Considerable digital asset impairment losses due to the old FASB accounting standards.

$MSTR will be able to show its gains from holding #bitcoin after 12/15/24.

$MSTR making moves to become more resilient

“Economics is pseudoscience before Satoshi… if you don’t have an instrument of proper money, you can’t posit a properly functioning economy…. #bitcoin is the singularity where science collides with economics.”

- nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

https://www.youtube.com/watch?v=A60jVnAIX40&t=376s

nostr:npub1d9ul75ee7ja8j2n93p0whs67dc8g625fhljk2k60329lnrnmkjvsfpyh73

Think about your life before:

Science crashed into medicine

Science impinged on astronomy

Science blasted into navigation

Now science is colliding with economics…

Pretty big deal

-nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

nostr:npub1d9ul75ee7ja8j2n93p0whs67dc8g625fhljk2k60329lnrnmkjvsfpyh73

“Economics is pseudoscience before Satoshi… if you don’t have an instrument of proper money, you can’t posit a properly functioning economy…. #bitcoin is the singularity where science collides with economics.”

- nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

https://www.youtube.com/watch?v=A60jVnAIX40&t=376s

nostr:npub1d9ul75ee7ja8j2n93p0whs67dc8g625fhljk2k60329lnrnmkjvsfpyh73

nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf & nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z believe #bitcoin will have a CAGR of 30-50% going forward

@saylor sees #bitcoin growing at 21-37% from here

Can anyone help me set up my primal wallet as a New Yorker?

If it matters I’ll be moving to New Jersey soon.

All I get are “Our apologies, we are not able to activate your Primal Wallet based on the information you provided.”

nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg

How nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m keeps track of the BTC accretion at $mstr:

Look at the change (%) in BTC/Assumed diluted shares outstanding

#MSTR ‘s volatility is a feature not a bug.

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m describes buying bitcoin as putting a “crypto oscillator” or “crypto engine” onto the balance sheet.

With such a large #bitcoin position, the crypto economy drives the volatility at #MSTR

- this volatility is driving the equity

- the equity is driving the options

- the options are driving the arbitragers

- the arbitragers are providing unsecured, almost interest free capital

- the capital is then used to reinvest into #bitcoin for the benefit of shareholders

#MSTR ‘s volatility is a feature not a bug.

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m describes buying bitcoin as putting a “crypto oscillator” or “crypto engine” onto the balance sheet.

With such a large #bitcoin position, the crypto economy drives the volatility at #MSTR

- this volatility is driving the equity

- the equity is driving the options

- the options are driving the arbitragers

- the arbitragers are providing unsecured, almost interest free capital

- the capital is then used to reinvest into #bitcoin for the benefit of shareholders

This upcoming halving “will be the most consequential halving in the history of #Bitcoin in my opinion. It will create a squeeze.”

- nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z ultra bullish on #Bitcoin and #mstr

“[MSTR] is going down in the history books as one of the most obscene transitions of a company that’s going to be a global dominant player in the future.

In 10 years everyone will know what microstrategy is just like Apple.”

Pumping it

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z ultra bullish on #Bitcoin and #mstr

“[MSTR] is going down in the history books as one of the most obscene transitions of a company that’s going to be a global dominant player in the future.

In 10 years everyone will know what microstrategy is just like Apple.”

“If I thought we were going through another [#Bitcoin] cycle, let’s say it goes to $400-$500k, where is it coming back down to?

I would say $90-$100k would be the low call it.”

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z ultra bullish on #Bitcoin and #mstr

“[MSTR] is going down in the history books as one of the most obscene transitions of a company that’s going to be a global dominant player in the future.

In 10 years everyone will know what microstrategy is just like Apple.”

