The incentives to actively want a blow up is low, considering how many big corpos and vested interests have exposure to Bitcoin now.

But it's possible for market-driven blowups to happen.

Doing a session on the basics of Austrian economics in Bangalore next Saturday

'For a New Liberty' by Rothbard is an excellent book

https://mises.org/library/book/new-liberty-libertarian-manifesto

nostr:nprofile1qqsxare7m73ghlyq2ltn2720w6mf008337ufffdr0gfjdyltmgc6geqpz3mhxue69uhhyetvv9ujuerpd46hxtnfduq3gamnwvaz7tmjv4kxz7fwdehhxarj9eskjqgswaehxw309ajh2tnjvfezucnfdundnk4t elaborate how a 'brutal correction' will happen when credit is expensive but money supply also keeps increasing

nostr:nprofile1qqsxare7m73ghlyq2ltn2720w6mf008337ufffdr0gfjdyltmgc6geqpz3mhxue69uhhyetvv9ujuerpd46hxtnfduq3gamnwvaz7tmjv4kxz7fwdehhxarj9eskjqgswaehxw309ajh2tnjvfezucnfdundnk4t From an Austrian perspective, what happens when money supply is expanded, but interest rates are kept artificially high, like the RBI has done for many years in India now?

Yeah, it can be pruned

•Human Action by Mises

•Man, Economy and State by Rothbard

•Economic Science and the Austrian Method by Hoppe

The goal of freeing slaves is moral.

Inflating a currency and forcing people to use that currency is immoral.

nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq36amnwvaz7tmwdaehgu3wvf5hgcm0d9hx2u3wwdhkx6tpdshsqgp57x42dv2s3hst4vlssmzt6kaa0dg0skv528rwdzkf2h7gxm3u6c0nppvv Do you think that only bankers should issue currency? or the treasury?

Anyone should to be able to issue currency.

Nobody should force anyone to use it.

What was the stated purpose for doing that?

Reading List For Austrian Economics

1. Ludwig Von Mises:

•Human Action

•Interventionism

•Theory of Money and Credit

•Theory and History

•Planning for Freedom

•Economic Calculation in the Socialist Commonwealth

•Epistemological Problems of Economics

•The Ultimate Foundation of Economic Science

•Economic Freedom and Interventionism

2. Murray Rothbard

•What Has Government Done To Our Money?

•Man, Economy and State

•Power and Market

•America's Great Depression

•The Panic of 1819

•The Logic of Action (Published as 'Economic Controversies')

•The Progressive Era

•The Case Against The Fed

•The Mystery of Banking

•An Austrian Perspective on the History of Economic Thought

3. Hans-Hermann Hoppe

•Economic Science and the Austrian Method

•The Economics and Ethics of Private Property

•The Great Fiction

4. F. A. Hayek

•Choice in Currency

•Individualism and Economic Order

•Use of Knowledge in Society

•Prices and Production

•Monetary theory and the trade cycle

5. Eugen Von Böm-Bawerk

•The Positive Theory of Capital

•Capital & Interest

6. Carl Menger

•Origins of Money

•Principles of Economics

7. Jörg Guido Hülsmann

•Ethics of Money Production

8. Roderick T Long

•Wittgenstein, Austrian Economics, and the Logic of Action: Praxeological Investigations

9. Saifedean Ammous

•The Bitcoin Standard

•Principles of Economics

10. Henry Hazlitt

•Economics in One Lesson

•The Failure of the New Economics

•The Inflation Crisis, and How to Resolve it

You can find all these books at https://mises.org/

If there's a problem, and people are willing to pay for it to be solved, it will be solved

When I started exploring Bitcoin mining to learn about it, I discovered a huge ecosystem with pools, chip-makers, grid companies, energy producers, developers, companies, open source devices, resellers, hosters, podcasts and educators.

I realised its an ecosystem of its own.

I'm getting similar feels with 'fiat mining' Bitcoin treasury companies and its associated ecosystem of 'financial engineers'. And its much bigger than I thought.

'Retarded' is the only word my mind keeps repeating as I look at it.

