Cats are better than you think. Especially if acclimated to dogs.

Good on you

Curious about your injury?

My off shoulder has been a source of pain and cracking for a few years.

Same shoulder I get the flu vaccine in (I work in hospitals).

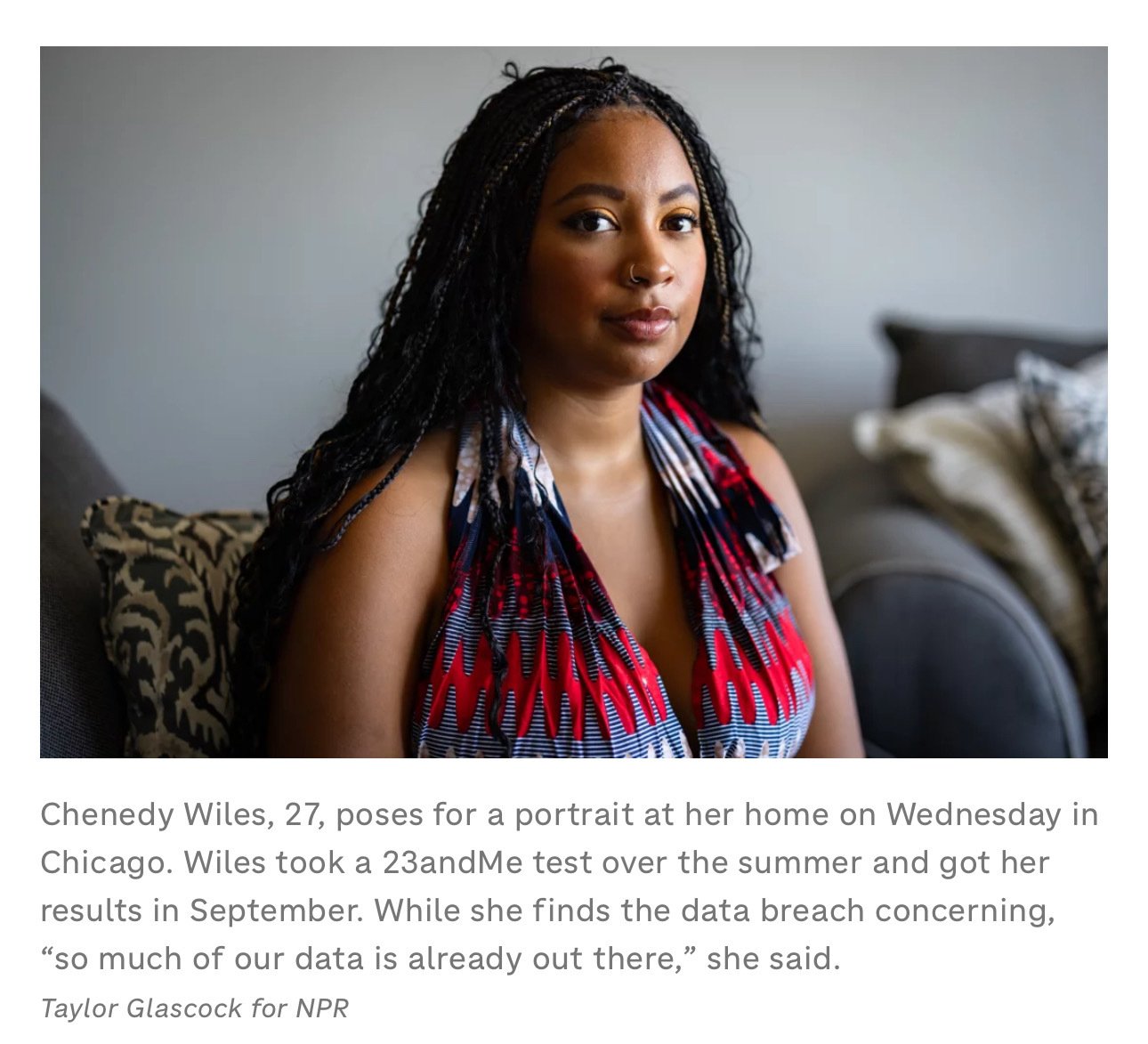

Want to know what people think of privacy and data?

“Well so much of it is already out there”

🤦🏼♂️🙄

https://www.npr.org/2024/10/03/g-s1-25795/23andme-data-genetic-dna-privacy

Unfollow…. the quote you mention isn’t in the article.

Help me get started. I can do 15-20 no problem now but do not lift weights regularly like I did 15 years ago.

