Scam! It's how they fund roads in low-tax Texas.

I do think it's a scam. IMO they borrow money and overbuild roads based on ambitious growth forecasts and maintenance will be costly.

However I recognize I'm a perma bear when it comes to building stuff. All I see is wasted money when I see new roads . All I needed for years to get to work was a bike path, not a 6 lane rolled highway.

Yes, most likely is the case. Vendor to gov for IT for roadway tolling systems.

I made mistake in past ventures of stopping caffeine by not waiting 30 days. In the first week or two it made my mornings feel so dull that I went back to coffee.

However I've heard it takes 30 days for that feeling to reset.

Congrats.

Wow! You are too kind. Ok, I will let you know when I get around to it. It's been a couple years so that would probably be a really good thing. Or maybe you take sats for editing? The power of Nostr.

But it's all good because I just so happened to discover this guy on the Exact same day.

Trying to figure out where my fear is. Uncomfortable social situations? Fear of not finding something interesting to say to someone new?

Specifically this page

https://retireearlyhomepage.com/Bengen_4.2_percent.html

"Bengen has finally realized that 50 or 60-year pay out period returns for the S&P 500 converge to a narrow band (i.e., asymptopic). Though I would quibble with the 4.2% figure. While we can calculate historical "safe" withdrawal rates to 3 or 4 decimal places, I don't believe you can predict the future with more than one significant digit of accuracy. Thus, I'd say the safe withdrawal rate (SWR) is closer to 4% than 3 or 5. Of course, the SWR for pay out periods of less than 30 years should rise above 4%."

The question is does this work on Bitcoin/MSTR hybrid and if so what's the drawdown rate.

Specifically this page

https://retireearlyhomepage.com/Bengen_4.2_percent.html

"Bengen has finally realized that 50 or 60-year pay out period returns for the S&P 500 converge to a narrow band (i.e., asymptopic). Though I would quibble with the 4.2% figure. While we can calculate historical "safe" withdrawal rates to 3 or 4 decimal places, I don't believe you can predict the future with more than one significant digit of accuracy. Thus, I'd say the safe withdrawal rate (SWR) is closer to 4% than 3 or 5. Of course, the SWR for pay out periods of less than 30 years should rise above 4%."

"Tired of commuting? Fed up with a nitwit boss? Bored with your job? Have you come to the conclusion that all this talk of empowerment is idiocy? Does Dilbert ring true? Are you, in the words of civil rights pioneer Fannie Lou Hamer, just plain "sick and tired of being sick and tired"?"

Which shitcoin is that? Sounds fancy.

I was just told I'm going to be laid off on April 1. It was such welcome news because I needed to change for a couple years now, and I was too scared to leave on my own. So it's like momma bird kicked me out of the nest.

That's kinda funny cause I just engaged in schadenfreude yesterday over federal workers getting laid off, and I don't even get their benefits haha. They got the last laugh on me 😂

Oh for me I can't rationalize it... I'm not the risk-taking investor type. I do admire the fact that someone took money and built something on this property tho.

At some point the only way to get more Bitcoin is to either work or own somethingnlike a business that earns Bitcoin. It's just right now building or expanding a business is such a risk for every getting it back.

But someone has to take that bet and build something in the meantime otherwise the world grinds to halt as we all just wait

A property investment scenario:

For sale, a slice of a property containing a hostel.

7 meters by 40 meters =280 square meters

With electric, water, plumbing

shared patios with the other 14 meter by 40 meters slice

The owner is selling a slice of her property to finish building some more rooms on her hostel for guests.

Current rooms are 5 with 1 to 4 beds, 1 with 1 bed.

$20 to $40 per person per night

The bedroom for sale is this one treehouse room.

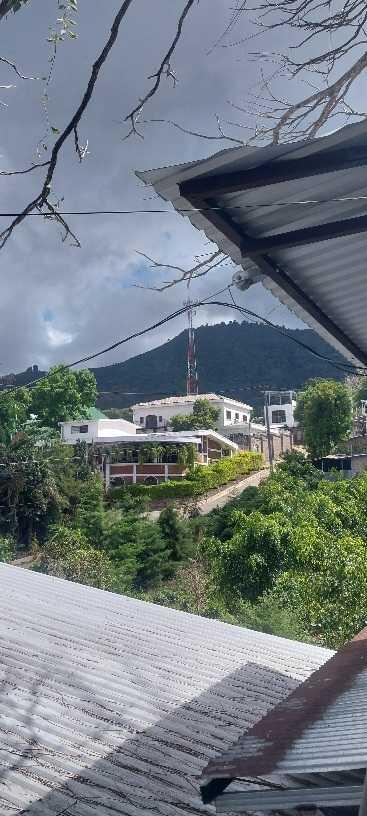

The monthly rent is $300. The views are volcano and tree crowns.

I did a quick calculation how much money I would spend in seven years renting this property with 10% yearly price increase:

Roughly $33,800 in 7 years.

I applied a conservative guestimate of how much Bitcoin per year that would cost me. I used

100k in 2024

200k in 2025

300k in 2026

...

700k in 2030

Total Bitcoin spent renting in 7 years: 0.13 or $13,000 total. I would therefore be willing to buy for at least 13,000 on a conservative BTC growth framework.

The landlady however is a visionary. She has already created a these rock trails from scratch, a kitchen in a treehouse, room the guest rooms from stone and wood and rock.

$75,000 is her number.

With this number, she hopes to complete several more rooms and pay off debt from current construction.

$75,000 investment in 2024.

Stuff like this makes me sweat. The risk of spending $75k building, and the inability to ever catch up with Bitcoin to buy 0.75 Bitcoin again.

My brain tried to wrap around how many guests would she need To earn back 0.75 Bitcoin in 7 years.

Seems like it's roughly 10 per night spending 20$ each. That is if the price of Bitcoin climbs slowly each year

Hotel investment is collateralized by real estate and earns a Bitcoin yield. $MSTR is collateralized by Bitcoin and earns a Bitcoin yield. The hotel investment must have a much higher yield to make up for the underperformance of the real estate on the balance sheet vs MSTR.

Where do you see yourself in 5 years?" The shaman asked. "Have you written down your thoughts? Our senses are directed to the outside. When we put our thoughts on paper, we have taken what was inside and put it outside where we can perceive it. It's like a mirror. "

I was surprised he took a sudden interest in my psychology. I had just listened for 10 minutes to his stories on the "Spirit mountain" volcano.

He explained the hex that he accidentally performed at the Mayan sacred space on the volcano.

"You can choose to be a shaman on the light side or neutral. Some choose dark. Most choose neutral." It sounded like most of these so inclined people take the easy route of neutrality so as not to rock the boat.

Being a shaman of light was quite l challenge. It was about pushing back against abuses of power, and financial interests to the extent of being known as the crazy one.

I recognized what he was describing as those few people who are unafraid to speak truth to power, unafraid of losing anything because of the humble life they already live.

Oh. This is more like 2 seconds.

But it just happened again for 1 second

Earthquake feels like a train 🚂 is going by

"I drove off in the morning, heading to the Conchagua volcano in the hopes of finding traces of Bitcoin City, the futuristic metropolis that Bukele promised to build back in 2021."

Negative interest rates! Where is this happening?

It would be a costly model to create for sure