I’m talking to nostr:npub14mcddvsjsflnhgw7vxykz0ndfqj0rq04v7cjq5nnc95ftld0pv3shcfrlx tomorrow for the next #BitcoinTalk episode of THE #Bitcoin Podcast.

Peter’s show “What Bitcoin Did” was the first Bitcoin podcast I started listening to, and is still my favorite for the best deep-dive discussions.

Peter’s also started making documentaries in multiple countries struggling with fiat inflation, like Argentina.

What questions do you have for Peter?

#AskNostr

#AnotherFuckingBitcoinPodcast

What’s does he feel is the most significant learning he’s had since his journey into Bitcoin began?

You should really buy nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a ‘s book if you haven’t already.

Lyn’s writes how she speaks; clearly, concisely, and with analytical logic that is, at the same time, not in the least antiseptic.

“The ability to debase coinage to pay for a war allows the war to happen first and the costs to be partially delayed, which increases the probability of war happening and increases the scale to which it may occur.”

On Chapter 26 👍

Since Bitcoin is a finite asset, and nobody can create more out of thin air, it means that there can never be a bail out from the government. If that’s the case, then why would I place my bitcoin in a fractional-reserve institution? Doing so would be risking the loss of a very large proportion of my original deposit.

For that reason, I think that retail credit will not exist on Bitcoin. Essentially, the Bitcoin protocol, which programmatically created a sound monetary system, will reprogramme the world and how it thinks about money and credit.

In time, the global population will come to realise that the fiat monetary system had power over them and their right to economic prosperity. They will realise that Bitcoin gives them freedom to save their economic energy through time without the risk of debasement through inflation.

A Credit Risk Analyst’s Journey into Bitcoin https://medium.com/@kris.john.adams/a-credit-risk-analysts-journey-into-bitcoin-c035ec86ba1

I think only a business that operates a Bitcoin standard with a strong positive cash flow that is independent of bitcoin. I think that’s the only “safe” leverage. Hence I’d own MSTR over any miner.

And it’s only safe so long as the strong positive cashflow remains.

I don’t see any other business model.

