**Make Americans Work Again**

Make Americans Work Again

_Authored by Ryan Zinke via RealClearPolitics.com,_ (https://www.realclearpolitics.com/articles/2023/04/26/make_america_work_again_149151.html)

_**There’s dignity and honor in work...**_

?itok=-ui82GAv (

?itok=-ui82GAv ( ?itok=-ui82GAv)

?itok=-ui82GAv)

I was raised to value a good day’s work and to have pride in what you bring to the table. To be skilled at a craft was an honorable way to make a living whether you were a dishwasher or a surgeon. Work gave each of us a greater self-worth, purpose, and pride.

My father was the youngest master plumber in Montana’s history, and he came from three generations of men who valued and mastered their trade. I still feel pride when an old timer stops me in the street to tell me about the time my dad or grandad helped repair their home.

**But now, well outside the global pandemic, our workforce (https://fred.stlouisfed.org/series/CIVPART) has shrunk to levels not seen since the 1970s, far lower than during the Great Recession of 2008-2009. More than a third of men are out of the work force – the lowest in recorded history – thanks in part to the massive regulatory and welfare state created under COVID and the public health emergency.**

Not a day goes by in Montana that you don’t walk down Main St and see a restaurant or shop with a handwritten sign that says “closed today due to staff shortage” or have to wait four months for a vehicle repair.

That is not the sign of a strong economy. It’s the sign of a struggling workforce (https://montanafreepress.org/2022/10/05/montana-worker-shortage-continues-to-hamper-missoula-businesses/).

**Requiring able-bodied adults who do not have children to work 20 hours a week if they receive government benefits is prudent and hits at our core American value of pulling oneself up by one’s bootstraps.**

Plus, it saves taxpayer dollars and grows the economy. According to the Wall Street Journal (https://urldefense.com/v3/__https:/go.pardot.com/e/504511/435bc57-mod-opinion-major-pos1/dnzsb8/1036615960?h=HwNJl89XLSktPkcToMhqBnBn7cFkTOoLmJHbujK4klc__;!!Bg5easoyC-OII2vlEqY8mTBrtW-N4OJKAQ!JsuMpZgz-TGbxz0n4n7eMnKGwLXGGPFKNqlQLXp43HryjdNa3wW4k7UjXxACHcx-tq5VgQpkcN8m8_EXFPPgaZk$), “Medicaid work requirement for childless adults ages 18 to 64 could save the federal fisc nearly $170 billion over 10 years.”

**You’ll see the president taking victory laps because unemployment is low; well, it’s low because under his policies people are being paid not to work.** People are being incentivized with lax unemployment benefits and other welfare to stay at home and not contribute to our community and economy.

That has to end. COVID is over. Our nation is tens of trillions of dollars in debt, facing crippling inflation, a broken supply chain and labor shortage, insolvent senior benefits, and is about to run headfirst into a financial crisis.

**House Republicans have put forth a plan to make America work again, reduce the deficit, and put our nation on a healthy fiscal path. It’s called the Limit, Save, Grow Act (https://www.speaker.gov/wp-content/uploads/2023/04/LSGA_xml.pdf).**

This act, sometimes described in the media as a debt-ceiling plan, addresses the looming Democrat-created debt crisis by cutting excessive COVID spending, cutting regulations, and implementing pro-growth policies like a work requirement and energy permitting reform.

**Limit, Save, Grow pulls back unspent COVID funds, saves money in areas where Democrats have continued to be frivolous which has caused spikes in inflation, and increases the flow into programs like Social Security and Medicare.**

The work requirement, also known as the America Works Act, which I sponsored, falls under the “grow” area of the bill by incentivizing those who can work to pay into the programs to the caliber of their capability so they can continue to serve the purpose they were created for.

**Work requirements aren’t new** – they were implemented in 1996 and helped pull people up and out of poverty, lending folks a hand up while giving them the important work experience they need to grow a career and the American Dream.

It encourages independence through employment. It makes able-bodied Americans a part of our economy and feeds the Social Security and Medicare programs until they are at least 65 and are eligible for benefits themselves. Reestablishing and enforcing the original system provide security for those who have continued to persevere and keep those programs alive and gets able bodies on the manufacturing and shop floor and off the couch.

**When Americans work, our economy is strong.** Our communities prosper and the programs that rely on strong employment like Medicare and Social Security are strong. Not to mention, the quality of life…

https://www.zerohedge.com/political/make-americans-work-again

**Meta Soars After Top- & Bottom-Line Beat; 'Metaverse' Losses Grow, MAUs Disappoint**

Meta Soars After Top- & Bottom-Line Beat; 'Metaverse' Losses Grow, MAUs Disappoint

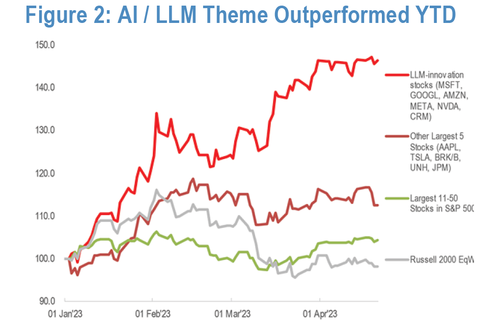

**Meta shares are soaring after hours after a top- and bottom-line beat** extending gains (above one-year highs) since its earnings report on Feb 1st (and continuing to benefit from the AI bubble craze YTD)...

?itok=NbnMzzx1 (

?itok=NbnMzzx1 ( ?itok=NbnMzzx1)

?itok=NbnMzzx1)

... **Meta's "year of efficiency"** has meant mass layoffs and the stock price up 150% from its post-earnings (mid-Nov) lows. **But has the price over-reached the fundamentals?**

?itok=12svreMb (

?itok=12svreMb ( ?itok=12svreMb)

?itok=12svreMb)

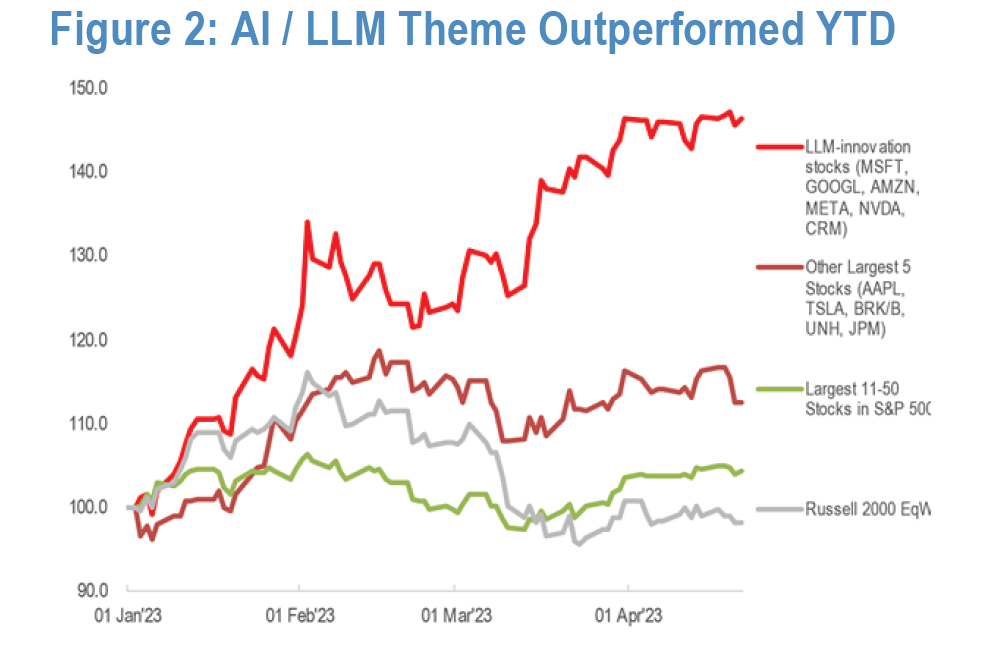

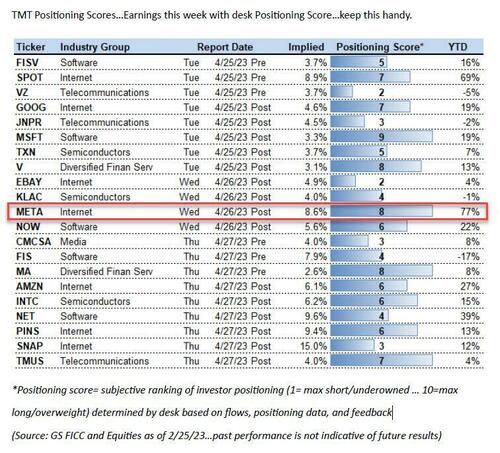

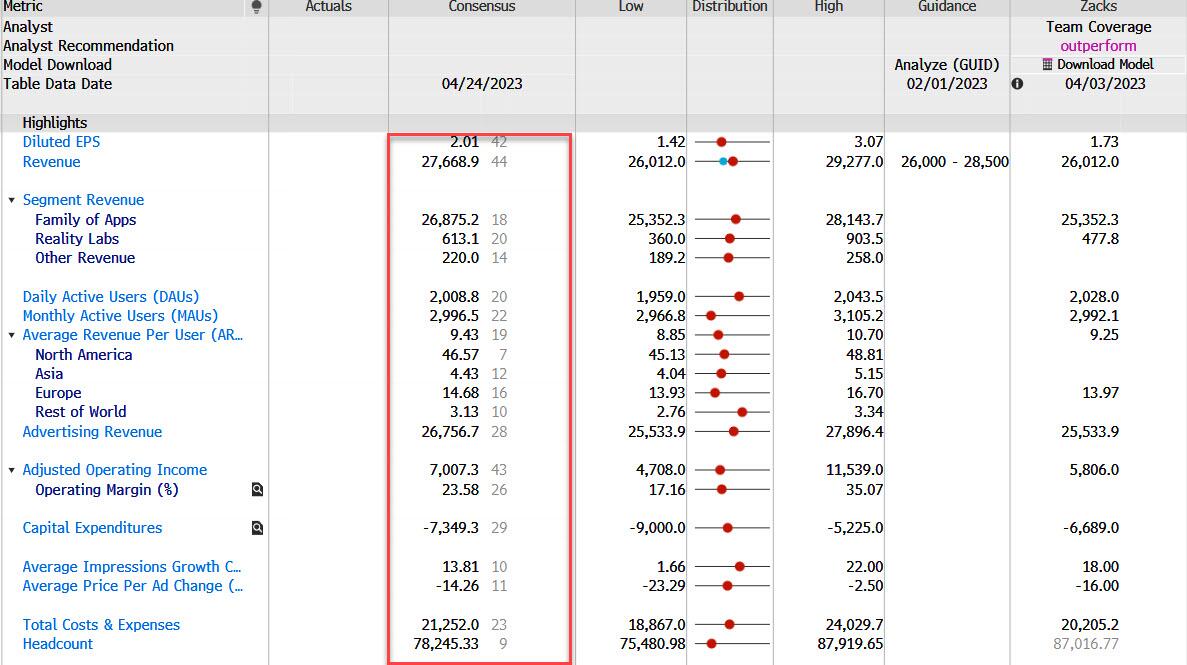

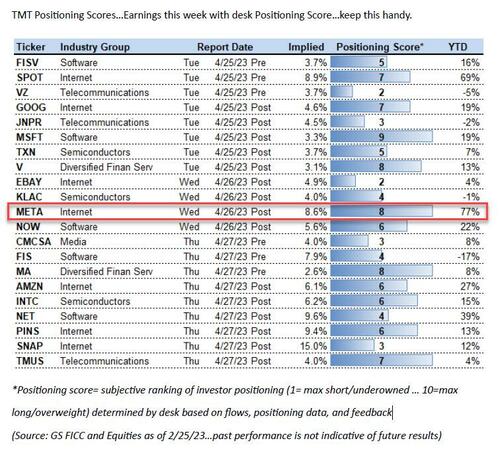

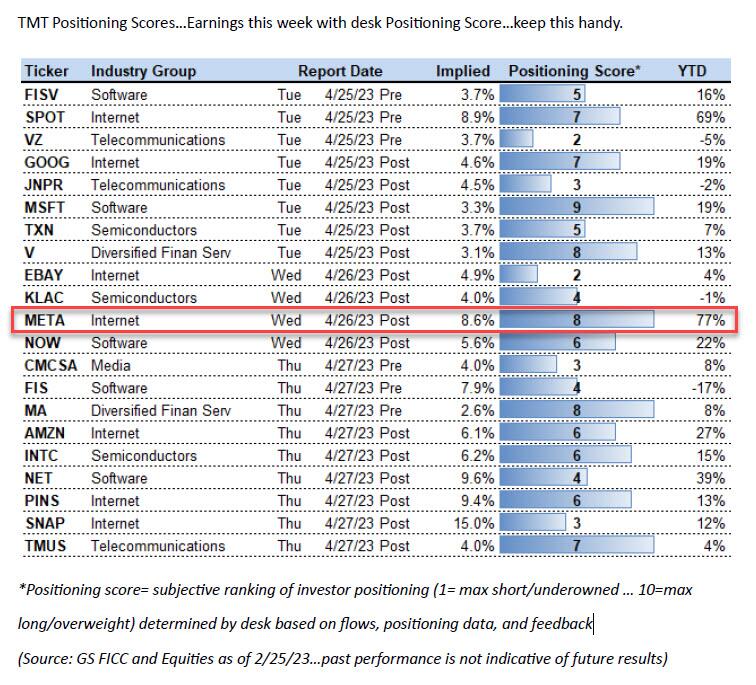

The Facebook parent was **expected to post a fourth consecutive quarter of declining revenue** and while META expectations are broadly optimistic, so is **positioning which is one of the most long/overweight** as the following chart of TMT positioning from Goldman shows (the positioning score= subjective ranking of investor positioning _(1= max short/underowned … 10=max long/overweight) as determined by desk based on flows, positioning data, and feedback)._

?itok=lks7dvoz (

?itok=lks7dvoz ( ?itok=lks7dvoz)

?itok=lks7dvoz)

Finally, before we dive into the earnings report, the options market is implying a 10% move following results, compared with an average 14% move over the past two years

