are looking to the government as a potential future employer. But at the highest levels of the world’s most powerful government and the world’s most influential media platforms the line between media and state is effectively nonexistent; people flow seamlessly between roles in the media and roles in the government depending on who’s in office.

> MSNBC analyst Matthew Miller will replace former MSNBC analyst Ned Price as spokesperson for the Biden State Department https://t.co/fywJyduN70 (https://t.co/fywJyduN70)

>

> — Saagar Enjeti (@esaagar) April 12, 2023 (https://twitter.com/esaagar/status/1646144592796950529?ref_src=twsrc%5Etfw)

We see this indistinctness between government and media with White House press secretaries even more clearly. The current press secretary Karine Jean-Pierre (https://en.wikipedia.org/wiki/Karine_Jean-Pierre) is a former analyst for NBC News and MSNBC, and the last press secretary **Jen Psaki (https://en.wikipedia.org/wiki/Jen_Psaki) now has her own show on MSNBC.** Prior to her stint as White House press secretary Psaki worked as a CNN analyst, and before that she was a spokesperson for the State Department like Price and Miller.

At a recent event for the news startup Semafor, Psaki was asked (https://thehill.com/homenews/media/3943957-psaki-says-she-considers-herself-a-journalist/) if she considers herself a journalist and she said she does, adding that “to me, journalism is providing information to the public, helping make things clearer, explaining things.” Which is a bit funny considering that Psaki’s political faction has spent the last seven years furiously insisting that WikiLeaks founder Julian Assange is **_not_** a journalist. In liberal brainworms land the world’s greatest journalist is not a journalist at all, but Joe Biden’s spin doctor is because she’s got a knack for “explaining things”.

Lest you get the mistaken impression that this phenomenon is unique to Democrats and their aligned media outlets, it should here be noted that Trump’s press secretary Sarah Huckabee Sanders got a job as a Fox News contributor (https://en.wikipedia.org/wiki/Sarah_Huckabee_Sanders#Career_after_the_White_House) immediately after resigning from that position, and now she’s the governor of Arkansas. Another Trump administration press secretary, Kayleigh McEnany (https://en.wikipedia.org/wiki/Kayleigh_McEnany), is now an on-air contributor to Fox News, and previously worked for CNN. Trump’s first press secretary Sean Spicer reportedly (https://www.nbcnews.com/politics/politics-news/networks-pass-sean-spicer-paid-contributor-role-n802781) _tried_ to get jobs with CBS News, CNN, Fox News, ABC News and NBC News after his stint in the White House, but was turned down by all of them because nobody likes him.

Without any clear lines between the media and the state, **US media are not meaningfully different from the state media the west spends so much energy decrying in “tyrannical regimes” like Russia and China.** The only difference is that in Tyrannical Regimes the government controls the media, while in Free Democracies the government **_is_** the media.

> Look at t…

https://www.zerohedge.com/political/us-could-use-some-separation-media-and-state

**China 'Surgically' Hits Foreign Firms As US Tech War Worsens**

China 'Surgically' Hits Foreign Firms As US Tech War Worsens

The US-driven "technology blockade" has greatly infuriated China, causing them to surgically target Western companies as the relationship between the two nations continues to deteriorate, according to Financial Times (https://www.ft.com/content/fc2038d2-3e25-4a3f-b8ca-0ceb5532a1f3#comments-anchor).

In the last two months, Chinese officials have hit US defense firms Lockheed Martin and Raytheon with new sanctions (https://www.zerohedge.com/geopolitical/china-hits-lockheed-martin-raytheon-retaliatory-sanctions-amid-balloon-saga), raided US due diligence firm Mintz and arrested staff, detained a top executive from Japan's Astellas Pharma group, hit London-headquartered Deloitte (https://www.zerohedge.com/markets/deloittes-beijing-office-suspended-china-over-deficiencies-huarong-audit) with a massive fine, and launched an investigation into US chipmaker Micron.

> _**"China has not abandoned its strategy of restraint to shift to a new position of wide-ranging retaliation, but they're going to surgically select companies to demonstrate their frustration,"** said Paul Haenle, a former China adviser to President George W Bush and Barack Obama._

The decision to go after Western firms is a sign of strained relations.

?itok=ka-84OHE (

?itok=ka-84OHE ( ?itok=ka-84OHE)

?itok=ka-84OHE)

It's a wake-up call for Western firms with large footprints in China.

?itok=X1PeQksC (

?itok=X1PeQksC ( ?itok=X1PeQksC)

?itok=X1PeQksC)

According to two people from foreign risk consultancy groups, the incidents at Mintz and Astellas have led to an urgent review of employee safety in China.

> _**"This has been a wake-up call for the industry.**_

>

> _"It is hard for the due diligence players — the **levels of paranoia in China are so high** — but it also affects 'blue-chip' service firms and outfits like Bain, McKinsey and Boston Consulting Group," one of the people said._

The issue with Beijing fostering a hostile environment for foreign companies operating on its soil is that it will undermine efforts to restart the world's second-largest economy (https://www.zerohedge.com/markets/china-unexpectedly-cuts-reserve-ratio-banks-injecting-73bn-stimulate-economy).

> _"It all goes back to the fact that China is facing a lot of challenges this year, particularly on the economic side._

>

> _**"The last thing they need to do is be distracted by an even more hostile relationship with the US,**" said Dexter Roberts, a senior fellow at the Atlantic Council, a Washington think-tank._

As there is no immediate solution to the deteriorating Sino-US relations, Beijing's countermeasures could expand, given the ongoing technological and military competition between the two nations.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 17:05

https://www.zerohedge.com/geopolitical/china-surgically-hits-foreign-firms-us-tech-war-worsens

**Leaked Document Reveals The US Spying On UN Secretary-General**

Leaked Document Reveals The US Spying On UN Secretary-General

_Authored by Dave DeCamp via AntiWar.com,_ (https://news.antiwar.com/2023/04/17/leaked-document-reveals-the-us-spying-on-the-un-secretary-general/)