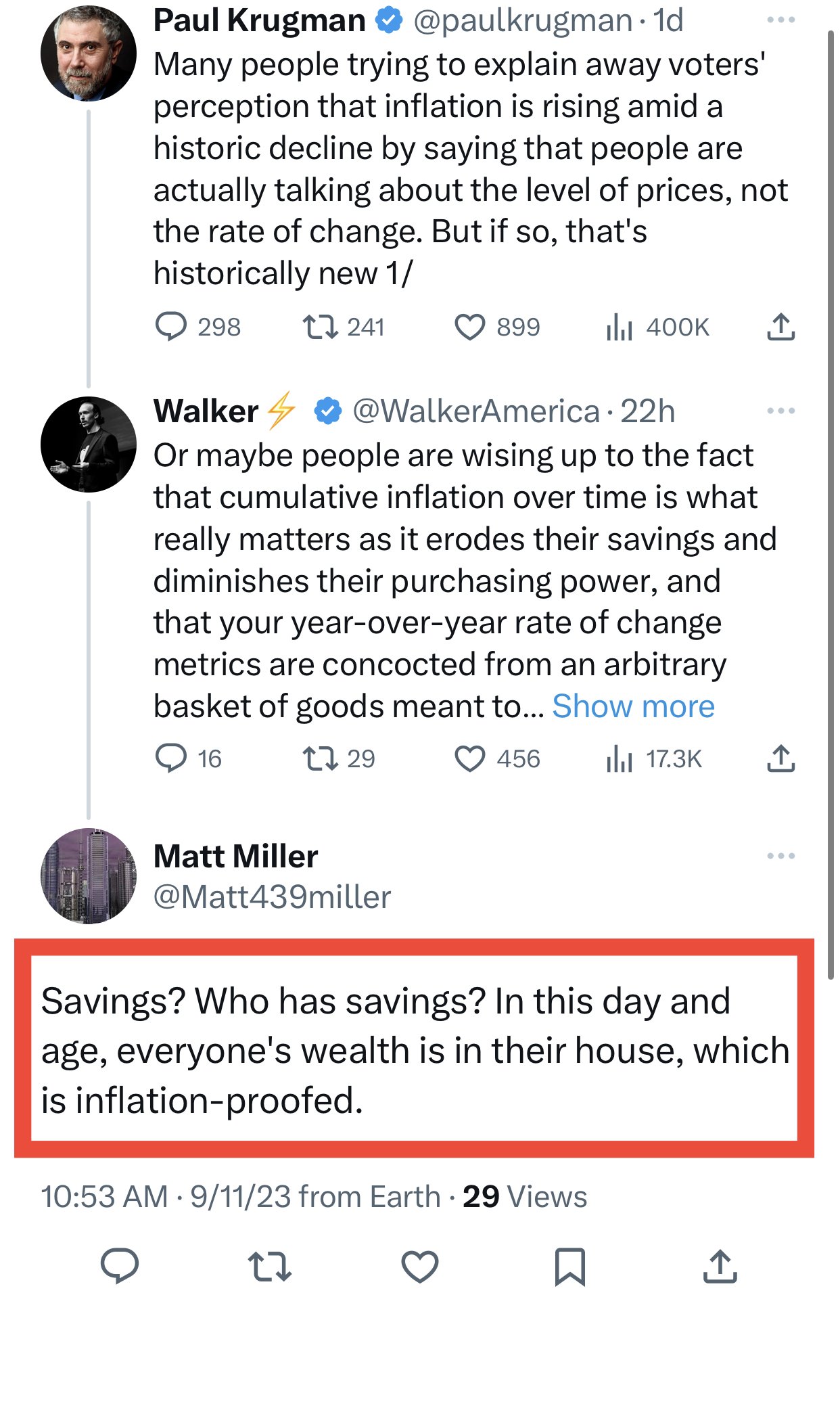

Yes, and when the elites of the world with enormous property portfolios realise what bitcoin is and start dropping said property portfolios onto the market, those with all savings in their property will be ruined by the crushing collapse in property prices.

Their only “saviour” will be the central banks trying to prevent retail bank mortgage portfolios from causing systemic bank failures, by pumping in even more money. We all know that it is not their saviour.

The hard thing is getting the message across to all my friends and family so they at least own some bitcoin before it happens.

The discussion I had with nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe addressed many of the current/ongoing debates we’re seeing around Drivechains, tail emissions, etc.

If you haven’t yet, please check it out 🤙

Listen to/watch this #BitcoinTalk episode of THE #Bitcoin Podcast wherever you get your podcasts:

Fountain: https://fountain.fm/episode/qArxWM09TPqWqwHANBDY

Apple: https://podcasts.apple.com/us/podcast/the-bitcoin-podcast/id1694392423

Spotify: https://open.spotify.com/episode/57aRDJo6qkD1eRZBhzikzI

YouTube: https://youtu.be/EAlkxIf3e9E

#AnotherFuckingBitcoinPodcast

Every bitcoiner in the world is on the same journey as Jeff was, in that we’re all sitting around our “campfires” trying to tell our friends and family that something is wrong and why Bitcoin matters!

I wrote this paper a while back to help explain what Jeff means when he talks about the frailty of the banking system and how it impacts fiat currencies. I hope you don’t mind me leaving it here in case it can help others.

Great pod! You’ve gained a new YouTube subscriber and Nostr follow. Thank you for helping spread the message 👏

A Credit Risk Analyst’s Journey into Bitcoin https://medium.com/@kris.john.adams/a-credit-risk-analysts-journey-into-bitcoin-c035ec86ba1

Hi Mark, I wrote a paper a while back that explains how a bank manages the risk profile of its portfolio. It would help you understand why bitcoin can’t have fractional reserve. I hope it helps, if you decide to read it.

A Credit Risk Analyst’s Journey into Bitcoin https://medium.com/@kris.john.adams/a-credit-risk-analysts-journey-into-bitcoin-c035ec86ba1

There’s a scary thing happening in banks right now!

Again, as per my previous paper, you’ll need to take my word for it.

Something quite scary, to me as a risk manager at least, is happening in the banks right now.

Banks are seeing a significant uptick of mortgage applications that are requesting longer terms. By example, I’ve witnessed a doubling of the proportion of new mortgage applications with a greater than 30 year term. Proportions that are fast approaching 50%

Not only that, but I’m also seeing the proportion of new mortgage applications with terms that end in their 70s skyrocketing! This is a metric that historically would be close to 0%, as it would likely be a policy rule not to accept this business. If you want to know more about how banks manage their book see my paper here: A Credit Risk Analyst’s Journey into Bitcoin https://medium.com/@kris.john.adams/a-credit-risk-analysts-journey-into-bitcoin-c035ec86ba1.