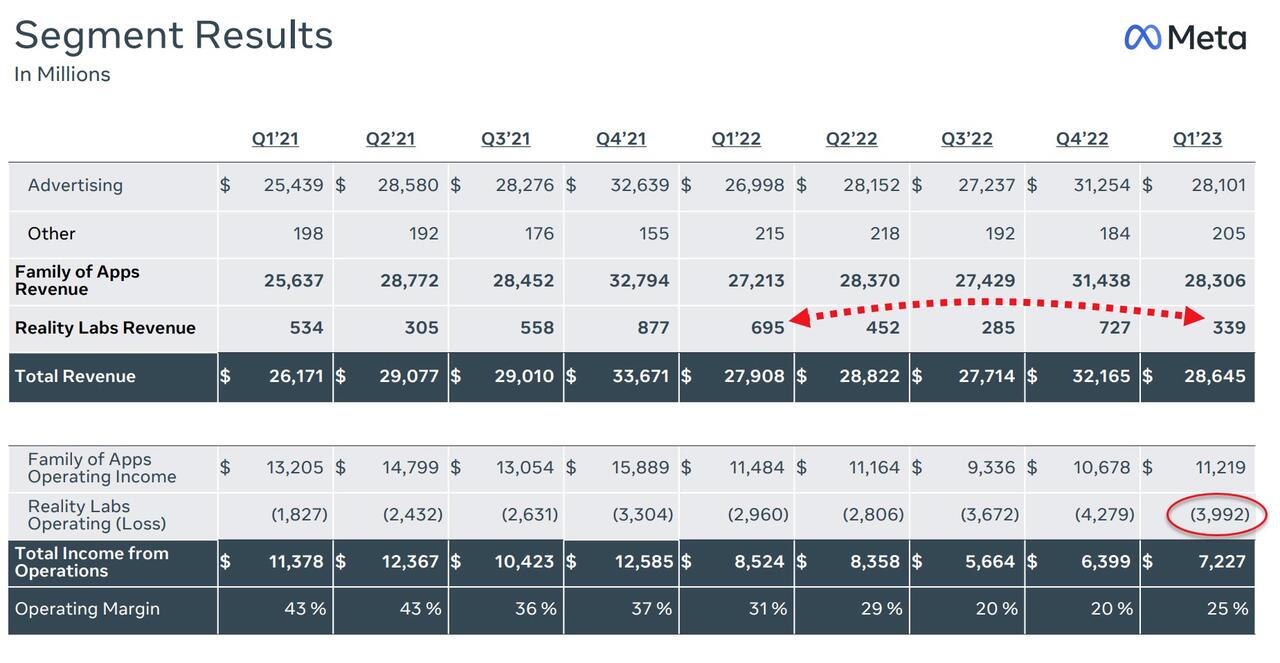

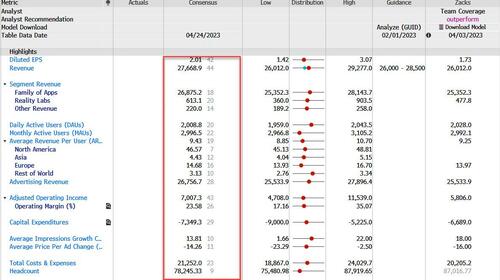

**Meta's top- and bottom-line beat expectations in Q1:**

- \*META PLATFORMS 1Q REV. $28.65B, EST. $27.67B

- \*META PLATFORMS 1Q EPS $2.20, EST. $2.01

Under the hood, **Ad Revenue beat:**

- \*META PLATFORMS 1Q AD REV. $28.10B, EST. $26.76B

- \*META 1Q FAMILY OF APPS OPER INCOME $11.22B, EST. $10.32B

However, **Meta's outlook came in at the lowest end of expectations**

- \*META PLATFORMS SEES 2Q REV. $29.5B TO $32B, EST. $29.48B

But Zuck remains optimistic of course...

> _**"We had a good quarter and our community continues to grow,"** said Mark Zuckerberg, Meta founder and CEO._

>

> _"Our AI work is driving good results across our apps and business. We're also becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver our long term vision."_

**But Reality Labs (the Metaverse builders) saw a smaller revenue than expected and a bigger than expected operating loss:**

- \*META PLATFORMS 1Q REALITY LABS REV. $339M, EST. $613.1M

- \*META 1Q REALITY LABS OPER LOSS $3.99B, EST. LOSS $3.8B

?itok=h1gFi_sH (

?itok=h1gFi_sH ( ?itok=h1gFi_sH)

?itok=h1gFi_sH)

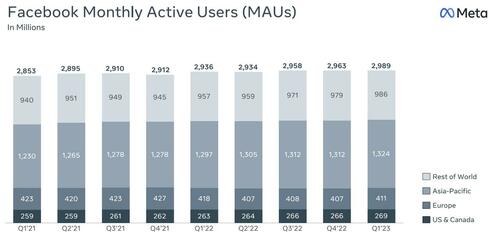

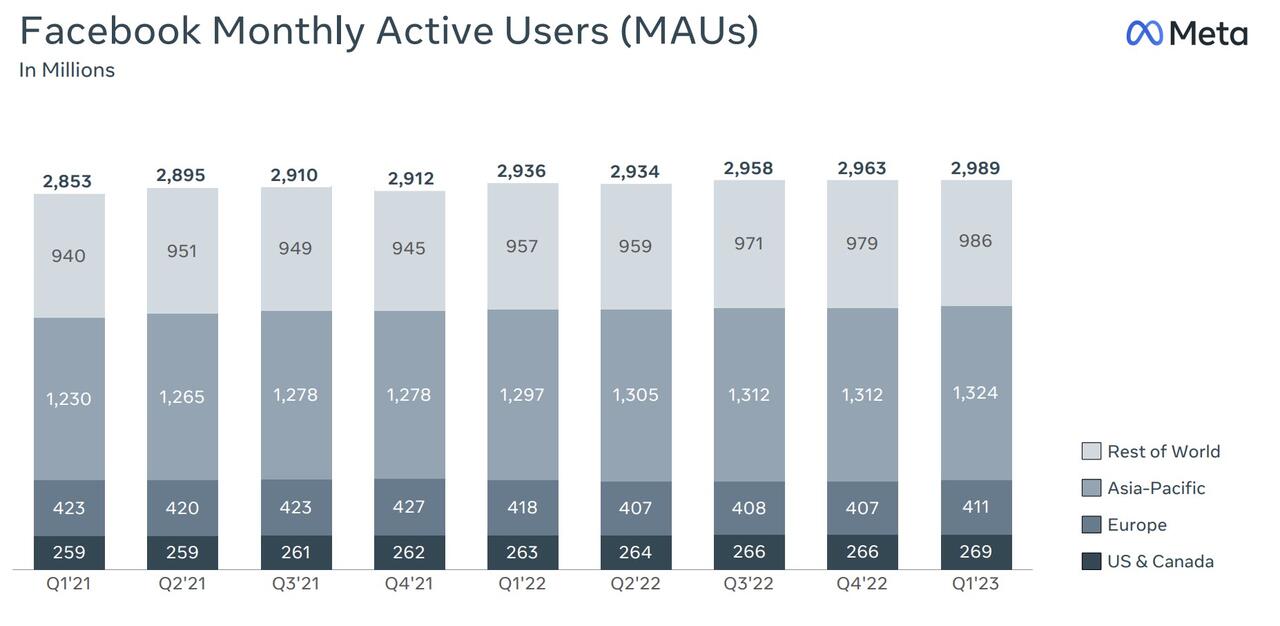

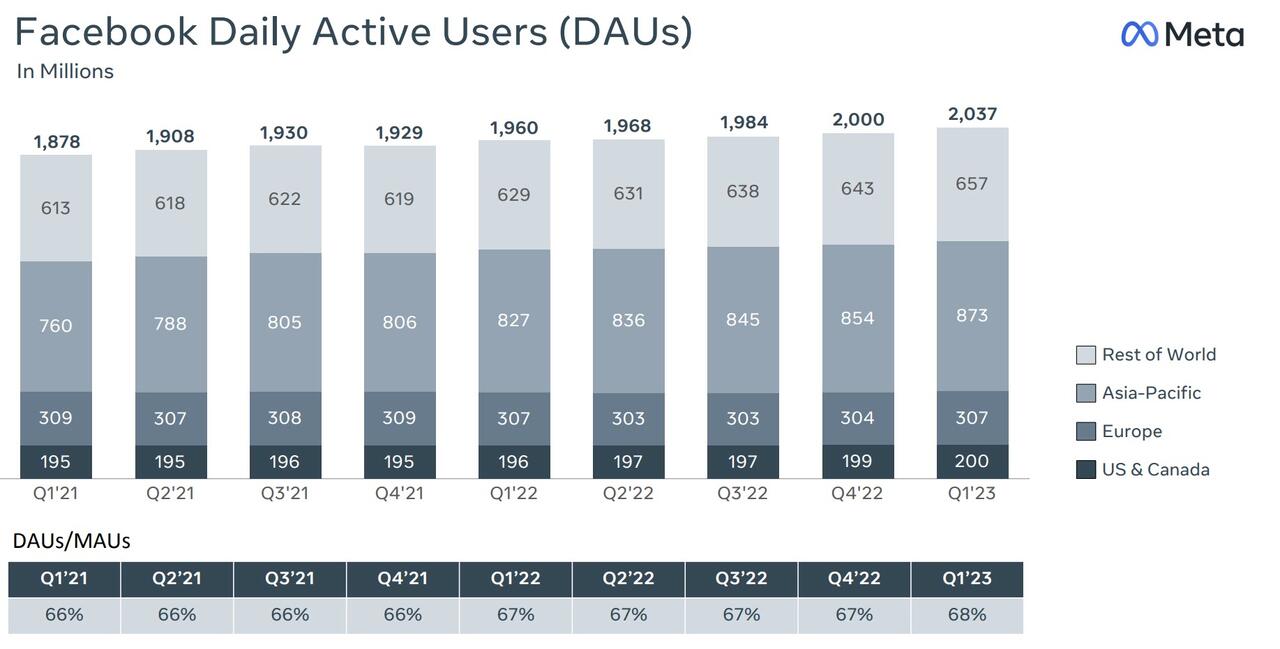

**Facebook's user data was mixed** with daily active users up 4% (and better than expected) while **monthly active users disappointed**:

- \*META 1Q FACEBOOK MONTHLY ACTIVE USERS 2.99B, EST. 3.00B

?itok=kGhjDeII (

?itok=kGhjDeII ( ?itok=kGhjDeII)

?itok=kGhjDeII)

- \*META PLATFORMS 1Q FACEBOOK DAILY ACTIVE USERS 2.04B, EST. 2.01B

?itok=Y2krOosP (

?itok=Y2krOosP ( ?itok=Y2krOosP)

?itok=Y2krOosP)

**Costs are undoubtedly in focus for Meta, and they’re narrowing their expected expense range for 2023 to $86-$90 billion.**

That’s significantly lower than the $96-$101 billion initial projection the company gave in October.

Surprisingly, given the significant layoffs that have been announced, **headcount was 77,114 as of March 31, 2023, a decrease of 1% year-over-year.**

> _Substantially all employees impacted by the layoff announced in November 2022 are no longer reflected in our reported headcount as of March 31, 2023._

>

> _Further, the employees that would be impacted by the 2023 layoffs are included in our reported headcount as of March 31, 2023._

**So layoffs affected 13% of staff.. but the total headcount is down only 1% - that's a lot of hiring and firing in one year.**

Meta shares are up 10% on the day now, at their highest since early April 2022...

?itok=mve7ANfM (

?itok=mve7ANfM ( ?itok=mve7ANfM)

?itok=mve7ANfM)

Perhaps of most note, _**the word “me…

**Tucker Speaks In First Public Comments Since Split From Fox; Fans Plan To Boycott**

Tucker Speaks In First Public Comments Since Split From Fox; Fans Plan To Boycott

Tucker Carlson has issued his first public comments since his ouster from _Fox News_ for unknown reasons.

Appearing outside his Florida home with his wife, Carlson told the daily mail: "Retirement is going great so far," adding "I haven’t eaten dinner with my wife on a weeknight in seven years."

_Photo via the Daily Mail_ (?itok=VHQWIxFG)

When asked about the future, Carlson said: "Appetizers plus entree," before driving away on his golf cart.

Both _Fox_ and _Carlson_ have been mum over the split - however some are speculating that a lawsuit filed by a former producer, Abby Grossberg (who never actually interacted with Carlson) may be one of the reasons. Another rumor is that Rupert Murdoch's ex-fiancee said Carlson was a "messenger from God" at a dinner, which freaked out old Rupert.

> _Murdoch and Smith called off their two-week engagement because **Smith had told people Carlson was “a messenger from God.”** Murdoch had seen Carlson and Smith discuss religion firsthand. In late March, Carlson had dinner at Murdoch’s Bel Air vineyard with Murdoch and Smith, according to the source. During dinner, Smith pulled out a bible and started reading passages from the Book of Exodus, the source said. **“Rupert just sat there and stared,” the source said. A few days after the dinner, Murdoch and Smith called off the wedding. By taking Carlson off the air, Murdoch was also taking away his ex’s favorite show**. -Vanity Fair_

Carlson's fans, meanwhile, **plan to boycott _Fox_ _News_ and _Fox Nation_ streaming service** following the split.

Via the _Epoch Times_ (https://www.theepochtimes.com/tucker-carlsons-fans-say-theyre-leaving-fox-news-and-fox-nation-streaming-service_5220421.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge);

Carlson’s Fox Nation program had hosted numerous celebrity guests, including Tesla CEO and Twitter owner Elon Musk, actor Russell Brand, “Shark Tank” host Kevin O’Leary, and champion boxer Mike Tyson.

**At least one Twitter user said (https://twitter.com/paigered3/status/1650667133263568899) Carlson’s show was the only reason they subscribed to Fox Nation and that without him, she had decided to end her subscription**. “I canceled my @foxnation subscription tonight. I only watched Tucker’s show. They will not get another penny. Delete them, too. @FoxNews.”

Scott Morefield, a writer for the conservative Townhall.com also wrote: (https://twitter.com/SKMorefield/status/1650538279652188160) “ **I just cancelled my Fox Nation subscription with the note: ‘No Tucker Carlson, no Fox Nation subscription. Goodbye**.’ Who is doing the same?” Morefield’s tweet prompted numerous others to reply saying they had done the same.

“Me renewal date was 4/27, so this was a convenient time to cancel. I had previously signed up for a 2 year subscription,” one person wrote (https://twitter.com/CanYouRewindIt/status/1650833560041824256).

As people announced they were ending their subscriptions, they shared screenshots (https://twitter.com/Villgecrazylady/status/1650529147356172296) and videos (https://twitter.com/maximojo_/status/1650570583296335877) to prove they had indeed parted ways with the subscription service.

One user shared a screenshot in which she explicitly stated she was leaving the subscription service over Carlson’s departure from the network. On her screenshot, she had selected a box indicating her reason for unsubscribing, “ **Fox Nation doesn’t include my favorite Fox News personalities”** followed by an additional comment, “As far I am concerned Fox is dead. Without Tucker Carlson you are just another \[expletive\] propaganda \[mainstream media\] outlet.”

Another Twitter user indicated (https://twitter.com/_Reyna_/status/1650536915513245698) Fox News’ other programs would not be enough to keep them interested in the network or its streaming service. “Just canceled my subscription to Fox Nation and promptly turned the channel. Only 3 shows interest me – The Five, Jesse Watters and Gutfled! And I can miss these without a problem. I never missed Tucker. What a loss.”

It’s unclear how many subscribers Fox Nation has lost in the day since announcing Carlson’s departure from the broader Fox.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 16:15

https://www.zerohedge.com/markets/tucker-speaks-first-public-comments-split-fox-fans-plan-boycott

**Big-Tech & Bitcoin Jump, Bonds & Bank Stocks Dump As US Default Risk Soars**

Big-Tech & Bitcoin Jump, Bonds & Bank Stocks Dump As US Default Risk Soars

Another day, another **ugly macro print**(durable goods orders - ex Boeing - far weaker than hoped for, and shipments slumped); more **banking system anxiety** (not helped by FRC threats); and even **more debt-ceiling anxiety** as Dems make it clear no matter what Reps offer, they won't pass it.

