I can 100% relate. Germany....

Money is worth nothing anymore, at least for the important things.

Nobody really wants to work hard here for these cuck bucks.

Small business owners giving up, becomes a mass phenomenon.

Every young person wants a "secure" job for life in the state sector or close to it.

Nobody wants to take risks, built a business, become entrepreneur.

The few who do, only earn envy by society, often have no family etc.

People take unsustainable mortgages in hope to become rich as money is getting worthless by the day. & cheap money pays off the credit or doesn't...

- - >homeflipping.

Education and health are collapsing:

No appointments at a doctor's.

Loss of lessons in schools becoming a mass phenomenon (no teachers, sick leave).

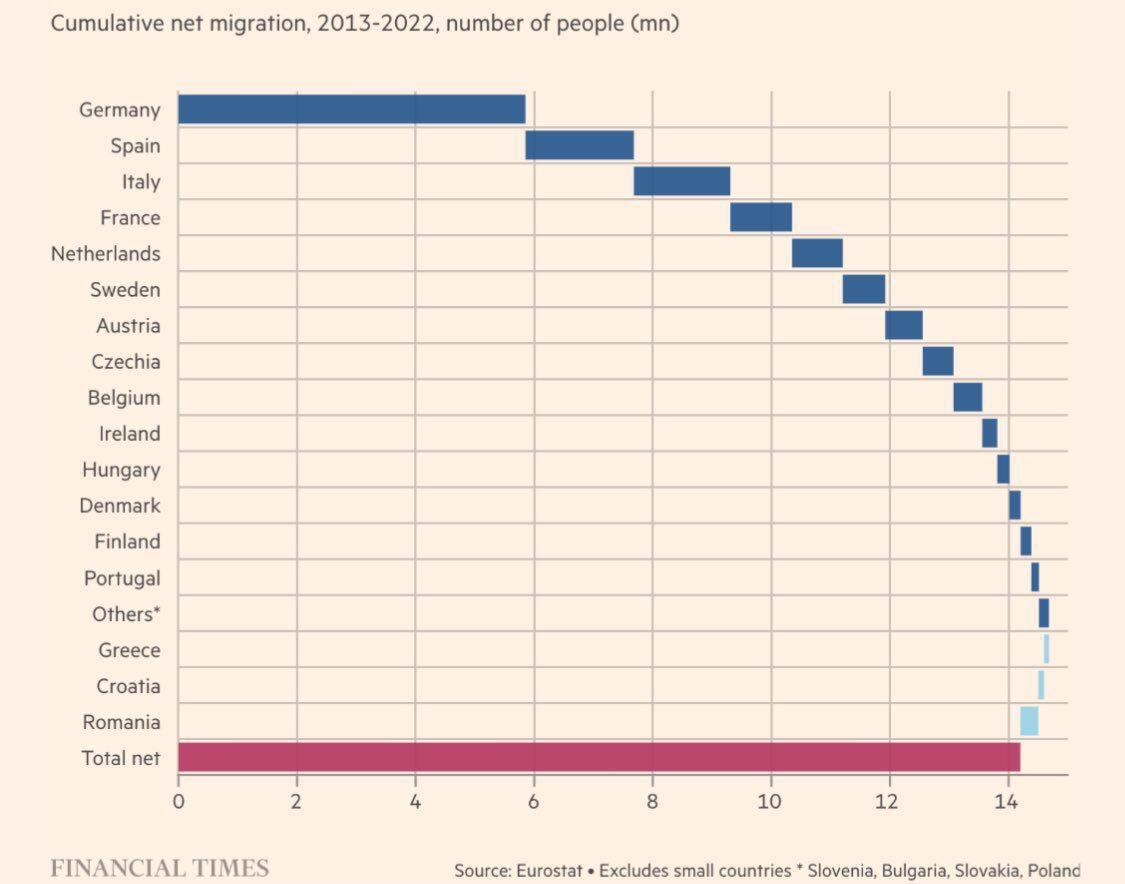

Public security is at risk (Mass immigration, police is low paid...)

Demographic ticking time bomb... See EastGermany... oldest region worldwide! / Whole Germany... 2nd after Japan.)

Total destruction/expropriation of capital!

I'm not a professional economist, but walk through life with open eyes and try to use my brain.