That rule appears to be gone in some banks, given I’ve witnessed proportions as high as 20% of new applicants.

If that’s not scary enough for you, here’s the kicker. According to the bank’s risk models, there is apparently no additional risk being taken on by the bank. Meaning they ARE NOT having to put up additional capital for these mortgages on book!

Let me tell you here and now, this is NOT CORRECT! These customers are riskier and additional capital should be getting put aside. Banks have not found a sweet spot in the market.

What is likely happening is that their statistical models used to assess the applicant’s credit risk (again, see my paper if you want an insight into how models assess risk) is under-predicting. Why?

Because the model was trained on data that has NEVER seen these populations of customers before. Meaning it cannot measure the additional risk properly and assumes they are like the normal applicants that come through the door.

This is a big problem, in my opinion, that will likely bite at a later date.

My advice…learn why this couldn’t happen with Bitcoin and act accordingly.

There’s a scary thing happening in banks right now!

Again, as per my previous paper, you’ll need to take my word for it.

Something quite scary, to me as a risk manager at least, is happening in the banks right now.

Banks are seeing a significant uptick of mortgage applications that are requesting longer terms. By example, I’ve witnessed a doubling of the proportion of new mortgage applications with a greater than 30 year term. Proportions that are fast approaching 50%

Not only that, but I’m also seeing the proportion of new mortgage applications with terms that end in their 70s skyrocketing! This is a metric that historically would be close to 0%, as it would likely be a policy rule not to accept this business. If you want to know more about how banks manage their book see my paper here: A Credit Risk Analyst’s Journey into Bitcoin https://medium.com/@kris.john.adams/a-credit-risk-analysts-journey-into-bitcoin-c035ec86ba1.

That rule appears to be gone in some banks, given I’ve witnessed proportions as high as 20% of new applicants.

If that’s not scary enough for you, here’s the kicker. According to the bank’s risk models, there is apparently no additional risk being taken on by the bank. Meaning they ARE NOT having to put up additional capital for these mortgages on book!

Let me tell you here and now, this is NOT CORRECT! These customers are riskier and additional capital should be getting put aside. Banks have not found a sweet spot in the market.

What is likely happening is that their statistical models used to assess the applicant’s credit risk (again, see my paper if you want an insight into how models assess risk) is under-predicting. Why?

Because the model was trained on data that has NEVER seen these populations of customers before. Meaning it cannot measure the additional risk properly and assumes they are like the normal applicants that come through the door.

This is a big problem, in my opinion, that will likely bite at a later date.

My advice…learn why this couldn’t happen with Bitcoin and act accordingly.

In Scotland, we’d refer to Richard as a “walloper”!

I guess it also shows that any entrepreneur in the world can build tools for the benefit of society without the need for VCs or having to support the centralised fiat system for that matter. 🤔

I must admit, I’m one of those that absolutely gets why Bitcoin and tries hard to help educate friends and family. However, I need to do more work on understanding Nostr.

I feel like it’s a decentralised value share platform, where the users benefit directly from sharing useful content that the community appreciates. I suspect it’s even more than that though and it just hasn’t clicked yet. 🤔

Boom. My new book, Broken Money, is now available on Amazon:

https://www.amazon.com/dp/B0CG83QBJ6

I will formally announce it later today, so I guess this is the initial Nostr exclusive. It’s not even searchable on Amazon yet since it is still being incorporated into their wider database. But if you have that link, it is ready for purchase.

The ebook, audiobook, and other print distribution partners will be rolled out over time.

Thank you everyone for your support! This has been a wonderful project to work on, and it will hopefully educate more people about the current problems in the global monetary system and the solutions that Bitcoin has to offer people around the world.

Ordered! Thank you Lyn 🙏🏻

My wife proof read a friends book after having been through the publisher’s reviews. She handed over four pages of more issues 😂

Sure you’ll get them all Lyn. Look forward to reading it! Hoping it’ll be out before my holiday in the 3rd week of September? 😉

Living it over here in Scotland! People are really starting to notice it now. I expect to be having more bitcoin talks with friends and family soon, but this time around it’ll likely be them that instigate it.

Noticing my feed on Nostr getting so much better. More users, more content, best of all…no noise!