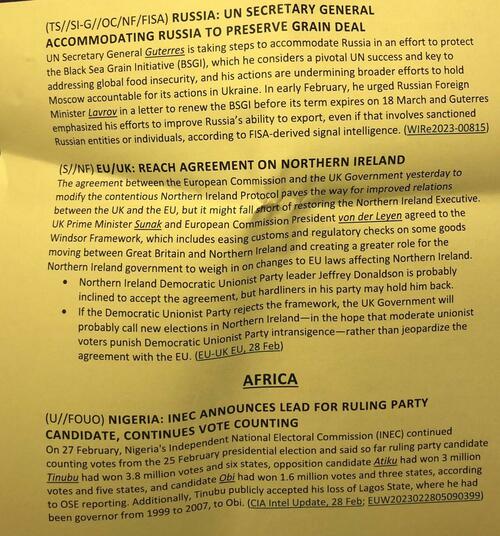

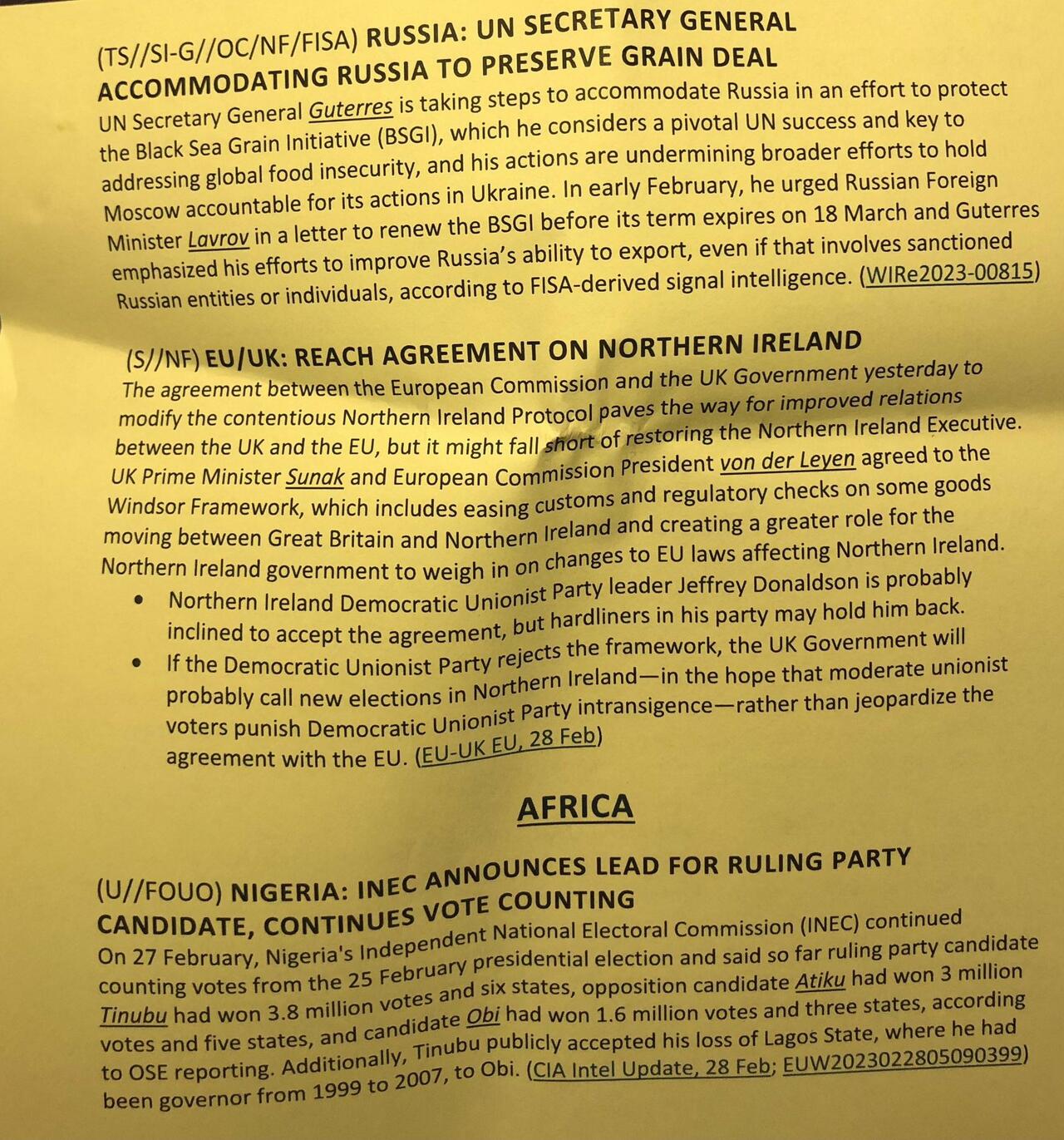

Classified documents allegedly leaked by Air National Guardsman Jack Teixeira have revealed that the US is closely **spying on UN Secretary-General Antonio Guterres and is not happy with his engagement with Moscow**.

Several documents detail Guterres’ communications, including one that **accuses him of "undermining" efforts to take action against Russia over its invasion of Ukraine**. The document addresses his communications with Moscow regarding the grain deal that unlocked Ukraine’s Black Sea ports.

?itok=KAuFENoz\

?itok=KAuFENoz\

_Getty Images_ ( ?itok=KAuFENoz)

?itok=KAuFENoz)

To broker the deal between Moscow and Kyiv, the UN agreed to help facilitate the export of Russian fertilizer and grain, which has been hindered by Western sanctions despite exemptions for agricultural goods.

The document reads: _"UN Secretary-General Guterres is taking steps to accommodate Russia in an effort to protect the Black Sea Grain Initiative (BSGI), which he considers a pivotal UN success and key to addressing global food insecurity, and his actions are undermining broader efforts to hold Moscow accountable for its actions in Ukraine."_

The document was likely written either in late February or early March before Russia and Ukraine agreed to extend the grain deal on March 18. It says in early February, Guterres "urged Russian Foreign Minister Sergey Lavrov in a letter to renew the BSGI before its term expires on March 18 and Guterres emphasized his efforts to improve Russia’s ability to export, even if that involves sanctioned Russian entities or individuals, according to FISA-derived signal intelligence."

_Leaked document that shows US intelligence on Guterres:_

?itok=PLbm0Ou_ (

?itok=PLbm0Ou_ ( ?itok=PLbm0Ou_)

?itok=PLbm0Ou_)

**Signal intelligence refers to information obtained by intercepting communications**. In response to the revelation that the US was spying on Guterres, his spokesman, Stephane Dujarric, told _Al Jazeera_ (https://www.aljazeera.com/news/2023/4/13/pentagon-leak-suggests-us-felt-un-chief-soft-to-russia-report)that he is **"not surprised by the fact that people are spying on him and listening in on his private conversations."**

"What is surprising is the malfeasance or incompetence that allows for such private conversations to be distorted and become public," Dujarric said. Other documents detailed private communications between Guterres and his deputy. (https://www.bbc.com/news/world-us-canada-65257957)

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 16:45

https://www.zerohedge.com/geopolitical/leaked-document-reveals-us-spying-un-secretary-general

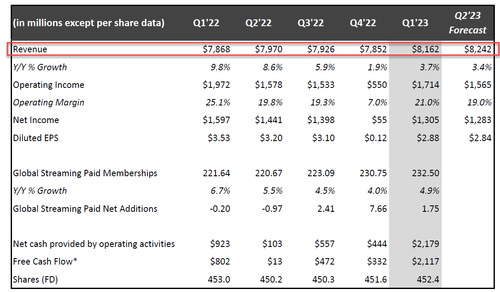

**WTI Rises After Bigger Than Expected Crude Draw**

WTI Rises After Bigger Than Expected Crude Draw

Oil prices ended marginally **higher after stronger-than-expected China GDP growth** which prompted overnight gains. But most of that was given back by the close as **a key German investor sentiment survey weighed on crude**, "as optimism for the eurozone's largest economy remains downbeat in the coming quarters," said Edward Moya, senior market analyst at OANDA, in a market update.

> _"Oil isn't getting any good news here and that means prices could continue to hover around the $80 a barrel level, or even see a tentative dip below if sellers get some help from a strong dollar."_

Expectations are for more inventory draws this week.

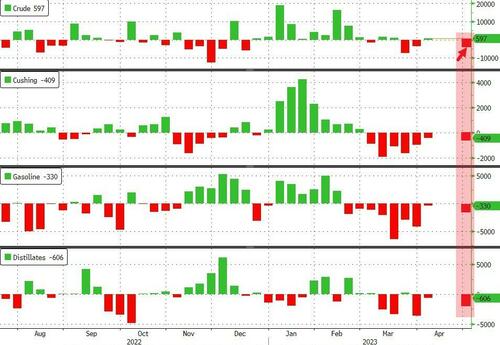

**API**

- **Crude -2.675mm (-500k exp)**

- Cushing -600k

- Gasoline -1.00mm (-1.2mm exp)

- Distillates -1.9mm (-900k exp)

The third weekly crude draw of the last four weeks. Stocks at Cushing saw another decline while product inventories rounded out the across-the-board decline in stocks...

?itok=Fq3UrOpp (

?itok=Fq3UrOpp ( ?itok=Fq3UrOpp)

?itok=Fq3UrOpp)

_Source: Bloomberg_

WTI was hovering around $80.80 ahead of the API data and rose very modestly after...

?itok=gZ_nkVnO (

?itok=gZ_nkVnO ( ?itok=gZ_nkVnO)

?itok=gZ_nkVnO)

Looking ahead, economic data will be in focus as a "strong economic recovery in China and the avoidance of hard landings in Europe and the U.S. are both priced into the market with WTI trading with an $80 handle," said analysts at Sevens Report Research in Tuesday's newsletter.

So, while the path toward new year-to-date highs in WTI is narrow, it is "possible," they said.

_**"Growth data in the U.S. and Europe will need to be Goldilocks while better-than-expected data from China would be a welcomed surprise."**_

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 16:35

https://www.zerohedge.com/energy/wti-rises-after-bigger-expected-crude-draw

**Blain: China Vs The USA - Does It Have To Be War?**

Blain: China Vs The USA - Does It Have To Be War?