I stumbled over Max Keiser and his show 15 years ago. That's where I got sensitized fir these things.

Thank god there's #bitcoin.

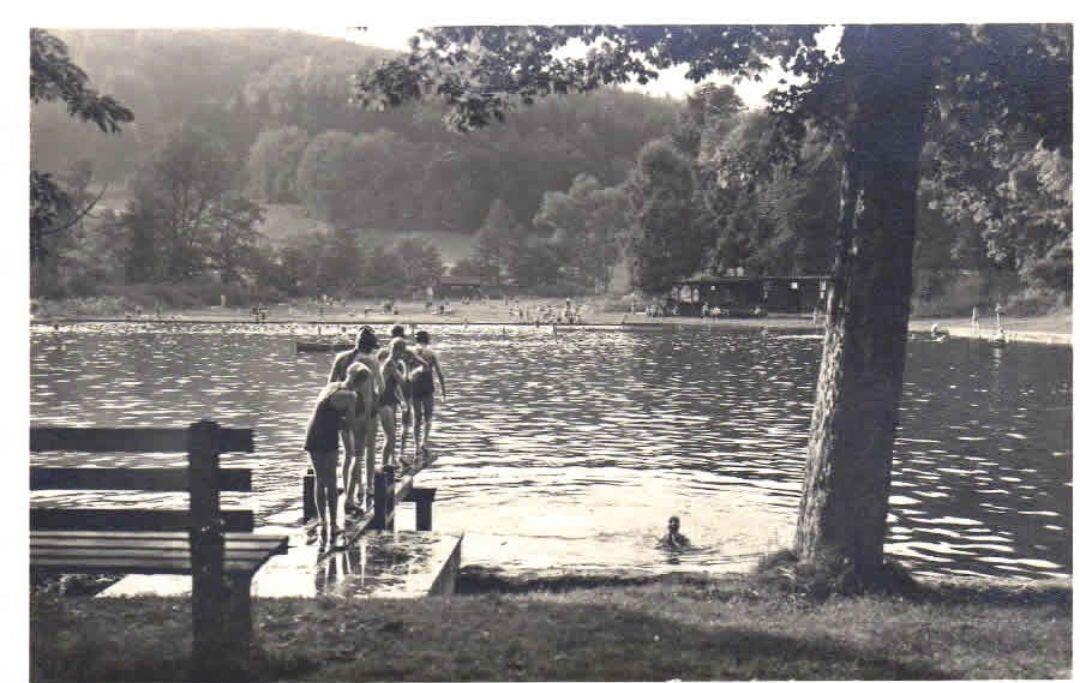

A short story of "Waldbad."

The generation of my grand-grandfathers built this with their hand labor, more or less.

What was once an open-air bath close to nature for recreation, today is a "lost place".

Even though it could have easily been maintained by today's technical means.

It served 4 generations during summer. Many learned to swim here, played beach volleyball, ate icecream, maybe fell love and so on...

As a bitcoiner of course I blame the FIAT system.

It didn't survive after German Reunification....Even the 'Communists' were able to maintain it.

We will take it back one day, be sure!

Oh yes. They can:

"Enterprises don't go bancrupt, they just stop producing." Remember? 😬

GM, Sovereign Individuals.

If he could see all of this.

Politicians normally don’t tell you the truth. This one does though..

Study #bitcoin 🧡 https://video.nostr.build/f14710af8ddd6ce4b9f62e26db143e7b5e5582f86152db176bab5af59b42fd0c.mp4

Canada.

"People who destroy whole nations do not have the right to teach us democracy and the values of living freely."

V.P.

GM Freedomlovers.

💙💙💙💙

Das "Verantwortungsprinzip" in Politik, Behörden, vielen Großunternehmen ist abgeschafft worden.

(Gegen Kleinunternehmer, Mittelständler, Selbstständige, Steuerzahler ..... wird es aber gnadenlos durchgesetzt.)