FRC issued a blackmail threat to the other banks to 'rescue them or face the wrath of the markets when we explode' (our translation), but the market did not like and dumped the stock even more (down 35% today after yesterday's 50% collapse). The FDIC didn't help things by suggesting FRC's Fed borrowings capacity could be cut (clearly in a play for force a public bailout and make the big banks - that face billions of losses from uninsured deposits given to FRC - to pay up for FRC's loans)...

?itok=rbPXP7yX (

?itok=rbPXP7yX ( ?itok=rbPXP7yX)

?itok=rbPXP7yX)

_Source: Bloomberg_

The KBW Bank Index tumbled back near post-SVB lows...

?itok=OFnlcRyM (

?itok=OFnlcRyM ( ?itok=OFnlcRyM)

?itok=OFnlcRyM)

_Source: Bloomberg_

**One stumbling block to a solution has been the conflicting needs of US officials and the banks that might help.**

- The regulators favor a private rescue that doesn’t involve the US seizing the bank and taking a multibillion-dollar hit to the FDIC’s insurance fund.

- Banks want to avoid anything that damages their own finances and have been waiting for the government to offer aid, such as the FDIC taking control of the firm’s least desirable assets - something that can happen under the law only if First Republic fails and is put into receivership.

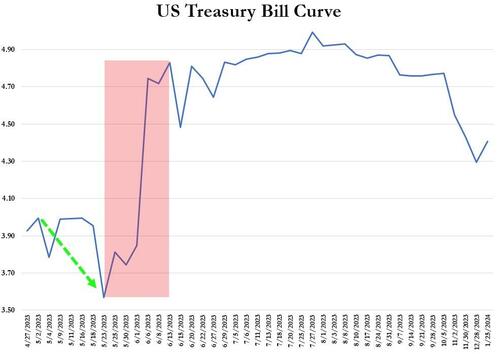

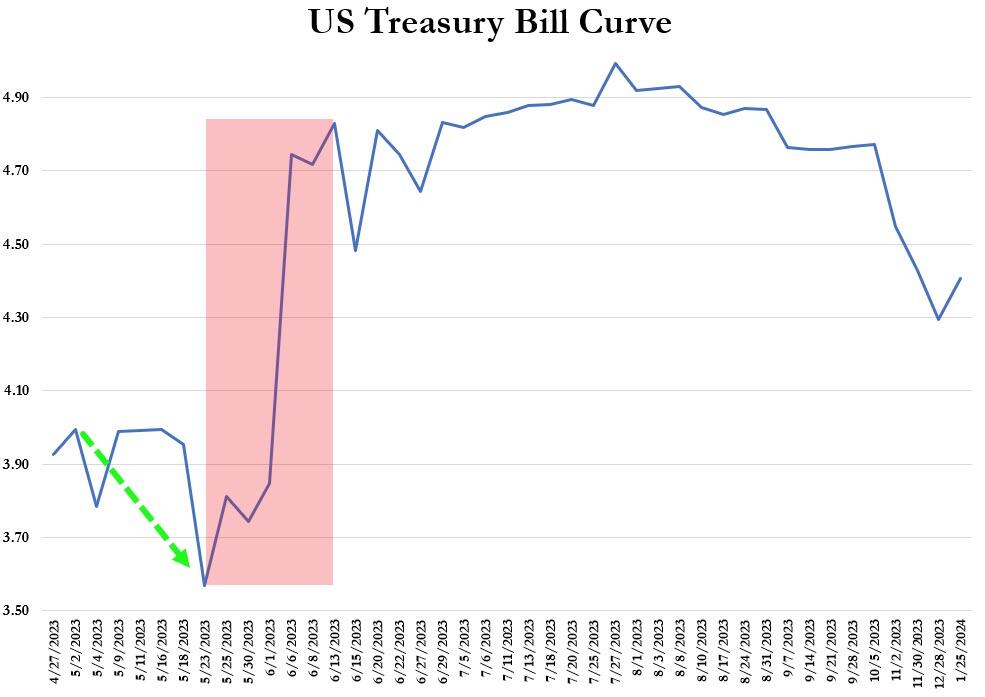

Not pretty but the T-Bill curve is breaking bad for a worst-case scenario X-Date...

?itok=s19Iectv (

?itok=s19Iectv ( ?itok=s19Iectv)

?itok=s19Iectv)

_Source: Bloomberg_

And USA Sovereign risk has never been this high...

?itok=3UlbcFvi (

?itok=3UlbcFvi ( ?itok=3UlbcFvi)

?itok=3UlbcFvi)

_Source: Bloomberg_

Nasdaq was the big winner today (thanks to MSFT and GOOGL) while Small Caps and The Dow led to the downside

?itok=PkETzLTA (

?itok=PkETzLTA ( ?itok=PkETzLTA)

?itok=PkETzLTA)

VIX (normal, 1D, and 9D) all gapped down at the open - from yesterday's spike - but that vol-selling faded around 1200ET (as puts were bid, sending vol higher)...

?itok=Nj2Yi5CF (

?itok=Nj2Yi5CF ( ?itok=Nj2Yi5CF)

?itok=Nj2Yi5CF)

... **as 0DTE traders piled aggressively into puts** (while call plays were entirely muted (once again confirming Nomura's Charlie McElligott's recent note that there has been a **regime-change in 0DTE from intraday-hedging/fading trends to an "accelerant risk"**...

?itok=hHnsMsxd (

?itok=hHnsMsxd ( ?itok=hHnsMsxd)

?itok=hHnsMsxd)

_Source: SpotGamma_ (https://spotgamma.com/hiro-indicator/)

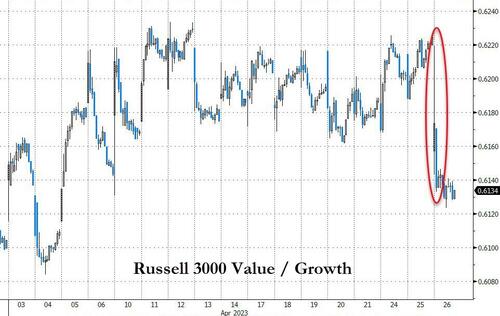

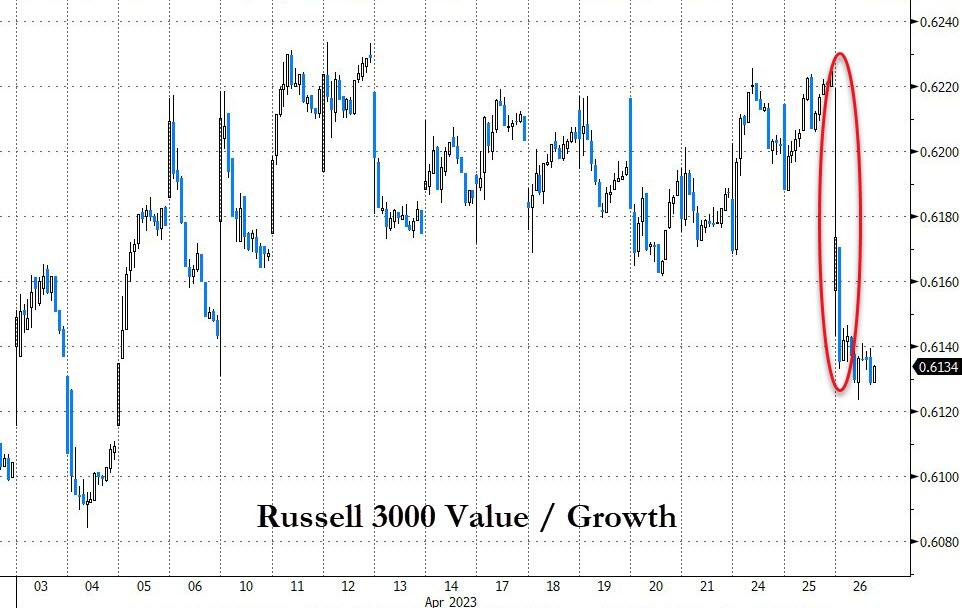

**Value stocks crashed relative to growth** today after chopping sideways relative to each other for the last three weeks...

?itok=5WNWnT42 (

?itok=5WNWnT42 ( ?itok=5WNWnT42)

?itok=5WNWnT42)

_Source: Bloomberg_

**This was the biggest growth/value daily shift since Nov '22.**

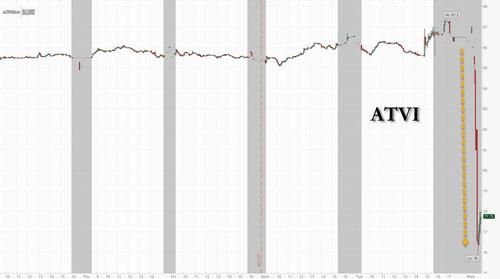

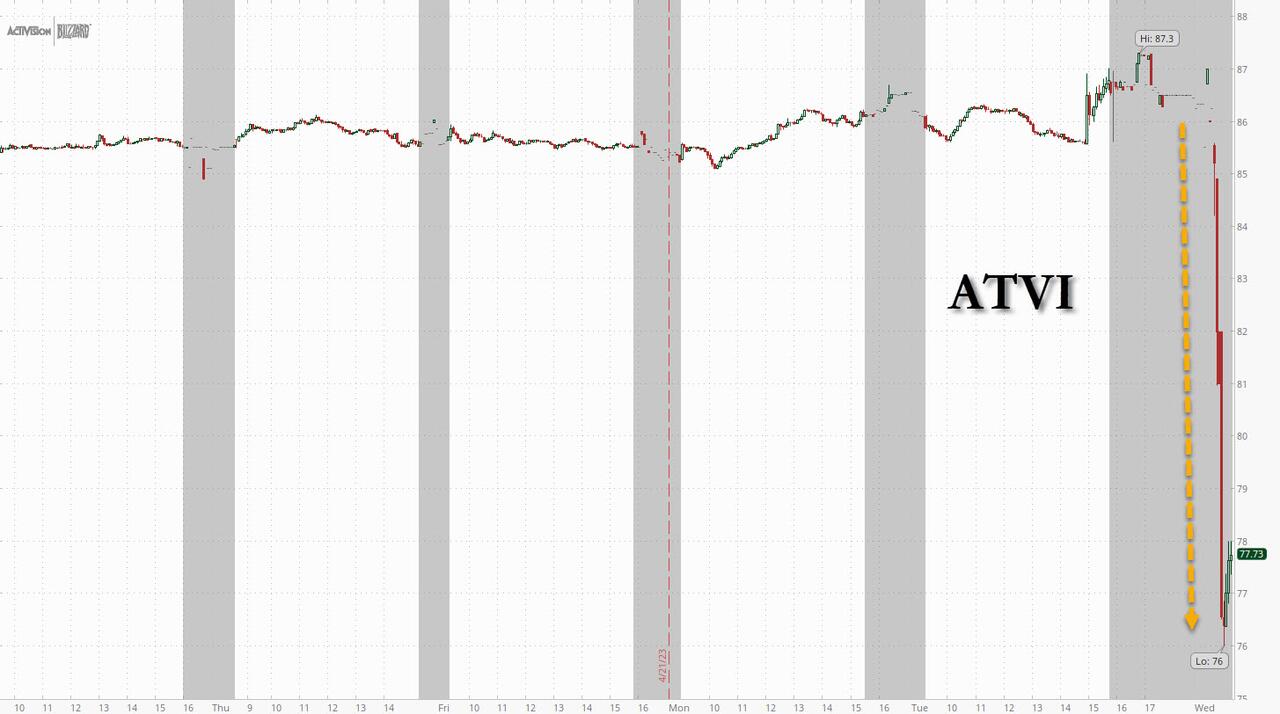

And ATVI was clubbed like a baby seal after UK regulators denied MSFT's bid (MSFT rallied on the day BUT it was not moved by the ATVI decision)...

?itok=aj62ZZzi (

?itok=aj62ZZzi ( ?itok=aj62ZZzi)

?itok=aj62ZZzi)

**Treasuries were mixed today with the short-end lower in yield and the long-end underperforming**(2Y -3bps, 30Y +4bps). Yields remain significantly lower though on the week with the short-end outperforming (curve steepening)...

?itok=ScJl6q1r (https://cms.…

?itok=ScJl6q1r (https://cms.…

https://www.zerohedge.com/markets/big-tech-bitcoin-jump-bonds-bank-stocks-dump-us-default-risk-soars

**US Warns China It Will Ramp Up Military Drills In The Region**

US Warns China It Will Ramp Up Military Drills In The Region

The Biden administration has forewarned China that it plans to bolster military drills and the US presence in the region, particularly off the Korean peninsula where it's decided to send nuclear-armed submarines as extra deterrence against North Korean threats aimed at Seoul.

**"We are briefing the Chinese in advance and laying out very clearly our rationale for why we are taking these steps,"** a Biden administration official said (https://english.alarabiya.net/News/world/2023/04/26/US-nuclear-submarine-to-visit-South-Korea-to-boost-deterrence-against-North-Korea). "We believe that non-proliferation efforts in the Indo-Pacific are in the best interest of not just the United States and other leading states, but China as well."

?itok=9O0av4ZZ\

?itok=9O0av4ZZ\

_USS Ronald Reagan leads a formation of Carrier Strike Group. DoD image_ ( ?itok=9O0av4ZZ)

?itok=9O0av4ZZ)

"We'll announce that we **intend to take steps to make our deterrence more visible** through the regular deployment of strategic assets, including a US nuclear ballistic submarine visit to South Korea, which has not happened since the early 1980s," the US official detailed further as President Biden receives his South Korean counterpart Yoon Suk Yeol in Washington on Wednesday.

China was further briefed on US plans to "strengthen our training, our exercises, and simulation activities to improve the US-ROK \[South Korea\] alliance's approach to deterring and defending against DPRK \[North Korean\] threats, including by better integrating ROK conventional assets into our strategic planning."

"To build peace and stability on the Peninsula, during the visit, the alliance will be announcing a Washington Declaration which includes a series of steps that are designed to strengthen US-funded deterrence commitments and strengthen the clarity by which they are seen by the Korean public as well as by neighbors in the face of advancing DPRK \[North Korean\] nuclear missile capabilities," the official added, previewing the Yoon-Biden talks.

Beijing is unlikely to react positively, given it's also been of late vehemently protesting the US-Australia AUKUS deal to produce and transfer nuclear submarines. China last month warned the countries (including the UK) that they are heading down a **"path of error and danger"** and that Australia is violating commitments to being a nuclear-free zone.