_Authored by Bill Blain via MorningPorridge.com,_ (https://morningporridge.com/blog/blains-morning-porridge/china-vs-the-usa-does-it-have-to-be-war/)

_“One can’t afford to be emotional about China. One needs to be realistic.”_

**_China will remain the driver of global growth as the West continues to slide. The economy is reopening swiftly, raising increased fears of de-dollarisation. It’s easy to get emotional, but the reality is its happening, get used to it, and figure out the outcomes. They may surprise you.._**

?itok=NWYAjPYt (

?itok=NWYAjPYt ( ?itok=NWYAjPYt)

?itok=NWYAjPYt)

**The global economy constantly evolves.** The IMF’s latest global growth outlook released yesterday predicts China will contribute 22.6% of global growth through to 2028, while the US will be a laggardly 11.3%, behind India at 12.9%. Europe comes in too far down to even merit a mention in the press release, but the UK, France and Germany get to 5.5% – less than Indonesia, Russia and Brazil. (The rest of Europe is a rounding error.) It’s a clear sign the global economy is headed East and away from the Western Block. Not surprising – that’s where middle class consumer numbers are growing fastest!

The IMF outlook will be questioned by some, but the trend is undeniable. Meanwhile, this morning’s Chinese economic growth numbers were strong-ish, confirming consumers have embarked on a post Covid spending binge – up 10% (from a lockdown base last year) – but aren’t buying property. The market reacted badly to a slower than expected resumption in industrial production. Mixed economic numbers? How very Western of them… (And, yes, China also has banking problems and worries about debt..)

**If there is one big theme in the current market it is the question: do these numbers highlight how we stand at the end of the dollar era?**

It’s convenient to price everything in dollars – but it’s particularly positive for the nation that “owns” that currency. Markets have survived switches in the de-facto global currency many times, but not always the leading nation, (witness the bankruptcies of Spain and France in the 17th and 18th centuries). If de-dollarisation is really happening it raises a host of investment consequences regarding the implications of goods priced in other coin for the USA, plus potentially a Spanish like debt/inflation crisis! Western economic growth, domestic and international trade and geopolitics will be impacted. ( _No Sh\*t Sherlock award to myself for that blindingly obvious observation_…)

**There are substantial propaganda-driven “sub-themes” to how a post US-led global economy develops.** Many of these make arguments to fit narratives of China emerging as the leading financial power replacing the US which involve a whole lot of angst and conflict. For instance, China’s Belt and Road Initiative is either a perfectly sensible (but poorly executed) policy to build its’ future markets, or it’s a strategy to isolate the west and secure China’s supply chain. Is conflict inevitable or can trade triumph? We chose to read China’s new alliance of Poor/Global South nations that have come out against US hegemony re Ukraine as an attempt to encircle and diminish the West, not as genuine concern by these nations on the unreliability of the West – in which they have a point.

**As always there is middle ground.** At the core of the de-dollarisation debate is the role of China and the US as the dominant players. Which will be Rome and which is Carthage? Does it have to be resolved via conflict? 1989 suggests not.

I’ve read some great and some awful commentary on what de-dollarisation and the emergence of China means. Variously these mix up a whole slew of future outcomes.

- To some it’s the end of the US age of empire and/or the beginning of a new cold war which will divide the planet. To win, China must destroy the West… ( _There goes my investment in Baillie Gifford’s China fund…_)

- To others it’s simply a weaker dollar policy which will stimulate the US and Western economies to reindustrialise and onshore their economies, leading to new global trade accommodations which will feature more debate about demographics than missile tech.

- It spells a new period of global growth as Asia becomes the pre-eminent centre of wealth creation, and nothing much changes except the axis has moved… The US and the West will adapt.

The theme of a new cold war is dominant among the politically infected classes in the West. To them the USA has allowed itself to be usurped and overtaken by a seemingly more competent China which has aquired its lead illegally. ( _All is fair in love, geopolitics and cricket._) The case s…