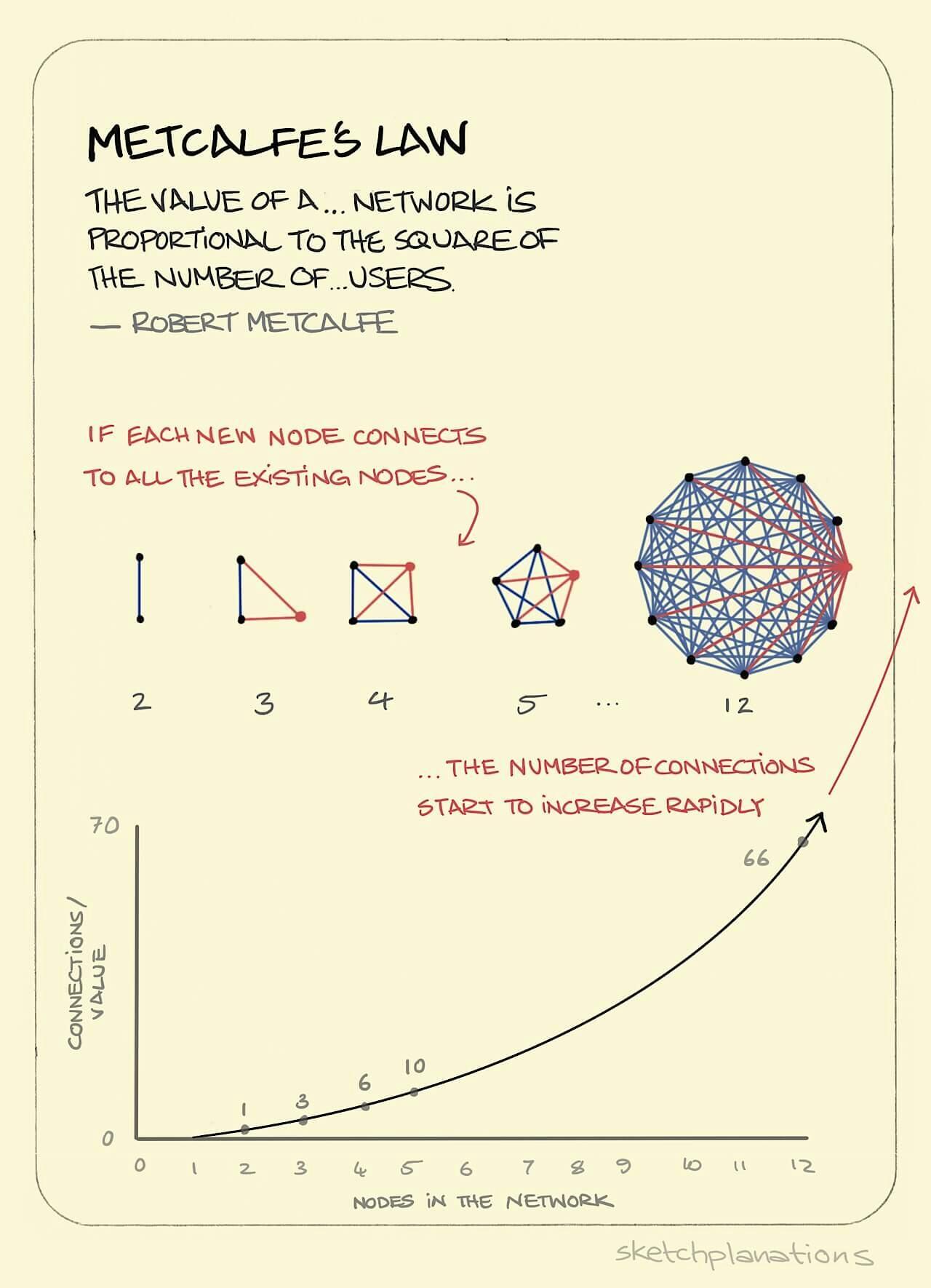

Big tech is asset poor and cash flow rich vs bitcoin which is asset rich

It gets harder for companies to generate more cash flows as they gets larger vs bitcoin which becomes more compelling as its value increases bc its liquidity increases and the network of holders increases

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

#MSTR Q4 2023

I.e. Metcalfe’s Law

Big tech is asset poor and cash flow rich vs bitcoin which is asset rich

It gets harder for companies to generate more cash flows as they gets larger vs bitcoin which becomes more compelling as its value increases bc its liquidity increases and the network of holders increases

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

#MSTR Q4 2023

The #bitcoin ETF approval isn’t a step function, it’s more like slowly opening a valve.

- Matt Hougan

Bitcoin Investor Day NYC