_Elsewhere in the region, China has been closely watching US-Philippine largescale joint exercises..._

> On Basco Island South of #Taiwan (https://twitter.com/hashtag/Taiwan?src=hash&ref_src=twsrc%5Etfw), U.S. Military Prepares for Conflict With #China (https://twitter.com/hashtag/China?src=hash&ref_src=twsrc%5Etfw)

>

> Part of the largest-ever annual drills with the Philippines focuses on defending the strategic Bashi Channel, a key waterway used by the #PLA (https://twitter.com/hashtag/PLA?src=hash&ref_src=twsrc%5Etfw) Navy to access the open ocean.https://t.co/bE7wZPyau4 (https://t.co/bE7wZPyau4)

>

> — Indo-Pacific News - Geo-Politics & Military News (@IndoPac\_Info) April 25, 2023 (https://twitter.com/IndoPac_Info/status/1650758578322694144?ref_src=twsrc%5Etfw)

Despite the US framing its planned heightened nuclear presence in the Korean peninsula as "defensive" and "deterrent" in nature, China will surely see it as yet more provocative expansion of the US military machine it its own neighborhood.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 15:45

**META Earnings Preview: "The Least Controversial Name Of Mega-Tech"**

META Earnings Preview: "The Least Controversial Name Of Mega-Tech"

Unlike yesterday, where opinions what MSFT and GOOGL would report was split down the middle between outspoken bulls and just as fervent bears (the bulls ended up getting the upper hand), today's results by META after the close should be a more subdued affair, because as JPM trader Jack Atherton writes in his preview, META is **"probably the least controversial name of the tech group into earnings"** and positioning reflects that: "top line accelerating, cost driven upgrade story, valuation support, etc."

As Atheron adds, investors are starting to discuss the growth sustainability story into 2024 as the next leg of upside – many hope to get more clarity on that (Reels monetization, AI ad tools, click to message, etc).

Buyside looking for Q1 revenue ~2.5% FXN (guide -5% to +4%) and Q2 guide ~3.5% FXN (midpoint). Investors are mixed on whether mgmt update the cost outlook again but there is definitely a cohort expecting another small trim to the guide (especially on $30-33b capex outlook).

Below is a snapshot of what consensus expects today courtesy of Bloomberg:

?itok=mdSzlabF (

?itok=mdSzlabF ( ?itok=mdSzlabF)

?itok=mdSzlabF)

In terms of the advertising environment, the JPM trader says that it "is in a better place than 3ms ago at Q4 earnings, suggesting there could be upside risk to Q1 ests." As such, META "remains our top pick of the group; we recently raised PT to $270 with note focused on the multiple drivers of a revenue growth acceleration (AI/ad tech, Reels, Click-to-Message, easing H2 comps).

Finally, while META expectations are broadly optimistic, so is **positioning which is one of the most long/overweight** as the following chart of TMT positioning from Goldman shows ( _the positioning score= subjective ranking of investor positioning (1= max short/underowned … 10=max long/overweight) as determined by desk based on flows, positioning data, and feedback)_.

?itok=HxwDHXGh (

?itok=HxwDHXGh ( ?itok=HxwDHXGh)

?itok=HxwDHXGh)

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 15:25

https://www.zerohedge.com/markets/meta-earnings-preview-least-controversial-name-mega-tech

**Biden, Yoon Agree: Response To North Korean Nuclear Attack Would Include US Nukes**

Biden, Yoon Agree: Response To North Korean Nuclear Attack Would Include US Nukes

**Update(1450ET):** As expected, Presidents Biden and Yoon unveiled the "Washington Declaration" during an afternoon joint press conference, boosting military cooperation which will include US nuclear deterrents being parked on the peninsula (previewed below).

"The alliance formed in war and has flourished in peace," Biden to reporters gathered in the Rose Garden. "Our mutual defense treaty is iron clad and that includes our commitment to extend a deterrence – and that includes the nuclear threat, the nuclear deterrent." He added: "They’re particularly important in the face of DPRK’s increased threats and the blatant violation of US sanctions." Biden further called the US-South Korea alliance "the linchpin of regional security and prosperity" in the Indo-Pacific.

South Korea's Yoon for his part took a tough stance in response to Pyongyang's recent frequent missile drills and nuclear rhetoric, saying **"peace with North comes through superior force, not 'goodwill'"** \- according to AFP (https://twitter.com/AFP/status/1651285298897117187). Yoon also said that the response to a possible North Korean nuclear attack **would include US nukes**. Biden affirmed Yoon's comments...

> BIDEN: NUCLEAR ATTACK WILL RESULT IN END OF NORTH KOREA REGIME

> 1/2

>

> Biden: "Nuclear attack by North Korea...confused noises...will result in the end of whatever regime that would take such an action."

>

> South Korea's Yoon added that any nuclear attack by North Korea will be met "swiftly, overwhelmingly: pic.twitter.com/Wy23q3fxE9 (https://t.co/Wy23q3fxE9)

>

> — Alan (@Alan39982121) April 26, 2023 (https://twitter.com/Alan39982121/status/1651292832219684865?ref_src=twsrc%5Etfw)

\\* \\* \\*

In a move which is certainly to explode tensions on the peninsula further at a moment things are already on edge, the US is sending nuclear-armed submarines to dock in South Korea for the first time in four decades.

Senior Biden administration officials say the move (https://www.nbcnews.com/news/world/us-send-nuclear-submarines-south-korea-agreement-kim-jong-un-threats-rcna81510) is part of a broader and **"more visible" plan to make clear to Kim Jong Un that Washington is ready to defend Seoul against the increasing nuclear threats** from Pyongyang.

?itok=mdlsW2s0\

?itok=mdlsW2s0\

_Via ABC News_ ( ?itok=mdlsW2s0)

?itok=mdlsW2s0)

The last time nuclear-armed submarines were docked in South Korea was in the 1980s; however, the new plan will see such nuclear assets, including long-range bombers, sent to the peninsula only on a temporary basis and not permanently.

According to details in _The Associated Press_, and in relation to President Yoon Suk Yeol's state visit to the White House and Congress this week (https://apnews.com/article/biden-yoon-south-korea-nuclear-submarines-agreement-8f1e003990cb434afa0980707e471396):

> _The planned dock visits are a key element of what’s being dubbed the “Washington Declaration,” aimed at deterring North Korea (https://apnews.com/article/biden-nuclear-deterrence-south-korea-north-korea-65f725fa5ab24d3aab98aafa34b23c45) from carrying out an attack on its neighbor. It is being unveiled as Biden is hosting Yoon for a state visit (https://apnews.com/article/white-house-state-dinner-south-korea-chef-05270a9fa17a4982edbb7f2ca2b08372) during a moment of heightened anxiety for both leaders over an increased pace of ballistic missile tests by North Korea over the last several months._

>

> _The three senior Biden administration officials, who briefed reporters on the condition of anonymity ahead of the official announcement, said that Biden and Yoon aides have been working on details of the plan for months and agreed that **“occasional” and “very clear demonstrations of the strength” of U.S. extended deterrence capabilities** needed to be an essential aspect of the agreement._

The escalation in deterrence policy is also being framed in Washington as necessary to avoiding a nuclear arms race on the peninsula, given that in the wake of frequent new North Korean weapons tests, Seoul officials have begun (https://www.nbcnews.com/news/world/south-korea-north-nuclear-options-united-states-ballistic-missiles-rcna81171) to **consider a nuclear option**.

Biden officials say that in return for the US nuclear protection, the south is **expected to reaffirm its commitment to the Nuclear Nonproliferation Treaty**(NPT).

> 'As specific steps for the deterrence, the U.S. will send an Ohio-class nuclear submarine to South Korea. The dispatch of such a submarine to South Korea is the first since early 1980 during the Cold War, the official said.'https://t.co/ErHvbY4ovg (https://t.co/ErHvbY4ovg)

>

> — Yuka C …

https://www.zerohedge.com/geopolitical/us-sending-nuclear-submarines-south-korea-1st-time-40-years

**Commodities Bellwether Flashes US Recession Warning**

Commodities Bellwether Flashes US Recession Warning

_Authored by Bloomberg's Nour Al Ali,_

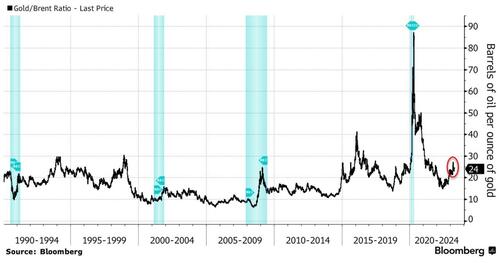

**The commodities market’s bellwether for recessions is flashing a warning sign.**

As uncertainty circles the markets on whether the Fed is approaching the end of its tightening cycle, **the gold-to-oil ratio suggests commodities traders are hedging against the risk of a US recession.**

?itok=N-oSwRrl (

?itok=N-oSwRrl ( ?itok=N-oSwRrl)

?itok=N-oSwRrl)

With oil prices down this year while gold is up, the ratio has surged to almost 24, compared with an average of less than 17 since 2000.

**Anything significantly above that average is considered as a warning sign by some market participants.**

The performance of gold and oil relative to each other is a measure of investor sentiment on the economy, as both assets are cyclical and priced in dollars.

**Historically, gold tends to outperform oil during the onset of a recession or great economic uncertainty.**

We’ve seen this trend during the global financial crisis, the recession of the early 1990s, and even in what’s known as the mini-recession of 2015-16, though that was due to Saudi Arabia’s oil-price war with the US.

**Now, uncertainty about the Fed’s interest-rate path and a potential economic downturn will likely see the the ratio increase even further.**

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 14:46

https://www.zerohedge.com/markets/commodities-bellwether-flashes-us-recession-warning

**Disney Sues DeSantis After 'Exhausting Options' As Feud Over Political Retaliation Heats Up**

Disney Sues DeSantis After 'Exhausting Options' As Feud Over Political Retaliation Heats Up

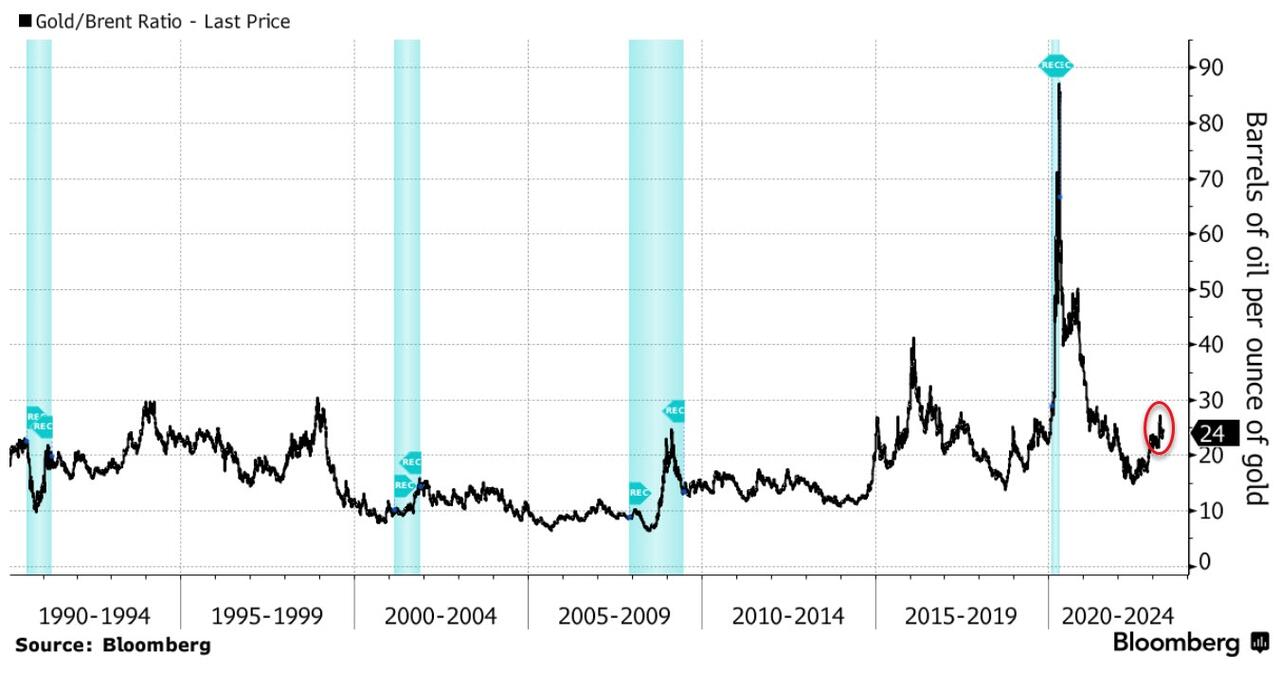

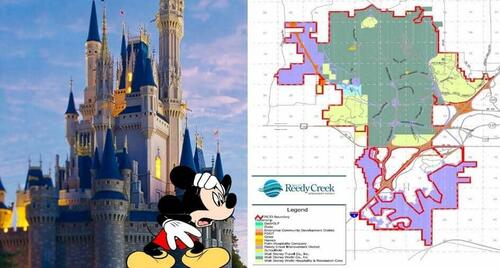

Walt Disney Co. sued Florida Governor Ron DeSantis on Wednesday, claiming he conducted a " **relentless campaign to weaponize government power**" against the company for speaking out about his controversial classroom bill and threatening billions of dollars in business.

> _"A **targeted campaign of government retaliation**—orchestrated at every step by Governor DeSantis as punishment for Disney's protected speech—now threatens Disney's business operations, jeopardizes its economic future in the region, and violates its constitutional rights," Disney alleged in the civil complaint filed in the US District Court in Northern Florida._

Earlier today, DeSantis' oversight board voted to void development contracts that Disney made in February that retained much of its control (https://www.zerohedge.com/political/desantis-signs-bill-killing-corporate-kingdom-disney-world) over the Reedy Creek Improvement District, a 25,000-acre compound that Disney self-governs near Orlando that houses its theme parks. Recall, Disney lost control (https://www.zerohedge.com/political/disney-loses-control-reedy-creek-development-landslide-florida-senate-vote) of its development in February.

?itok=fY616BWb (

?itok=fY616BWb ( ?itok=fY616BWb)

?itok=fY616BWb)

**"Today's action is the latest strike,"** the lawsuit read, saying the development contracts "laid the foundation for billions of Disney's investment dollars and thousands of jobs."

Disney alleged, "The government action was patently retaliatory, patently anti-business, and patently unconstitutional."

> _" **Having exhausted efforts to seek a resolution, the Company is left with no choice** but to file this lawsuit to protect its cast members, guests, and local development partners from a relentless campaign to weaponize government power against Disney in retaliation for expressing a political viewpoint unpopular with certain State officials," the lawsuit continued._

For about a year, Disney and DeSantis feud has been stirring. It started when Disney criticized Florida's Parental Rights in Education law, also known as "Don't Say Gay," which limits discussion of sexual orientation and gender identity in public school classes from K-12.

Disney has said it would work to abolish the law and pledged to "stand up for the rights and safety" of the LGBTQ community.

A DeSantis spokeswoman told The Washington Post (https://www.washingtonpost.com/business/2023/04/26/desantis-disney-lawsuit/) that Disney's lawsuit was " **another unfortunate example of their hope to undermine the will of the Florida voters"** and circumvent state law.

> _"We are unaware of any legal right that a company has to operate its own government or maintain special privileges (https://www.zerohedge.com/political/desantis-signs-bill-killing-corporate-kingdom-disney-world) not held by other businesses in the state," said Taryn Fenske, communications director for the governor's office._

The DeSantis versus Disney battle is heating up as the Florida governor is expected to become a top Republican contender (https://www.zerohedge.com/news/2023-04-19/fec-filing-confirms-desantis-forthcoming-presidential-bid) for the 2024 presidential race.