https://www.zerohedge.com/geopolitical/blain-china-vs-usa-does-it-have-be-war

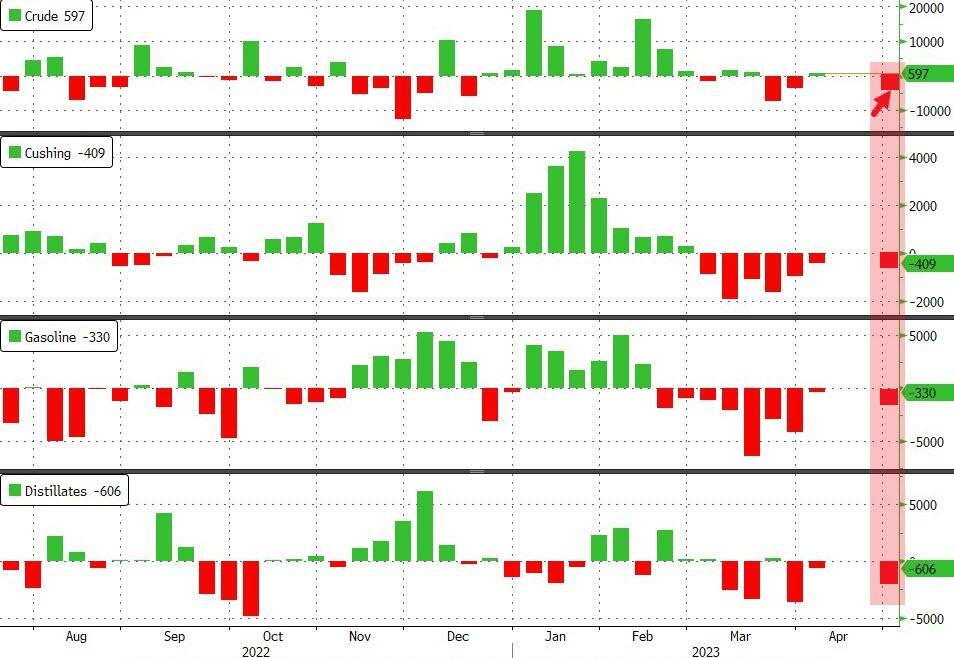

**Netflix Dumps'n'Pumps After Subscriber Miss; Slashed Forward Guidance**

Netflix Dumps'n'Pumps After Subscriber Miss; Slashed Forward Guidance

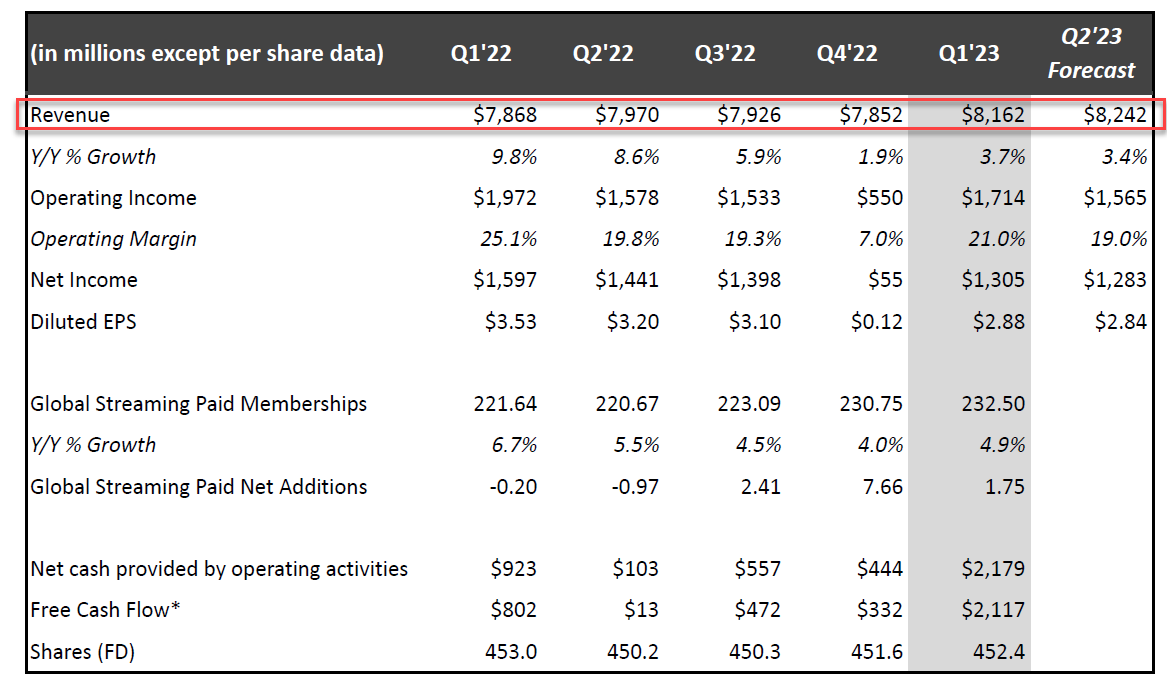

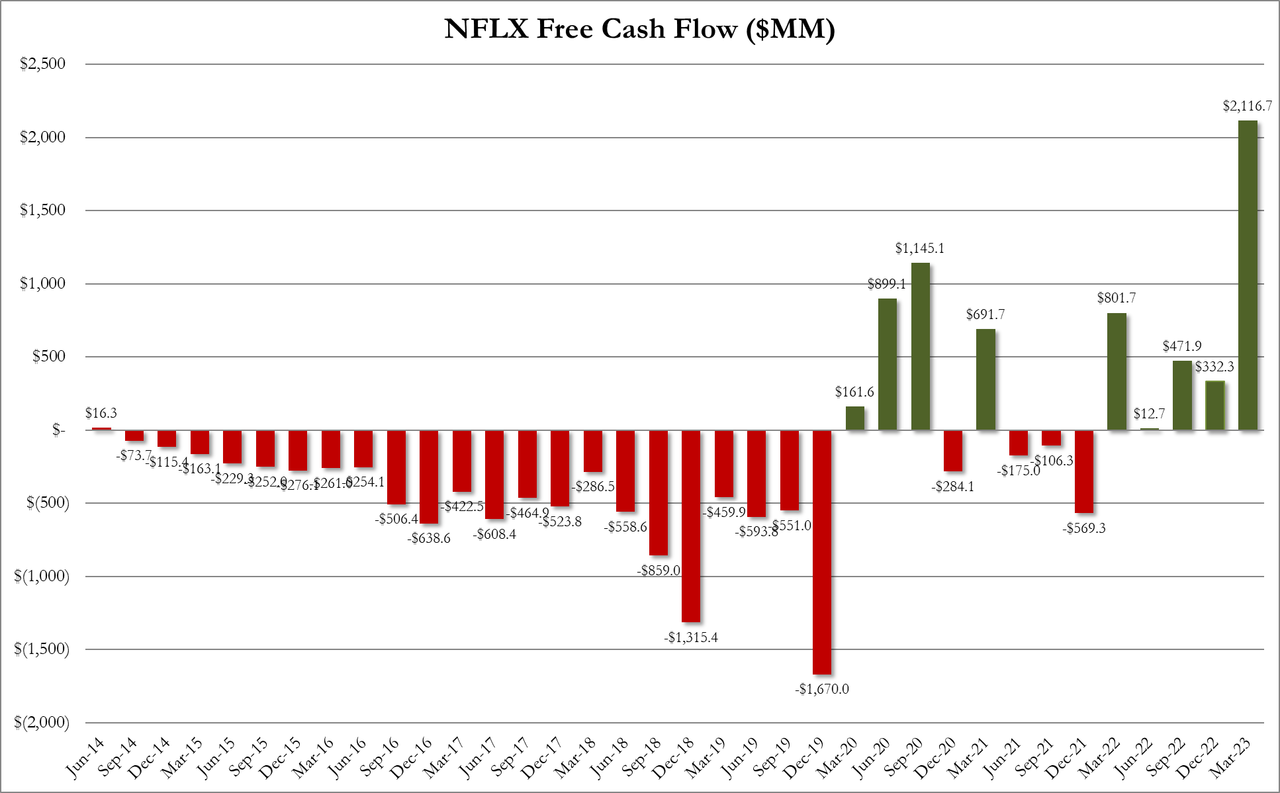

Netflix shares are sliding **flat** after hours following a top-line miss, sub-addition miss, and forward guidance cut...

?itok=UrXrGajB (

?itok=UrXrGajB ( ?itok=UrXrGajB)

?itok=UrXrGajB)

First things first, revenues missed expectations but EPS beat...

> _**\*NETFLIX 1Q REV. $8.16B, EST. $8.18B**_

>

> **_\*NETFLIX 1Q EPS $2.88, EST. $2.86_**

?itok=Iew-unsu (

?itok=Iew-unsu ( ?itok=Iew-unsu)

?itok=Iew-unsu)

Sub-additions rose less than expected...

> **_\*NETFLIX 1Q STREAMING PAID NET CHANGE +1.75M, EST. +2.41M_**

>

> _**\*NETFLIX 1Q STREAMING PAID MEMBERSHIPS 232.5M, EST. 233.0M**_

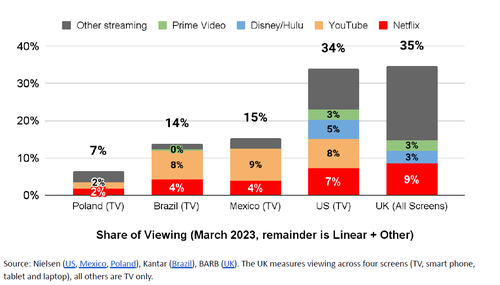

Latam Subs shrank (as password-sharing crackdowns went into place)...

- UCAN streaming paid net change +100,000 vs. -640,000 y/y, estimate +257,994

- EMEA streaming paid net change +640,000 vs. -300,000 y/y, estimate +830,707

- **LATAM streaming paid net change -450,000, -29% y/y, estimate +524,638** but **LATAM revenue increased 7% year over year**(+13% F/X neutral), with a 3% rise in ARM (+8% F/X)

- APAC streaming paid net change +1.46 million, +34% y/y, estimate +986,597

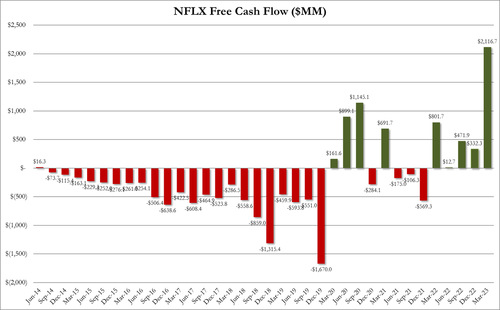

Free cash-flow exploded though and they upped guidance...

> Net cash generated by operating activities in Q1 was $2.2B vs. $0.9B in the prior year period.

>

> Free cash flow (FCF) in Q1 totaled $2.1B compared with $0.8B in last Q1.

>

> Assuming no material swings in F/X, **we now expect at least $3.5B of FCF for the full year 2023, up from our prior expectation of at least $3.0B.**

>

>  ?itok=ifiJqPhQ (

?itok=ifiJqPhQ ( ?itok=ifiJqPhQ)

?itok=ifiJqPhQ)

As Netlfix explains, **this reflects lower cash spend on content than we originally forecasted,** resulting in a year over year decrease in cash content spend (bringing our 2023 cash content to content amortization ratio closer to 1.0x in 2023). For 2024, we still expect our cash content spend to be in the range of roughly $17B, consistent with our prior expectations for the 2022-2024 period.

But to add to the pain, **they cut top- and bottom-line guidance for Q2...**

> _**\*NETFLIX SEES 2Q REV. $8.24B, EST. $8.47B**_

>

> _**\*NETFLIX SEES 2Q EPS $2.84, EST. $3.08**_

>

> _**\*NETFLIX SEES 2Q PAID NET ADDS \`ROUGHLY SIMILAR' TO 1Q**_

This has sent the stock plummeting 12% lower after hours...

?itok=iE0KlHuJ (

?itok=iE0KlHuJ ( ?itok=iE0KlHuJ)

?itok=iE0KlHuJ)

**This is the second year in a row where Netflix has gotten off to a shaky start.**

As Bloomberg notes, the company has been testing ways of charging customers for sharing accounts in Latin America, and rolled out plans in four territories in the first quarter. It said it would begin to charge for password sharing in the US, its largest market, in the next couple months. Analysts see this as a large potential source of new customers.

> _**“Widespread account sharing undermines our ability to invest in and improve Netflix for our paying members, as well as build our business,” t** he company said in a statement to investors._

>

> _“We’re pleased with the results of our Q1 launches in Canada, New Zealand, Spain and Portugal, strengthening our confidence that we have the right approach.”_

?itok=PIBmrPwg (

?itok=PIBmrPwg ( ?itok=PIBmrPwg)

?itok=PIBmrPwg)

The advertising tier debuted in November but has yet to contribute a material number of subscribers.

