We're happy to announce Mutiny Wallet is now available on iOS and Android!

In addition to the existing PWA, you can now get the same great Mutiny experience in native app form directly from the Apple App Store and Google Play Store.

We built Mutiny to be unstoppable. To do that, we knew we had to build it first for the web, without the censorship of permissioned app stores. Today, anyone can visit app.mutinywallet.com and get a self-custodial lightning wallet that can't be shut down by Apple or Google.

We have had the Android APK available to download for awhile, but starting today you may get it directly from the Google Play Store or using Obtainium on our Github. Here is the Play link:

https://play.google.com/store/apps/details?id=com.mutinywallet.mutinywallet

The testflight has been out for awhile too, exclusive to our Mutiny+ users. Now available to all is our iOS Apple Store release.

https://apps.apple.com/us/app/mutiny-wallet/id6471030760

We have a lot of new features planned for Mutiny Wallet in the coming months (for all platforms), so stay tuned as we work to make Mutiny more social, more powerful, and even easier to use.

if you want to help shape Mutiny's future, please join our new Discord server or Matrix community. We want to build the best spending wallet in bitcoin and your feedback can help us get there.

More info in the blog below:

https://blog.mutinywallet.com/mutiny-wallet-android-and-ios/

🔥

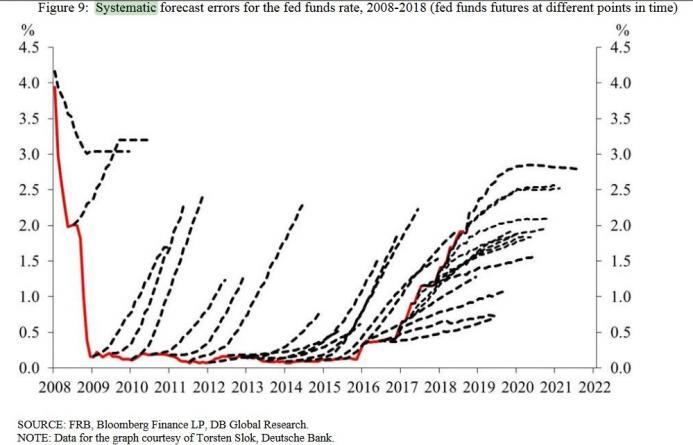

Imagine thinking the world moves linearly despite mountains of proof that reality is endlessly multi variable and non-linear

https://x.com/bitcoinerrorlog/status/1765274730469142546

My friends the secret to running an LSP is you don’t carry cost of capital for people who are filling up channels.

Channel “depleters” or in other words, people who stack on lightning are paying for those UTXOs then paying to take them from you. That liquidity goes back to a larger channel that has bidirectional flow.

LSPs are liquidity managers, having the mental model of this is important. An LSP only needs to keep capital in channels that are active and paying fees for activity, otherwise splice out. Inactive users can be the sole hodlers of their lightning liquidity.

This does not mean LSPs do not require a good chunk of capital. This means as an LSP you have to know and think deeply about lightning liquidity

There’s a lot of things that they don’t tell you about having kids

My favorite is the pacifier’s transition from something a child sucks on to go to sleep to a small talisman they take with them on their sleep journey.

Professional Twitter posters are an attack on bitcoin

Oh yeah and in the future every time bitcoin goes up the news story will be a picture of Larry Fink smiling

Coinbase going down is a signal

Clickspring started the antikythera mechanism 7 years ago?? Damn I’m old https://youtu.be/ML4tw_UzqZE

There’s 10k self-custodial and company run lightning nodes, all capable of running lnbits, which gets you the same experience as a federation without having to convince other people to do it with you. How many of them do it? There’s a difference between a hobbyist node runner and setting something up to hold people’s money.

Up front, custodial systems have regulatory risk. Mainly if you look like a bank, quack like a bank etc. you will be expected to get a banking license. Banking licenses came about because back in the day everyone made their own banks and it was very easy to take a whole lot of other people’s money.

While it was at the time illegal to take people’s money, the courts can only handle so many “they pretended they were trustworthy then took my money” lawsuits. This is where licensing and regulatory oversight come in— when an industry has the ability to harm others by nature of their business and bad actors continue to take advantage. Custodians are in a position of great power over their depositors.

Custodial ecash gives you the ability to easily be a custodian, and up to a point, (2-5 people?) You probably aren’t looking like a bank. Additionally, if you’re in a country where it is rare for people to use banks, you likely have more cover.

This is where fedimint wants to live. The multi sig federation stuff is uninteresting besides for the unbanked village use case.

Positioning these systems for any use cases beyond very close family / friends or the underbanked village use case is doomed. Here’s the scenario:

A wallet pitches itself as an ecash wallet and has a recommended ecash provider. That provider is a 3/5 federation of bound custodians or one benevolent custodian. By virtue of being the default that custodian grows in depositors and assets under management, despite warnings to know your custodian personally. It becomes too big to not fail (be regulated like a bank).

Wallet of Satoshi went exactly this route, despite recommendations to only use it for small amounts you don’t care to lose. Many small amounts, many depositors, quacking like a duck etc etc.

Said ecash wallet could lean on the thought that we do get the dream of everyone doing it right and there being 1000s upon 1000s of highly trusted and small ecash mints with users who are very careful in choosing their custodians. Unfortunately, this is limited by the number of people who care enough to set up an ecash mint.

A common argument against self-custody is its difficulty to set up. Ecash mints are in the same boat. The difference is, as UX improves for both, self custody will win over creating an ecash mint. Any honest ecash creation service must sufficiently disclaim the amount of trust and risk the custodian and depositors are taking on. Federated systems, doubly so. Self-custody conceptually is very easily explained, and the tools to do it are getting easier.

If creating custodial ecash services is as complicated or more complicated than self custody, only so many mints will exist, and it’s likely that usage will fall into the trap laid out above.

We’ve seen this already with the fediverse. A vast majority of mastodon and similar users are on one instance, being on your own instance is the exception that proves the rule.

In my culture and pov, I could see myself setting up an ecash mint for myself and my parents, maybe my sisters. Beyond that, it’s hard to imagine for me. Even families have issues, /especially/ when it comes to money.

Maybe some hope for Liz here actually? Can she put 2 and 2 together and understand why Muslim Americans are routinely closed out of the banking system?

Bitcoin scaling doomers / busy bodies

Re ordinals, they are creating a problem to justify a solution. It’s even worse than a solution looking for a problem.

Goes to your last note, we are not close to the real scaling challenges yet. We know what limitations we have, but how we approach them and what the system looks like when we do due to broad adoption remains to be seen. Which limitations we approach first and how inform the solutions we go after greatly.

There is simply so much that can happen and radically change what that future looks like between now and then. Oversolving now can put us in a much worse place.

When you open a lightning channel you pay according to the on-chain fee market. That cost gets you your next 10 - 1000 btc txns for a tiny fraction of that. One time fee to zap to your heart’s content.