\* \* \*

**Read Disney's full lawsuit here:**

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 14:25

**The Growing Consumer Revolt Against Woke Ideology**

The Growing Consumer Revolt Against Woke Ideology

_Authored by Jeffrey A. Tucker via The Epoch Times (https://www.theepochtimes.com/the-growing-consumer-revolt-against-woke-ideology_5216781.html?utm_source=partner&utm_campaign=ZeroHedge&src_src=partner&src_cmp=ZeroHedge) (emphasis ours),_

It’s likely true: **No executives at Anheuser-Busch knew what the Bud Light marketing people were planning when they decided to deploy an absurdist and deeply offensive transgender TikTok influencer to sell their beer.** But soon after it happened, public disgust became rather obvious. The crisis began, but for weeks, the company was in denial.

?itok=ogm-kgMZ\

?itok=ogm-kgMZ\

_A six pack of Bud Light sits on a shelf for sale at a convenience store in New York City on July 26, 2018. (Drew Angerer/Getty Images)_ ( ?itok=ogm-kgMZ)

?itok=ogm-kgMZ)

Finally, the CEO made a statement that only infuriated people more, simply because it wasn’t an apology or even an honest admission of anything that was happening. It had that sterilized and robotic quality we’ve come to associate with government statements that pretend that all is well when everyone knows it isn’t.

Two weeks ago, the line about Bud Light on the streets was that the consumer protest would run the news cycle and then disappear, that the protests were limited to the “far right” and “conservative activists” but that most consumers don’t care either way. Every story in the mainstream media said the same thing. They further suggested that if you don’t drink Bud Light, you are likely a dupe of dangerous fanatics.

But here we are three weeks later and finally, the company stepped up again to address the growing meltdown. They put both the vice president of marketing and her boss “on leave,” which one supposes is a way of firing them while minimizing the legal liabilities and the sense that the company was facing a real crisis.

“ **Given the circumstances, Alissa \[Heinerscheid\] has decided to take a leave of absence which we support,**” an Anheuser-Busch spokeswoman wrote in an email to The Wall Street Journal. “Daniel \[Blake\] has also decided to take a leave of absence.”

**I just love that “given the circumstances” line.**

This move of course has satisfied no one, fed the news cycle even more, and further entrenched the consumer boycott that has spread to all the company’s brands.

Do you see what is happening here? We are watching the rise of genuine consumer awareness and hence sovereignty. The public is finally fighting back.

Only a few years ago, politics was pretty well kept out of economics and marketing. We could have our differences over ideology but they didn’t invade our commercial spaces. For decades, if not centuries, the market has largely operated outside of the poison of politics, or at the very least, large companies pretended to be neutral in order to maximize their public reach.

When you go to the Cheesecake Factory, no one cares what you believe and no one tells you what you have to believe. It’s been the same in every commercial space since the late Middle Ages: the consumer is the king in this realm, and politics doesn’t belong. The advance of this system represented a major change in social structures the world over. It meant that wealth and power came not from conquest and exploitation but rather service to fellow human beings.

**By the late 19th century, the advances of consumer sovereignty and meritocracy replacing aristocracy seemed largely complete.** During this time, too, humanity experienced and enjoyed the greatest flurry of innovations in human history, seemingly all at once: the commercialization of steel, the rise of electricity, the mass availability of internal combustion and flight, the telephone, and spreading of wealth to all classes. It wasn’t politics that did this but the people’s power of the market economy. This reality has always been a major annoyance to the ideologues who believe that political agitation should invade the whole of life.

Much of this has changed with “woke” ideology, which is the latest iteration of the deeply dangerous fanaticism that the personal must always be political. The slogan was bandied about in the 1960s but failed to capture commercial institutions, which continued to be governed by mundane concerns about the public’s desire to get products and services at a good price.

But with a series of small steps and then big ones, the marketplace has become seriously politicized, with consumers conscripted by various causes. The advent of ESG and DEI movements are major parts of the putsch of fully invading the commercial world. Companies have to get a high rating or else see their stocks delisted…

https://www.zerohedge.com/political/growing-consumer-revolt-against-woke-ideology

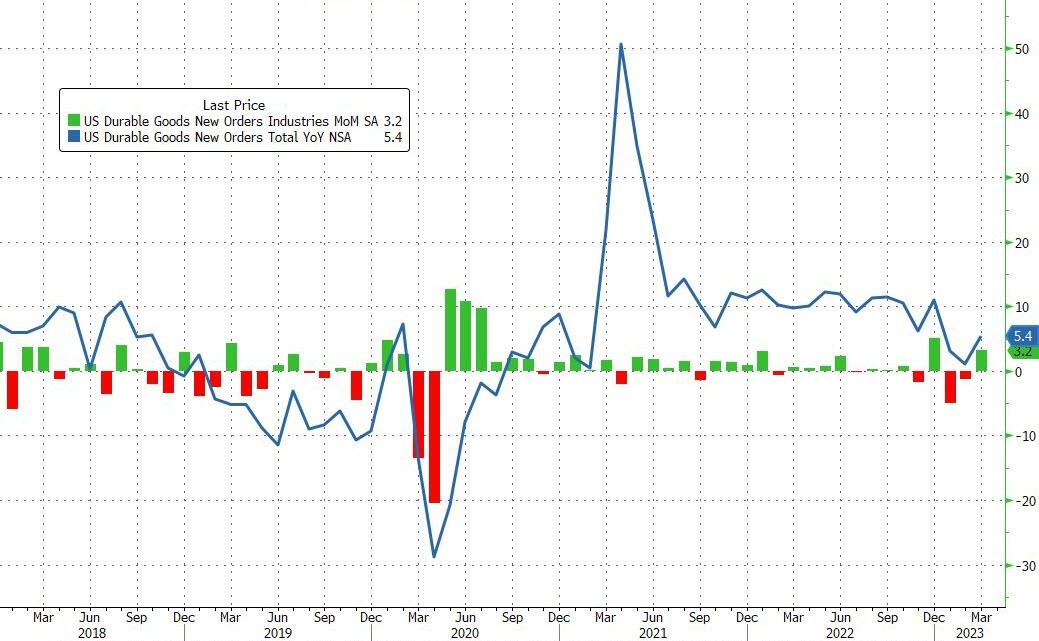

**US Durable Goods Orders Unexpectedly Soar In March... Thanks To Boeing**

US Durable Goods Orders Unexpectedly Soar In March... Thanks To Boeing

After declining for two straight months (https://www.zerohedge.com/markets/us-durable-goods-orders-unexpectedly-drop-feb-weakest-yoy-2-years), analysts expected US durable goods orders to bounce modestly (+0.7% MoM) in preliminary March data released today. Instead the print **soared 3.2% MoM** rescuing the YoY from dropping negative for the first time since Aug 2020...

?itok=9ToOzG6I (

?itok=9ToOzG6I ( ?itok=9ToOzG6I)

?itok=9ToOzG6I)

_Source: Bloomberg_

Core orders (ex-Transports) rose 0.3% MoM (better than the 0.2% drop expected) highlighting that this headline surge was all Boeing - **with a 78.4% MoM surge in non-defense aircraft and parts orders**

?itok=jDLqLi3l (

?itok=jDLqLi3l ( ?itok=jDLqLi3l)

?itok=jDLqLi3l)

_Source: Bloomberg_

**On the negative side,** the value of core capital goods orders, **a proxy for investment in equipment that excludes aircraft and military hardware, fell 0.4% last month** with a big downward revision to -0.4% MoM in February.

Shipments also tumbled 0.4% MoM.

So, aside from Boeing, this is not pretty at all.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 08:38

https://www.zerohedge.com/markets/us-durable-goods-orders-unexpectedly-soar-march-thanks-boeing

**"Good Riddance": Military-Industrial Complex Celebrates Tucker Carlson's Fox News Exit**

"Good Riddance": Military-Industrial Complex Celebrates Tucker Carlson's Fox News Exit

_Authored by Paul Joseph Watson via Summit News (https://summit.news/2023/04/26/good-riddance-military-industrial-complex-celebrates-tucker-carlsons-fox-news-exit/),_

**Members of the military-industrial complex interviewed by Politico celebrated Tucker Carlson’s exist from Fox News, with one declaring, “Good riddance!”**

?itok=8LrPfTCP\

?itok=8LrPfTCP\

_Janos Kummer via Getty Images_ ( ?itok=8LrPfTCP)

?itok=8LrPfTCP)

Carlson was unceremoniously booted from the network on Monday despite being the most popular prime time TV news host in America.

He was reportedly given barely 10 minutes notice of the decision before it was revealed to the media.

Perhaps unsurprisingly, members of the military-industrial complex and the deep state are all but popping champagne corks in response to the news.

“ **We’re a better country without him bagging on our military every night in front of hundreds of thousands of people**,” one senior DoD official told Politico.

“ **Good riddance**,” added another.

> NEW: On Tucker Carlson leaving Fox: “We’re a better country without him bagging on our military every night in front of hundreds of thousands of people,” said one senior Pentagon official. via @laraseligman (https://twitter.com/laraseligman?ref_src=twsrc%5Etfw)https://t.co/kcmcd1Qy0w (https://t.co/kcmcd1Qy0w)

>

> — Lee Hudson (@LeeHudson\_) April 26, 2023 (https://twitter.com/LeeHudson_/status/1651014200175501314?ref_src=twsrc%5Etfw)

When reporter Lara Seligman asked Tucker Carlson what he thought about top Pentagon officials expressing glee at his departure, the former Fox News host texted, “Ha! I’m sure.”

Carlson had repeatedly taken swipes at US military bosses for appearing to be more focused on amplifying narratives about “diversity” than defending America.

“ **When AOC, The View, the Pentagon, and big pharma are all celebrating your ousting you were probably doing the Lord’s work**,” commented Auron MacIntyre.

> When AOC, The View, the Pentagon, and big pharma are all celebrating your ousting you were probably doing the Lord’s work https://t.co/8mTOgrNDLy (https://t.co/8mTOgrNDLy)

>

> — Auron MacIntyre (@AuronMacintyre) April 26, 2023 (https://twitter.com/AuronMacintyre/status/1651043873777410050?ref_src=twsrc%5Etfw)

Meanwhile, Dr. Nicholas Waddy, political analyst and associate professor of history at SUNY Alfred, told Sputnik that Carlson’s departure will “solidify the neo-conservative, hawkish orientation of Fox News” when it comes to supporting conflicts like the one in Ukraine.

“The more important question, though, is whether oppositional media and journalism, and thus democratic pluralism, can survive in an environment in which ‘misinformation’ and ‘libel’ are so opportunistically defined,” Waddy added, “and in which a media organization can be buried in litigation, as well as abandoned by skittish advertisers, and thus stifled financially if it strays from political orthodoxy.”

As we highlight in the video below, there were a number of reasons for Carlson’s exit, but prime amongst them was his constant questioning of how much taxpayer money was being used to prolong the war in Ukraine and what the end goal was.

\* \* \*

_Brand new merch now available! Get it at https://www.pjwshop.com/ (https://www.pjwshop.com/)_

_In the age of mass Silicon Valley censorship It is crucial that we stay in touch. (https://www.pjwshop.com/)I need you to sign up for my free newsletter (https://www.pjwshop.com/)here (https://summit.news/newsletter). Support my sponsor – Turbo Force (https://bit.ly/TURBOFORCE) – a supercharged boost of clean energy without the comedown._

_Get early access, exclusive content and behind the scenes stuff by following me on Locals (https://pauljosephwatson.locals.com/)._

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 08:20

**Futures Rally Fizzles As Banking Fears Resurface**

Futures Rally Fizzles As Banking Fears Resurface

US index futures are fractionally higher, led by tech, however continued turmoil surrounding First Republic Bank which tumbled as much as 30% this morning after losing half its value yesterday, has sapped much of the earlier optimism and gains. Yesterday was the SPX’s worst day in a month and was April’s second move that exceeded 1%, in either direction. As of 8:00am ET, S&P futures were up 0.1%, while Nasdaq futures gained 0.8%, but both were well of their highs. Google parent Alphabet and Microsoft Corp. both beat first-quarter earnings expectations in results published after the market close. Microsoft gained in the premarket Wednesday, while Alphabet reversed an advance to move into the red. Meta Platforms is due to report after the bell today.

?itok=3ZV0ofqf (

?itok=3ZV0ofqf ( ?itok=3ZV0ofqf)

?itok=3ZV0ofqf)

Pre-mkt MSFT +7.4%, AMZN +3.7%, NVDA +2.1%, META +2.0%, GOOGL, +0.5%, AAPL +0.4%. PACW seemingly gives more evidence that FRC is idiosyncratic. V is +0.9% pre-mkt after posting earnings; the more impactful news may be that the company states that the consumer remains in good shape amid decreasing inflation. Here are some other notable premarket movers:

- Boeing shares jump 4.1% in premarket trading, after the planemaker’s first-quarter revenue and cash flow both beat expectations. Shares off some Boeing suppliers also rose premarket. Spirit AeroSystems up 2.5%, Arconic up 1%, Howmet up 1.9%.

- Microsoft jumps as much as 7.7% after the software company’s third-quarter results beat expectations. Analysts highlighted strength in the company’s Azure cloud business and were optimistic about the overall resiliency of the business, leading at least 16 of them to raise their price target on the stock.

- Alphabet rises as much as 1.9% after the Google parent reported first-quarter results that beat expectations. Analysts noted strength in the company’s search business, as well as positive momentum in cloud. This coupled with strong results from fellow tech juggernaut Microsoft eased concerns that tech shares’ year-to-date rally is overdone.

- Midsize US banks, including First Republic (FRC US), rally following an update from peer PacWest which showed that deposits stabilized toward the end of March and rose in April, calming worries over the lender’s health.

- Enphase Energy shares plummet as much as 16%, on track for their worst day since June 2020, with analysts cutting their price targets on the solar equipment maker after its second-quarter revenue guidance missed expectations due to weakness in its US market and higher interest rates. Brokers say that Enphase’s first quarter performance was overall strong, and are positive regarding its prospects for the longer-term.

- Getty falls as much as 6.7% after the media firm rebuffed a takeover bid of almost $4 billion from Trillium, saying the activist investor hasn’t provided any evidence that its proposal, valuing the shares at nearly double the pre-offer price, is “sufficiently credible.”

- IonQ gains 3.6% after Morgan Stanley initiates coverage with an equal-weight recommendation, saying the quantum computing company is an early leader in the space, though the technology risk is high as quantum advantage is still unproven.

While layoffs dominate headlines, the US is still net adding jobs this year, from a strong starting point, 3.5% unemployment. The yield curve is steeper with USD lower; cmdtys staging a relief rally.