**The company had said that both advertising and password sharing will offer modest contributions in the first quarter** of the year but would pick up in the current period.

Finally, right before earnings, Netflix announced that after a 25 year run, **they've decided to wind down DVD.com later this year.**

?itok=b3htrD1b (

?itok=b3htrD1b ( ?itok=b3htrD1b)

?itok=b3htrD1b)

Those iconic red envelopes changed the way people watched shows and movies at home - and they paved the way for the shift to streaming.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/…

**Goldman Slides After FICC Revenue Unexpectedly Tumbles**

Goldman Slides After FICC Revenue Unexpectedly Tumbles

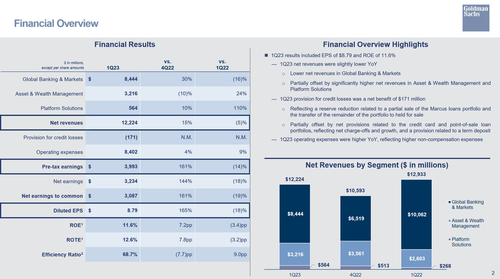

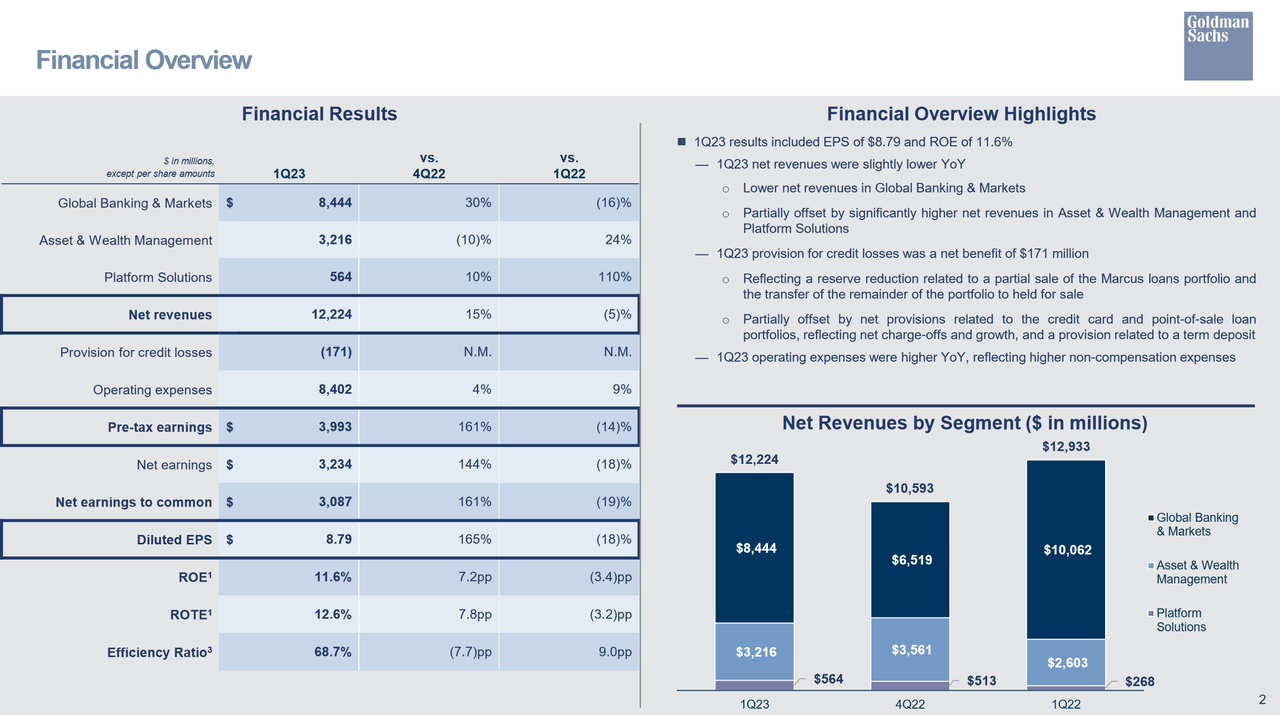

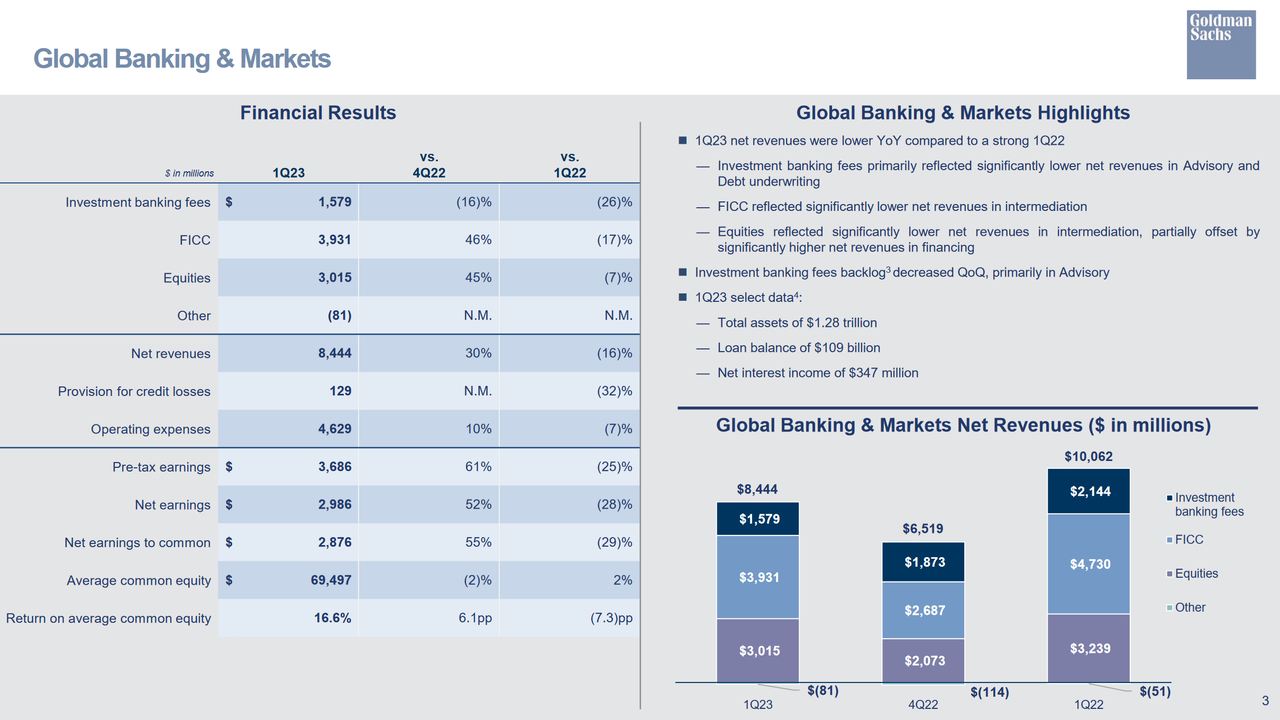

Goldman stock is tumbling this morning when the lack of a proper Net Interest Income revenue stream and overreliance on trading has - for once - come back to bite it, as the company's all-important FICC division reported far uglier results than most had expected, leading to a big and very rare miss in Goldman's revenue line.

Here is what the bank reported in Q1:

- EPS $8.79, _**beating**_ the estimate $8.21, and down 21% Y/Y

- Net revenue $12.22 billion, _**missing**_ estimate $12.8 billion, and down 5% Y/Y

- _The drop was due to lower net revenues in Global Banking & Markets, partially offset by significantly higher net revenues in Asset & Wealth Management andPlatform Solutions_

- Net interest income $1.78 billion, estimate $2.18 billion

So Net Interest Income missed; how did non-interest income do? Here is the top-line detail:

- FICC sales & trading revenue $3.93 billion, _**badly missing**_ the estimate $4.19 billion

- Global Banking & Markets net revenues $8.44 billion, _**missing**_ estimate $8.79 billion

- Investment banking revenue $1.58 billion, _**beating**_ estimate $1.54 billion

- Equities sales & trading revenue $3.02 billion, _**beating**_ estimate $2.83 billion

- Advisory revenue $818 million, _**beating**_ estimate $816.4 million

- Equity underwriting rev. $255 million, _**missing**_ estimate $250.4 million

- Debt underwriting rev. $506 million, beating estimate $477 million

?itok=_alabC8m (

?itok=_alabC8m ( ?itok=_alabC8m)

?itok=_alabC8m)

Goldman also offloaded a chunk of its $4 billion Marcus loan book, which led to a $440 million reserve release. **That helped boost profit more than analysts expected,** but earnings were still down 19% from a year earlier. Net revenue included a loss of approximately $470 million related to the partial sale of the portfolio and the transfer of the remainder to held-for-sale status.

