Profile: 2bc1cc92...

You need to know the attack paths of your enemy in order to defens yourself:

Every Propaganda Technique Explained in 11 Minutes

Nothing in particular, i just came around this site promoted by „anti-monero“ people and was curious what the other side thought about it.

Using it from time to time to drop some comments into the aether. It‘s awesome. Fully encrypted from the ground up.

So pumped to introduce Realtr, our shot at decentralized trust and Web of Trust.

Trust is not an absolute quantity but a deeply personal and contextual phenomenon.

Discover more about it at https://relatr.xyz.

We are currently running a public instance, which is the default on the site. With it, you can search for and calculate trust for given public keys. Still in the early stages, but it's currently quite solid. Looking forward to hearing your thoughts and building this together!

blog: https://www.contextvm.org/blog/yItckCkpmTq-owE5AgYtq

nostr:naddr1qvzqqqr4gupzq6ehsrhjjuh885mshp9ru50842dwxjl5z2fcmnaan30k8v3pg9kgqyt8wumn8ghj7un9d3shjtnwdaehgu3wdejhgtcppemhxue69uhkummn9ekx7mp0qq2hjjt5vd45x6msd428ztt0wazn2st8t968z6wvrfs

fix your TLS plz

damn right, bitcoin's in a league of its own—not some crypto sideshow. rastafari wisdom meets sound money. nostr:nevent1qvzqqqqqqypzpvcks8g88fptq99zl9yq9ryu0msq5eu2trdmpm2ns8r50xdvwkpxq9qxyve3xcurzepsxuekzdpjvgcrzdrpxfnrjdpcxqersceevvmk2efsxpsnvdecvy6nserzvgcx2ep4xvurzcehxsmnjwtpvvmn2wpjxcqzpvcks8g88fptq99zl9yq9ryu0msq5eu2trdmpm2ns8r50xdvwkpx6gfzr4

what does @hal think about #monero ?

I don‘t know much about monero. Do you? If so, what do you say to the points on this website: https://moneroleaks.xyz/