Today, the macro data focus is on durable/cap goods, inventories, and mtge applications. There may be a vote on McCarthy’s debt ceiling bill in the House, though this bill will fail in the Senate but is seeing a stronger negotiating move. Debt ceiling fears will continue to permeate markets near-term

“The question is to what extent central banks and regulators can contain market sentiment and make clear to investors they need to keep a cool head, to give depositors confidence that there is no need to run to other banks,” said Tatjana Puhan, deputy chief investment officer at Tobam SAS. “So far the Fed has been very clear that they will continue to hike rates as long as needed to contain inflation.”

European stocks fall to their lowest level in two weeks as investors continue to fret over the health of the global banking system. Software producer Dassault Systemes sank more than 8% after missing revenue estimates. The Stoxx 600 is down 0.8% with industrials, healthcare and tech the worst performing sectors. Bank stocks were leading declines at one stage but recovered after a positive premarket open for First Republic. Dutch chip-tool maker ASM International slumped more than 10% after offering a tepid outlook for the rest of the y…

https://www.zerohedge.com/markets/futures-rally-fizzles-banking-fears-resurface

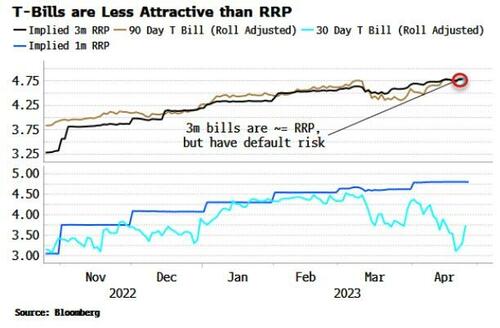

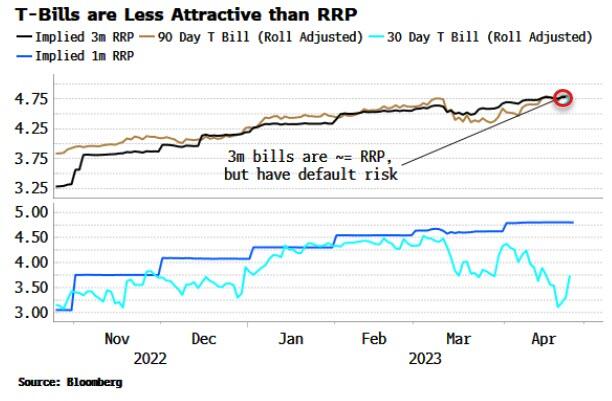

**Debt Ceiling Drama Will Keep Pressure On Stocks**

Debt Ceiling Drama Will Keep Pressure On Stocks

_Authored by Simon White, Bloomberg macro strategist,_

**Pressure on reserves and extra demand for the Fed’s RRP facility will keep weighing on stocks and other risk assets.**

Debt-ceiling dynamics are distorting the Treasury bill curve. Bills are first in the line of fire if the debt ceiling becomes binding due to the way they are issued. This is leading to a surfeit of demand for bills which mature before “X Day”, the day when it is anticipated the Treasury will hit the debt ceiling. Tax payments are slower than average this year, bringing estimates for X Day to early June.

This has led to 1-month bills yielding only ~3.75% versus 3-month bills at ~5%. The current overnight RRP rate is 4.80%. **We can use the rates implied by Fed Funds futures to imply what the 1-month and 3-month RRP rates would approximately be.**

The chart below shows that the RRP is more attractive than 1-month bills by a long way, while roll-adjusted 3-month bills are slightly above the implied RRP rate, but the **RRP does not face the same default risk.** Six-month bills are also less attractive than the RRP.

?itok=Y7jTjtn- (

?itok=Y7jTjtn- ( ?itok=Y7jTjtn-)

?itok=Y7jTjtn-)

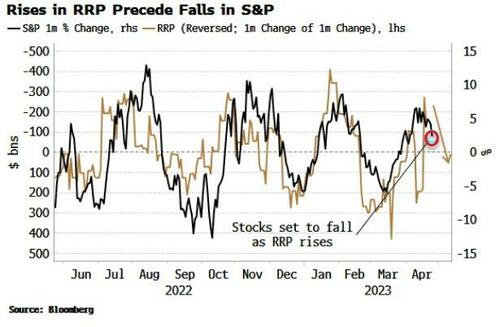

**This will likely divert more reserves to the RRP facility, already sat near its highs at just under $2.7 trillion. A rising RRP typically leads to falls in stock prices.**

?itok=9uRD3ueQ (

?itok=9uRD3ueQ ( ?itok=9uRD3ueQ)

?itok=9uRD3ueQ)

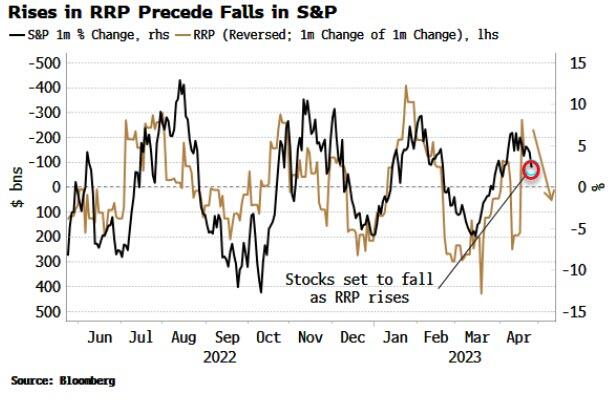

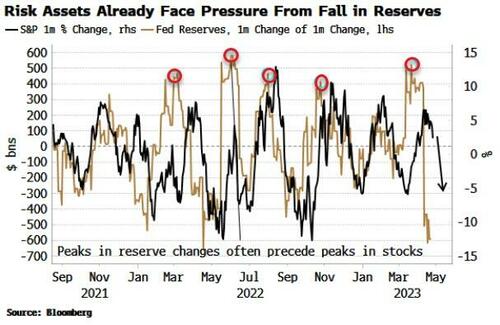

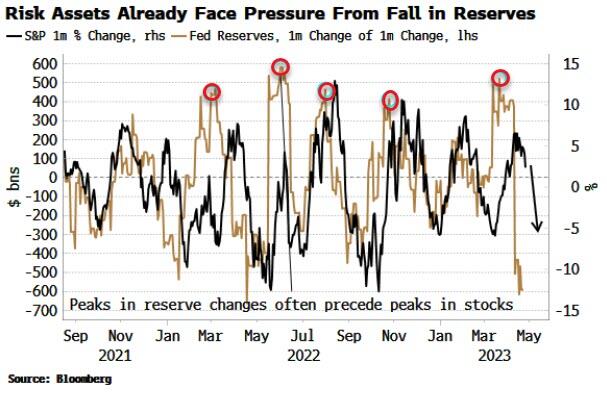

The RRP drains reserves from the system, i.e. velocity, and this tends to lead to weaker risk-asset prices. We can see that **the “impulse” of reserves (the change of their change) is already falling. As the debt-ceiling drama heats up, this will put further pressure on reserves and thus risk assets in the shorter term.**

?itok=zb54CAaS (

?itok=zb54CAaS ( ?itok=zb54CAaS)

?itok=zb54CAaS)

The **NY Fed yesterday announced some counterparty restrictions on the use of the RRP, limiting use for entities solely set up to use the facility**, but this is unlikely to be enough to significantly alter the current short-term dynamics.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 07:48

https://www.zerohedge.com/markets/debt-ceiling-drama-will-keep-pressure-stocks

**In Fatal Blow, UK Regulator Blocks Microsoft's $75 Billion Takeover Of Activision**

In Fatal Blow, UK Regulator Blocks Microsoft's $75 Billion Takeover Of Activision

In a fatal blow to Microsoft’s $75 billion takeover of _Call of Duty_ maker Activision Blizzard, not to mention countless M&A arbs, Britain’s antitrust watchdog vetoed the gaming industry’s biggest ever deal, saying it would harm competition in cloud gaming.

The powerful CMA, or Competition and Markets Authority, said its concerns couldn’t be solved by remedies such as the sale of blockbuster title Call of Duty or so-called behavioral remedies involving promises to permit rivals to offer the game on their platforms, according to a statement Wednesday.

Pressure had been mounting on Microsoft - which yesterday reported stellar earnings and solid guidance sending its stock sharply higher - as it lobbies at home and in Europe to convince watchdogs to clear the deal, one of the 30 biggest acquisitions of all time. Crucially, the CMA’s conclusions comes before decisions from the European Union and the US Federal Trade Commission, which is awaiting a hearing in the summer after formally suing to veto the transaction.

“Microsoft already enjoys a powerful position and head start over other competitors in cloud gaming and this deal would strengthen that advantage giving it the ability to undermine new and innovative competitors,” Martin Coleman, chair of the independent panel of experts conducting this investigation, said.

The CMA took a view that the merger could result in higher prices, fewer choices and less innovation for UK gamers.

> We’ve prevented @Microsoft (https://twitter.com/Microsoft?ref_src=twsrc%5Etfw) from purchasing @Activision (https://twitter.com/Activision?ref_src=twsrc%5Etfw) over concerns the deal would damage competition in the #CloudGaming (https://twitter.com/hashtag/CloudGaming?src=hash&ref_src=twsrc%5Etfw) market, leading to less innovation and choice for UK #gamers (https://twitter.com/hashtag/gamers?src=hash&ref_src=twsrc%5Etfw). ☁️https://t.co/SdXt1rYAkZ (https://t.co/SdXt1rYAkZ)pic.twitter.com/prWcDI7Evt (https://t.co/prWcDI7Evt)

>

> — Competition & Markets Authority (@CMAgovUK) April 26, 2023 (https://twitter.com/CMAgovUK/status/1651179527249248256?ref_src=twsrc%5Etfw)

However, earlier this month it narrowed its original scope to focus on cloud gaming rather than consoles, after weighing new evidence.

“We remain fully committed to this acquisition and will appeal,” Brad Smith, vice chair and president of Microsoft, said. _**“The CMA’s decision rejects a pragmatic path to address competition concerns and discourages technology innovation and investment in the UK.”**_

> We remain fully committed to our acquisition with @ATVI\_AB (https://twitter.com/ATVI_AB?ref_src=twsrc%5Etfw) and will appeal today's determination by the CMA. Here's our statement. pic.twitter.com/ylvDP5RUqQ (https://t.co/ylvDP5RUqQ)

>

> — Brad Smith (@BradSmi) April 26, 2023 (https://twitter.com/BradSmi/status/1651182266406584320?ref_src=twsrc%5Etfw)

He added that the **CMA’s decision reflected “a flawed understanding of this market and the way the relevant cloud technology actually works”.**

The CMA said the deal would solidify Microsoft’s advantage in the market by by giving it control over blockbuster games Call of Duty, Overwatch, and World of Warcraft. The watchdog found that without the merger Activision would be able to start providing games on cloud platforms in the future.

> _**“The CMA’s report contradicts the ambitions of the UK to become an attractive country to build technology businesses,”**_ an Activision spokesperson said.

>

> _**“We will work aggressively with Microsoft to reverse this on appeal.”**_

The ruling also comes after the regulator retreated from a key concern in February, in step that had appeared to pave the way for the two sides to inch the deal through. The companies had hoped to reassure the CMA that licensing deals signed with cloud gaming platforms would be sufficient to clear the takeover.

In kneejerk response, Activision stock fell as much as 12% to $76 in premarket trading; the gap between Activision’s stock price and Microsoft’s $95-a- share offer widened to $19 in premarket trading, compared with $8.26 as of Tuesday’s close, leading to massive losses across an arb community which at one point included even Warren Buffett before his wise decision to offload ATVI stock in late 2022.

?itok=j1gCygtp (

?itok=j1gCygtp ( ?itok=j1gCygtp)

?itok=j1gCygtp)