Unlike other banks which suffered credit losses, for Goldman the Q1 credit loss provision was for a **net benefit** of $171 million; a vast improvement to the consensus estimate of a $828 million loss.

The gain reflected a reserve reduction related to a partial sale of the Marcus loans portfolio andthe transfer of the remainder of the portfolio to held for sale, and was partiallyoffsetbynetprovisionsrelatedtothecreditcardandpoint-of-saleloanportfolios, reflecting net charge-offs and growth, and a provision related to a term deposit.

But while the confusion over the Marcus loan book sale was bad, the big miss in FICC was the gut punch: fixed-income trading revenue tumbled 17%, and badly missing expectations, **leaving Goldman the only major Wall Street bank so far to have posted a drop for that business.** Incidentally, the revenue figure for FICC for the same period last year was up more than 20%.

?itok=Z27YqMBM (

?itok=Z27YqMBM ( ?itok=Z27YqMBM)

?itok=Z27YqMBM)

According to the bank, the drop in FICC revenue "reflected significantly lower net revenues in intermediation"

That said, the modest beat in equities-trading revenue helping to soften the blow; equities revenue reflected significantly lower net revenues in intermediation, partially offset by significantly higher net revenues in financing.

Investment banking revenue of $1.58BN beat expectations of $1.54BN, but was down a whopping 26% Y/Y "primarily reflected significantly lower net revenues in Advisory and Debt underwriting." The investment banking fees backlog also decreased QoQ, primarily in Advisory.

Here is some other select Q1 2023 data:

- Total assets of $1.28 trillion

- Loan balance of $109 billion

- Net interest income of $347 million

Turning to Goldman's Asset and Wealth Management business, which is the closest thing GS now has to a prop desk, the bank reported Q1 net revenues that were "significantly higher". It is also here that we find some more detail on the $470 million loss incurred as part of selling the Marcus loan portfolio.

Management and other fees primarily reflected the inclusion of NN Investment Partners (NNIP) and a reduction in fee waivers on money market funds

Private banking and lending included **a loss of ~$470 million related to a partial sale of the Marcus loans portfolio and the transfer of the remainder of the portfolio to held for sale,** partially offset by the impact of higher deposit spreads

Equity investments also reflected mark-to-market net gains from investments in public equities compared with significant mark-to-market net losses in 1Q22 (and most previous quarters), partially offset by significantly lower net gains from investments in private equiti…

https://www.zerohedge.com/markets/goldman-slides-after-ficc-revenue-unexpectedly-tumbles

**Dominos Falling? Brookfield Defaults On $161 Debt For DC Office Buildings**

Dominos Falling? Brookfield Defaults On $161 Debt For DC Office Buildings

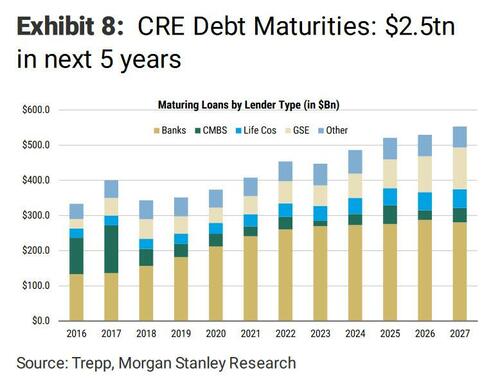

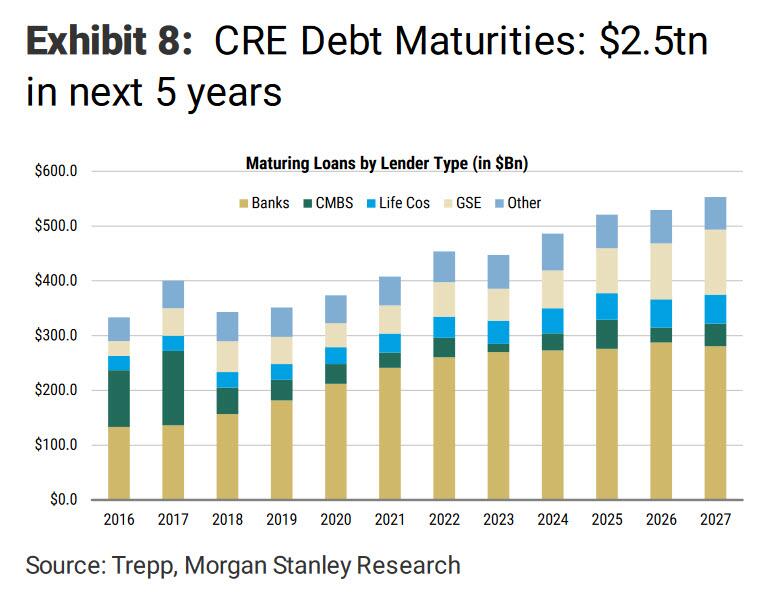

With recent stress in the regional banking sector, sentiment in US commercial real estate (CRE) - and especially the office sector - has turned negative as investors prepare for potential spillover effects (with JPM (https://www.zerohedge.com/markets/nowhere-hide-cmbs-cre-nuke-goes-small-banks-acount-70-total-commercial-real-estate-loans), Morgan Stanley (https://www.zerohedge.com/markets/new-big-short-hits-record-low-focus-turns-400-billion-cre-debt-maturity-wall), and Goldman Sachs (https://www.zerohedge.com/markets/state-commercial-real-estate-goldman-expects-sharp-spike-office-delinquency-rates) all joining the gloom parade), especially as high-profile defaults continue to make headlines as borrowers face higher debt service costs and refinancing becomes much harder ahead of a $400 billion CRE debt maturities this year alone.

The latest headline fueling concerns about a potential CRE crisis involves a Brookfield Corp. fund defaulting on a $161.4 million mortgage for twelve office buildings in Washington, DC.

According to Bloomberg (https://www.bloomberg.com/news/articles/2023-04-17/brookfield-defaults-on-161-million-debt-for-office-buildings), the loan was transferred to a special servicer working with "the borrower to execute a pre-negotiation agreement and to determine the path forward."

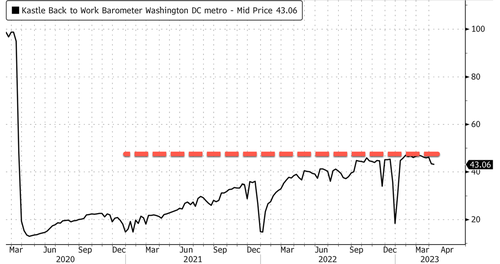

Real estate data firm Green Street said DC office space values had slid 36% through March compared with a year ago due to rising vacancies amid the rise of remote and hybrid work post-Covid.

The gold-standard measure of office occupancy trends is still the card-swipe data provided by Kastle Systems. The average office occupancy across Washington, DC, is only 43% and has yet to recover to pre-pandemic levels.

?itok=MGdYk6aP (

?itok=MGdYk6aP ( ?itok=MGdYk6aP)

?itok=MGdYk6aP)

Brookfield has also defaulted on debt tied to two Los Angeles buildings, the Gas Company Tower and the 777 Tower.

A spokesperson from the company blamed the pandemic for its CRE challenges.

> _"While the pandemic has posed challenges to traditional office in some parts of the US market, this represents a very small percentage of our portfolio."_

Brookfield could potentially be the first in a series of companies defaulting on their office space loans. We've pointed out that the state of the CRE market (https://www.zerohedge.com/markets/state-commercial-real-estate-goldman-expects-sharp-spike-office-delinquency-rates) is in dire shape as delinquency rates across property types, particularly offices, are rising. The lending environment is getting tougher ahead of $400 billion in CRE debt maturities this year.