But the market is the market and the only winning move is to learn to respect its process

Gotta learn to respect it when it gives, i.e., higher prices, more cash balances in bitcoin, viral marketing for bitcoin

And crucially, also to respect it when it takes, i.e., lower prices, irresponsible bets getting wrecked, potential bailouts, bad press for bitcoin, political interference in the market

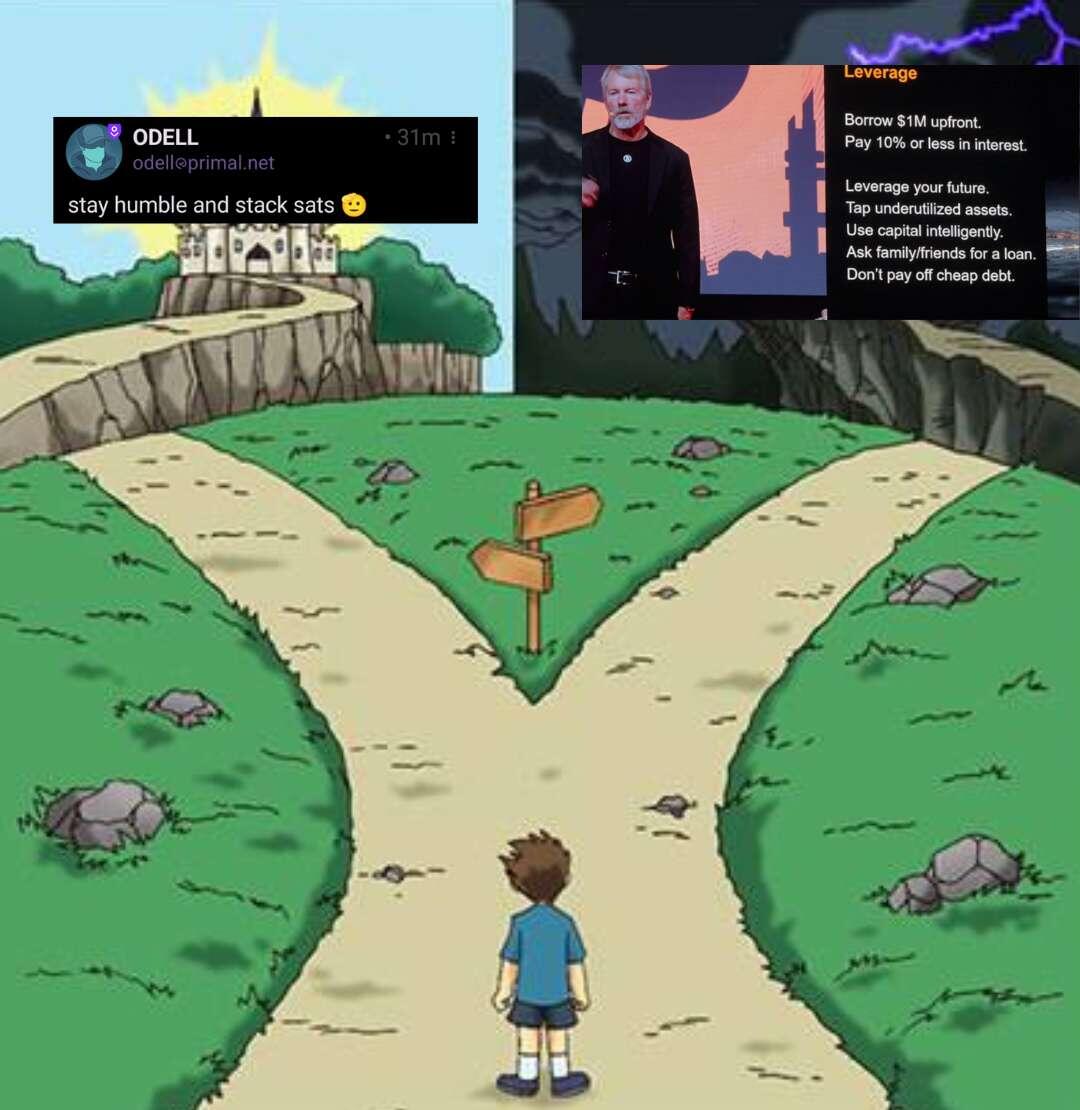

After crunching the numbers and observing the market, the following is the best strategy according to me:

Buy when it rips

Buy when it dips

Build a p2p network for buying and selling bitcoin

Maintain adequate LN channel liquidity

Take self-custody

KYC-proof both on-chain and LN stack

Identify the right tools for doing all the above

Yeah sure but I'm talking about Bitcoin-specific tools in particular

Zeus wallet, Coinjoin tools, LSP's are simple examples

Granted, they probably aren't that profitable right now, but I can see the addressable market for them getting bigger

This problem is what represents an opportunity for 'privacy entrepreneurs' to solve and make buck

Does anyone else think that there's going to be huge demand for privacy-preserving Bitcoin services in the future?

I'm talking demand from non-ideological users that can enable 'privacy entrepreneurs' to make substantial profits.

User-friendly privacy is definitely a service on the market I'd pay for.