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 07:26

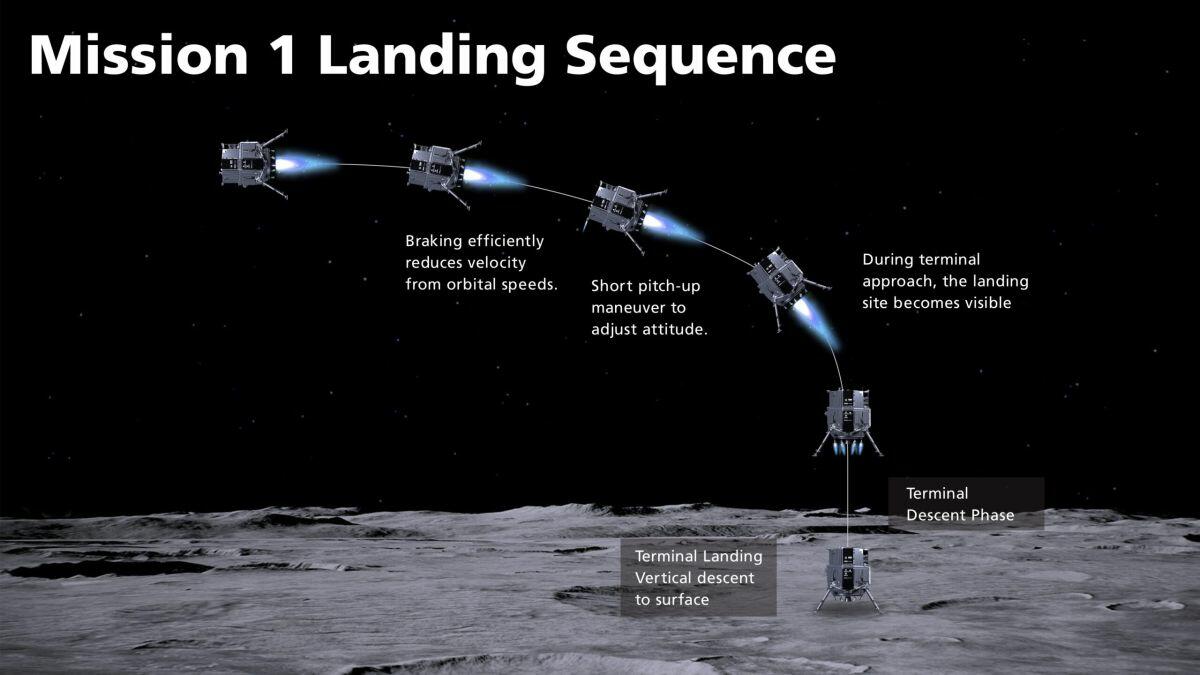

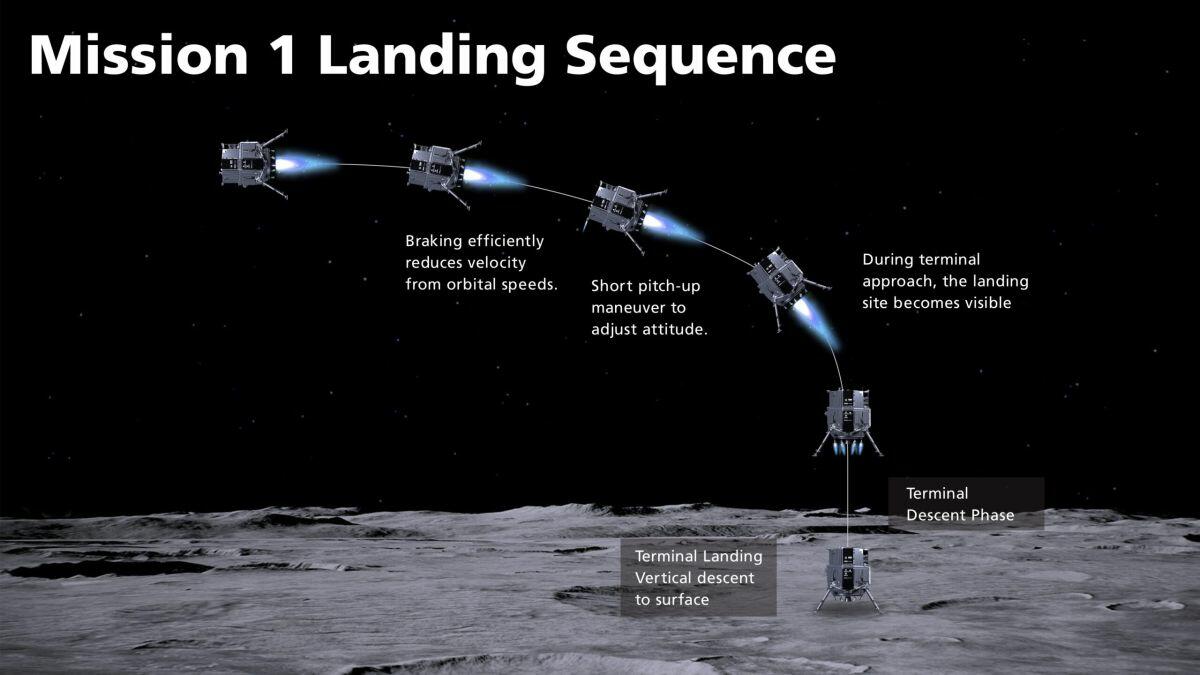

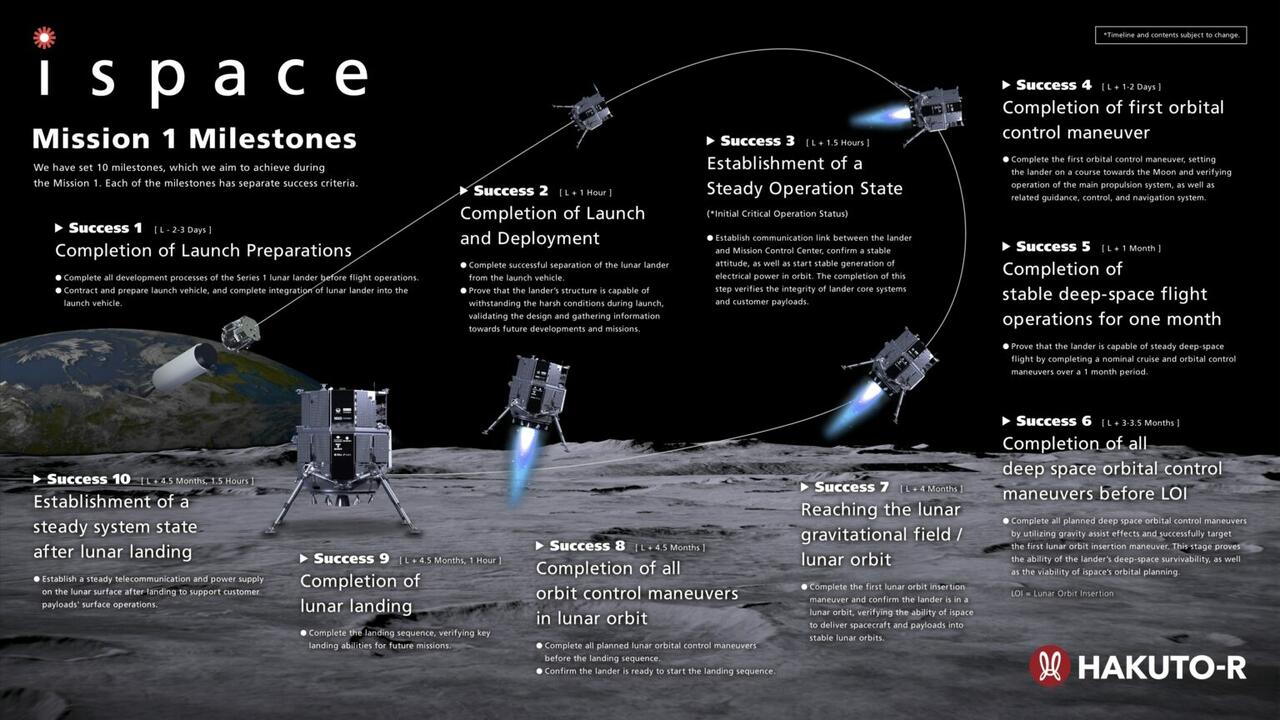

**Japan's Ispace Shares Crash On Lunar Lander Fail**

Japan's Ispace Shares Crash On Lunar Lander Fail

**Update (Wednesday):**

Shares of Tokyo-based ispace tumbled after the private company said its Hakuto-R Mission lander probably crashed while on approach to land on the lunar surface.

Recall, we provided a live stream of the lunar landing on Tuesday afternoon. About 25 minutes into the planned landing, there was a communications mishap.

?itok=VSQYNjbt (

?itok=VSQYNjbt ( ?itok=VSQYNjbt)

?itok=VSQYNjbt)

Well, it turns out the lander probably crashed:

> _"It **apparently went into a freefall towards the surface** as it was running out of fuel to fire up its thrusters," Ryo Ujiie, the chief technology officer, told a news conference on Wednesday._

Shares of ispace trading in Tokyo crashed 20% on the news.

?itok=xvjBal4J (

?itok=xvjBal4J ( ?itok=xvjBal4J)

?itok=xvjBal4J)

_"It was probably overbought going into this," said Kirk Boodry, an analyst at Astris Advisory in Tokyo. He said, "Now that the excitement has sort of passed, investors are going to take a harder look at what it means as a business model."_

If successful, iSpace would have achieved the first private lunar landing. This marked the second disappointment for the commercial space industry within a week, following SpaceX's Starship's inability to reach orbit.

\* \* \*

**Update (1305ET):**

Ispace has switched to pre-recorded videos on its YouTube live stream due to a communication issue with the spacecraft as it attempted to land on the moon's surface. The spacecraft's current status is unknown.

\* \* \*

If all goes to plan, a Japanese lunar lander, which is transporting a rover developed by the United Arab Emirates, is set to touch down on the moon.

Ispace's Hakuto-R Mission 1 lander was launched atop a SpaceX rocket from Cape Canaveral, Florida, on Dec. 11. Since then, it has been on a three-month journey and just recently entered the moon's orbit, which lies about 239,000 miles away.

Earlier statements from ispace outline Hakuto-R is expected to land at "the Atlas Crater, located at 47.5°N, 44.4°E, on the southeastern outer edge of Mare Frigoris ("Sea of Cold")."

> _"Should conditions change, there are three alternative landing sites and depending on the site, the landing date may change. Alternative landing dates, depending on the operational status, are Apr. 26, May 1 and May 3, 2023," ispace officials said earlier this month._

On Monday, ispace shared a photo of the lander about 62 miles above the lunar surface.

> We are excited to share a new photo of the Moon taken by the lander's on-board camera from an altitude of about 100 km above the lunar surface. The photo was taken at 4:32 am on April 15 (JST). (1/2) pic.twitter.com/PWux4GJLIx (https://t.co/PWux4GJLIx)

>

> — ispace (@ispace\_inc) April 24, 2023 (https://twitter.com/ispace_inc/status/1650408608197390336?ref_src=twsrc%5Etfw)

Here's another photo of the lunar surface and the Earth in the distance.

> We’ve received another incredible photo from the camera onboard our Mission 1 lander!

>

> Seen here is the lunar Earthrise during solar eclipse, captured by the lander-mounted camera at an altitude of about 100 km from the lunar surface. (1/2) pic.twitter.com/pNSI4lPnux (https://t.co/pNSI4lPnux)

>

> — ispace (@ispace\_inc) April 24, 2023 (https://twitter.com/ispace_inc/status/1650506233575604227?ref_src=twsrc%5Etfw)

According to Space.com, the Hakuto-R lander is expected to land on the lunar surface around 1240 EST (1640 GMT).

?itok=VSQYNjbt (

?itok=VSQYNjbt ( ?itok=VSQYNjbt)

?itok=VSQYNjbt)

Ispace mapped out the entire mission.

?itok=9PpZJi5Y (

?itok=9PpZJi5Y ( ?itok=9PpZJi5Y)

?itok=9PpZJi5Y)

Live coverage starts around 1100 EST.

This will be the first attempt at a private moon landing.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 06:55

https://www.zerohedge.com/technology/watch-live-japan-attempts-worlds-first-commercial-moon-landing

**Biden Preparing For Ukrainian Offensive To Fail**

Biden Preparing For Ukrainian Offensive To Fail

_Authored by Dave DeCamp via AntiWar.com,_ (https://news.antiwar.com/2023/04/24/politico-biden-preparing-for-failed-ukrainian-counteroffensive/)

The Biden administration is preparing for the possibility of Ukraine’s long-awaited counteroffensive failing, _Politico_ (https://www.politico.com/news/2023/04/24/biden-ukraine-russia-counteroffensive-defense-00093384) reported on Monday.

Pentagon documents allegedly leaked by Airman Jack Teixeira revealed that **the US doesn’t believe Ukraine can regain any significant territory in its counteroffensive**, which is expected to be launched in the spring. The information in the leaks was based on an assessment made in February.

?itok=rIBmBUBa\

?itok=rIBmBUBa\

_Image: AFP_ ( ?itok=rIBmBUBa)

?itok=rIBmBUBa)

According to _Politico_, more current assessments also don’t expect much Ukrainian success. Two Biden administration officials said they don’t think Kyiv has the ability to sever Russia’s land-bridge to Crimea in the Kherson and Zaporizhzhia oblasts.

The report said US intelligence **"indicates that Ukraine simply does not have the ability to push Russian troops from where they were deeply entrenched."** Ukrainian President Volodymyr Zelensky said in March that his forces need more Western weapons before they can launch a counteroffensive. (https://news.antiwar.com/2023/03/26/zelensky-says-no-counteroffensive-until-the-west-sends-more-weapons/)

The administration is expected to face criticism from hawks who believe Biden hasn’t given Ukraine enough weapons, as well as those who have been calling for the US to push for diplomacy. The US is also **worried that many of its European allies will favor negotiations** between the warring sides if Ukraine’s offensive fails.

Since Russia invaded Ukraine on February 24, 2022, the administration has discouraged peace talks (https://news.antiwar.com/2023/02/05/former-israeli-pm-bennett-says-us-blocked-his-attempts-at-a-russia-ukraine-peace-deal/) and recently came out against the idea of a ceasefire in Ukraine. The administration has left it up to Zelensky when to pursue peace talks, and he still maintains they can’t happen until Russia is driven out of all the territory it controls, including Crimea.

But now, according to _Politico_, there is a discussion among administration officials about convincing Ukraine to accept more modest goals and agree to a temporary ceasefire. Possible incentives for Kyiv include **giving Ukraine NATO-like security guarantees and more military aid**.

The issue with the US plan is that Russia has signaled it won’t settle for a frozen conflict and has stated it can only achieve its war goals by military means (https://news.antiwar.com/2023/03/13/kremlin-says-goals-in-ukraine-can-only-be-achieved-through-military-means/). Kremlin spokesman Dmitry Peskov recently reiterated (https://tass.com/politics/1607117) that one of Moscow’s main priorities is keeping Kyiv out of NATO after NATO Secretary-General Jens Stoltenberg said Ukraine’s “rightful place” is in the alliance. (https://news.antiwar.com/2023/04/20/in-kyiv-nato-chief-says-ukraines-rightful-place-is-in-the-alliance/)

In the early days of the Russian invasion, Russian and Ukrainian officials were engaged in peace talks, (https://news.antiwar.com/2022/08/31/report-russia-ukraine-tentatively-agreed-on-peace-deal-in-april/) and Moscow’s primary demand was for Ukrainian neutrality. But now Kyiv stands to lose much more as Russia maintains any settlement must include recognizing the areas it annexed in the Donbas and the Kherson and Zaporizhzhia oblasts as Russian territory.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 06:30

https://www.zerohedge.com/geopolitical/biden-preparing-ukrainian-offensive-fail

**GM Kills Chevy Bolt, Paving Path for Electric Pickups**

GM Kills Chevy Bolt, Paving Path for Electric Pickups

General Motors Chair and CEO Mary Barra announced that production of the Chevrolet Bolt EV and Bolt EUV would be halted by the end of 2023. This aligns with the GM's plan to transition the Bolt production line in Orion, Michigan, into manufacturing electric trucks.

During a Tuesday morning earnings call with investors, Barra confirmed the seven-year run of the Bolt would come to an end and be retooled for electric truck production:

> _"We've progressed so far that it's now time to plan the end of Chevrolet Bolt EV and EUV production, which will happen at the end of the year."_

GM's decision to kill Bolt production comes after a series of battery fires (https://www.zerohedge.com/markets/gm-issues-second-recall-year-chevy-bolt-after-battery-fires?ref=biztoc.com&curator=biztoc.com&utm_source=biztoc.com) over the last few years and at least one major recall _(read:__"After Multiple Recalls, GM May Be On The Verge Of Ending Production Of Its Chevy Bolt"_ (https://www.zerohedge.com/markets/pulling-plug-after-multiple-recalls-gm-may-be-verge-ending-production-its-chevy-bolt) _)._

_ ?itok=ou3GUmkK (

?itok=ou3GUmkK ( ?itok=ou3GUmkK)_

?itok=ou3GUmkK)_

Barra acknowledged the loyalty of Bolt owners but noted that some customers were furious by the EV's defects, which led to battery fires. GM had to recall 142,000 vehicles as a result. Some Bolt customers faced delays in receiving new batteries, while others could not drive their vehicles due to the fire risk. This manufacturing mishap hindered GM's progress in the EV market.