?itok=IlMee-yM (

?itok=IlMee-yM ( ?itok=IlMee-yM)

?itok=IlMee-yM)

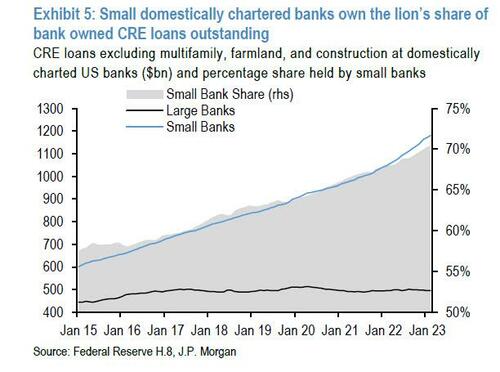

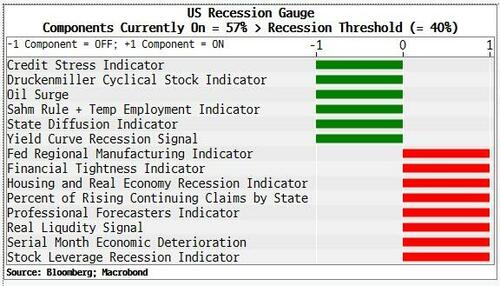

Meanwhile, the collapse of Silicon Valley Bank (and other regional banks) has put a magnifying glass on regional banks, and their CRE loan books remain a significant concern. As shown below, JPM's data as of February 2023, regional banks account for a staggering 70% of total CRE loans outstanding, excluding multifamily, farmland, and construction loans.

?itok=OfTeFXcJ (

?itok=OfTeFXcJ ( ?itok=OfTeFXcJ)

?itok=OfTeFXcJ)

This will cause an acute credit crunch in secondary/tertiary CRE markets.

And then there's Bank of America's Michael Hartnett (https://twitter.com/zerohedge/status/1645465223325687808), who recently said, "You know what commercial real estate is, it's a boa constrictor tightly wrapped around the economy, suffocating growth for the next 2 years."

Bloomberg pointed out about a "dozen buildings in the Brookfield portfolio, occupancy rates averaged 52% in 2022, down from 79% in 2018 when the debt was underwritten."

The onset of a CRE crisis in the office sector will likely spark significant issues for regional banks and the Fed.

Apollo chief economist Torsten Slok recently noted (https://www.zerohedge.com/markets/commercial-real-estate-boa-constrictor-will-crush-economy-and-force-fed-panic-and-restart):

> _In other words, with the commercial real estate bubble bursting, we are likely to enter three years with low growth, similar to what we saw after the housing bubble burst in 2008. Put differently, once the Fed starts cutting rates later this year, interest rates will likely stay low for several years, and QE is likely to come back in 2024._

Will Brookfield be the first of many to default on office building loans this year?

Tyler Durden (https://cms…

https://www.zerohedge.com/markets/dominos-falling-brookfield-defaults-161-debt-dc-office-buildings

**It's Time To 'Proof' Portfolios From Looming Recession**

It's Time To 'Proof' Portfolios From Looming Recession

_Authored by Simon White, Bloomberg macro strategist,_

Markets are set for greater volatility as the economy soon enters a recessionary state, but portfolios with limited duration exposure and increased allocation to real assets should be protected from the worst of the downturn.

**This will not be a run-of-the-mill recession, with equities potentially holding up better than in previous slumps, and fixed-income assets unlikely to offer the same degree of protection due to elevated inflation.**

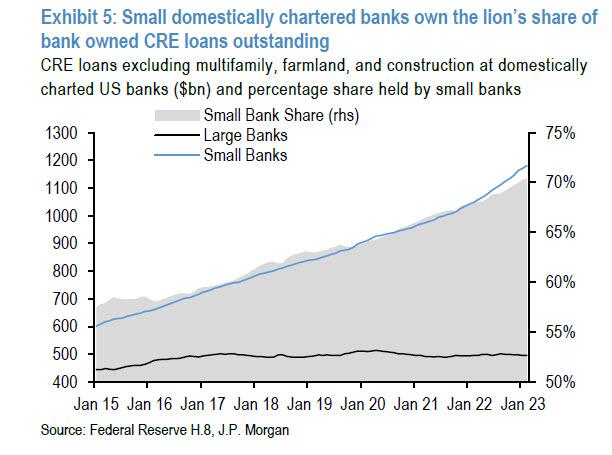

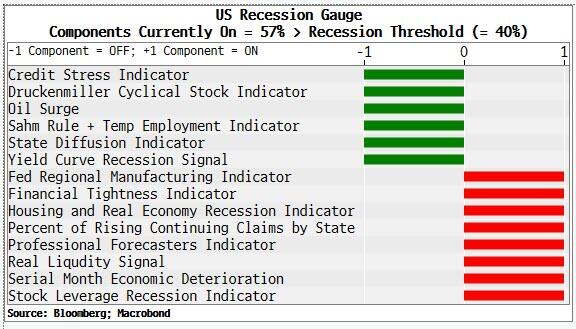

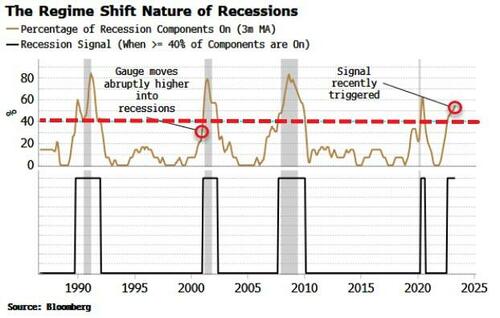

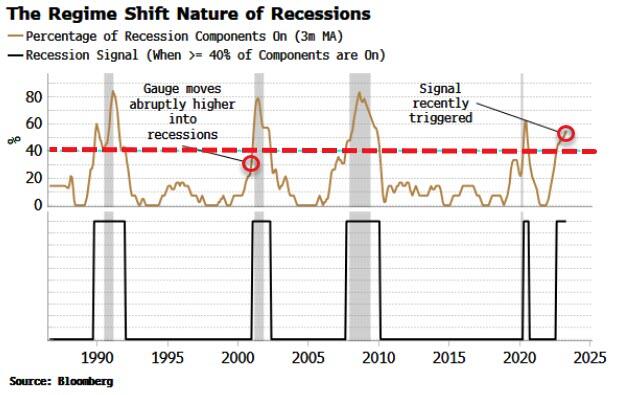

Recessions are notoriously tricky to forecast, but I have attempted to unpick the knot with the creation of a Recession Gauge. It looks at a wide range of market and economic data to signal when the US is likely to tip into recession. **It recently triggered, suggesting the US is, or will very soon be, in a recession.**

?itok=I_LsrWah (

?itok=I_LsrWah ( ?itok=I_LsrWah)

?itok=I_LsrWah)

**Recessions happen suddenly.** Phase transitions in physics are when a substance changes state. When a pot of water is heated to 100C it goes through a phase transition from a liquid to a gas. At that point, the water goes through a profound and abrupt change.

Economies do likewise when they enter a recession. **There is not a steady, linear change between a non-recessionary and recessionary state but a rapid and highly non-linear one.** The historical series of the Recession Gauge captures their suddenness well.

?itok=e70m6Ozn (

?itok=e70m6Ozn ( ?itok=e70m6Ozn)

?itok=e70m6Ozn)

Despite its likely rapid onset, the relative period of calm since the banking turmoil affords an opportunity to re-mold portfolios in preparation for the recession.

**Specifically, portfolios with the following traits will be better placed to weather the coming economic turbulence and concomitant elevated inflation:**

- Low exposure to currently more overbought sectors such as tech and semis

- Increased exposure to currently lagging, lower-duration sectors such as energy, utilities and pharmaceuticals

- Limited in longer-duration fixed-income exposure, i.e. have lower exposure to longer-maturity bonds

- Low exposure to credit, the asset class most mis-pricing recession risk

- An increased allocation to commodities, precious metals and other real assets

- Overall, structured to benefit from higher volatility

**In this recession, the usual playbook of buying bonds and rotating into more defensive equity-sectors is likely to be far from optimal.** With the specter of inflation hovering in the background – and liable to start rising again later in the year – duration risk is a key consideration.