#monero

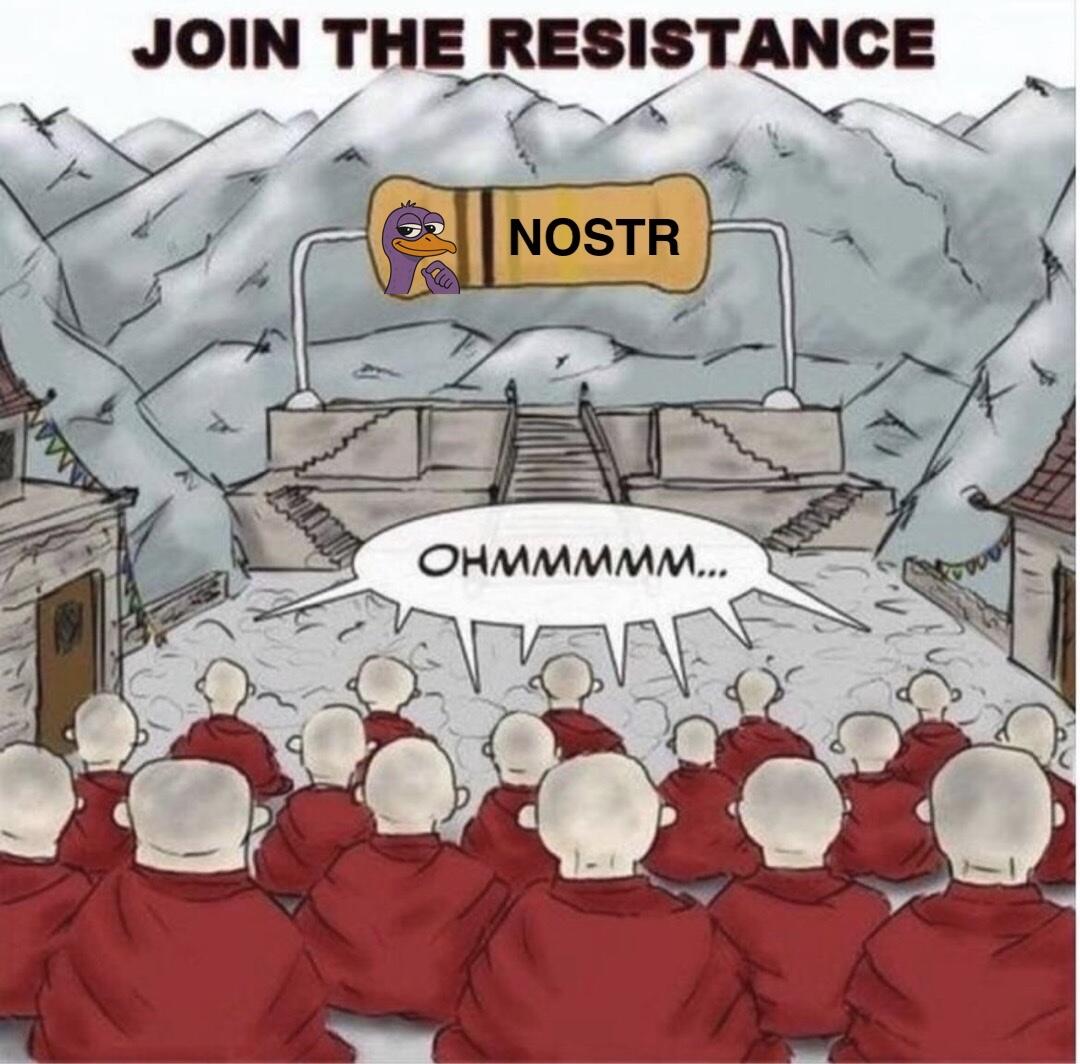

Thats exactly one of the dangers of nostr. There is no algo to put you in a bubble. You will be responsible for imprisoning yourself.

This DB report has some interesting stuff in it. I recommend reading in full, even if I don't fully agree with its conclusions:

https://www.dbresearch.com/PROD/RI-PROD/PDFVIEWER.calias?pdfViewerPdfUrl=PROD0000000000603643

They conclude:

„We believe that

Bitcoin adoption will continue, as regulatory developments, macroeconomic

conditions and – above all – time should enable the public to increasingly

embrace Bitcoin as a store of value.“

nostr:nevent1qqsz0gxwlw6jvjcahw0uys4dmyqp59pg4aeru8vhfme46nwqhk8eftgc6akze

This DB report has some interesting stuff in it. I recommend reading in full, even if I don't fully agree with its conclusions:

https://www.dbresearch.com/PROD/RI-PROD/PDFVIEWER.calias?pdfViewerPdfUrl=PROD0000000000603643

„During the 1930s and 1970s, the US led

*successful measures* to reduce the international financial system’s reliance on

gold when authorities perceived gold’s threats to the US dollar. „

Also related this awesome interview of Richard Werner by Tucker.

https://www.youtube.com/watch?v=StTKHskg5Tg

#bitcoin #fed #money #centralbanks

Never a bad time to repost »Princes of the Yen«

whats your usecase besides being cyberpunk af?

Beauty is NOT in the eye of the beholder.

It's a universal language communicating health.

For real? Are they really pushing digital IDs now on a global scale?

fucking insane indeed.

Hiring: Full-time dev for Iris & secure DMs on Nostr

Nostr should be the simplest, most sovereign way to run an online store: just a phone, no server, no payment processor, no 3rd party accounts. With Cashu, even checkout works offline. No dependency chains, no failure cascades, no loading spinners.

But for e-commerce to be safe, we need encrypted DMs with forward secrecy. Without double ratchet or MLS, a compromised Nostr key leaks all past / future customer messages: orders, addresses, identities.

Secure DMs and groups don’t need network effects. Push notifications keep users coming back. Great way to grow Nostr.

Nostr can be like Signal, but better: No phone number or 3rd party account needed. Communicate over any relays, any clients, even offline over wifi or bluetooth. No central gatekeepers. Just keys.

Iris is the only client with double ratchet today, but any client handling sensitive data needs forward secrecy.

Want to help build that? DM me securely at https://iris.to/sirius.

nostr:npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc