Ahh got ya, thanks, still quite new here so learning the basics.

So I’m guessing the nprofile is basically the metadata (profile pic, bio, link) associated with the npub/nsec key pair I created with Damus client when I first started?

Holy shit burgers Batman, thats some

Ambition

Haven’t created a njump yet, should I just go straight to nosta.me to set up instead?

The wide range of benefits from Bitcoin are pretty clear at this point. Safe to say a little more than wearing a car tire around your neck 🤔

Perhaps you’ll be jumping on the bandwagon to accept btc payments when BTC in USD denominated terms is $0.1M per coin, $0.25M, $1M? Fiat printing has no ceiling, there’s no limit to how much your fiat savings iceberg can melt in purchasing power. Bitcoin is just the best expression of that fact.

History has shown the earlier you adopt it the more you benefit. Every person gets Bitcoin at the price they deserve

Can you say that for every single bitcoiner on the planet today? No, of course not. The trajectory has been pretty clear for some years now, more are joining the ‘get on zero club’ while less and less are remaining part of the ‘fiat only and no btc club’

The waters warm, you may as well swim, it’s better than drowning in fiats poison pool

Chinese war dog robots...

Brace for impact, bright future ahead 💥 https://video.nostr.build/02e229a9c74401e1ab7771abc1a8bdf6d2e3167d2f9d32b6d16f9d9ef13c9e42.mp4

Happy days

Republicans have #X

Democrats have #Bluesky

Communists have #Mastodon

Anarchists have #Nostr.

Harmony ☺️

Tribal memefare

Not sure how you can say all bitcoiners have fiat on hand? The saying ‘get on zero’ means get on zero fiat, by getting 100% onto the Bitcoin standard.

It’s an evolution of the saying ‘get off zero’ which encourages ppl to begin with Bitcoin by just allocating 1% to BTC.

It doesn’t just apply to ppl living in Bitcoin circular economies, some searching online shows ppl posting & podcasting about it, it’s not easy, but possible.

As more businesses, for e.g. your competitors, start accepting btc over time, they’re more likely to attract bitcoiners compared to businesses that don’t.

Peter schiff was saying things like past performance…. And Bitcoin is tulip mania…as far back as 2011 or 2012. He was very articulate about how the price will crash soon etc etc. 12-13 years & 2-3 million percent later we’re still all waiting on his call to ring true

Very busy, but beautiful day today.

Spending time outdoors and taking a quick swim keeps me going, especially in cold water. Facing challenges head-on is what makes us stronger in the long run.

#plebchain #grownostr https://video.nostr.build/f23a2ea06bd1a30ea90a32318429b820fab8f2d266523c9c0ca36dfc4295c31e.mp4

😍

Excited af about the future nostr:note1avakxglk9254v5xaga66q25w80vk5nhyalfj5ej704kglqkj9fnsz0z7su

The hyphenation turns into a plus symbol if the man’s last name comes first and the woman’s last name comes last or the hyphenation turns into an equals symbol if the woman’s last name comes first and the man’s last name comes last

Censorship in sheep’s clothing

Bitcoin captures that insanity, without BTC we’d be in trouble

This note (& lower tech cars) will age well

Anyone who has neck / back issues especially at computer or driving, i feel ya pain!

Had injuries in the past that cause problems? I've settled on a few things that work really well for me, nothing groundbreaking, but they just work.

Physio's & chiro's feel great at the time & are how i got most of these things, however without a routine i found myself always needing to returnto them at some point. And imagine if you saved all those osteo bills in BTC over the years!

1) A full campaign of stretching every other morning. Routine / creating a habit seems to be key here, & prob helps with circadian rhythms also.

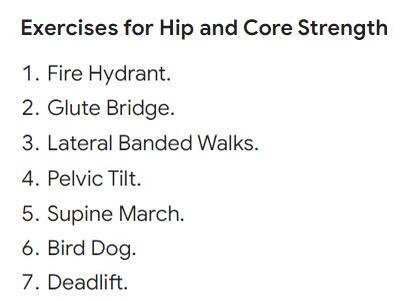

2) Every other day focus on core & hip strength, this can have an outsized impact compared to anything else.

3) Daily walks. Get in the natural light, leave phone at work / home, do it, its great. Bonus points for barefoot if your not walking on icy cement or needle ridden streets.

4) Adjustable desk. Your body will tell you when it feels like standing or sitting

5) Frequent micro breaks away from desk, stretch your body out by putting arms up to a doorframe & leaning fwd. Bonus points for nurturing the left / right brain by juggling (rolled up socks won't bounce everywhere when dropped) or touching left ear with right hand etc. Yes this could be ridiculous in a workplace, easier for those who WFH.

6) 5-10 mins laying down in the evening w/ a rolled up towell under neck, or the blue plastic thing-a-ma-jiggy-me in the pic (Start w/ 5 mins!)

7) A cushion behind the lower back of your car seat, make adjustments for max support / upright back as possible.

8) Lift weights. Have a cup of cement & harden up.

nostr:npub13lkyycj8s3da6fhndtj0wd6s3s2ahmq86s7wrruvzd4tnc66cgfqn4lpsy nostr:npub1jqckepsld3xn98aeq7yg72g0yrqkz92vegkv6k3prfhkzu356v5qa6akee 👇 nostr:note1ervs6kjy9p0mlsdupx0pl6esjhxf0gr6ce2aks5h9qmcw3fs9a4s089vqn

If your business allows for zero saving the only way Bitcoin can help you is accepting btc payments to attract / retain / reward (yes there are btc rewards / cash back solutions also) potential customers.

If making online sales your addressable market of Bitcoiners is huge, some estimations 100 million. And we’re passionate (to a point of being labelled as a cult by some) towards fellow Bitcoiners esp w/ businesses, the benefits of offering btc payment option to a potential customer base like that is obvious.

If your business only makes brick & mortar sales, you’d need to be in one of the globes Bitcoin circular economies for there to be any impact from btc sales. At this early stage of bitcoin’s evolution it would likely be a rounding error in terms of total sales.

If your business allows for zero savings, then that is all academic really, first point of order is to join the ranks of the millions & millions of businesses world wide that run an operation that has savings & thinks about how best to protect & grow that balance as the years roll on.

That’s when Bitcoin can really help the bottom line. You could even be someone that has a time preference that is so high that 2-3 years seems like a long time. Even on that timeframe the volatility of your savings in Bitcoin will become very favourable to the business bottom line.

Keep adding to the savings in Bitcoin, keep your borrowings an expenses & cash flow in fiat as required.

Bitcoins diminishing volatility over its lifetime has happened within a 120 million percent USD denominated price increase.

People & businesses with any form of savings only have to lower their time preference a little bit, e.g think in terms of 4 years halving cycles, to benefit massively from that volatility.

For any person or business with the opportunity to think about their savings, fiat is pathetic in comparison. It is really good at loosing considerable amounts (7%, 12%, 15%…) of purchasing power every 12 months, with low volatility / great stability. The popular CPI is the CPLie, it is provably not a reliable indication of how much purchasing power your fiat savings are actually loosing. And that effective loss in savings compounds negatively!