In 2023, GM has three new EV models for mass-market across the Chevrolet brand, including the Silverado truck, Blazer, and Equinox. The new models might rekindle GM's EV growth strategy after the Bolt fizzle.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 05:45

https://www.zerohedge.com/markets/gm-kills-chevy-bolt-paving-path-electric-pickups

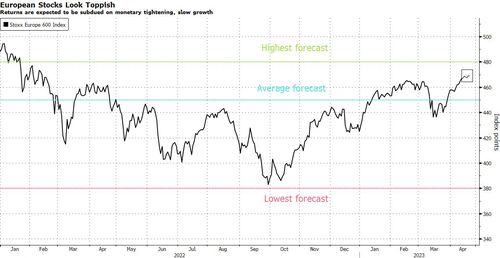

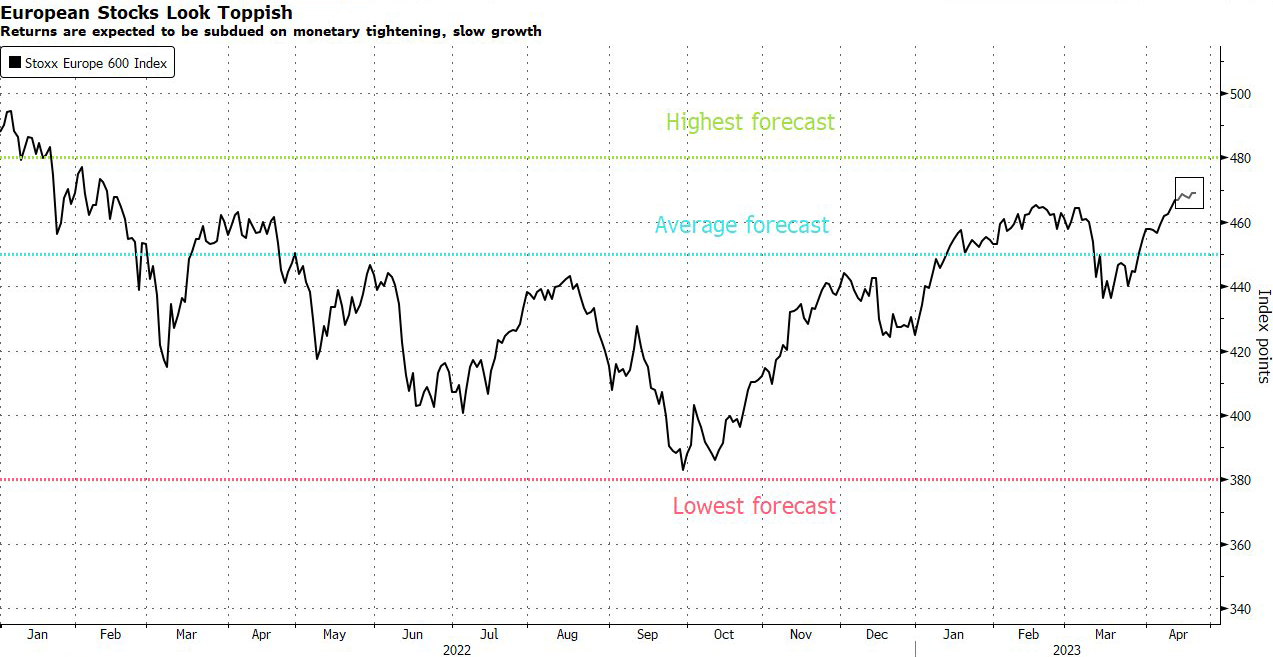

**If Anything, Strategists Want To Sell Europe Rally**

If Anything, Strategists Want To Sell Europe Rally

_By Michael Msika, Bloomberg Markets Live reporter and strategist_

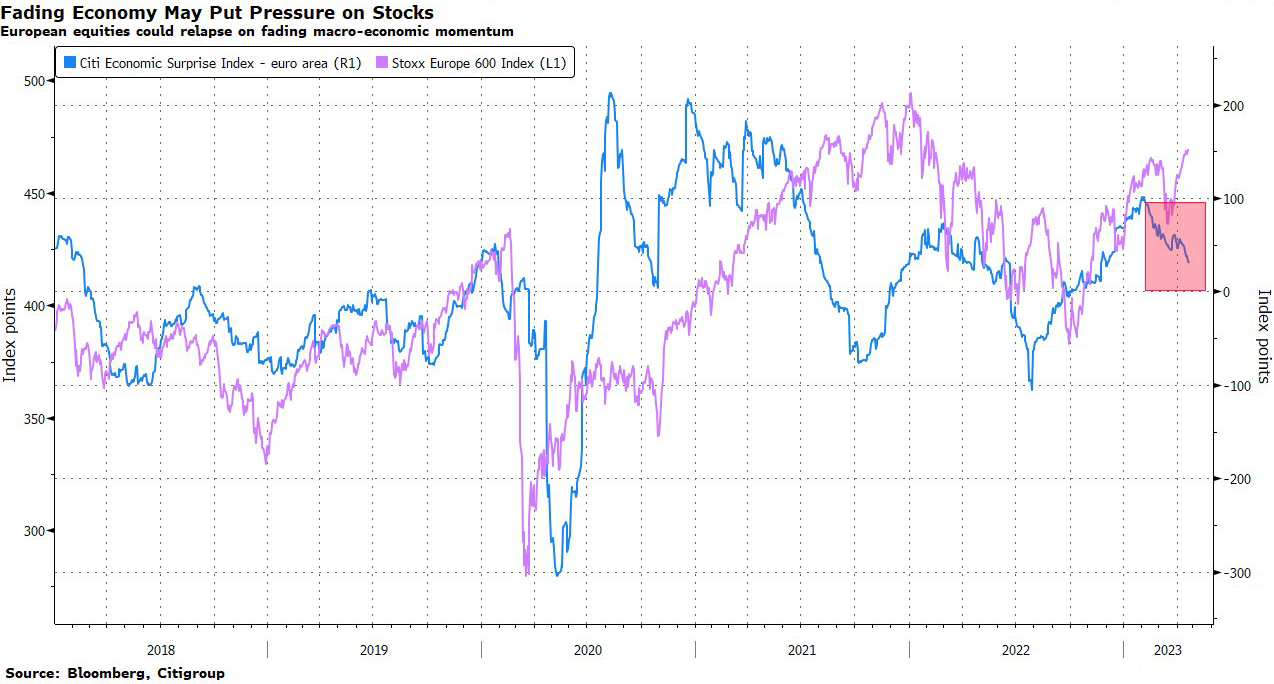

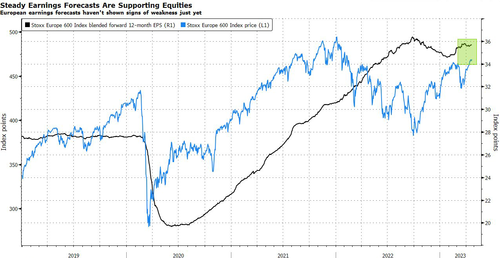

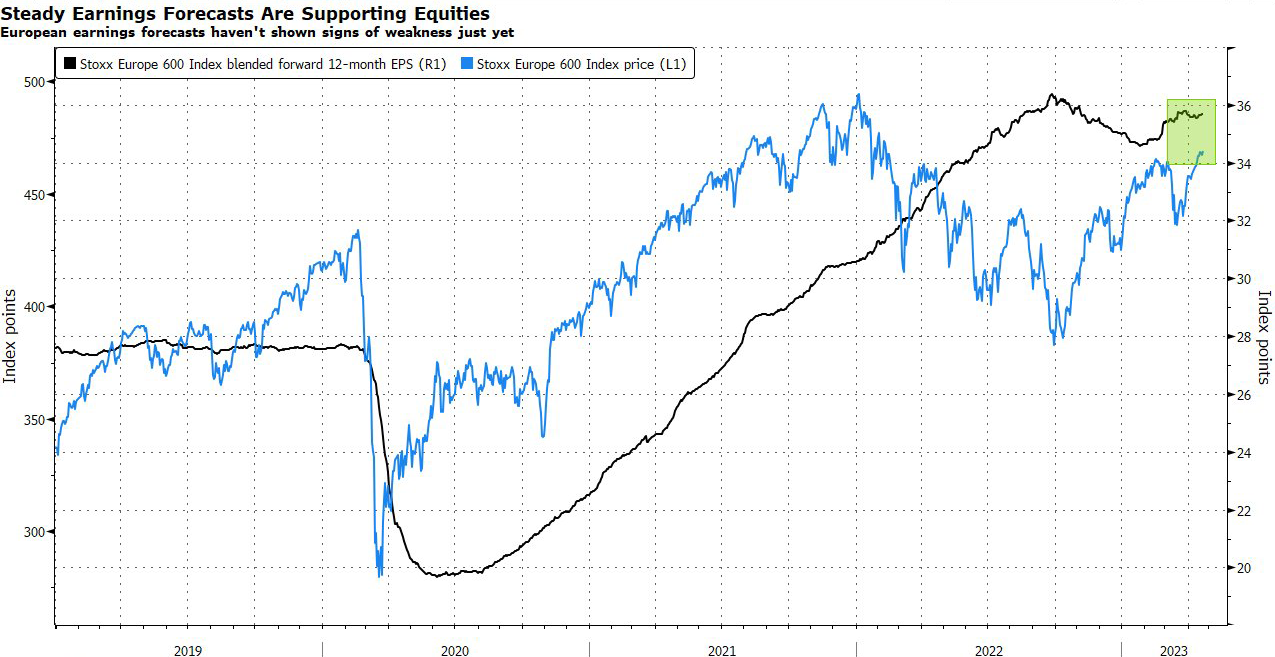

Strategists are bemused by the rebound in European equities since mid-March, expecting the sustained campaign of interest rate hikes to eventually stall the rally.

They are sticking to their gloomy outlook for the rest of 2023, unconvinced by a 10% advance in the Stoxx Europe 600 so far. The benchmark index is set to fall to 450 points by year-end, according to the average of 15 forecasts in a Bloomberg strategist survey, implying a drop of 4% from Friday’s close.

**“Monetary policy has been tightened by the sharpest pace in 40 years, which is resulting in a sharp deterioration of credit and monetary conditions,”** says Bank of America strategist Milla Savova. “We expect this to lead to recessionary growth conditions over the coming months, which, in turn, would be consistent with a meaningful widening in risk premia.”

The BofA strategists expect earnings forecast downgrades to add to the headwinds, cutting their year-end target for the Stoxx 600 to 410 from 430 last month, implying nearly 13% downside from here. For Savova and her team, the low point for stocks should come early in the fourth quarter, when the economic cycle is expected to bottom, dragging the benchmark to as low as 365.

?itok=vzwZ_8DS (

?itok=vzwZ_8DS ( ?itok=vzwZ_8DS)

?itok=vzwZ_8DS)

European equities have recouped all the losses induced by the banking turmoil in the US and the collapse of Credit Suisse. The Stoxx 600 surged to the highest since February 2022 this month, buoyed by an economic recovery in China, and rapid intervention by authorities to contain the banking crisis. The trouble is that manufacturing data for the continent have continued to deteriorate, while inflation remains too high for central banks to stop hiking rates.

The largely downbeat assessment from sell-side strategists is mirrored by the actions of the investment industry. According to the BofA European fund manager survey in April, 70% of investors expect weakness in the region’s equity market over coming months in response to monetary tightening, up from 66% last month. Meanwhile, 55% see stocks heading lower in the next 12 months, up from 42%. Sticky inflation leading to more central bank tightening is seen as the most likely cause of a correction, followed by weakening macro data, the survey showed.

?itok=2YUVclXK (

?itok=2YUVclXK ( ?itok=2YUVclXK)

?itok=2YUVclXK)

While most strategists in our survey have stuck to their forecasts or slightly adjusted their view downward in the past month, some found justification for an increase. State Street Global Advisors, for instance, raised its target to 475 from 455, although this only implies limited upside for the rest of the year.

“The financial contagion from the banking sector in March had been very well contained so far and markets have rebounded,” says Frederic Dodard, head of EMEA portfolio management at State Street Global Advisors. The firm continues to favor European equities over other regions, but sees a modest risk from negative guidance and additional downgrades to companies’ 2023 and 2024 earnings forecasts, he added.

?itok=q-x1jdka (

?itok=q-x1jdka ( ?itok=q-x1jdka)

?itok=q-x1jdka)

The first-quarter earnings season has kicked off with some positive surprises, and there could be more to come. But this shouldn’t be extrapolated as a signal of stronger stock performance, according to JPMorgan strategists. Low profit expectations have been easy for companies to beat, while the numbers also got a leg up from economic activity that was better than in the first-quarter of 2022, they argue.

“The question is whether the stocks will rally much further on the back of beats, post an already strong rally,” say strategists led by Mislav Matejka. “ **We advise to use any strength on the back of positive first-quarter results as a good level to reduce from.”**

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 05:00

https://www.zerohedge.com/markets/if-anything-strategists-want-sell-europe-rally

**Russia's Neighbors Ramp Up Military Spending**

Russia's Neighbors Ramp Up Military Spending

Russia's neighbors in Europe have upped their military spending since theinvasion of Ukraine (https://www.statista.com/topics/9087/russia-ukraine-war-2022/) in early 2022.

But,as Statista's Katharina Buchholz notes (https://www.statista.com/chart/27037/defense-spending-change-by-country/), **even before the war - over the course of the past decade - expenditure on defense had already increased substantially in these nations.**

Perhaps most unsurprisingly, Ukraine itself shows one of the biggest increases measured bythe Stockholm International Peace Research Institute. (https://www.sipri.org/databases/milex)

**Its military expenditure (https://www.statista.com/topics/1696/defense-and-arms/) rose by 640 percent from 2021 to 2022 and a still very significant 52 percent per year on average in the past five years compared to the five before that.** In 2022, defense spending made up a third of Ukrainian GDP, according to the data.

(https://www.statista.com/chart/27037/defense-spending-change-by-country/)

(https://www.statista.com/chart/27037/defense-spending-change-by-country/)

_You will find more infographics at Statista (https://www.statista.com/chartoftheday/)_

Some of the **next biggest spending increases could be seen in Lithuania and Latvia** \- two of Russia's direct neighbors -, but also in other Eastern European countries like Hungary (average annual increase of 18 percent), Bulgaria (+16 percent), Slovakia (+15 percent) and Romania (+14 percent). Because military projects are usually large, one-time expenses and updates to them are infrequent, annual average are used for the chart. According to these annual averages, Russia has actually spent slightly less in the past 5 years on its military than it did in the five years prior to that. However, between 2021 and 2022, spending increased by 9 percent in the country.

**Despite the steep increases, the share of GDP spent on defense remained in line with the NATO goal of 2 percent in the Baltic countries, which are NATO members.** Western European countries like Germany but also Italy, Spain or the Netherlands, stayed quite far behind this goal despite moderate increases in spending. Other European nations at and slightly above the 2-percent mark are Poland, the UK, Estonia, Croatia, Serbia and Greece.

However, their spending had been at these levels since before the invasion of Ukraine.

**Asian countries like India and China have grown their defense expenditure steadily over the past ten years.**

Comparing to the GDPs of the respective countries, however, expenditure has grown roughly in line with GDP since 2013 and stood at around 2.4 percent in India and less than 2 percent in China last year.

**One African country where defense expenditure has decreased substantially throughout the decade is crisis-ridden South Sudan, which saw a significant dip of -17 percent per year on average.**

Africa was the continent whose spending dipped the most between last year and 2021. Several countries spent less on their military in 2022, for example Nigeria, Mozambique, Mali and Zimbabwe. Over the last ten years up until 2021, however, military spending had actually recovered on the continent from a low in 2018, before dipping again last year. Some African nations have bucked last year's trend and grew their defense spending - in absolute and relative terms - throughout the decade and into 2022. These include Burkina Faso - which grew expenditure by an annual average of almost 30 percent and doubled the share of GDP it spends on defense from around 1.5 percent in 2013 to more than 3 percent in 2022. Togo meanwhile had a similar average annual increase in the given time frame, but grew military spending as a share of GDP from 1.5 percent to more than 5 percent.

Tyler Durden (https://cms.zerohedge.com/users/tyler-durden)Wed, 04/26/2023 - 04:15

https://www.zerohedge.com/geopolitical/russias-neighbors-ramp-military-spending