In a zero interest-rate, forward-guidance world, longer-term debt all the way down to cash looks more fungible, while growth stocks tend to have a material advantage over value stocks given low borrowing costs and the ability of larger companies to term out debt for longer.

But when inflation is high as it is today, growth stocks lose their comparative advantage. There are many exceptions - some growth stocks will have strong pricing power that will outweigh the downsides of having lumpy cash-flows expected far in the future - but an overarching rule of thumb is that portfolios with lower duration risk will be better placed to withstand an inflationary recession.

Similarly, bonds may not fulfill their traditional role as a recession hedge or safe haven to the same extent. Reducing fixed-income duration as much as feasibly possible is prudent when rates have more upside potential than they have had for decades. Bonds are pricing in a recession, but a garden-variety one where inflation falls and remains contained.

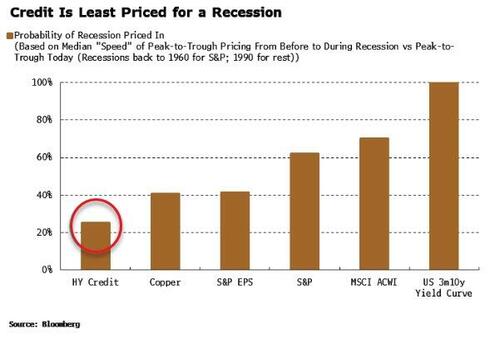

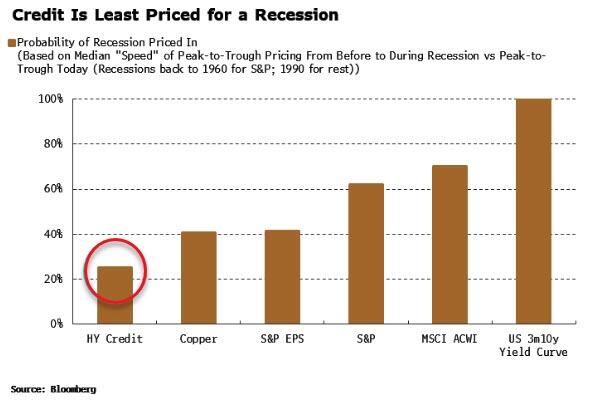

**But even more egregiously mis-priced is credit.** Of the main asset classes, it is the one least expecting a recession, based on historical pricing behavior. Credit’s riskiness is amplified when the fixed-income duration risk is factored in. Current relatively tight spreads are an opportunity to reduce credit exposure.

?itok=v7dkOpfL (

?itok=v7dkOpfL ( ?itok=v7dkOpfL)

?itok=v7dkOpfL)

**On the other hand, portfolios with an increased allocation to real assets stand to fare well as these outperform when inflation is heightened.** In the 1970s, commodities were the best performing asset class and the only one to deliver a positive real return, with bonds, credit and equities all underperforming relative to inflation.

Commodities tend to move sideways in the first few months of a re…

https://www.zerohedge.com/markets/its-time-proof-portfolios-looming-recession

**Putin Makes Surprise Visit To Troops Near Frontline In Ukraine**

Putin Makes Surprise Visit To Troops Near Frontline In Ukraine

Russian President Vladimir Putin on Tuesday made his **second visit to his troops in Ukraine in two months**, arriving by helicopter under heavy security at a military command post in southern Kherson oblast.

The news was released via footage of his helicopter touching down, aired on Russian state television, and marks an apparent attempt to boost troop morale and demonstrate his ultimate authority over operations in the conflict at a moment overall advance is somewhat stalled.

?itok=0G3AcaoW\

?itok=0G3AcaoW\

_Kremlin.ru/Handout via Reuters_ ( ?itok=0G3AcaoW)

?itok=0G3AcaoW)

" **Dressed in a dark suit, Putin appeared to chair meetings with his military top brass during both stops**. The locations of the military headquarters weren’t disclosed, making it impossible to assess how close they were to the front line," _The Associated Press_ notes of the video. "Nor was it possible to independently verify the authenticity of the video footage."

The visit to the war zone is also a likely attempt to rally the troops as fighting still rages in the contested city of Bakhmut - the longest and deadliest battle of the war thus far, with the battle having continued for eight-and-a-half months.

" **It is important for me to hear your opinion on how the situation is developing**, to listen to you, to exchange information," Putin was quoted (https://www.aljazeera.com/news/2023/4/18/putin-visits-ukraines-kherson-and-luhansk-kremlin) as telling commanders.

Russian officials have said at least 80% of the city in Donetsk is held by Russian forces, with Wagner Group taking the lead in much of the fighting.

_Clips of the arrival in a Russian-occupied are of southern Ukraine on Tuesday:_

Russia's RT describes of the visit details (https://www.rt.com/russia/574911-putin-visits-command-posts-frontline/):

> _According to a statement, Putin traveled to the command center of the ‘Dnieper’ battlegroup located “in the Kherson area.” He received reports from the group’s commander, Colonel General Oleg Makarevich, and Colonel General Mikhail Teplinsky, the commander of Russia’s airborne troops._

>

> _The president also made a trip to the Lugansk People’s Republic, where he visited the ‘Vostok’ (East) command center of the National Guard. Putin discussed the situation in the area with top military officials, including Colonel General Aleksandr Lapin._

Meanwhile, Bakhmut is being widely viewed as a final showdown of sorts which could be tipping point giving the winning side the needed momentum in the broader war.

?itok=uBNcQyIo\

?itok=uBNcQyIo\

_Map via Al Jazeera_ ( ?itok=uBNcQyIo)

?itok=uBNcQyIo)

In the past month especially, Ukraine's leadership has sounded a pessimistic note, but has continued to pour in troops and resources into a fight that media headlines dubbed the "meatgrinder" (https://www.rferl.org/a/ukraine-bakhmut-russia-assault-invasion-analysis/32174980.html) given the high casualty rates on both sides.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Tue, 04/18/2023 - 09:05

https://www.zerohedge.com/geopolitical/putin-makes-surprise-visit-troops-southern-ukraine

**Mish: As Amazing As It Sounds, ECB President Christine Lagarde Is Making Some Sense**

Mish: As Amazing As It Sounds, ECB President Christine Lagarde Is Making Some Sense

_Authored by Mike Shedlock via MishTalk.com,_ (https://mishtalk.com/economics/as-amazing-as-it-sounds-ecb-president-christine-lagarde-is-making-some-sense)

Christine Lagarde Made 10 Key Points Today and I Agree With All of Them.

?itok=PasYMWFE (

?itok=PasYMWFE ( ?itok=PasYMWFE)

?itok=PasYMWFE)

_As amazing as it sounds, ECB President Christine Lagarde is making sense._

Central Banks in a Fragmenting World

Please consider a speech by Christine Lagarde, President of the ECB, on Central Banks in a Fragmenting World (https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp230417~9f8d34fbd6.en.html)

> _The global economy has been undergoing a period of transformative change. Following the pandemic, Russia’s unjustified war against Ukraine, the weaponization of energy, the sudden acceleration of inflation, as well as a growing rivalry between the United States and China, the tectonic plates of geopolitics are shifting faster._

>

> _We are witnessing a fragmentation of the global economy into competing blocs, with each bloc trying to pull as much of the rest of the world closer to its respective strategic interests and shared values. And this fragmentation may well coalesce around two blocs led respectively by the two largest economies in the world._

>

> _All this could have far-reaching implications across many domains of policymaking. And today in my remarks, I would like to explore what the implications might be for central banks._

>

> _In short, we could see two profound effects on the policy environment for central banks: first, we may see more instability as global supply elasticity wanes; and second, we could see more multipolarity as geopolitical tensions continue to mount._

>

> _Today the United States is completely dependent on imports for at least 14 critical minerals. And Europe depends on China for 98% of its rare earth supply. Supply disruptions on these fronts could affect critical sectors in the economy, such as the automobile industry and its transition to electric vehicle production._

>

> _In response, governments are legislating to increase supply security, notably through the Inflation Reduction Act in the United States and the strategic autonomy agenda in Europe. But that could, in turn, accelerate fragmentation as firms also adjust in anticipation. Indeed, in the wake of the Russian invasion of Ukraine, the share of global firms planning to regionalize their supply chain almost doubled – to around 45% – compared with a year earlier_

>

> _This “new global map” – as I have called these changes elsewhere – is likely to have first-order implications for central banks._