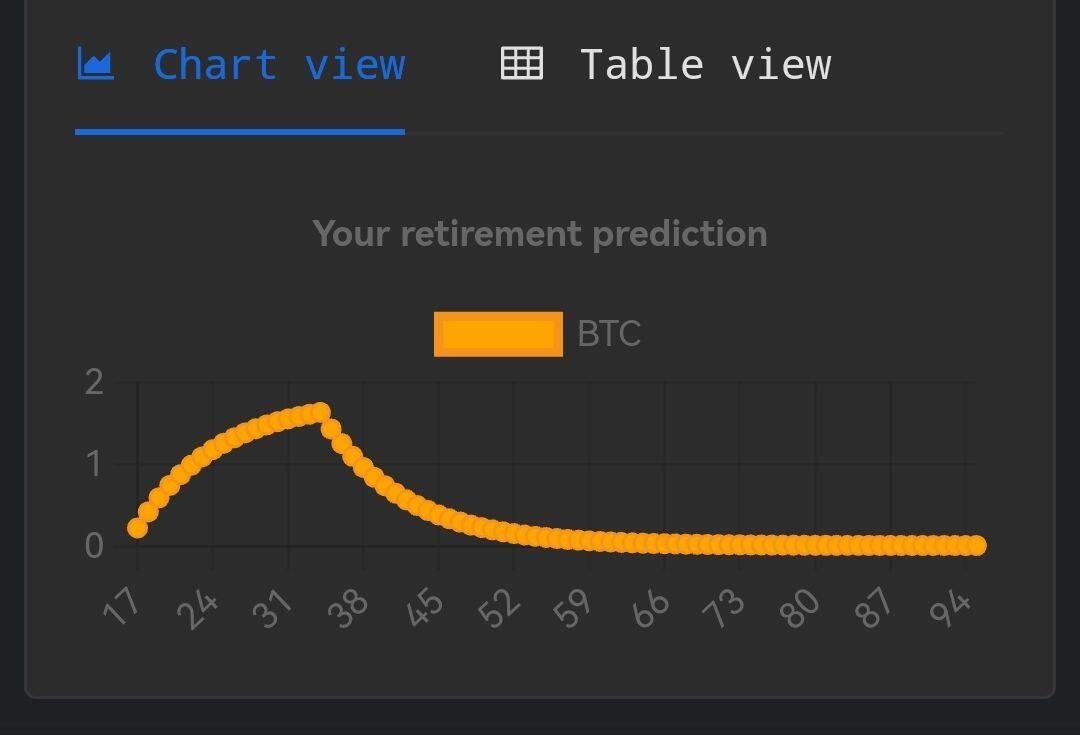

Setting both at same rate would mean bitcoin had no advantage compared to FIAT b/c both behave similar.

We know that isn't the case.

The difference of both is what actually matters.

I estimate the difference to be higher than productivity growth as long as adoption (hyperbitcoinization) is completed.

After that the difference would be at the overal productivity growth / rate of technological deflation.

Don't know if FIAT still existed then or would be fixed to BTC... But doesn't matter here.

Seems quite clear to me.

Lösch den andern Scheiß🫢 und verbring Deine Zeit und & Energie hier. Wirst es wohl nicht bereuen.

Salve.

I haven't seen the underlying codebase for this tool.

Maybe it's published somewhere? (github etc.)

I have taken your statement as a matter of course.

...Just made an example calculation and it gives this btc balance over time. The incremental build up seems to slow down in btc terms. So I guess he/she did it right. 👇

#Bitcoin Retirement Calculator.

Amazing tool to play with:

https://calc.bitcoineracademy.com

I inserted 15% for "annual growth" & 10% for "annual inflation" (FIAT supply).

Totally conservative! ... No adoption, no network effect etc.

Only considering the hardest money character (closed system)

& 5% annual productivity growth according to Jeff Booth.

A today 16 year old, if he worked hard, lived at his parents, saved everything in #bitcoin & had a modest 'retirement lifestyle' could retire after 12-15 years!!

Till his 90ies.

He would be young enough (around 30) to start a family & spend time with them.

Man, I wish I were 16 again and knew this. I wouldn't give a f*** what others said/thought.

#Bitcoin Retirement Calculator.

Amazing tool to play with:

https://calc.bitcoineracademy.com

I inserted 15% for "annual growth" & 10% for "annual inflation" (FIAT supply).

Totally conservative! ... No adoption, no network effect etc.

Only considering the hardest money character (closed system)

& 5% annual productivity growth according to Jeff Booth.