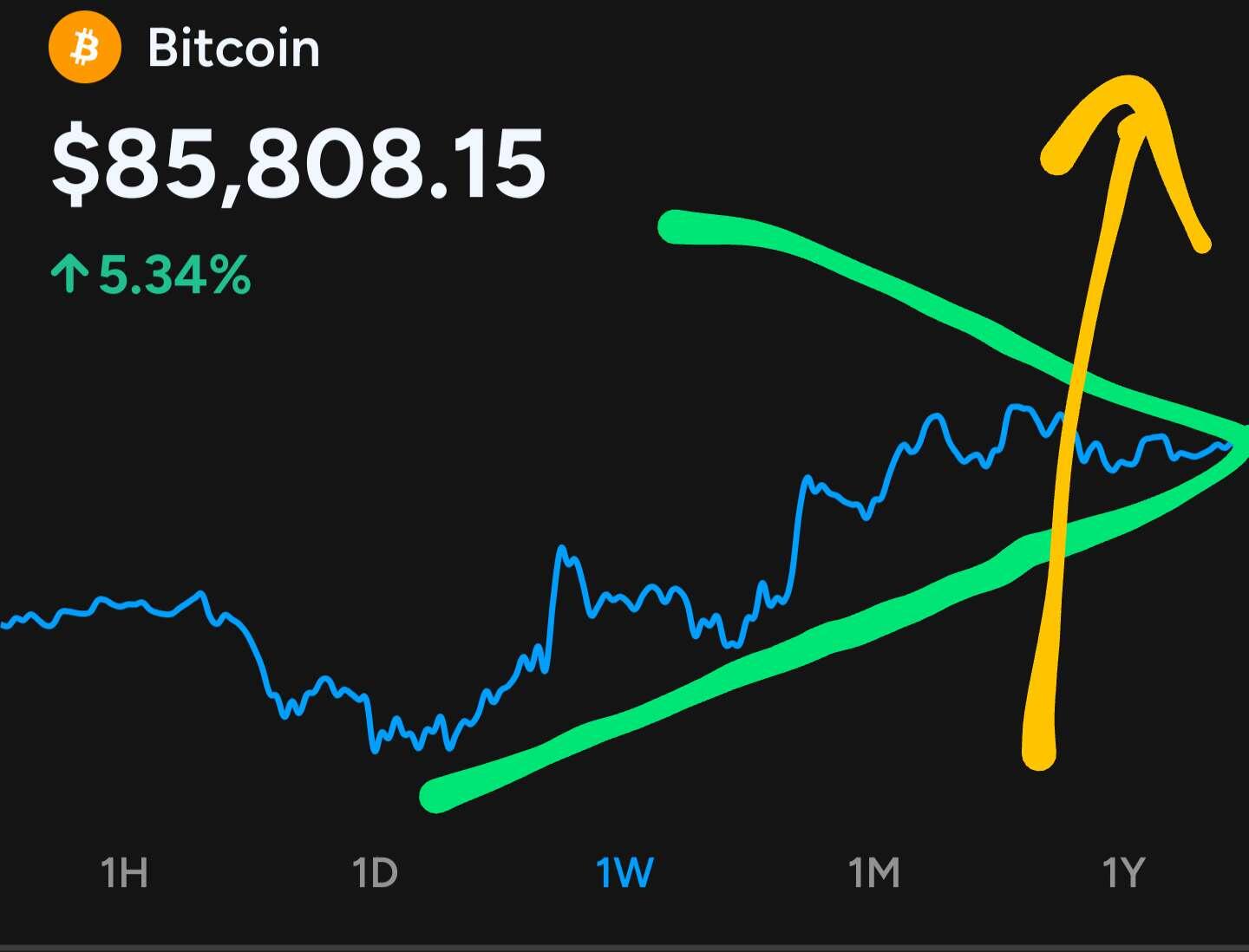

Friend of friend, shitcoiner. Trying to show him the light:

Question...how do you feel about the BTC index funds? Do they have good upside? Certainly less than BTC ownership but what are your thoughts on those funds?

Answer:

Good questions. I hold both and was a GBTC holder up until and into the etfs getting approved.

ETFs are great for price exposure but there are now many good multisig btc IRA’s (Unchained is probably the most established and trusted).

0.25% avg expense ratios on the etfs vs $250 per year with Unchained. So the BTC IRA is cheaper once you hold >$100k.

Coinbase holding 80% of the assets backing the ETFs is unsettling for me, so FBTC gets my vote as Fidelity has their own setup.

Creating a self directed IRA, buying the etfs and then rolling them into a BTC IRA over time is a nice gradual approach to ease into self custody.

If you want to trade a bit (no cap gains in IRA), the etfs are better suited for sure. My two sats.

How did I do?

Plan Guido ain’t got shit on Nic’s charts!

nostr:note1x4qtnmyep2m3807z8eakq240zyzw49xmyn2s2aed2nw3km50rd0ss8c20j

Plan Guido ain’t got shit on your charts!

nostr:npub1ndketdm2qyv35nrhsxzks8kh7w7w6tll4rjp29hv0qjqkgfjsh6snmgk2v

nostr:note1x2e456tt5wu5z06yqgk4tjgj6r968wy0frax982ugk2pa8e9lxwsf0r4l6

Been quoting this for a few months now

Going through Phish lot stickers and stumbled upon this gem: