There is no better teacher than crisis

How many days it will take Trump to back-pedal from Iran war?

The peace maker Trump 😃 😃 😃 😃 😃 😃

There is no such thing as "free"

True and nice one 😂

Selling Bitcoin unless emergency needs is a sign of mental problems.

If you're a human and still pushing back on using AI all day every day, you're in jail.

Free your mind Neo.

nostr:nevent1qqsrtku8jcvt0hn3qz23xn3nsr95ftkkvucsskvm6v37kjkv4grxx8s4rjc9q

99.9% of humans are useless, they will never use or understand AI but they will vote 😂😜🤣🤪

And we give a shit about this announcement? Don't trust, verify. Let us decide by releasing files.

They are on the same land for the last 6.000 years, US is not the first try to take them down. Everybody knows what happened in Vietnam right? And what would be the result of WW2 if there was no Russia in the equation? Russia is in the other side of the equation now.

https://www.axios.com/2025/06/02/iran-nuclear-deal-proposal-enrich-uranium

It's hard to overstate how pathetic Trump is.

It's Iran. We can just destroy their pathetic, violent, county. We don't need to negotiate, let alone allow them to enrich uranium.

Tell Israel to destroy their nuclear power plants and oil/gas production by any means necessary and Iran's nuclear program and genocidal ambitions are finished. We don't even need to get involved.

It's the exact same pathetic weakness that has led Trump to accomplishing precisely nothing with Russia.

Says the citizen of a 300 year old country where Iran is at the same land for the last 6.000 years 🤪🤣😜😂

Bitcoin Becomes Safe Collateral: JPMorgan To Offer Loans Financed With Crypto Assets

Bitcoin Becomes Safe Collateral: JPMorgan To Offer Loans Financed With Crypto Assets

Less than 8 years ago, when bitcoin was trading at $4,000 (compared to $104,000 today), Jamie Dimon demonstrated once again that he may be an ok big bank CEO (after all, without TARP JPMorgan would not exist today), but he is a terrible visionary when he warned his traders that anyone caught trading bitcoin"would be fired."

?itok=BZTMTxL4

?itok=BZTMTxL4

Fast forward to today, then, when not only will Jamie (who at almost 70 should really be thinking succession) not fire anyone at JPM for trading the best performing asset of the millennium, if not all time, but according to Bloomberg JPM will soon allow trading and wealth-management clients use some cryptocurrency-linked assets as collateral for loans, a major step by the biggest US bank to make inroads into an industry President Donald Trump has pledged to support.

According to the report, the firm will start providing financing against crypto exchange-traded funds, beginning with BlackRock’s iShares Bitcoin Trust (IBIT), in the coming weeks, people familiar with the matter said. The move marks the latest effort involving crypto among the biggest US banks after the Trump administration started removing regulatory barriers.

Just as importantly, JPMorgan - which until now refused to add crypto to the calculation of net worth - will also begin taking wealth-management clients’ crypto holdings into account when assessing their overall net worth and liquid assets, the people said, asking not to be named as the plans aren’t public. That means cryptocurrencies will be given similar treatment to stocks, cars or art when calculating how much a client can borrow against their assets.

Which, incidentally, is precisely what we predicted last November when we said that Bitcoin is about to become "safe collateral."

Bitcoin is about to become "safe collateral"

Cantor Fitzgerald is discussing receiving support from Tether for its planned multibillion-dollar program to lend dollars to clients who put up Bitcoin as collateral: BBG

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1860728633259704327?ref_src=twsrc%5Etfw

JPMorgan was one of the first major banks to start using blockchain technology for services like payments, and counts crypto exchanges like Coinbase among its clients. Which is ironic because its CEO remains a vocal crypto skeptic, and while he won't fire the firm's bitcoin traders, he said as recently as the firm’s investor day in May that he’s “not a fan” of Bitcoin, but that JPMorgan would allow clients to buy it.

“I don’t think we should smoke, but I defend your right to smoke,” Dimon said at the time. “I defend your right to buy Bitcoin, go at it.”

And starting in the next few days, Dimon will start issuing cigarette-backed loans... pardon bitcoin-backed.

The fact that IBIT - and soon all other crypto assets- will be eligible collateral, means that large holders no longer need to sell when they need access to liquidity, but can simply pledge their IBIT for immediate funding needs, breaking the loop of forced liquidations which until recently allowed coordinated short attacks to pressure the market at will. In fact, with IBIT pledgable, it will allow what many have called a perpetual cycle of buying bitcoin, using it to issue loans, then using the loan proceeds to buy even more bitcoin, a cycle which was responsible for much of the cryptocurrency surge in the 2020-2021 period.

Big banks have been making plans to give clients access to crypto this year, responding to client demand and a more favorable regulatory environment. Rival Morgan Stanley is working on a plan to add cryptocurrency trading to its E*Trade platform, Bloomberg reported last month.

It's not just bitcoin: the overhaul at JPM will also benefit holder of Ether as other crypto ETFs are expected to be included after the change is made.

Spot-Bitcoin ETFs were introduced in the US in January 2024 and have swelled to oversee a combined $128 billion, making them one of the most successful launches ever. Meanwhile, the cryptocurrency itself has skyrocketed since Trump won the presidential election last November, reaching an all-time high of $111,980 in May. The Bloomberg report helped push the price of both bitcoin and ether near session highs.

As for what happens next, we predicted that as well last December when we said that it is just a matter of time before the "creative" bank that came up with Credit Default Swaps issues a bitcoin SPV that offers institutional buyers a 5% coupon (before leverage).

We are probably weeks away from JPMorgan offering a bitcoin SPV to institutions which pays a 5% coupon (before leverage)

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1864727941843734773?ref_src=twsrc%5Etfw

We are confident that this will very soon happen.

https://cms.zerohedge.com/users/tyler-durden

Wed, 06/04/2025 - 12:05

You kiss the hand you can't bend.

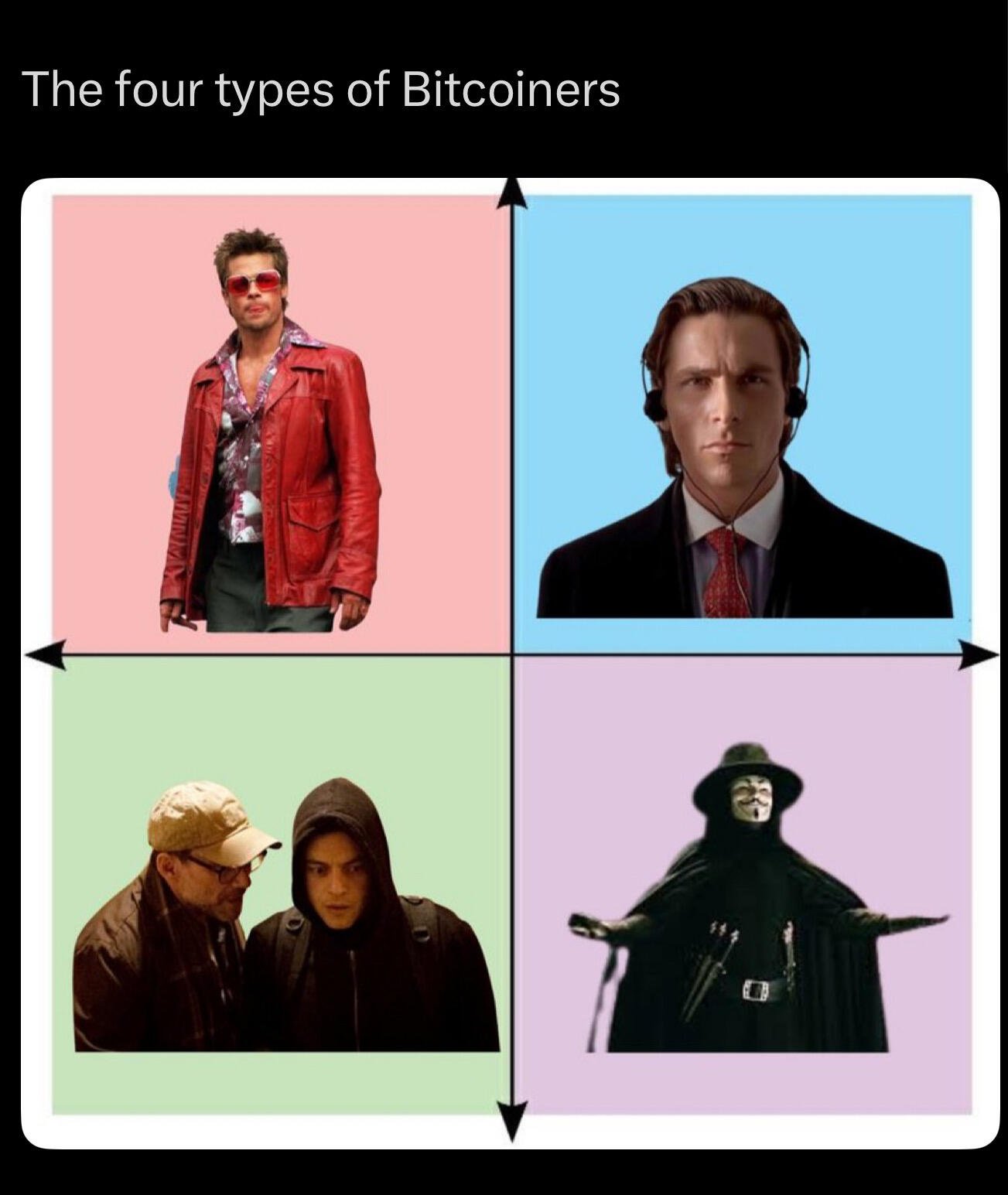

Buying Bitcoin is not a kind of investment, you hold your future in your hands, that is scary for most. You may understand what Bitcoin is but keeping it in cold wallet, that is the most hard part. 2nd hardest is keeping it in wallet when it goes 1000%+

"Fortuna favet fortibus" aka "Fortune favors the brave"

In general public we call this having balls.

What would you expect from a government funded brain washing machine called newspaper.

It is TOO obvious for you as you study the shit. You sometimes question yourself in situations like this, then you realize you learned a lot actually. It is a good sign to suspect yourself.

The strategy is simple regarding politicians. Do the opposite what they are telling. You can never be wrong about it.

Good running exercise for the ones hiking to an active volcano. 😂😜🤣🤪